A retrospective look, 10 years on

It is often good to look back at where we have been and consider how our views have evolved over a specific period towards the current consensus. In this context, achievement of robust investment returns as an active investor are usually related to investing before the crowd, yet few of us able to do so successfully and with repeatability. Passive investors of course are consigned to investing with the crowd!

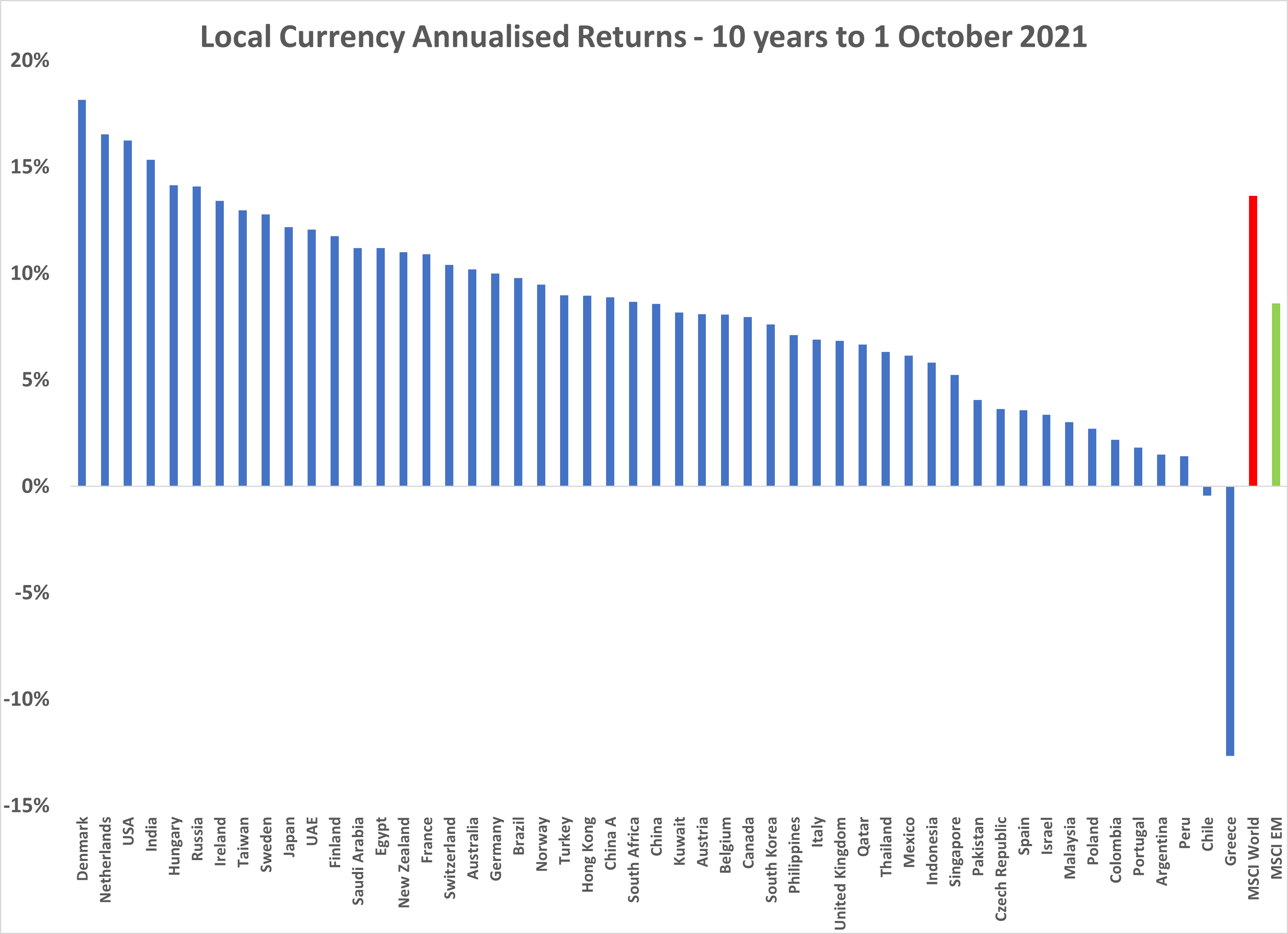

When we look at local currency annualised returns achieved across 49 developed and emerging market countries we can correlate these to some of our thoughts at the time i.e. October 2010. The US had been through a tough period during the GFC and was grappling with a debt ceiling and corresponding market volatility.

In fact few would have guessed that some equity markets could have produced 18% annualised returns from where we were 10 years ago. Yet led by the US equity markets, compounding has been significant for patient investors. Indeed, the opportunity cost of sitting on the sidelines and waiting for a correction has been painful.

India is often "mythically" considered a laggard when it comes to investment returns and particularly in comparison to China (middle of the pack over the decade). However, it had produced strong returns despite being deeply impacted by the aftermath of the GST through weak growth and rising inflation and then its currency being tagged as one of the "fragile five" in 2012. Quite often perceived complexity and lack of understanding is confused with achievement of investment returns!

Today, India's macroeconomics, market infrastructure, digitalisation and financialisation make it an interesting proposition for the next 10 years. No doubt it will occupy a larger slice of the Index pie by 2030.

Australia finished in the second quartile, mainly due to lack of a technology sector, which was the standout sector globally, over the period. Other points to note are:

- Economies like Greece and Argentina take along time to recover from weakness.

- The Nordic countries have all finished in the top half, highlighting stable economies and well governanced businesses.

- The rest of Europe has lagged and peripheral emerging markets in Latin America and Eastern Europe have been weak due to anaemic and volatile growth.

- Developed markets have clearly been driven by US equity markets, which have led it to outperform Emerging markets. Can China carry EM in the 2020's?

Local currency returns are used as macroeconomics and hard currency returns are likely to fare differently over the next 10 years, including the USD.

4 topics