Afterpay: What the market is missing

The word “Afterpay” is now a verb in Australia. When the name of a company makes this extremely rare transition, there is something special going on.

Afterpay (“APT”) has grown its Australian customer base to 3.2million in just over 4 years, and in the US it now has 4.4million customers after only 18 months or so of operations. Amazingly, it has spent very little on marketing, so its customer acquisition costs are negligible.

A key fact is that existing customer usage of its service also grows significantly over time. On average, in the first year of use, a customer will use the service 3 times, and this rises to 23 times per year for a customer who has been with the service for 4 years. This implies that the value of its millions of customers will grow substantially as the customer base matures, and APT is adding to this customer base on a daily basis.

Given the geographic expansion of the business, management has been building out the cost base to support the business. However, once the infrastructure is built, the operating leverage in this business will be significant.

Strong share price performance

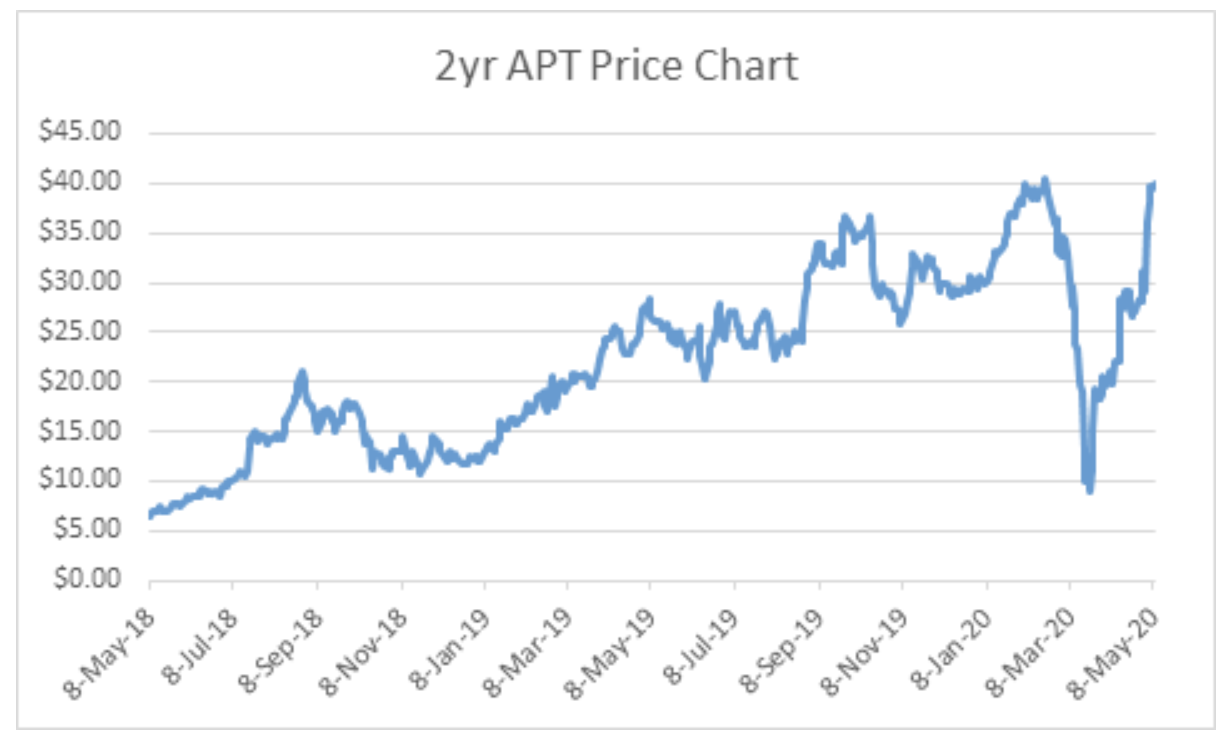

Over the last 2 yrs, APT’s share price has performed strongly, reflecting the strong growth in the business as evidenced by the phenomenal growth in customer numbers referred to above, while maintaining key operating metrics.

Price chart for Afterpay over 2 years

From time to time, the share price has suffered falls due to some form of regulatory event. As it was a new financial product, regulators were always going to review it. However, to date, none of these reviews has led to anything substantial.

Fundamentally, we believe the reason for this is simple. Given the design of the product, it is hard for a consumer to come to financial harm. The average size of a transaction is only $150, and if a customer is behind on any payment, they are frozen out of the system. Given the small sums involved and the quick action on customers falling behind, the risks to the customer are low. Clearly, regulators understand this point.

When it comes to merchants who are paying for the service, we also believe the regulatory risk is low. Merchants can choose whether to use the service or not. The ones that do use it report higher conversion ratios and better customer engagement and have access to APT’s millions of customers. Also, APT’s payment terms are much faster than other providers helping the retailers’ cashflow. There is much more to consider than simply the merchant fee.

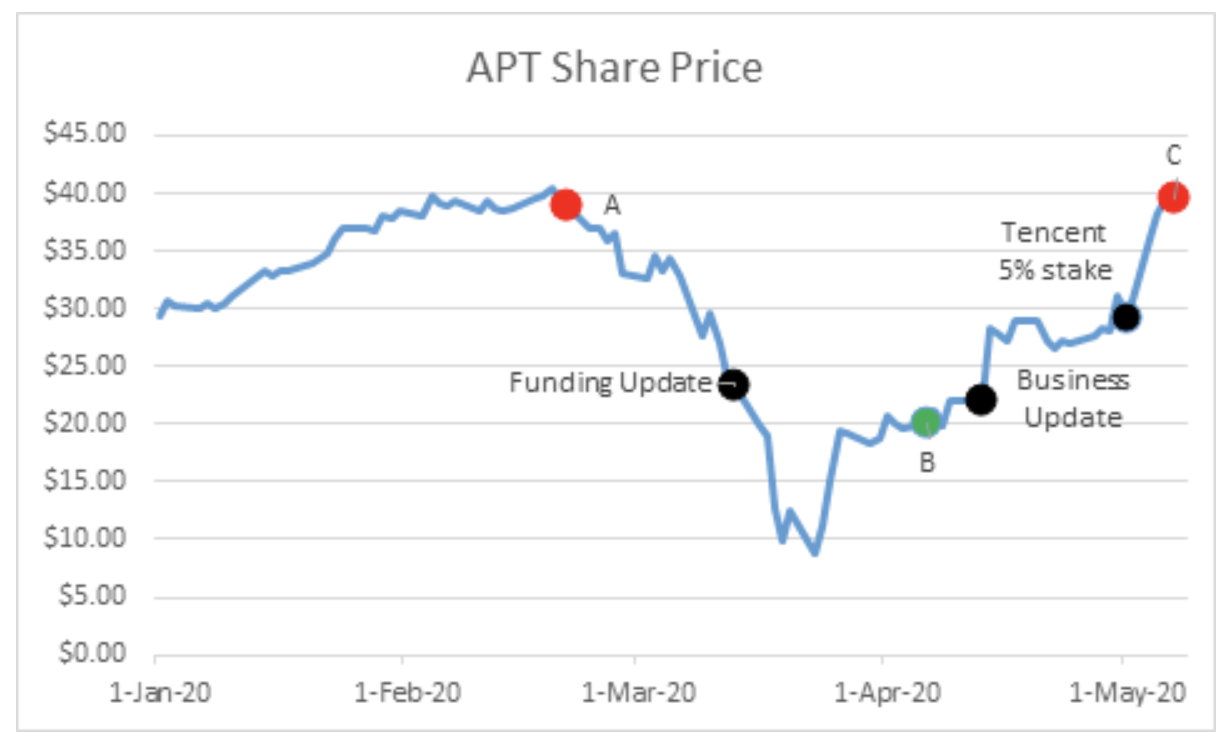

Focusing on the current calendar year, as a high price-to-earnings (“PE”) growth stock, the share price of APT was marked down heavily as the concerns over COVID-19 grew in late February / early March, reaching a low of $8.90. This was obviously a challenging time, with COVID-19 infection rates climbing exponentially and in response, shutdowns were being announced around the world. We fortuitously cut our position significantly on 21 February (point A in the chart) due to our growing concerns over COVID-19.

Price chart for Afterpay for 2020 so far

On 14 March, APT provided a funding update to the market. The first key point was that it had a very strong liquidity position of $672.1m, with management stating

“Our strong liquidity position provides us with the capacity to both continue to fund our operating expenditure and significantly expand our business activities in the medium term.”

They also indicated that they had not seen any changes in customer repayment behaviour and that if this did occur they had a number of options to manage such a situation. This all meant that APT did not need to raise capital (something that would become commonplace in the equity market in the weeks that followed). However, this did not stop the slide in APT’s share price as the concerns over COVID-19 were simply too great.

The share price bottomed at $8.90 and then started to rally. It was around this time that social distancing measures were beginning to “flatten the curve” and the massive amounts of Government assistance were beginning to be fully appreciated by the market. While we were not brave enough to pick the bottom in the APT share price, we did rebuild our position on 7 April (point B in the chart).

Key points from business update

On 14 April, APT provided a business update. This update contained a large amount of detail, but some of the highlights were:

1) March 2020 was the third-largest underlying sales month on record, with strong growth rates across the board. As lockdown / social distancing measures came into force APT saw a 4% reduction in the last 2 weeks of March versus the first 2 weeks of March, however in the period up to 14 April (the date of the update) growth had resumed, up 10% on the second half of March;

2) New merchant onboarding was in line with pre-COVID-19 levels;

3) There was no deterioration in operating metrics, with the net transaction margin in line with previous periods, and gross losses at 1.0%, also in line with previous periods;

4) APT had tightened its risk setting, with the key change being the requirement for customers to make the first payment upfront; and

5) Liquidity had improved to $719.2m and management stated that no capital raising was planned.

The share price responded well to this update. Interestingly, one of the things in the update that the “Bears” latched onto was the requirement for consumers to make the first payment upfront. The Bear view being that this could lead to a slowdown in growth for APT. While time will tell on this point, we suspect it will have a minimal impact given the small sums involved and the strong customer preference for using Afterpay. What was missed in relation to this change is the fact that it will increase significantly APT’s recycling of its capital and hence its liquidity.

The final notable event has been the Chinese giant Tencent acquiring a 5% stake in APT. It is unclear at this stage what will arise from this, but it is noteworthy that James Mitchell, Chief Strategy Officer and a member of the senior management Group, was quoted in the release.

We took the opportunity to take profits to control its portfolio weight and reduced our position somewhat (point C in the chart).

What the market is missing

We continue to like APT for a number of reasons. Firstly, the market continues to under-appreciate the increase in existing customer usage of the service over time, and what this will do to underlying sales growth and the associated benefits to operating leverage.

The growth in customer numbers is unquestionable, the pace at which APT is able to grow its customers and the negligible cost of acquiring these customers makes any LVT/CAC ratio irrelevant.

The market also under-appreciates the implications of APT’s targeting of small size transactions of on average $150. It has implications for regulatory risk as mentioned above, but it also has implications for competition as a number of buy-now-pay-later players have commenced operations but are tending to target higher market segments.

It also means that APT has a very short duration receivable book and therefore can recycle its capital quickly and monitor its risk position dynamically.

Since the shutdowns were implemented there has been a huge and accelerated shift to online shopping. APT predominantly services the online retail market, and as such has been a beneficiary of this shift in consumer spending behaviour.

We suspect this will last well after the shutdowns ease, given how well the online retailing experience has performed.

Benefit at every stage of a cycle

Monash Investors Limited invest in a small number of compelling stocks that offer considerable upside and short expensive stocks that are at risk of falling. Want to learn more? Hit the 'contact' button to get in touch or visit our website for further information.

1 stock mentioned

1 contributor mentioned