When cash is trash: Gold tells the real story for Aussie investors

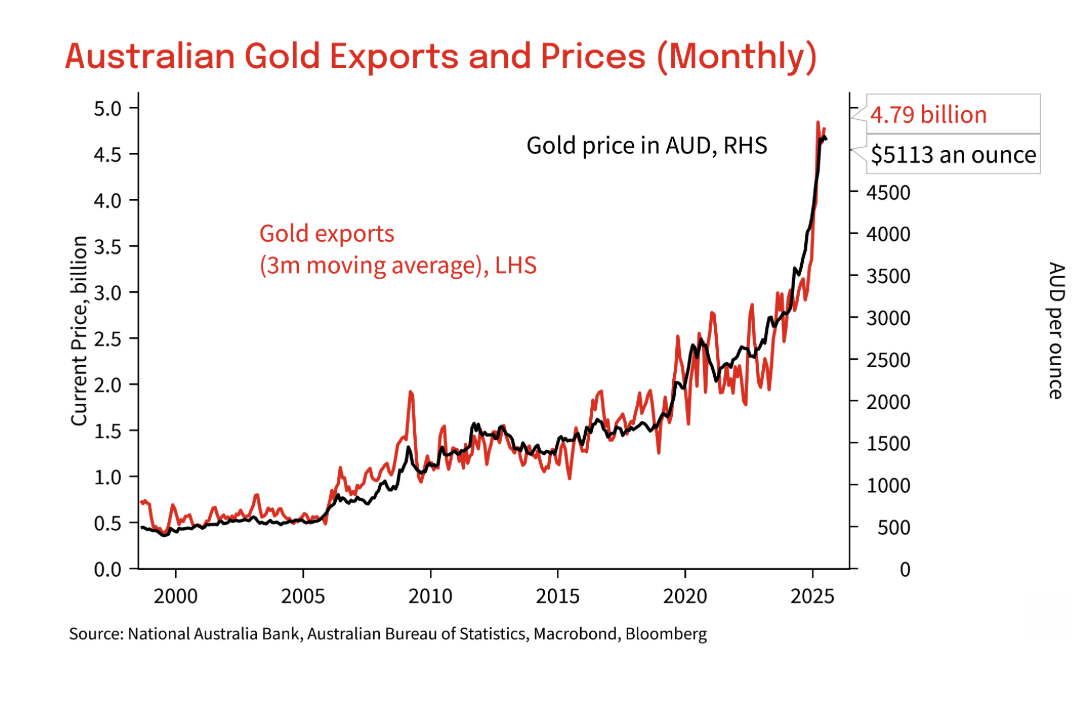

Australia's gold mining sector is going gangbusters as the dollar falls and prices soar for the metal considered a hedge against inflation and central bank money printing.

Trade data for June shows gold is now Australia's third most valuable commodity export behind only iron ore and other mineral fuels such as oil and gas, with the Australian dollar gold price rocketing 39% over the 12 months to August 7.

The jaw-dropping price action means this time last year you needed $3,720 to buy an ounce of gold, but today you need just $5182 to buy the same ounce of gold.

On those numbers the rise is about $1462 - or $121 every month - for a historic climb as the Australian dollar's loss of purchasing power turns spectacular.

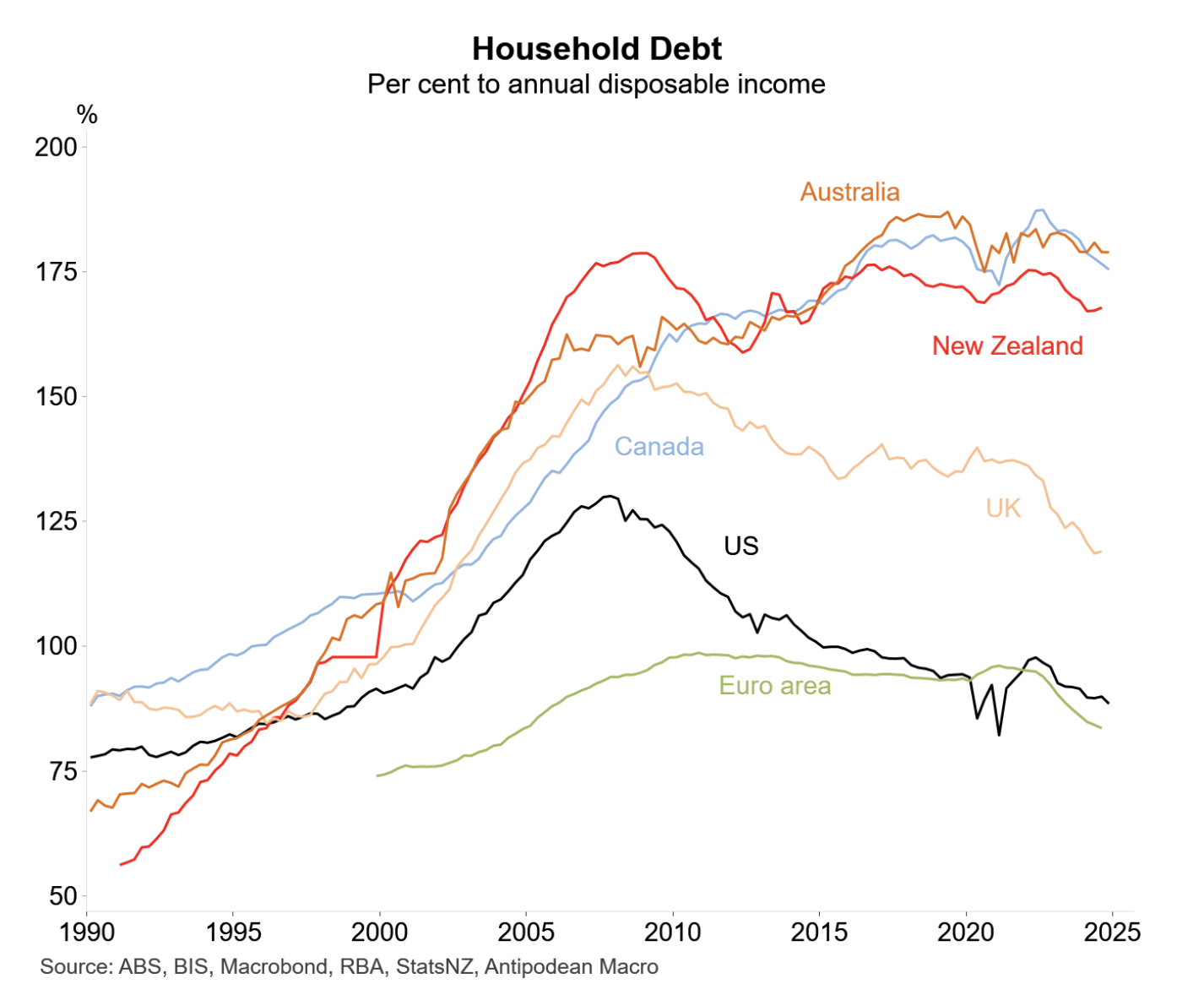

Australian household debt to income

For Australians, the main reason their wages and cash savings are losing value so rapidly versus gold is because of ridiculous amounts of household debt to income (via home loans), meaning that interest rates must be kept artificially low here.

The chart below shows why Australia has the highest household debt to income in the world and why you may feel rich as a homeowner, but not so rich if you worked out how many ounces of gold your property could buy each year.

Australia's benchmark borrowing rates peaked at just 4.35% in November 2023 (in the face of high inflation), before falling to 3.6% on Tuesday to show rates are never likely to get high enough to push the Australian dollar up, versus gold itself, or the US dollar.

By comparison, rates in the US, New Zealand, Canada and the UK all peaked between 5% and 5.5% in 2023, which is significantly higher than Australia.

One conclusion is that if you're not in property here, you don't want to be in cash as an alternative, as it will lose value to protect the mortgage serviceability of home loan owners.

As another example, take Japan. It has a huge debt problem, but in the public, not the household sector. Japan's government has borrowed 235% of its annual GDP as of May 31, which is nearly two-and-a-half times what it produces every year.

To service the interest on this debt relative to the nation's income, its central bank had to keep benchmark borrowing rates negative or around 0.5% for around the last 10 years.

These crazy policies mean the cost of an ounce of gold has climbed nearly 1000% against the Yen over the past 20 years, according to Goldprice.org. If you're Japanese, then your real net worth is down about 90% in gold terms since 2006.

Gold and the US dollar

Gold's been a store of value for thousands of years and it was pegged to the US dollar at a fixed exchange rate of $US35 an ounce under the Bretton Woods monetary system until US President Nixon unchained it in 1971.

This was an effective monetary reset that accelerated under legendary Fed chair and financier Paul Volcker

Since 1971, gold has ballooned in value against the US dollar, or a better way to look at it is the US dollar has crashed in value against the same ounce of gold. As the ounce of gold has not changed in size, utility, or weight, like other assets or goods will.

This is why gold works as a store of value and some say as the only real hard money.

As the US's post-WWII economic hegemony has crumbled since 1971, the GFC and now what the gold price is signalling as a fiscal crisis, even if it's not portrayed as such in the mainstream media.

The gold price is also hard to manipulate, unlike bond yields via quantitative easing, which is a practice where central banks buy government debt to artificially cap yields or interest costs.

In response to all this, President Trump's executive and cronies are jumping into the lifeboats, but of the crypto and bitcoin variety. Some see this as an alternative solution to gold as a store of value, but so far it has proved closer to risk-on assets, more closely correlated to animal spirits or the Nasdaq index, for example.

I don't expect these trends to change and this monetary reset is something we're now living through, with golds' role as Australia's third most valuable commodity export just another symptom of this.

5 topics

.jpg)

.jpg)