Apollo: The global economy may have "no landing", and that's bad news for your portfolio

For three years, financial market participants have been asking a question to which the answer is still unclear. Can the global economy experience a soft landing, or will it have to endure a hard landing? Put another way, can central banks and governments unwind stimulus in such a way that it leads to a reduction in inflation without nuking the labour market?

Even three years on, the split on The Street is still palpable. In this wire, we'll go through what some of the top research houses are thinking. Then, we'll introduce you to someone who is going his own way. Torsten Sløk at Apollo Global Management recently authored a note suggesting neither option will eventually materialise.

And that won't be good news for risk assets.

The hawks: Deutsche and BlackRock

Depending on who you ask, this question may inform a lot of asset allocation decision making. For instance, BlackRock and Deutsche Bank both have a US recession in their respective base cases. Unsurprisingly, BlackRock continues to favour short-term bonds over equities, while Deutsche simply believes there is a "90%" chance of a recession of some form.

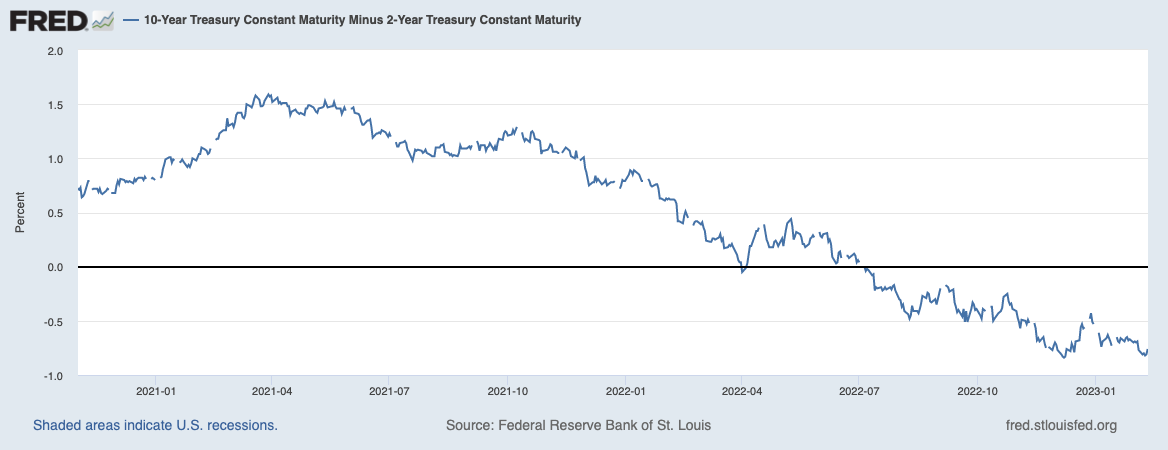

One argument very much in favour of this dogma is where the US 2s/10s curve is currently sitting. In short, the curve is heavily inverted and out of whack with history. Every time the curve has inverted (including right now), the US has gone into a recession. Some milder than others, but the concept stands.

.png)

The doves: Goldman Sachs (and the entire US equity market, apparently)

Then, there's Goldman Sachs, which believes we won't see a US recession at all. Last week, Chief Economist Jan Hatzius cut the chance of a US recession from 35% to 25%. Hatzius predicts that the US Federal Reserve will stop hiking rates in the "low 5%" area.

But that doesn't mean all that good news will flow to equities immediately, as Hatzius' colleague David Kostin explains:

"A soft landing — and in fact above-trend growth — is already priced in U.S. equities. Valuations are elevated vs. history and will be constrained by an eventual rise in interest rates. Even avoiding recession, earnings are unlikely to grow substantially in 2023."

Then, there's China

The biggest weapon in the "soft landing" arsenal, apart from resilience in the corporate and labour markets, is the reopening of China. Shane Oliver from AMP explained the implications of that reopening for Australians in our latest episode of Signal or Noise.

"I think you have to see this overall as positive. Reopening will boost the Chinese economy ... on its own, given its global share of GDP, that will contribute about 0.6%. Yes, you'll see depressed growth in the US and Europe but that's significantly offset by what's going on in China."

Shane says we're even starting to see some early signs of re-growth in the private sector PMIs of late.

Garry Laurence of Profeta Investments and Jonathan Wu of Premium Asia Funds Management shares a similar view for long-term investors who are willing to see through the month-to-month noise.

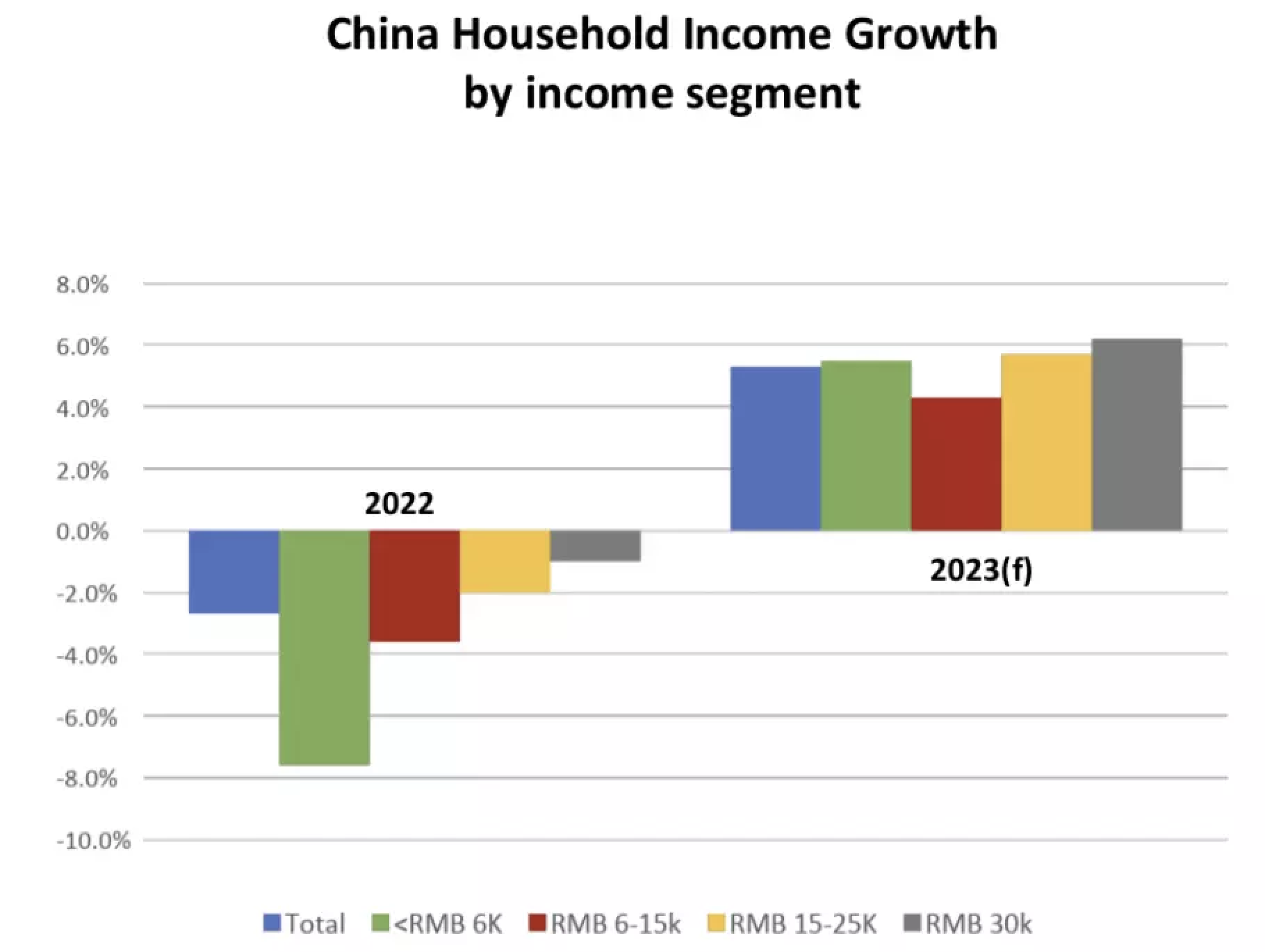

Laurence believes most of the Chinese recovery/reopening will be led by the consumer. And although household income growth contracted in 2022, things are looking healthier for this year.

"People are very optimistic about 2023, and across all income brackets, they all see their incomes will be growing closer to 5%," he said. "We're invested in companies that are exposed to the Chinese consumer as well as other industries that benefit from that consumption like advertising and technology."

This chart shows what Laurence is referring to.

What about "no landing"? The Apollo case

So far, I've given you the two camps that most on Wall Street are in. But what if the answer to this question was actually "neither"? That's the case being put forward by Torsten Slok, Apollo Global Management Chief Economist. In a note dated February 4th 2023, Sløk argues the US economy is not heading toward a definite position:

"...it is beginning to look more like a “no landing” scenario..."

Sløk's theory balances the facts. The US economy isn't slowing down with personal consumption and the labour market continuing to remain strong. The unemployment rate is just 3.4% stateside. And any fears of a wage-price spiral have moderated with the "average hourly earnings" indicator not moving above 0.5% growth per month since mid-2022.

But it's also true inflation is still relatively high, with the latest stateside print for January seeing a 0.5% increase month-on-month (and 6.4% increase year-on-year).

Lest I remind you, this is still triple the Fed's desired inflation target and then some.

Given all of this, Sløk isn't exactly sold on a Goldilocks scenario.

"Under the no landing scenario, the economy does not slow down, and upside risks to inflation are coming back after the initial decline in inflation driven by supply chain improvements. And under the no landing scenario, the Fed will need to raise rates more and keep rates higher for longer to get inflation all the way back to the Fed’s 2% target."

And it's that line about keeping rates higher for longer that has Sløk believing markets won't see good returns again this year.

"The no landing scenario is negative for markets because higher rates for longer increases the downside risks for equities and credit, particularly for tech and highly levered companies that will see higher interest payments for longer."

If he is right, markets will feel like 2022 all over again!

To catch Shane, Garry, and Jonathan's full comments on the Chinese reopening, you can watch the latest episode of Signal or Noise here:

2 topics

2 contributors mentioned