Apple is calling AI's bluff - it's crunch time for AAPL stock

Apple's famous Worldwide Developers Conference (WWDC) has a tendency to dominate Silicon Valley conversations when it comes around each year.

But it's actually an innocuous-seeming paper from Apple's machine learning research team that should really be the talk of the town right now.

The prosaically-titled paper, "The Illusion of Thinking: Understanding the Strengths and Limitations of Reasoning Models via the Lens of Problem Complexity", makes the case that current AI models are fundamentally incapable of reasoning.

This is despite the proclamations of leading AI founders like OpenAI's Sam Altman suggesting models like ChatGPT are capable of performing complex reasoning and OpenAI employees even claiming their model had already the holy grail of AI - artificial general intelligence (AGI).

With this paper, Apple (NASDAQ: AAPL) has in effect accused current AI models of being little more than the emperor's new clothes.

While no doubt motivated, at least in part, by the fact it has found itself losing the AI arms race to big tech rivals like Google, Meta and OpenAI, Apple's paper claims to demonstrate that there are "fundamental limitations" in leading AI models.

While these large reasoning models (LRM), including OpenAI's o3 model and Google's Gemini Thinking, could solve low-complexity problems, they would "collapse" when faced with harder problems and actually reduced their efforts as things got too difficult.

It's a claim that potentially puts paid to the widely-pushed idea that AI models are close to overtaking human reasoning, which has been the line pushed by AI evangelists (and those running the biggest AI companies).

The timing of the paper's publication is also interesting, given many expected AI to take centre stage at this year's WWDC.

While there were a raft of AI-related features announced as part of iOS 26, Apple mostly used the conference to reveal it was bringing a modicum of logic to its increasingly-convoluted operating system naming conventions and a slick update to the iPhone display that it's calling Liquid Glass.

The relatively small focus on AI was especially notable given the fact it dominated last year's WWDC, when Apple used the conference to argue it was very much part of the AI conversation.

But it has instead spent the last year struggling to meaningfully incorporate its take on AI - hubristically called Apple Intelligence - into its celebrated product line.

Earlier this year, Apple was even forced to pull an ad hyping up the new agentic power of its much-maligned Siri chatbot after it conceded the update was taking longer than expected.

So at a time when it has little in the way of exciting new products to fall back on, Apple's decision to pour cold water on AI could come back to bite it.

Despite striking a deal with OpenAI last year, Apple has yet to follow the lead of rivals like Google and Meta in throwing big money at developing its own AI.

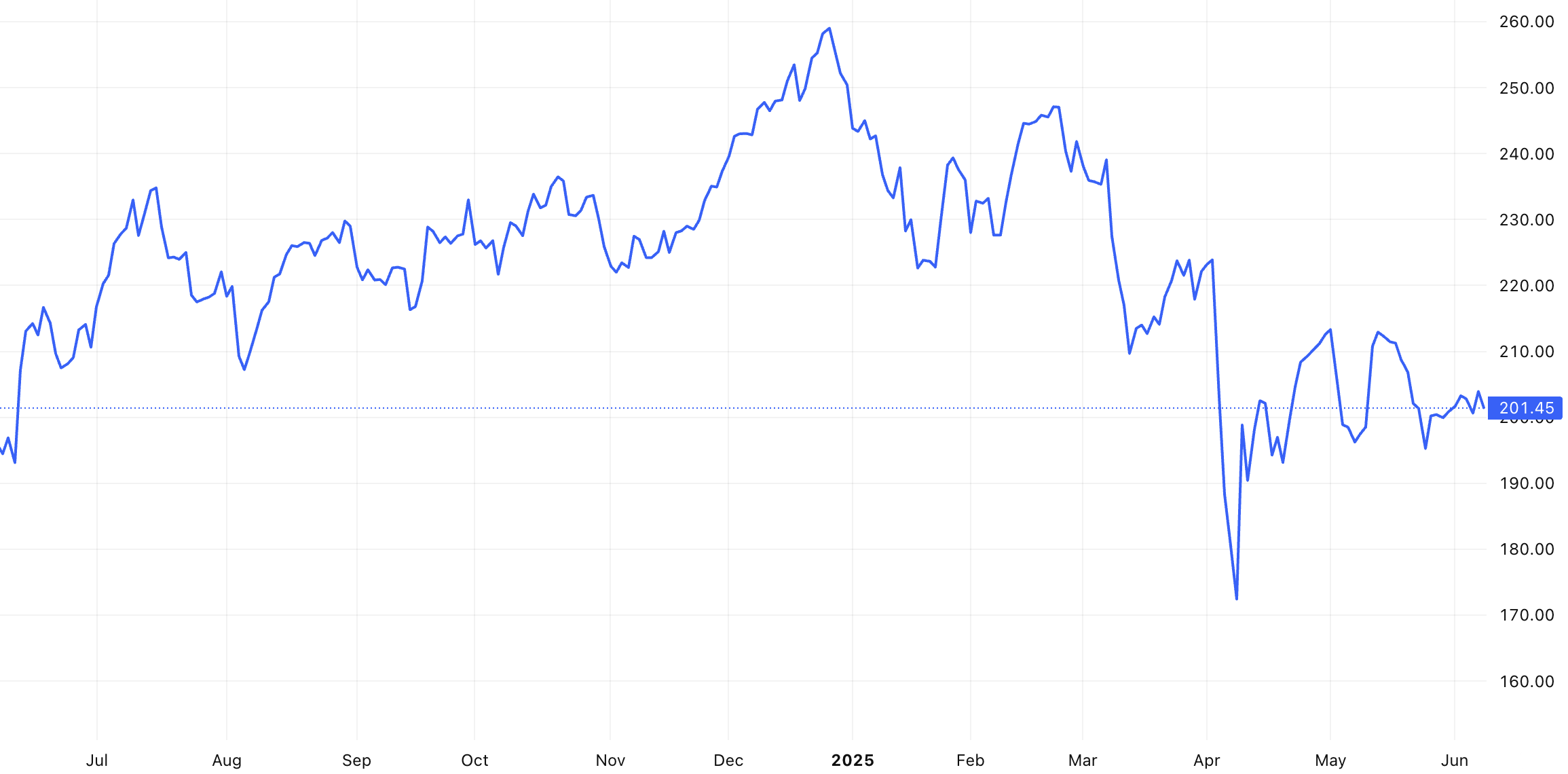

If investors can't see much in the way of innovation and believe Apple is sidelining itself on the possible AI revolution, Apple's status as a market darling could be under threat, especially at a time when the US stock market is already historically expensive.

Or maybe putting its neck on the line on AI will prove to be a masterstroke if these much-heralded models fail to make any significant breakthroughs over the next few years.

It's a gamble either way for a company that normally likes to play it pretty safe.

5 topics

1 stock mentioned