Are investors too fearful of a recession? This strategist certainly thinks so

Picture it, New York City, September 11th, 2001. I don't have to tell you what happened that day - we all probably remember where we were when we heard the news that New York and Washington were under attack.

In response, the events of that day caused a plunge in global stock markets - $1.4 trillion according to Investopedia. The immediate shock was so bad that stock exchanges were closed for six days thereafter. The US dollar collapsed against all its major trading partners and the gold price soared by more than $70 an ounce in the space of a single day.

In the days and weeks which followed, sentiment was obviously fragile. Now take that fragile sentiment and fast forward it by nearly 21 years and what do you have? History repeating itself.

For the first time in more than two decades, fund managers are hoarding their cash with two hands. The experts are viewing hawkish central banks, and their intent on winding down stimulus while raising interest rates, as the biggest risk to the global economy. Not far behind are the 'r' and 's' words - namely recession and stagflation.

But how did we get here so quickly - and more importantly does everyone feel unilaterally the same way?

Money, money, money

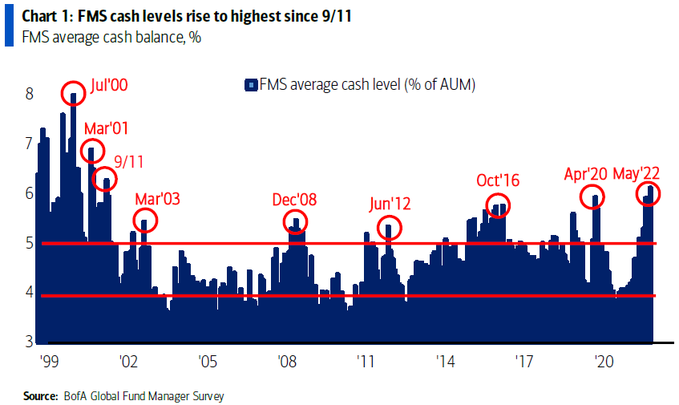

The chart above comes to us from the Bank of America Global Fund Manager Survey. Taken once a month, it's a really good indicator of the sentiment of the professionals and how they react to market-moving moments. This month's survey saw 300+ of the smartest minds in global finance submit their responses - and the results are stark:

- Global growth expectations are at -72% (lowest on record)

- Hawkish central banks were cited by 31% of fund managers as the most important risk

- 66% of respondents said global profits will decline this month (most since GFC)

- Allocation to US equities has actually reversed with fund managers taking the money and running!

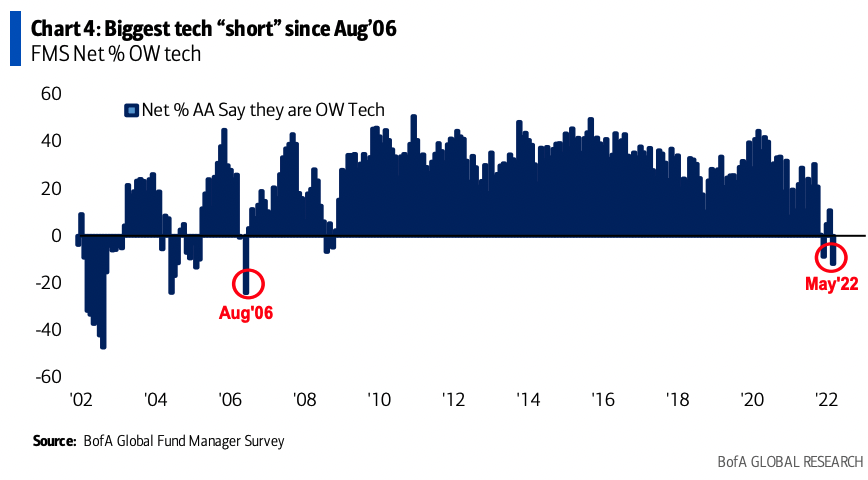

If you'd like any proof of that reversal, there's this chart to satisfy your curiosity.

But the most important stat is the cash stat - levels are at their highest on average since 9/11. Though curiously (at least to me), the average level is 6.1%, perhaps showing some money managers are still fully invested even in a market like this. As James Whelan of VFS Group pointed out, the moves to cash may be marginal for rainy day funds but the much more important moves are probably from one sector to another.

That is - stay invested!

For those with cash, it's very possible that they are waiting for lasting dips to buy - something the Bank of America team has reacted quickly to shut down.

Stocks are prone to imminent bear rally, but the ultimate lows have not yet been reached.

Where is the love...?

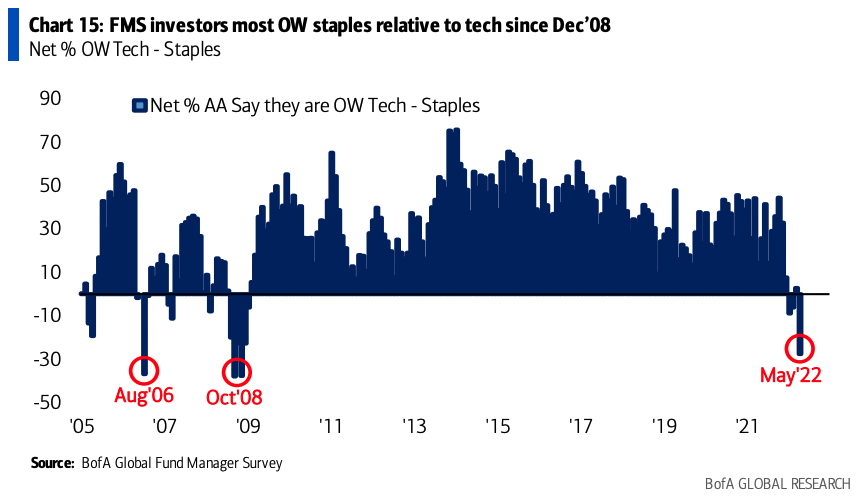

In addition to cash, fund managers are “very long” commodities, healthcare stocks, and staples stocks. On the latter, supermarkets and household goods names are receiving the most inflows since 2006 as the chart below shows.

Or, in the words of Andreas Steno Larsen at Heimstaden:

Buy, buy, buy

While I've been going on about how pessimistic fund managers are right now, it's very important to mention that this is not a universal thought bubble. This brings me to Marko Kolanovic of JP Morgan who wrote recently that everyone's fear of a recession is all way too overdone.

Our view remains that the probability of a recession over the next 6-12 months is low and thus stay with a pro risk stance.

So why is Marko so optimistic? For one, his base case is twofold. If a recession occurs and equity markets are right, it may be short-lived. If the rates market is right, then the Federal Reserve may be able to pull off the soft landing - thus avoiding a recession and creating a lift for equities.

Peak hawkishness is starting to get traction; multiples have de-rated, but earnings are not following. Profit margins delivery remains better than feared. Put together, if recession doesn’t come through, multiple derating was already very substantial, and given the reduced positioning and downbeat sentiment, equities stand to recover from here.

He's telling his clients to buy more value as he has been doing for a few months. Among his list of ideas, use the dip to buy energy names. He's also predicting emerging market equities - and in particular, China - to outperform in spite of recent economic and stock market downgrades from other houses.

Finally, Kolanovic believes that macro conditions remain conducive for the US dollar to remain bullish (the right tightening at the right pace could lead to a long upside run for the world's reserve currency).

This all sounds very rosy apart from one key caveat. Marko has not had his call entirely vindicated by the market. The S&P 500 is down nearly 15% year-to-date while the benchmark equity index in Shanghai is down more than 18%. His employer also recently downgraded its S&P 500 year-end target from 5,500 to 4,900 suggesting the ride will not be easy.

Although I'm sure equity bulls will latch onto Marko's call hoping he's right in the long run.

One more thought

Earlier in this wire, I mentioned that tech positions have been sold off significantly in the last few weeks as investors rotate out of growth into cash, commodities, or value stocks. But Daniel Ives at Wedbush Securities has another idea:

In a nutshell, this is not a Dot-com Bubble 2.0 in our opinion, its a massive over correction in a higher rate environment that will cause a bifurcated tech tape with clear HAVES and HAVE NOTS of tech.

While he notes that every fund manager is human (I should hope so!), Dan is right in saying that the best opportunities often come up when everyone does not want to rummage in the rubble. After all, Amazon and Apple will still be here in 20 years' time - but Pets.com may not be.

Conclusion: Be it tech, energy, or cash - hold on to quality... and your hat!

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

3 topics