Are you positioned for the value cycle to run?

Severe underperformance by specific emerging market countries has historically created a fertile hunting ground to find alpha-generating stocks. Pzena is finding good value opportunities in 2021’s laggards.

While developed markets were strong in 2021 with most countries posting positive returns, emerging markets lagged significantly. The broad MSCI Emerging Markets Index came in slightly lower for the year despite most countries moving higher, as notable laggards such as China, Turkey, and Brazil each faced unique macro uncertainties, and were all sharply lower. Ardent fundamental value investors view this wholesale selling, and the resulting cheap prices caused by the uncertainty, as opportunities to explore and potentially initiate positions in select companies at attractive starting points.

For China in particular, investors who enjoyed several years of stability, growth, and perceived safety fled the increasingly uncertain environment, as the government took actions investors see as anti-capitalist. While the circumstances creating potential opportunity in particular countries may be unique, experienced value investors are accustomed to uncertainty; in fact, we seek it out to identify mispricing and thus raise the opportunity for superior returns.

Find Value in Emerging Markets

There are numerous studies showing that value philosophy works across market cap, geography, and asset classes. Before we started managing emerging market portfolios in 2008, we undertook a study to see how value performed in emerging market countries, and found it worked quite well (Exhibit 1).

Many view emerging market investing as a growth story, but over time, the value approach has proven superior. Higher beta emerging markets endure more frequent bouts of volatility but offer amplified return potential for value investors for several reasons, including:

- Psychology — Investors tend to exaggerate the significance of near-term problems and discount the potential for business, industry, management, currency, or macroeconomic improvements over time. The emotional response is more pronounced in emerging markets, adding to valuation dispersions that offer opportunities when deeper discounts are ascribed to out-of-favor companies.

- Earnings power — Despite a lack of empirical evidence, investors often associate GDP growth with higher equity returns. When growth-seeking investors don’t achieve the quick gains they’re looking for, their reaction to disappointment can be amplified, presenting opportunity to the disciplined value investor.

- Wide range of outcomes — The array of political and legal structures, currencies, and governance practices each add to the complexity in emerging markets. The variety of economies, industries, and market capitalizations offer robust opportunities across a large pool of stocks.

- Underexploited — Most investment managers tend to favor macroeconomic or quantitative approaches to investing in emerging markets, leading to crowded trades and wider market swings.

These factors are ever-present in emerging markets, though they are usually ignored when markets perform well and can make entire markets “uninvestable” during times of uncertainty. Uninvestable situations, implying investors wouldn’t purchase at any price, are something value investors find intriguing. These opportunities to purchase stocks with low expectations, at low starting points, sow the seeds for future outperformance.

Country-Specific Opportunities

Geographic, or country-specific opportunities, which arise when a region or country faces an uncertainty that others don’t, are more pronounced in the emerging markets. While there are periods where general fears lead to broad underperformance versus developed markets, country-specific fears are far more prevalent. Uncertainty can make a specific country uninvestable to many, leading to share prices that decouple from the broad emerging-markets index, often creating an asymmetric risk/reward profile. Countries, however, do generally recover, and good businesses find ways to navigate crises.

The disciplined value investor sees these collapsing stock prices as opportunities to begin deep fundamental company-level research, seeking to identify strong companies unduly punished by a sweeping reaction to temporary issues. Is this a sound strategy, and do countries actually recover? We studied this phenomenon and found significant long-term alpha potential available to investors who adhere to this discipline.

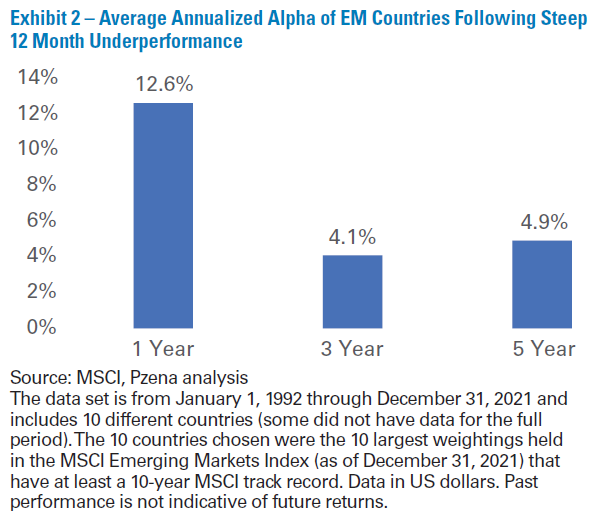

We looked at significant emerging market country declines, defined as 2,000 basis points or more of underperformance versus the MSCI Emerging Markets Index over the prior 12 months, and then looked at how those countries performed over the next several years. Our data set includes 30 years of data for 10 different countries (some did not have data for the full period). In these instances, we found 4.9% of outperformance per annum, on average, versus the MSCI Emerging Markets Index over the five years following those steep declines (Exhibit 2).

Like all strategies that create significant alpha, this approach doesn’t always work. In fact, it generated alpha about 60% of the time. This is what value investors expect; if the strategy worked all the time, it would not generate subsequent annual outperformance, as there would be no associated uncertainty with investigating beaten-down emerging market countries. The key is to recognise that it will not always work, and therefore focus on the significant alpha generated over the long term.

Opportunity in Emerging Market Uncertainty

Macroeconomic issues specific to emerging market countries over the past 12 months have created many value opportunities. China is a good example of an entire country experiencing uncertainty. From 2016-2020 China was seen as an emerging market safe haven and generated a 19% compound annual return. In 2021, however, market perception deemed China uninvestable, and the MSCI China Index declined by 22%, trailing the rest of emerging markets by more than 30 percentage points. As our study showed, this level of market underperformance is generally a good investment starting point, with subsequent outperformance typically led by the most undervalued stocks.

We recently built positions in Chinese internet e-commerce giant Alibaba and property company China Overseas Land and Investment (COLI). (For additional detail, revisit our 3Q21 Newsletter.) However, there are statistically cheap areas that we are avoiding, as they offer poor risk/reward profiles, such as the education sector.

History has shown that stock market sell-offs are generally a good time to dedicate resources to research beaten-down geographies. As investors fear uncertain macroeconomic outlooks, we are finding fantastic emerging-market businesses trading at a fraction of their intrinsic values.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics