Are you putting all of your eggs in one basket?

Investors are flocking to opportunities within alternative assets after recent turmoil in public markets demonstrated that conventional approaches to portfolio allocation are no longer sufficient in providing an appropriate level of diversification. Concurrent downturns in public equity and public bond markets experienced in the first half of 2022 have demonstrated the insufficiency of this conventional approach in providing appropriate diversification, serving as a painful reminder that the positive correlation between these two asset classes has become increasingly frequent [1].

Triggered by inflation and rising interest rates, this trend has demonstrated the necessity of expanding an investor’s opportunity set to include alternative assets within their portfolio.

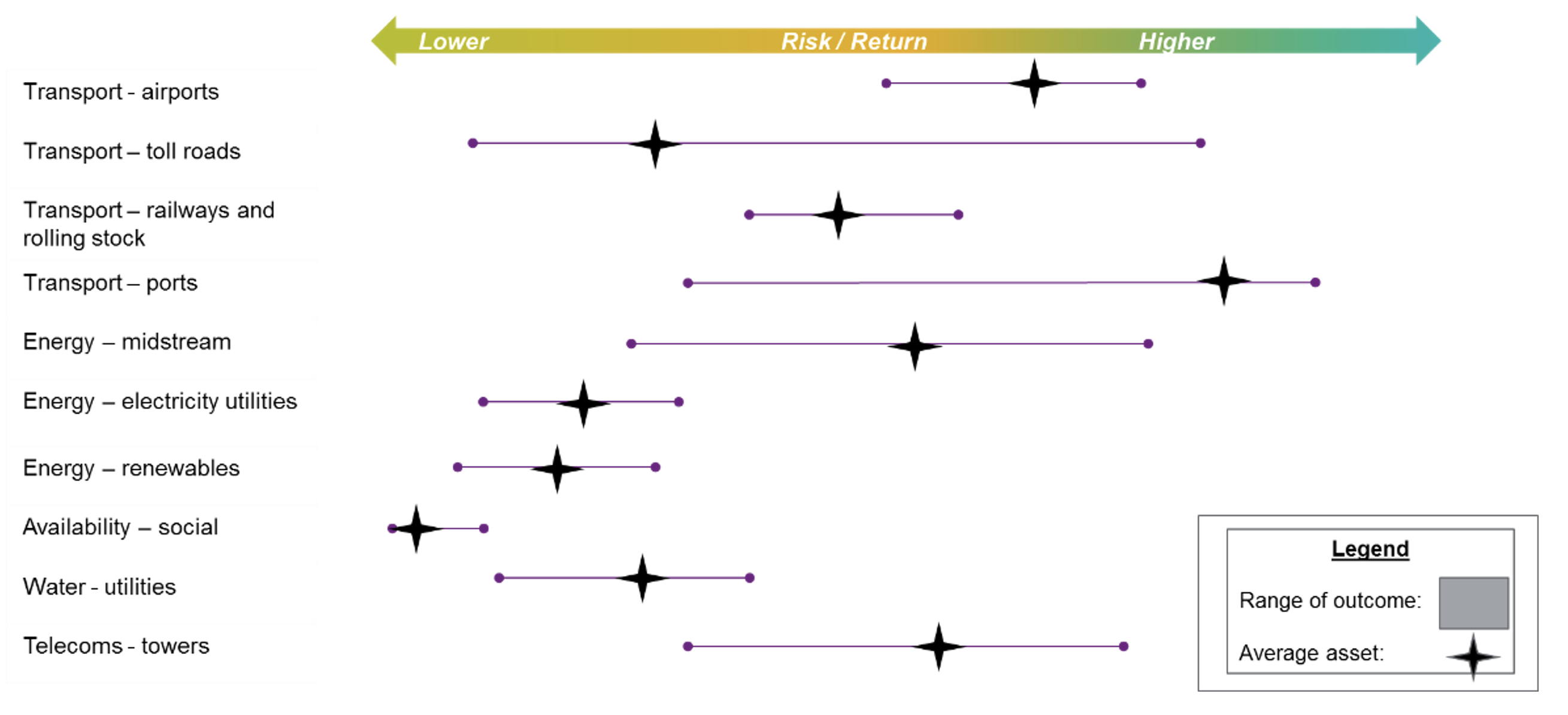

The opportunity set for alternative asset investing encompasses a broad range of asset classes, including private equity, real estate, infrastructure, and real assets (such as agriculture and water rights). As demonstrated in the figure below, a variety of strategies within each asset class exhibit different risk-return profiles and investment characteristics, with many exhibiting low or even negative correlation with public equities.

One example of how alternative assets can provide additional diversification to an investment portfolio is evidenced by investments in water rights. Water rights are assets that represent the right to receive an annual share of available water in a consumptive pool (e.g. a river system or catchment). This share of water can then be used for consumptive purposes, such as by irrigators or farmers, by State Water Authorities to meet urban water requirements or for environmental purposes, and can be traded i.e. bought, sold, and leased.

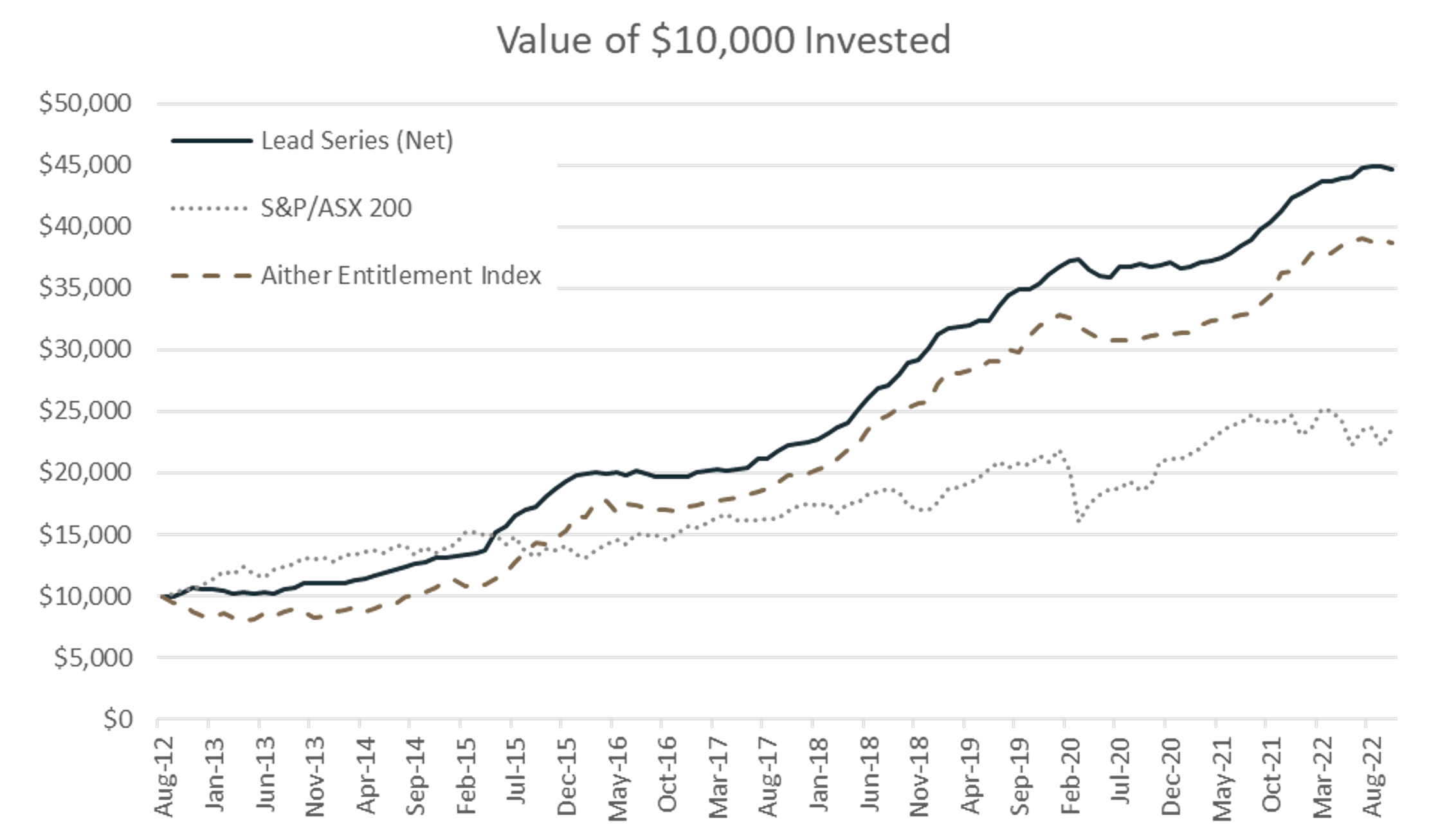

Water rights can provide valuable diversification benefits to an investment portfolio as the underlying returns are driven by climactic conditions, which differ from the equity risk premium that drives the returns of public equity markets. Research by Argyle Capital Partners (2022), one of WAM Alternative Assets (ASX: WMA) investment partners, demonstrates that water rights exhibit -0.05 correlation to the ASX200 Price Index and -0.11 correlation to the S&P500 Price Index:

Alternative assets can also provide additional diversification to a portfolio through varied investment strategies. Within private equity, a turnaround/transformation and special situations strategy focus on quality businesses that are facing distress.

In a period of economic turmoil, the opportunity set for this kind of strategy expands as more companies begin to experience event-specific challenges, enabling investors to enter at attractive, discounted valuations and implement their turnaround and transformation strategy to later exit it at a premium, providing the opportunity for outsized returns. Certain strategies not only provide protection in the case of a market downturn but can also thrive in these scenarios.

The inclusion of alternative assets within an investment portfolio can provide diversification benefits. As the traditional asset classes of public equities and public bonds become increasingly correlated, expanding one’s investment horizon to include alternatives is no longer just a benefit, but a necessity, to ensure the creation of a well-diversified and optimised portfolio.

Through an investment in Wilson Asset Management’s ‘alternatives’ fund, WAM Alternative Assets (ASX: WMA), retail investors gain access to alternative asset classes, which have traditionally only been accessible by high-net-worth and institutional investors. WAM Alternative Assets seeks to democratise alternative investing for retail investors through its listed investment company (LIC) structure.

1Markowicz, Sean. “What Drives the Equity-Bond Correlation?” Why Is There a Negative Correlation between Equities and Bonds? 8 Feb. 2022, (VIEW LINK).

Learn more

WAM Alternative Assets provides retail investors with exposure to a portfolio of real assets, private equity and real estate. The company aims to expand into new asset classes such as private debt and infrastructure. For further information, please visit their website.

2 topics

1 stock mentioned