Asian infrastructure - Trip insights with 4D Infrastructure (part 1)

The team at 4D Infrastructure recently conducted the 15th in our series of Trip Insights, where myself, and Chris James, Senior Investment Analyst, travelled through Indonesia, Malaysia, Thailand and Hong Kong/China, meeting with management teams from regulated utilities, communications and transport companies. Company management meetings and site visits are integral to our investment process, and where possible, we look to visit core regions at least annually.

Over four instalments, we will be sharing some interesting themes and observations from the trip that supports our ongoing investment in the region.

POLITICS

The mood on the ground seemed content if not relatively buoyant across the four countries. Domestic politics were not top of mind or raised in conversation, with locals welcoming to foreigners as they moved about enjoying post COVID life. We didn’t feel uncomfortable at any point and would certainly be happy to visit each of the destinations for business or tourism going forward.

Indonesia

Post February’s election outcome, the political situation in Indonesia feels very stable. With a significant majority, the policies of the very successful outgoing president, Joko Widodo, are expected to continue under his nominee, Prabowo Subianto. Subianto is not without a checkered military history. However, domestically he is considered the best option to continue what has been a very stable period in Indonesia’s political history and one which saw strong economic advancements of the middle class.

We are supportive of a continuation of Widodo’s mandate as he has successfully advanced the infrastructure investment in Indonesia in a way that offers investors strong growth and reliable returns.

Malaysia

Politically, Malaysia felt stable. The one recurring concern voiced was around the weakness of the Malaysian Ringgit and potential government directives to limit off-shore flow of capital in support of domestic business and currency.

Some feel that Malaysia could be a beneficiary of the China +1 strategy but to date no strategy seems defined. It is still very early days in determining how they could participate.

Thailand

Thailand is not without a history of political protesting from pro-democracy, criticism of the monarchy, political corruption, up-rising of youth to basic human rights. With the exception of a few, these protests are generally relatively peaceful.

After the Move Forward Party won the 2023 election, but was blocked from forming a government by the military controlled Senate, expectations of protests have been elevated. However, we did not get the impression of any imminent political posturing with a general feel that locals were enjoying the freedom of a post COVID world and benefiting economically from the return of the tourist.

Again, there is some expectation that Thailand could be a beneficiary of the China +1 strategy, but this was also very loosely discussed. We did speak to a private investor in power plants in neighbouring Laos and Vietnam who hoped to capitalise on the regional demand from a China+1 strategy and the associated need for power. It was clear, this investment was not easy and not without political hurdles but the potential return to date had outweighed the cost (time and money) of the associated red tape.

Hong Kong/China

We had expected to see or hear more of the mainland voice in Hong Kong. However, by contrast, the influence felt much more in the background on this trip relative to last (noting that our last trip coincided with the Hong Kong pro-democracy protests of 2019). It definitely felt like Hong Kong is back to status quo as an independent, yet quasi Chinese, territory.

Masks remain very noticeably in force across Hong Kong, including in corporate meetings. This appeared to be by choice, not mandate, noting that culturally Asians were an advocate of the mask even before COVID.

The other point of note is that while historically an ex-pat enclave of Asia, a number of ex-pats have relocated away from Hong Kong post the Covid era and what was considered arduous conditions through the pandemic. This has had an impact on property pricing across the territory. At the same time, increasing numbers of mainland Chinese are now relocating to the territory, taking the position of the departed ex-pats. Would expect a mix of economic and political motivation behind a move to Hong Kong.

Economics

The economic outlook across the region was disparate.

Indonesia, Malaysia and Thailand felt very affordable while Hong Kong was a shock in terms of pricing – this is no doubt partly due to the relative strength of the respective currencies to the AUD (noting the HKD is pegged to the USD).

The economic mood was solid and people in general seemed happy, with many individuals out socialising in shopping centres and bars. Homelessness while prevalent in every major city today, did not feel any better or worse in Asia (noting our time was largely spent in city centres). Public transportation networks were crowded while ride share dominated over taxis in every country.

Indonesia

One thing that's immediately noticeable throughout Jakarta is the extremely congested highways and crowded streets. Novelist Seno Gumira Ajidarma once wrote that ‘the average Jakartan spends 10 years of their life in traffic’, and it doesn’t take long in the Indonesian capital to see why this rings true. Expressways are extremely captive, with many of the 3.5 million people who commute into Jakarta daily travel by car due to the lack of suitable public transportation alternatives.

During the day, most cafes and restaurants were largely empty, likely influenced by the observance of Ramadan. However, the streets were filled with activity. In the evening, the scene shifted dramatically, with many people flocking to street stalls, cafes and restaurants. The atmosphere was vibrant, with activities heard from the hotel well into the evening.

Malaysia

We are always surprised at how developed and advanced Kuala Lumpar feels relative to its neighbouring Asian capitals. The roads are high quality and free flowing, cars were relatively new and mopeds/bikes were in limited use, the shopping areas were full of western brands and the city centre real estate was on par with a developed capital.

Unfortunately, we visited in the middle of Ramadan so the feel on the ground was probably a little quieter than normal. However, the general mood of the locals we met appeared very content and as always incredibly welcoming to foreigners.

As noted above the Malaysian Ringgit has been notably weak which is partly also why Kuala Lumpar felt very affordable, if not cheap, as a westerner visiting.

One other data point deserving of comment was the rise of Grab (Asia’s equivalent of Uber) which while very convenient and comfortable was also in very high demand throughout the day with wait times of 15 minutes or more for a ride in peak periods.

Thailand

The COVID shutdowns hit the heavily tourism dependent Thai economy hard, compounded by a slower post COVID economic rebound relative to its ASEAN peers. Knowing that, interestingly it felt like the buzz of Bangkok was well and truly back to pre-Covid times. With huge traffic congestion, crowded metro systems, bustling tourists filling the streets and restaurants, and locals actively engaging with the vibrant restaurant scene, the city was alive and bustling.

This tourism recovery has been bolstered by a pickup in arrivals from China and Malaysia this year as well as the implementation in September 2023 of a visa-free policy for visitors from China and Kazakhstan. Like Malaysia, Bangkok offered incredible affordability in local areas. However, in tourism centres, while it remained relatively affordable, there was certainly a premium that tourists were happy to pay. This is no doubt in part due to much lower inflation relative to regional and global peers helping to keep pricing down. For example, a lunch at a local Thai restaurant, with queues of locals waiting for a seat, set us back a huge A$8 for two rice dishes and cans of soft drinks. By contrast a single drink in a tourist bar set you back A$11.

From an infrastructure versus economics standpoint, there were a couple of interesting points:

- The road network was highly congested and slow moving. Even the expressway network was very busy at times. Interestingly, on the expressway network, the majority of toll payments still seemed to be cash by choice – automatic tolling was available but every transaction we had was via the cash channels and this included taxis and Grabs.

- The metro system which was still relatively new on our last visit has been significantly developed. Importantly, it is widely used, air conditioned, comfortable and very affordable. They were standing room only on every line we used.

Hong Kong

A tale of two cities

- Hong Kong island was very lively – people on the streets and in the restaurants and bars. This may be due to arriving at the end of the Rugby Sevens which does see an influx of tourists, but in general it felt like the Island was returning to normal post COVID with very few vacant areas.

- By contrast, Kowloon felt flat. Many of the shop fronts were vacant and the streets felt quieter. It feels like this ‘local’ side has been harder hit and will take longer to recover.

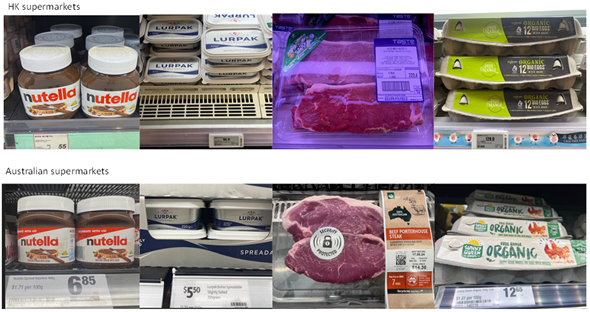

Universally however, things felt very expensive. Our tour of the supermarket found eggs by the dozen at A$25 (Australian equivalent A$12.95), Lurpak butter at A$19.50 (A$5.80), Nutella at A$11 (A$6.85), steak at A$90 kilo (A$40). However, discussing this with one management team, our supermarket study is probably overstating prices, as locals only use supermarkets for pantry items and imported goods, with all fresh produce, meat and dairy purchased at the wet markets where pricing was much more reasonable.

Restaurants and shopping centres were also quite expensive when comparing to their Asian peers, but also relative to Australian pricing. However, despite the increased pricing, restaurants remained full, and locals had no problems paying A$9 for a very mediocre cup of coffee.

Interestingly, there has been a complete 180 on the relative attractiveness of Hong Kong shopping versus the mainland. Historically, mainland residents used to make the trip to Hong Kong just to shop and now Hong Kong residents are spending their weekends on the mainland for the same purpose with luxury and household shopping being much more affordable in RMB versus HKD.

Moving around Hong Kong proved very easy with Uber’s abundant and generally a Tesla!

China

Mainland concerns around the property sector dominated. However, interestingly, everyone we spoke to felt that the Chinese property situation would resolve. It would not be immediate, but they felt in the next few years (2-3) the situation would normalise. Importantly, it became very clear, that there is a significant disconnect with Tier 1 cities, where property demand remained buoyant versus Tier 2 and 3 cities where the situation remained untenable. For example, a property development in Shenzhen city saw all but six units (out of ~200) pre-sold on day one of pre-sale opening. By contrast books of inventory in Tier 2 cities were not moving.

The other prevalent theme, discussed further below, is the increasing dependence of mainland investors on corporate dividend yields. With historical investment in the property sector out of favour and interest rates moving down, mainland investors are looking to the equity markets for a secure form of return, through yield. This is providing downside support to strong dividend payers but also seeing companies that cut their dividends immediately punished. This was very evident in the fiscal year reporting season where a dividend disappointment, no matter how big or small and irrespective of other metrics and fundamentals, saw stocks sold off anywhere from 5-20% on the day. Importantly, the strong management teams are cognisant of the importance of a stable, growing dividend while weaker management teams seemed to ignore these investor concerns/requirements to their detriment.

3 topics