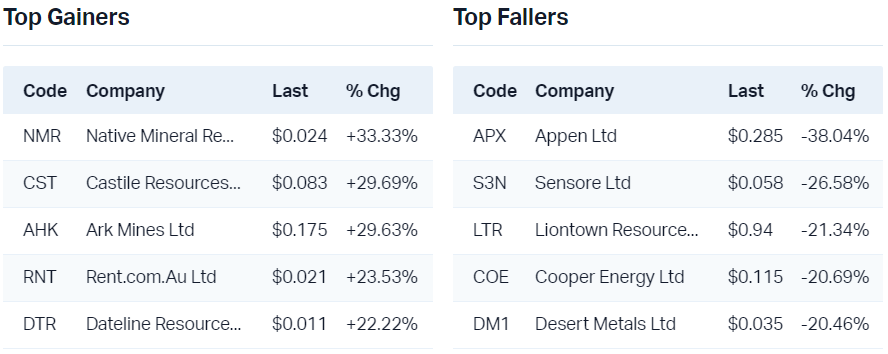

ASX 200 advances on consumer, financial sectors, as lithium bloodbath resumes

Today in Review

Markets

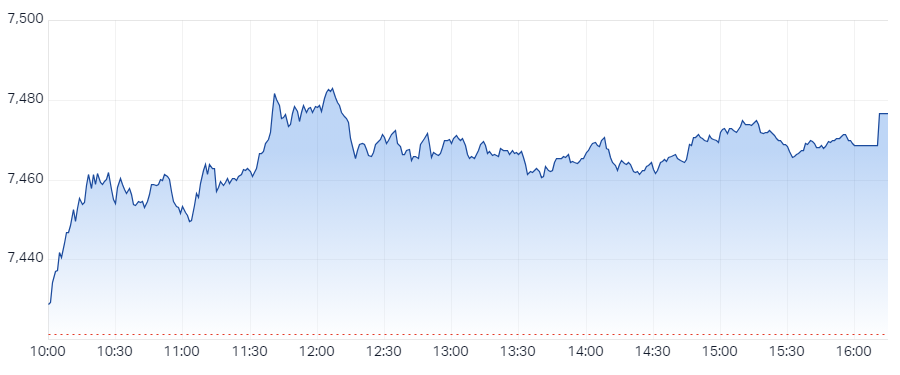

ASX 200 Session Chart

%20Intraday%20Chart%2020%20Jan%202024-.png)

Another solid gain for the S&P/ASX 200 to take us another important step towards the 2 January high. That high, was a whisker from the all time high set way back in August 2021. Is this the start of the much anticipated "next leg up" to finish the job?

Consumer stocks were again the best performers today, the Consumer Discretionary (XDJ) sector rose 1.7% and the Consumer Staples (XSJ) sector added 1.3%. Also doing well today was the Financials (XFJ) sector +1.2%. The combination of these three sector indices at the top of the sector performance list, and thereabouts for a couple of weeks now, suggests fund managers are betting on the local economy outperforming amidst a backdrop of uncertain global economic growth.

Assuming it can continue to edge higher during the week, the XFJ is on track for its best close since April 2017. Plenty has happened to the banks since then, and they've faced plenty of uncertainty since the pandemic and as interest rates shot up at the fastest pace in history. The technicals may reflect a growing view the worst is behind them.

We know that around the same time as the above sectors have been prospering, sectors which are more exposed to the global growth story, or lack thereof, have struggled. The Materials (XMJ) -0.2% was once again the worst performing sector today, as it and Utilities (XUJ) -0.2% were the only two sectors among the 11 major ASX sectors to show losses for the session.

One can't discuss the woes which have befallen the Materials sector without acknowledging the absolutely horrendous day experienced by lithium stocks. It was a sea of red, and some very decent falls to boot, as can be seen in the table below:

See the Interesting Moves section for more details, but suffice it to say, the charts of the vast majority of ASX lithium stocks were already in well-entrenched short and long term trends. I suggest there's value in even the most ardent fundamental analysts keeping one eye on the technical trends!

Economy

No major economic data today!

What to watch out for...

Later this week:

Tue - Bank of Japan interest rate decision, Japan CPI

Wed - European Flash PMIs

Thu - US Flash PMIs

Fri - ECB interest rate decision; US Durable Goods, US New & Pending Home Sales, US PCE Price Index, US Personal Spending & Personal Incomes

Latest News

Everything you need to know about Liontown's selloff and Gina Rinehart's silence

The numbers are in: ETFs outstripped managed funds for the first time in 2023

ASX 200 stocks with fresh 52-week highs and lows – Week 4

ASX 200 stocks attracting the biggest broker upgrades this week: Super Retail Group, Fortescue

The 10 most overbought and oversold ASX 200 stocks – Week 4

Interesting Movers

Trading higher

- +16.5% Zip Co (ZIP) - 2Q FY24 Results Update and interim 1H24 Results Update, rally is consistent with the prevailing short and long term uptrends

- +9.8% Polynovo (PNV) - 1H24 Trading Result (unaudited)

- +6.3% The A2 Milk Company (A2M) - No news since 19-Jan Citi retained at buy, price target $4.81

- +5.1% Humm Group (HUM) - Sector recovery (see Zip Co.), rally is consistent with the prevailing short and long term uptrends

- +5.1% The Star Entertainment Group (SGR) - No news 🤔

- +5.0% IDP Education (IEL) - No news 🤔

- +4.8% Life360 Inc. (360) - No news, general tech sector strength

- +4.1% Pacific Current Group (PAC) - No news 🤔

- +4.0% Maas Group Holdings (MGH) - No news, rally is consistent with the prevailing short and long term uptrends

- +3.6% Bega Cheese (BGA) - No news, rally is consistent with the prevailing short and long term uptrends

- +3.6% MA Financial Group (MAF) - No news, rally is consistent with the prevailing short and long term uptrends

- +3.5% Alumina (AWC) - Generally positive broker commentary in wake of Curtailment of Kwinana Alumina Refinery

- +3.4% AUB Group (AUB) - Retained at outperform by Macquarie (see Broker Moves), rally is consistent with the prevailing short and long term uptrends

- +3.4% Steadfast Group (SDF) - Retained at outperform by Macquarie (see Broker Moves), rally is consistent with the prevailing short and long term uptrends

Trading lower

- -21.3% Liontown Resources (LTR) - Project and Funding Update, lithium sector weakness due to falling lithium minerals prices, Bell Potter PT cuts (see Broker Moves), fall is consistent with prevailing short and long term downtrends

- -9.6% Mineral Resources (MIN) - Lithium sector weakness due to falling lithium minerals prices, Bell Potter PT cuts (see Broker Moves), fall is consistent with prevailing short and long term downtrends

- -7.3% Arcadium Lithium (LTM) - Lithium sector weakness due to falling lithium minerals prices, Bell Potter PT cuts (see Broker Moves), fall is consistent with prevailing short and long term downtrends

- -7.1% Calix (CXL) - Lithium sector weakness due to falling lithium minerals prices, Bell Potter PT cuts (see Broker Moves), fall is consistent with prevailing short and long term downtrends

- -7.0% Piedmont Lithium Inc (PLL) - Lithium sector weakness due to falling lithium minerals prices, Bell Potter PT cuts (see Broker Moves), fall is consistent with prevailing short and long term downtrends

- -6.7% Beacon Lighting Group (BLX) - No news ⚠️

- -5.8% Deep Yellow (DYL) - No news since 18-Jan December 2023 Quarterly Activities Report, Broad uranium sector pullback, lingering fears of imminent capital raising due to media reports

- -5.6% Judo Capital Holdings (JDO) - Several broker reports over last few days, many dropping price target (see Broker Moves)

- -5.3% Bannerman Energy (BMN) - Broad uranium sector pullback

- -4.9% Perenti (PRN) - No news since 18-Jan Perenti secures A$420 million of contract extensions, fall is consistent with prevailing short and long term downtrends

- -4.7% Chalice Mining (CHN) - Corporate update, fall is consistent with prevailing short and long term downtrends

- -4.5% EML Payments (EML) - Pullback after rally following EML Payments to exit 'PCSIL' business

- -4.3% Vulcan Energy Resources (VUL) - Lithium sector weakness due to falling lithium minerals prices, Bell Potter PT cuts (see Broker Moves), fall is consistent with prevailing short and long term downtrends

- -4.0% Pilbara Minerals (PLS) - Lithium sector weakness due to falling lithium minerals prices, Bell Potter PT cuts (see Broker Moves), fall is consistent with prevailing short and long term downtrends

Broker Notes

Atlantic Lithium (A11) retained at outperform Macquarie; Price Target: $0.56 from $0.60

Ampol (ALD) retained at hold Ord Minnett; Price Target: $35.00

Alkane Resources (ALK) retained at buy Bell Potter; Price Target: $1.00

Atlas Arteria (ALX) retained at neutral Macquarie; Price Target: $5.80 from $5.84

AMP (AMP) retained at accumulate Ord Minnett; Price Target: $1.30

ANZ Group Holdings (ANZ) retained at accumulate Ord Minnett; Price Target: $31.00

APM Human Services International (APM) retained at hold Bell Potter; Price Target: $1.50 from $1.90

AUB Group (AUB) retained at outperform Macquarie; Price Target: $32.40

Alumina (AWC) retained at accumulate Ord Minnett; Price Target: $1.18

Aurizon Holdings (AZJ) retained at neutral Goldman Sachs; Price Target: $4.00 from $3.90

Azure Minerals (AZS) retained at hold Bell Potter; Price Target: $4.85

Bendigo and Adelaide Bank (BEN) retained at hold Ord Minnett; Price Target: $10.50

Boral (BLD) initiated at hold Bell Potter; Price Target: $5.15

Bank of Queensland (BOQ) retained at accumulate Ord Minnett; Price Target: $8.00

Commonwealth Bank of Australia (CBA) retained at hold Ord Minnett; Price Target: $90.00

Coronado Global Resources Inc. (CRN) retained at buy Bell Potter; Price Target: $2.15 from $2.00

Curvebeam AI (CVB) initiated at buy Bell Potter; Price Target: $0.50

Cygnus Metals (CY5) retained at buy Shaw and Partners; Price Target: $0.50

Coventry Group (CYG) retained at buy Bell Potter; Price Target: $1.80 from $1.45

Delta Lithium (DLI) retained at buy Bell Potter; Price Target: $0.75 from $0.85

Droneshield (DRO) retained at buy Bell Potter; Price Target: $0.50

Experience Co (EXP) retained at buy Ord Minnett; Price Target: $0.32 from $0.35

Fortescue (FMG) retained at sell Bell Potter; Price Target: $21.39 from $17.37

Graincorp Class A (GNC) retained at buy Bell Potter; Price Target: $9.50 from $9.55

Genetic Signatures (GSS) retained at buy Bell Potter; Price Target: $0.80 from $0.83

Green Technology Metals (GT1) retained at buy Bell Potter; Price Target: $0.39 from $0.72

Harvey Norman Holdings (HVN) upgraded to buy from neutral at UBS; Price Target: $4.75 from $3.75

IGO (IGO) retained at buy Bell Potter; Price Target: $8.50 from $11.30

Inghams Group (ING) retained at neutral UBS; Price Target: $4.50 from $3.25

-

Judo Capital Holdings (JDO)

Downgraded to sell from buy at Citi; Price Target: $0.87

Retained at hold Ord Minnett; Price Target: $1.10

Lake Resources (LKE) retained at buy Bell Potter; Price Target: $0.12 from $0.25

Latin Resources (LRS) retained at buy Bell Potter; Price Target: $0.43 from $0.46

-

Arcadium Lithium (LTM)

Retained at buy Bell Potter; Price Target: $12.10

Initiated at buy Citi; Price Target: $10.75

Liontown Resources (LTR) retained at buy Bell Potter; Price Target: $2.25 from $2.75

Lynas Rare Earths (LYC) retained at buy Bell Potter; Price Target: $8.50 from $8.80

Macquarie Technology Group (MAQ) retained at buy Goldman Sachs; Price Target: $77.70

-

Michael Hill International (MHJ)

Retained at outperform Macquarie; Price Target: $1.10

Retained at neutral Citi; Price Target: $0.86

Mineral Resources (MIN) downgraded to hold from buy at Jefferies; Price Target: $65.00 from $70.00

Medibank Private (MPL) retained at neutral Macquarie; Price Target: $3.65

Macquarie Group (MQG) retained at hold Ord Minnett; Price Target: $175.00

Mystate (MYS) retained at buy Ord Minnett; Price Target: $4.80

National Australia Bank (NAB) retained at hold Ord Minnett; Price Target: $31.00

NIB Holdings (NHF) retained at neutral Macquarie; Price Target: $7.70

Orecorp (ORR) retained at hold Bell Potter; Price Target: $0.58 from $0.53

Propel Funeral Partners (PFP) retained at buy Bell Potter; Price Target: $5.90 from $5.70

Piedmont Lithium Inc (PLL) retained at outperform Macquarie; Price Target: $0.60

Pilbara Minerals (PLS) retained at hold Bell Potter; Price Target: $3.60 from $3.90

Prospect Resources (PSC) retained at outperform Macquarie; Price Target: $5.60

Platinum Asset Management (PTM) retained at sell Bell Potter; Price Target: $0.84

QBE Insurance Group (QBE) retained at buy Goldman Sachs; Price Target: $18.52 from $18.34

Steadfast Group (SDF) retained at outperform Macquarie; Price Target: $6.10 from $5.90

Synlait Milk (SM1) downgraded to hold from buy at Bell Potter; Price Target: $0.95 from $1.50

Santana Minerals (SMI) retained at buy Bell Potter; Price Target: $1.80 from $1.45

Suncorp Group (SUN) retained at hold Ord Minnett; Price Target: $13.50

Seven Group Holdings (SVW) downgraded to hold from buy at Bell Potter; Price Target: $38.00 from $33.00

Transurban Group (TCL) retained at outperform Macquarie; Price Target: $13.40 from $13.65

Westpac Banking Corporation Ordinary (WBC) retained at accumulate Ord Minnett; Price Target: $28.00

-

Whitehaven Coal (WHC)

Downgraded to hold from add at Morgans; Price Target: $8.50

Retained at accumulate Ord Minnett; Price Target: $8.80

Retained at sell Bell Potter; Price Target: $7.65

Retained at buy Citi; Price Target: $9.40

Retained at neutral Goldman Sachs; Price Target: $6.20

Zip Co (ZIP) retained at buy Ord Minnett; Price Target: $0.75 from $0.42

Scans

This article first appeared on Market Index on 22 January 2024.

5 topics

9 stocks mentioned