ASX 200 edges higher as Kogan blows past expectations, TPG, NIB and Endeavour disappoint

Today in Review

Markets

%20Intraday%20Chart%2026%20Feb%202024.png)

The S&P/ASX200 (XJO) finished 9.2 points higher at7,652.8 , 0.21% from its session low and 0.40% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 153 to 114.

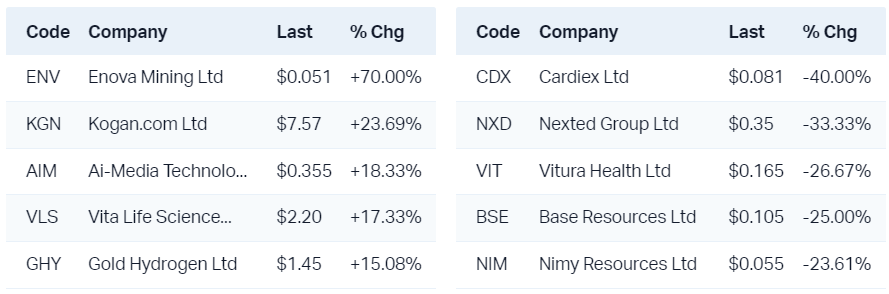

The Gold (XGD) (+1.6%) sub-sector was the best performing sector today, partly due to the gold price edging higher since our last update, but more likely in response to a strong performance from Gold Road Resources (GOR) (+4.9%) which was the beneficiary of several positive broker reports following its full year results on Friday.

The sector has been doing it tough of late, so today's broad based gains are no doubt welcome among ASX gold bugs!

Also doing well today was the Consumer Discretionary (XDJ) (+1.1%) and Information Technology (XIJ) (+0.9%) sectors, both following up their strong performances from last week. Much of the recent performance is due to a few sector heavyweights within both sectors respectively reporting strong / better than expected results.

Doing it tough today (again!) was the Energy (XEJ) (-2.1%) and Utilities (XUJ) (-0.8%) sectors. While we're on the topic of underperforming sectors, I note the Resources (XJR) (-0.8%) sector wasn’t much chop either.

In energy, Santos (STO) (-5.3%) went ex-dividend, but more broadly speaking, crude oil and natural gas prices were sharply lower Friday. In resources, continued weakness in the iron ore price is no doubt contributing to falls, but really, it's probably just a matter of where investors see earnings upgrades and tailwinds versus downgrades and headwinds.

ChartWatch

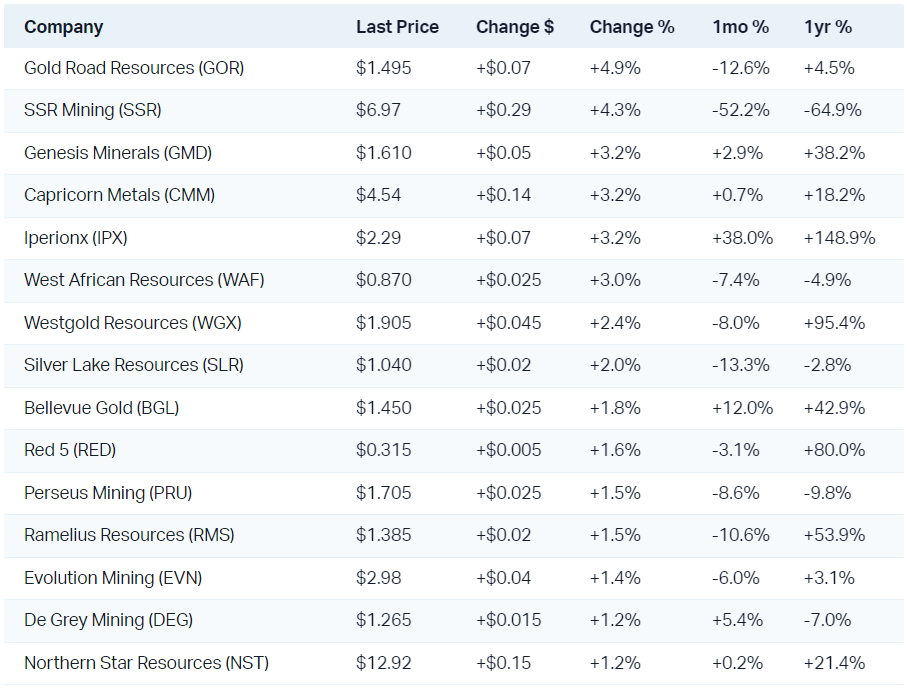

Boss Energy (ASX: BOE)

.png)

I haven't covered uranium stocks for a while in ChartWatch, and the sector probably deserves another review, but I spotted a couple of very interesting candles today which are worth highlighting.

Firstly, on Boss Energy, it's the full and long white candle which had its low smack-bang on the long term uptrend ribbon. As you know, I believe these ribbons act as dynamic support/resistance zones in strong trends. In an uptrend, the ribbon is green and is expected to offer dynamic support. In a downtrend, the ribbon is dark pink and is expected to offer dynamic resistance.

In strong trends, think of my long term trend ribbons as where the big, smart money comes into the market to buy/sell into overly pessimistic/optimistic pullbacks/rallies.

Boss shareholders will be hoping its a case of buying the pullback, and it couldn't come too soon as the recent correction has hobbled the short term uptrend. Follow-up demand-side candles (i.e., white bodies and or downward pointing shadows) will confirm excess demand is returning, and in the medium term, a resumption of higher peaks and higher is essential.

Static resistance (i.e., from historical peaks/troughs) moves to 5.16, while today's low of 4.40 is now the key point of demand.

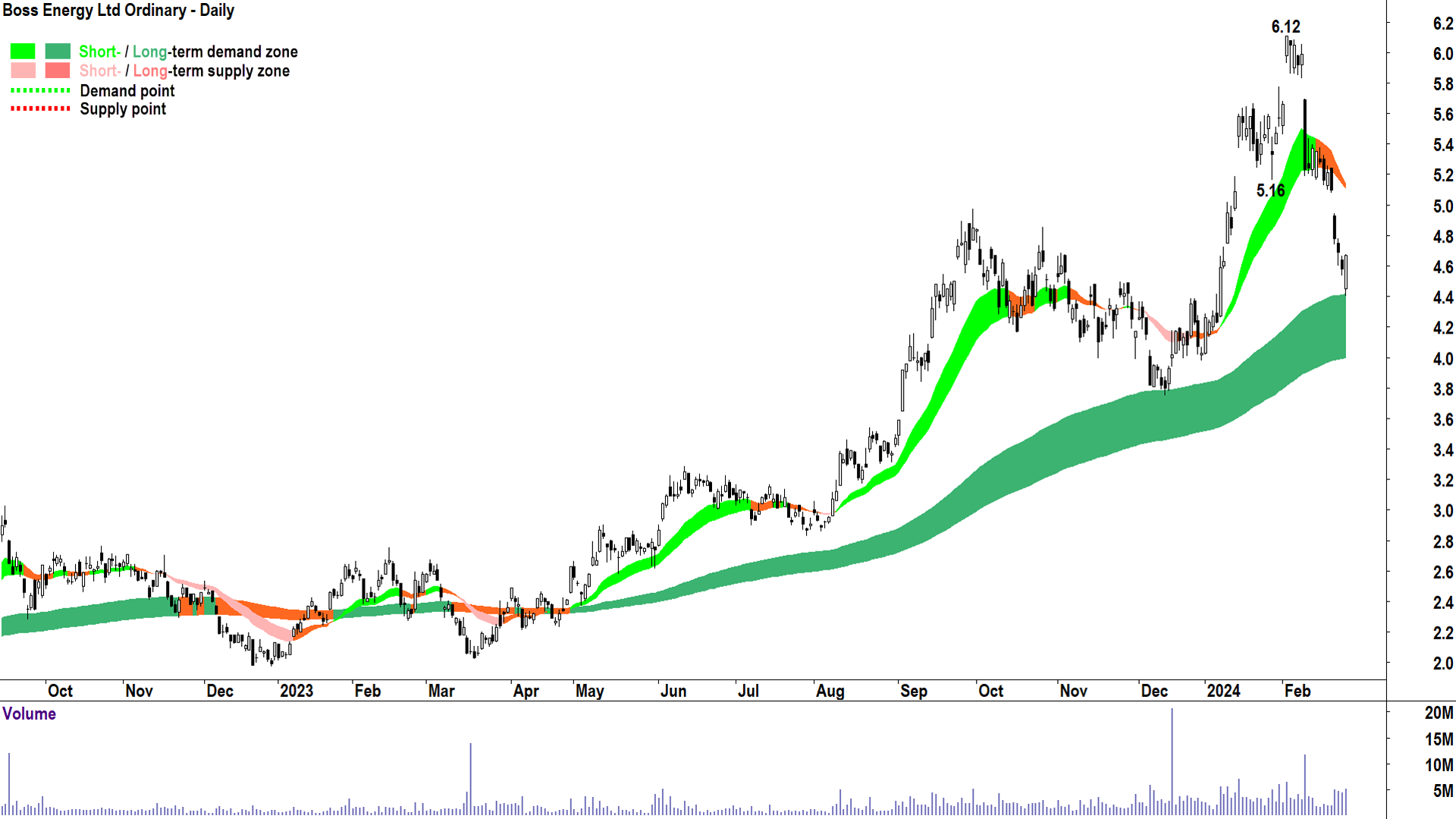

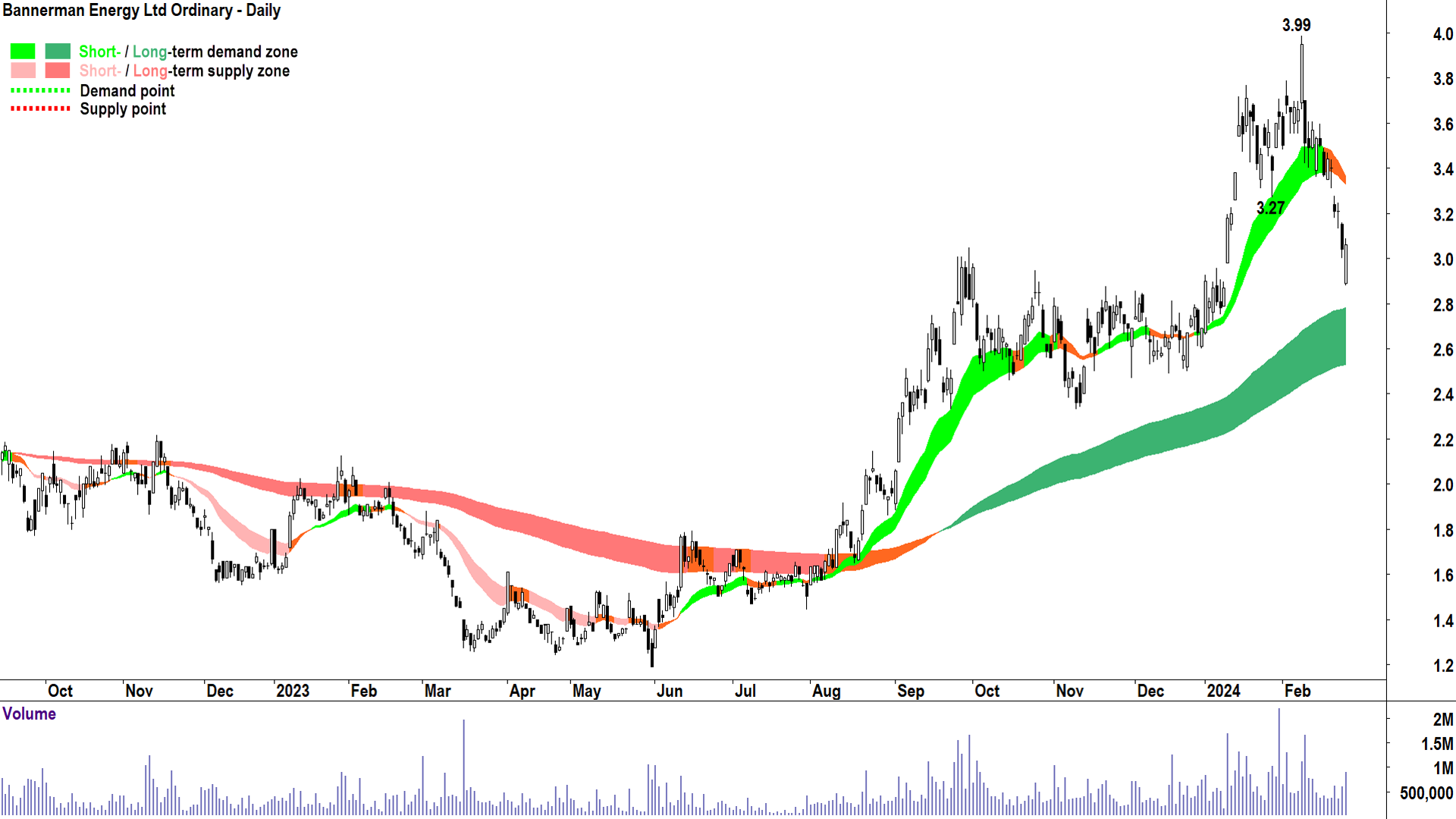

Bannerman Energy (ASX: BMN)

.png)

It's largely a case of "ditto" for Bannerman, so I won't do the whole spiel about dynamic support again. But, I am also impressed with today's strong demand-side candle, and it's no impediment it occurred above the long term trend ribbon (it just indicates greater demand in the system).

I note there's likely a good reason why today's candle appeared above the long term trend ribbon – today's low coincides with an extended period of static support through the basing pattern from October to January.

3.27 is now the key overhead static resistance point. Today's low of 2.88 is now the key point of demand.

Economy

Today

No major economic announcements today!

Later this week

-

Tuesday

USA: New Home Sales (680k forecast vs 664k previous)

-

Wednesday

USA: Durable Goods Orders (-4.7% forecast vs 0.0% previous & Core +0.2% forecast and 0.5% previous)

USA: CB Consumer Confidence (114.8 forecast vs 114.8 previous)

AU: Consumer Price Index CPI (+3.6% p.a. forecast vs +3.4% p.a. previous)

-

Thursday

USA: Prelim GDP December quarter (+3.3% p.a. forecast vs 3.3% p.a. previous)

AU: Retail Sales January (forecast +1.6% vs -2.7% previous)

-

Friday

USA: Core PCE Price Index January (+0.4% forecast vs +0.2% previous)

CHN: Manufacturing PMI (49.1 forecast vs 49.2 previous) and Non-Manufacturing PMI (50.7 forecast vs 50.7 previous)

CHN: Caixin Manufacturing PMI (50.7 forecast vs 50.8 previous)

EU: Eurozone Core Consumer Price Index CPI (+2.9% p.a. forecast vs +3.3% p.a. previous)

-

Saturday

USA: ISM Manufacturing PMI (49.5 forecast vs 49.1 previous)

Latest News

Why the ASX 200's highest paying dividend stock is flashing a buy opportunity

ChartWatch: Pilbara Minerals probes key resistance as lithium futures eye fourth straight gain

The best nuggets from Warren Buffett's 2023 shareholder letter

The ASX 200 stocks attracting the biggest broker upgrades: Reliance Worldwide, Wisetech

ASX 200 stocks hitting fresh 52-week highs and lows – Week 9

Newmont vs Evolution: Which is the superior gold miner?

Don't miss an ASX announcement this reporting season, check out our comprehensive H1 FY24 Earnings Season Calendar and set up and receive announcements direct to your inbox on Market Index: Create Alert Now

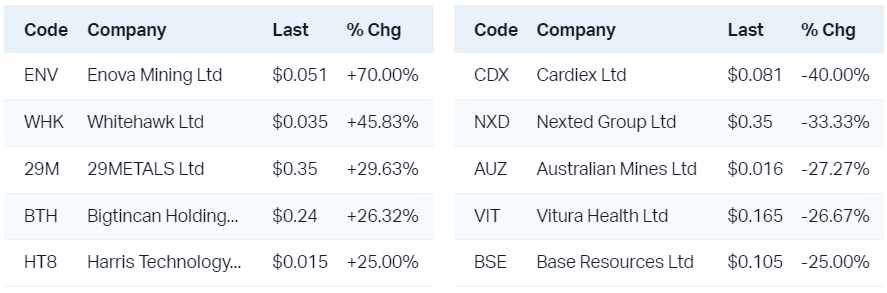

Interesting Movers

Trading higher

+23.7% Kogan.Com (KGN) - Half Yearly Report and Accounts

+14.9% Mayne Pharma Group (MYX) - Half Yearly Report and Accounts

+13.7% Integral Diagnostics (IDX) - Continued positive response to 20 Feb Half Yearly Report and Accounts, rise is consistent with prevailing short term uptrend, closed above long term downtrend ribbon

+8.4% Liontown Resources (LTR) - Investor Presentation - BMO Conference, part of broader lithium sector rally on 4th straight gain in GFEX futures

+7.5% Zip Co (ZIP) - No news, rise is consistent with prevailing short and long term uptrends

+7.1% Lovisa Holdings (LOV) - Continued positive response to 22 Feb Half Yearly Report and Accounts, 2 x price target increases from brokers (see Broker Moves), rise is consistent with prevailing short and long term uptrends

+6.9% Alumina (AWC) - Alumina and Alcoa enter into Exclusivity Deed

+6.6% Lotus Resources (LOT) - Bounce after fall following Friday's $30million Placement for Uranium Restart & Development

+5.9% Regis Healthcare (REG) - Half Yearly Report and Accounts

+5.8% Tabcorp Holdings (TAH) - Bounce after fall following 22 Feb Half Yearly Report and Accounts

+5.7% Pilbara Minerals (PLS) - Corporate Presentation - BMO Conference, improving techincals - see article, part of broader lithium sector rally on 4th straight gain in GFEX futures

+5.6% The Star Entertainment Group (SGR) - No news, possible positioning ahead of Half Yearly Report and Accounts on Thurs 29 Feb

+5.3% Neuren Pharmaceuticals (NEU) - No news, bounce following sharp sell off following Comment on research report

+5.2% Imdex (IMD) - No news, continued positive response to 19 Feb Half Yearly Report and Accounts, rise is consistent with prevailing short term uptrend, long term trend transitioning to up

+4.9% Gold Road Resources (GOR) - Continued positive response to Friday's Appendix 4E and 2023 Preliminary Final Report, 5 x buy ratings & 2 price target increases with brokers (see Broker Moves)

Trading lower

-16.0% Nanosonics (NAN) - Half Yearly Report and Accounts, fall is consistent with prevailing short and long term downtrends

-8.0% TPG Telecom (TPG) - Appendix 4E and 2023 Annual Report

-6.7% Accent Group (AX1) - Continued negative response to Friday's Half Yearly Report and Accounts, closed below long term uptrend ribbon

-6.5% Iress (IRE) - Iress enters into agreement to sell Platform business, closed back below long terrm downtrend ribbon

-5.6% NIB Holdings (NHF) - Half Yearly Report and Accounts

-5.4% Infomedia (IFM) - No news, pullback after sharp rally following 20 Feb Half Yearly Report and Accounts

-5.3% Santos (STO) - Ex-dividend $0.268 unfranked

-4.0% Bravura Solutions (BVS) - No news, pullback after sharp rally following 20 Feb Half Yearly Report and Accounts, 2 x Change in substantial holding (sell downs)

-3.6% Iluka Resources (ILU) - No news, fall is consistent with prevailing short and long term downtrends

-3.4% Endeavour Group (EDV) - Half Yearly Report and Accounts, fall is consistent with prevailing short and long term downtrends

-3.3% Platinum Asset Management (PTM) - No news, fall is consistent with prevailing short and long term downtrends

-3.1% Monadelphous Group (MND) - Monadelphous Contracts Update

-3.0% Brambles (BXB) - No news, negative response (likely US investors) following Friday's Half Yearly Report and Accounts, 2 x broker rating downgrades (see Broker Moves)

-2.9% Clinuvel Pharmaceuticals (CUV) - Continued negative response to 22 Feb Half Yearly Report and Accounts, fall is consistent with prevailing short and long term downtrends

Broker Notes

-

29METALS (29M)

Retained at overweight at Morgan Stanley; Price Target: $0.50 from $0.60

Downgraded to neutral from outperform at Macquarie; Price Target: $0.29 from $0.70

-

ARN Media (A1N)

Retained at neutral at Macquarie; Price Target: $1.04 from $1.00

Retained at neutral at UBS; Price Target: $0.87 from $0.82

Downgraded to market-weight from overweight at Wilsons; Price Target: $0.92 from $1.24

-

Aussie Broadband (ABB)

Retained at neutral at Barrenjoey; Price Target: $4.50 from $3.85

Retained at positive at E&P; Price Target: $4.90 from $4.50

Retained at hold at Jefferies; Price Target: $4.30 from $4.00

Retained at underweight at JP Morgan; Price Target: $3.75 from $3.60

Retained at accumulate at Ord Minnett; Price Target: $4.88 from $4.03

Retained at buy at Unified Capital Partners; Price Target: $5.36 from $4.80

Air New Zealand (AIZ) retained at accumulate at Ord Minnett; Price Target: $0.74

AMA Group (AMA) retained at buy at Bell Potter; Price Target: $0.13 from $0.14

Australian Unity Office Fund (AOF) retained at hold at Ord Minnett; Price Target: $1.13 from $1.14

APA Group (APA) retained at equalweight at Morgan Stanley; Price Target: $9.18 from $9.28

-

Eagers Automotive (APE)

Upgraded to neutral from sell at Citi; Price Target: $13.90 from $13.25

Retained at neutral at UBS; Price Target: $14.10

-

Austal (ASB)

Retained at buy at Bell Potter; Price Target: $2.85 from $2.75

Retained at buy at Citi; Price Target: $3.10 from $2.75

Retained at outperform at Macquarie; Price Target: $2.10

Autosports Group (ASG) retained at buy at UBS; Price Target: $3.10

-

Avita Medical Inc (AVH)

Retained at buy at Bell Potter; Price Target: $7.00 from $6.85

Retained at hold at Ord Minnett; Price Target: $5.40

-

Accent Group (AX1)

Retained at buy at Citi; Price Target: $2.43 from $2.11

Upgraded to underperform from sell at CLSA; Price Target: $2.00 from $1.75

Retained at neutral at Jarden; Price Target: $2.05 from $1.87

Retained at equalweight at Morgan Stanley; Price Target: $1.90

Retained at add at Morgans; Price Target: $2.30

Retained at outperform at RBC Capital Markets; Price Target: $2.30

Retained at sell at UBS; Price Target: $1.95 from $1.85

Retained at marketweight at Wilsons; Price Target: $2.10 from $1.90

-

Bapcor (BAP)

Retained at outperform at Macquarie; Price Target: $6.90 from $6.12

Retained at underweight at Morgan Stanley; Price Target: $5.20

Retained at hold at Ord Minnett; Price Target: $6.10

Retained at neutral at UBS; Price Target: $6.00 from $6.10

-

Brambles (BXB)

Downgraded to neutral from buy at BofA; Price Target: $15.55 from $15.50

Retained at sell at Citi; Price Target: $14.25 from $13.15

Retained at sell at Goldman Sachs; Price Target: $14.45 from $13.90

Retained at overweight at Jarden; Price Target: $15.70 from $15.35

Downgraded to underweight from hold at Jefferies; Price Target: $13.22 from $12.92

Retained at outperform at Macquarie; Price Target: $16.25 from $15.70

Retained at equalweight at Morgan Stanley; Price Target: $15.40

Retained at hold at Morgans; Price Target: $15.65 from $14.95

Retained at outperform at RBC Capital Markets; Price Target: $18.25 from $17.25

Retained at buy at UBS; Price Target: $17.10 from $16.55

Coast Entertainment Holdings (CEH) retained at at Ord Minnett; Price Target: $0.60

-

COG Financial Services (COG)

Retained at buy at Bell Potter; Price Target: $1.84 from $1.83

Retained at buy at Ord Minnett; Price Target: $1.90 from $1.87

CSR (CSR) retained at hold at Bell Potter; Price Target: $9.00 from $5.70

Corporate Travel Management (CTD) initiated at buy at Shaw and Partners; Price Target: $20.00

Clinuvel Pharmaceuticals (CUV) retained at accumulate at Ord Minnett; Price Target: $18.00

-

Cedar Woods Properties (CWP)

Upgraded to buy from hold at Bell Potter; Price Target: $5.30

Upgraded to add from hold at Morgans; Price Target: $5.60 from $4.50

-

Calix (CXL)

Retained at buy at Bell Potter; Price Target: $5.10

Retained at buy at Shaw and Partners; Price Target: $4.50 from $6.00

Coventry Group (CYG) retained at buy at Bell Potter; Price Target: $1.80

De Grey Mining (DEG) retained at outperform at Macquarie; Price Target: $1.80

Environmental Group (The) (EGL) retained at buy at Bell Potter; Price Target: $0.32 from $0.34

-

Fortescue (FMG)

Retained at sell at Bell Potter; Price Target: $21.51 from $21.39

Retained at sell at Goldman Sachs; Price Target: $19.60 from $19.80

Genusplus Group (GNP) retained at buy at Bell Potter; Price Target: $1.70 from $1.50

-

Gold Road Resources (GOR)

Retained at buy at Bell Potter; Price Target: $1.85 from $1.80

Retained at buy at Goldman Sachs; Price Target: $1.95

Upgraded to overweight from neutral at JPMorgan; Price Target: $1.60 from $1.55

Upgraded to outperform from neutral at Macquarie; Price Target: $1.60

Retained at buy at Ord Minnett; Price Target: $1.70 from $1.80

Genetic Signatures (GSS) retained at buy at Bell Potter; Price Target: $0.75

Harmoney Corp (HMY) retained at accumulate at Ord Minnett; Price Target: $0.86 from $0.85

Hub24 (HUB) retained at buy at Citi; Price Target: $42.80 from $42.20

-

Insignia Financial (IFL)

Retained at outperform at CLSA; Price Target: $2.45 from $2.10

Retained at overweight at Jarden; Price Target: $2.80 from $2.70

Retained at overweight at JP Morgan; Price Target: $3.15 from $3.10

Integrated Research (IRI) retained at buy at Bell Potter; Price Target: $0.66

-

Jumbo Interactive (JIN)

Downgraded to neutral from outperform at Macquarie; Price Target: $17.15 from $16.85

Retained at overweight at Morgan Stanley; Price Target: $20.80 from $19.20

Latitude Group Holdings (LFS) upgraded to neutral from sell at Citi; Price Target: $1.15 from $0.95

LGI (LGI) retained at buy at Bell Potter; Price Target: $2.55 from $2.32

-

Lovisa Holdings (LOV)

Retained at buy at Bell Potter; Price Target: $30.70 from $26.50

Retained at neutral at Macquarie; Price Target: $26.90 from $18.50

Arcadium Lithium (LTM) retained at buy at Bell Potter; Price Target: $10.40 from $12.10

-

MA Financial Group (MAF)

Retained at buy at Ord Minnett; Price Target: $7.00 from $7.50

Retained at buy at UBS; Price Target: $5.60 from $6.10

Matrix Composites & Engineering (MCE) retained at buy at Bell Potter; Price Target: $0.42 from $0.34

Medibank Private (MPL) retained at equalweight at Morgan Stanley; Price Target: $3.84 from $3.66

-

Monash IVF Group (MVF)

Upgraded to buy from hold at Jefferies; Price Target: $1.70 from $1.50

Retained at outperform at Macquarie; Price Target: $1.55

Retained at overweight at Morgan Stanley; Price Target: $1.65 from $1.45

Retained at add at Morgans; Price Target: $1.55 from $1.50

Retained at accumulate at Ord Minnett; Price Target: $1.50 from $1.40

Retained at buy at Unified Capital Partners; Price Target: $1.60 from $1.50

Maxiparts (MXI) retained at buy at Ord Minnett; Price Target: $3.20 from $3.40

Mystate (MYS) retained at buy at Ord Minnett; Price Target: $4.80

Omni Bridgeway (OBL) retained at neutral at Goldman Sachs; Price Target: $13.75 from $13.80

Pacific Current Group (PAC) retained at buy at Ord Minnett; Price Target: $12.00 from $12.20

-

Paladin Energy (PDN)

Retained at buy at Citi; Price Target: $1.45

Retained at outperform at Macquarie; Price Target: $1.50

Piedmont Lithium Inc (PLL) retained at outperform at Macquarie; Price Target: $0.40 from $0.49

Pro Medicus (PME) retained at outperform at Macquarie; Price Target: $120.00

Perseus Mining (PRU) retained at accumulate at Ord Minnett; Price Target: $2.00

-

Pexa Group (PXA)

Retained at overweight at Barrenjoey; Price Target: $16.00 from $15.30

Retained at neutral at Goldman Sachs; Price Target: $13.10 from $12.85

Retained at neutral at Jarden; Price Target: $11.65 from $11.50

Retained at hold at Jefferies; Price Target: $11.91 from $11.45

Retained at outperform at Macquarie; Price Target: $15.45 from $14.65

Retained at hold at Morgans; Price Target: $12.19 from $11.66

Retained at buy at UBS; Price Target: $14.00

-

Qantas Airways (QAN)

Retained at positive at E&P; Price Target: $6.90 from $7.73

Retained at buy at Jarden; Price Target: $7.00 from $6.90

Retained at buy at Jefferies; Price Target: $7.62 from $7.79

Retained at hold at Ord Minnett; Price Target: $6.10

Retained at buy at UBS; Price Target: $7.55 from $7.70

-

Qube Holdings (QUB)

Downgraded to accumulate from buy at Ord Minnett; Price Target: $3.59 from $3.34

Retained at neutral at UBS; Price Target: $3.53 from $3.33

Rural Funds Group (RFF) retained at buy at Bell Potter; Price Target: $2.40

Regis Resources (RRL) retained at neutral at Goldman Sachs; Price Target: $2.15

Scentre Group (SCG) retained at accumulate at Ord Minnett; Price Target: $3.50 from $3.40

-

Sandfire Resources (SFR)

Retained at neutral at Goldman Sachs; Price Target: $7.20

Retained at outperform at Macquarie; Price Target: $8.10 from $7.90

Retained at accumulate at Ord Minnett; Price Target: $7.50

Retained at buy at UBS; Price Target: $7.60

Block (SQ2) retained at hold at Ord Minnett; Price Target: $83.00

Servcorp (SRV) retained at buy at UBS; Price Target: $4.70 from $4.50

Strike Energy (STX) retained at buy at Goldman Sachs; Price Target: $0.31 from $0.50

-

Tabcorp Holdings (TAH)

Retained at neutral at Barrenjoey; Price Target: $0.78 from $0.91

Retained at overweight at Jarden; Price Target: $0.95 from $1.15

Retained at buy at Jefferies; Price Target: $0.83 from $1.15

Retained at neutral at JP Morgan; Price Target: $0.70 from $0.88

Telix Pharmaceuticals (TLX) retained at buy at Bell Potter; Price Target: $14.00

-

Universal Store Holdings (UNI)

Retained at buy at Bell Potter; Price Target: $5.65 from $4.80

Retained at buy at UBS; Price Target: $5.25 from $4.60

Woodside Energy Group (WDS) retained at sell at Citi; Price Target: $27.00

Xero (XRO) retained at buy at Goldman Sachs; Price Target: $141.00

Scans

This article first appeared on Market Index on 26 February 2024.

5 topics

14 stocks mentioned