ASX 200 rebounds as lithium stocks score rare win, jilted Santos tumbles

Today in Review

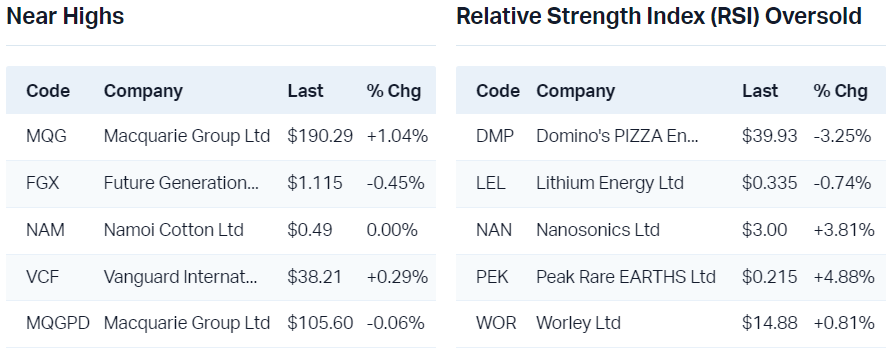

Markets

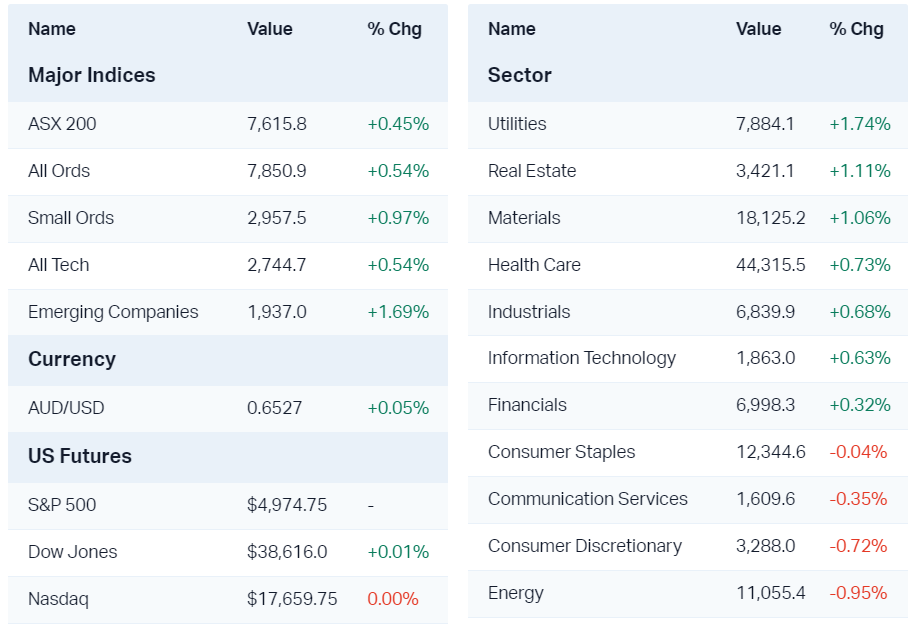

ASX 200 Session Chart

%20Intraday%20Chart%207%20Feb%202024.png)

The S&P/ASX200 (XJO) finished 34.2 points higher at 7,615.8, roughly in the middle of its trading range, 0.45% from its session low and 0.38% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by an impressive 209 to 74. This is important because broad-based moves are more likely to be sustainable.

Utilities (XUJ) (+1.7%) was the best performing sector today, but it's dominated by its two largest stocks Origin Energy (ORG) and AGL Energy Ltd (AGL) which were up 2.7% and 1.8% respectively. Real Estate Investment Trusts (XPJ) (+1.1%) and Materials (XMJ) (+1.1%) also prospered today, the latter bouncing back after a sharp 2-day sell off.

Consumer Discretionary (XDJ) (-0.7%) and Energy (XEJ) (-1.0%) were the worst performers. Discretionary was a mixed bag, though, with Domino's PIZZA Enterprises (DMP) (-3.6%) suffering from a disappointing investor call, while the likes of Nick Scali Ltd (NCK) (+5.9%), Temple & Webster Group Ltd (TPW) (+6.3%), and Cettire Ltd (CTT) (+25.2%) each prospered.

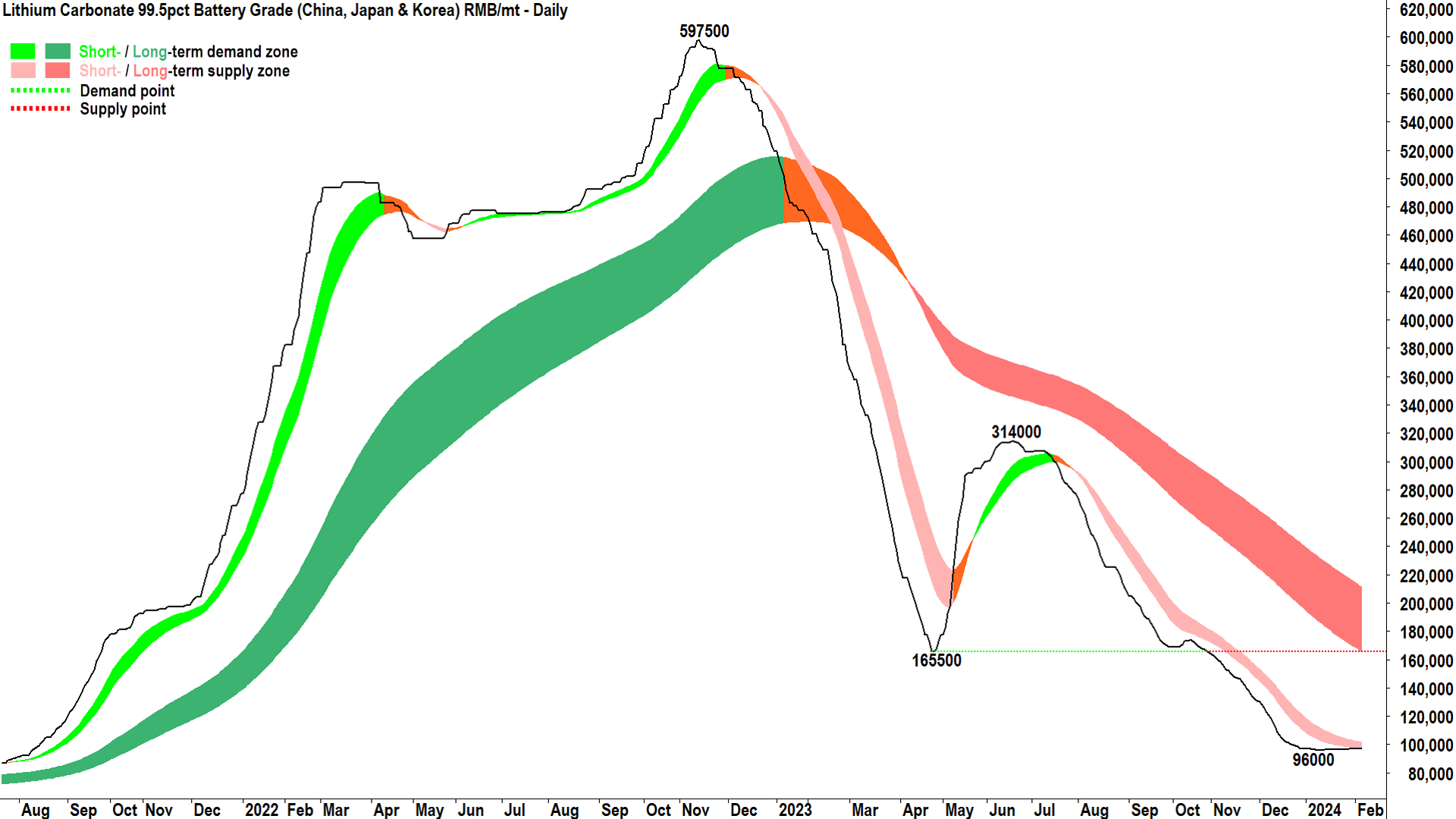

The other bright spark worth mentioning, well, because it so rarely gets mentioned in this context, was the lithium sector. It followed its US counterparts higher today on no major news drivers. Certainly, there's little happening on the lithium minerals side of things with most contracts hovering around their lows (Lithium Carbonate spot price chart below!).

Energy was dragged lower on the news that Woodside Energy (WDS) (+0.5%) has walked away from its proposed merger with Santos (STO) (-5.9%). There's more details on each of these moves in the Interesting Moves section below.

ChartWatch

Santos Ltd (ASX: STO).png)

There really wasn't anything in the technicals to suggest today's drop was coming. As good as technical analysis is, it's not a crystal ball! But, let's dust off the old ball and try and figure out where to next for Santos.

Big black candles are never a good look. They indicate a rush to the door, with plenty of shareholders desperate to get out and few cash owners brave enough to fish for a bottom. The downward pointing shadow on today's Santos candle provides a sliver of hope, though, that at least a few investors were prepared to punt on a low.

The trough low of $7.41 set on 11 January held on a closing basis today (today's close was $7.41), and this is another small bonus. Past points of demand should act as future points of demand and at least this has occurred so far.

Tomorrow's candle is now crucial. A continuation sell off would demonstrate the supply-side has grasped control of the Santos price and this could facilitate further declines. A large white bodied candle, or one with a long downward pointing shadow would indicate the selling is done, and the demand-side has stepped back in.

For the most part, the Santos chart is largely sideways, so the next candle may be moot. The trading range between $6.70 and $8.10 looks well-entrenched here.

Economy

No major economic updates today!

Thursday

12:30 China CPI y/y to January: consensus forecast -0.5% p.a. vs -0.3% p.a. in November; China PPI y/y to January: consensus forecast-2.6% p.a. vs November -2.7% p.a.

Friday

09:30 AU RBA Governor Bullock speaks

Latest News

Why Citi thinks iron ore prices could hit US$150 a tonne

Short Selling: Pilbara Minerals and Syrah remain the most shorted stocks, Appen shorts ease

Norfolk Metals' maiden drill run paves the way for future uranium discoveries

How these ASX investors are positioned (including 17 stocks on their watchlists)

Interesting Movers

Trading higher+25.2% Cettire (CTT) - H1 FY24 Appendix 4D and Financial Report

+10.8% Piedmont Lithium Inc (PLL) - Piedmont Lithium Provides Corporate Update

+8.6% DGL Group (DGL) - No news 🤔, rise is consistent with prevailing short term uptrend, long term trend has transitioned from down to neutral

+8.5% Chalice Mining (CHN) - Corporate Presentation - February 2024

+7.4% GQG Partners Inc. (GQG) - FUM as at 31 January 2024, rise is consistent with prevailing short and long term uptrends

+7.0% Zip Co (ZIP) - No news, rise is consistent with prevailing short and long term uptrends

+6.7% Grange Resources (GRR) - No news 🤔

+6.5% Perenti (PRN) - No news 🤔

+6.3% Temple & Webster Group (TPW) - No news, rise is consistent with prevailing short and long term uptrends

+5.9% Nick Scali (NCK) - Follow through buying from yesterday's Half Yearly Report and Accounts, rise is consistent with prevailing short and long term uptrends

+5.6% Pilbara Minerals (PLS) - General lithium sector strength today, following strong performance in US lithium sector Tuesday

+5.6% Liontown Resources (LTR) - General lithium sector strength today, following strong performance in US lithium sector Tuesday

-5.8% Santos (STO) - Santos concludes discussions with Woodside

-4.5% CSR (CSR) - Downgraded to sell from buy at UBS, and to sell from underperform at CSLA

-3.7% Domino's Pizza Enterprises (DMP) - Investor Call Transcript, fall is consistent with prevailing short and long term downtrends

-3.4% Eagers Automotive (APE) - No news 🤔

-2.9% Fineos Corporation Holdings (FCL) - No news 🤔

-2.9% PSC Insurance Group (PSI) - No news 🤔

-2.8% G.U.D. Holdings (GUD) - No news 🤔

Broker Notes

Altium (ALU) retained at underweight at Jarden; Price Target: $42.00 from $37.60

Amcor (AMC) retained at neutral at Jarden; Price Target: $14.30

Bapcor (BAP) retained at outperform at Macquarie; Price Target: $6.12 from $7.58

Brickworks (BKW) retained at buy at UBS; Price Target: $33.00 from $29.00

Boral (BLD) retained at neutral at UBS; Price Target: $5.50 from $5.15

BWP Trust (BWP) retained at underweight at Jarden; Price Target: $3.30

Centuria Industrial REIT (CIP) retained at overweight at Jarden; Price Target: $3.50

-

CSR (CSR)

Downgraded to sell from buy at UBS; Price Target: $6.60 from $6.50

Retained at neutral at Jarden; Price Target: $6.60 from $6.00

Retained at neutral at Macquarie; Price Target: $6.60

Downgraded to sell from underperform at CLSA; Price Target: $6.20 from $5.80

Cyclopharm (CYC) retained at buy at Bell Potter; Price Target: $3.80 from $4.25

De Grey Mining (DEG) retained at buy at UBS; Price Target: $1.50

Domain Holdings Australia (DHG) initiated at buy at Bell Potter; Price Target: $3.95

Hub24 (HUB) retained at neutral at Jarden; Price Target: $37.10 from $36.80

-

Janison Education Group (JAN)

Retained at buy at Shaw and Partners; Price Target: $0.70

Retained at buy at Bell Potter; Price Target: $0.55

JB HI-FI (JBH) retained at neutral at UBS; Price Target: $55.00 from $47.00

James Hardie Industries (JHX) retained at buy at UBS; Price Target: $68.70 from $58.50

-

Nick Scali (NCK)

Upgraded to overweight from underperform at Jarden; Price Target: $13.87 from $10.40

Retained at outperform at Macquarie; Price Target: $14.90 from $12.60

Upgraded to overweight from market-weight at Wilsons; Price Target: $15.40 from $11.30

News Corporation (NWS) retained at neutral at Macquarie; Price Target: $37.00 from $33.00

Pact Group Holdings (PGH) retained at overweight at Jarden; Price Target: $1.30

REA Group (REA) initiated at hold at Bell Potter; Price Target: $179.00

Reece (REH) retained at sell at UBS; Price Target: $16.60 from $15.80

-

Region Group (RGN)

Retained at overweight at Jarden; Price Target: $2.50

Retained at equalweight at Morgan Stanley; Price Target: $2.35 from $2.30

Retained at neutral at Macquarie; Price Target: $2.30 from $2.23

Reliance Worldwide Corporation (RWC) retained at buy at UBS; Price Target: $4.80 from $4.50

South32 (S32) retained at neutral at Macquarie; Price Target: $3.10

Suncorp Group (SUN) retained at buy at Jarden; Price Target: $15.25 from $15.10

Seven Group Holdings (SVW) retained at hold at Bell Potter; Price Target: $38.00

Treasury Wine Estates (TWE) retained at neutral at Citi; Price Target: $11.00

Virgin Money UK LSE (VUK) retained at outperform at Macquarie; Price Target: $3.70 from $3.45

West African Resources (WAF) retained at outperform at Macquarie; Price Target: $1.40 from $1.60

Wisetech Global (WTC) downgraded to neutral from overweight at Jarden; Price Target: $68.00 from $76.00

Xero (XRO) downgraded to neutral from overweight at Jarden; Price Target: $110.00 from $108.00

Scans

This article first appeared on Market Index on 7 February 2024.

5 topics

10 stocks mentioned