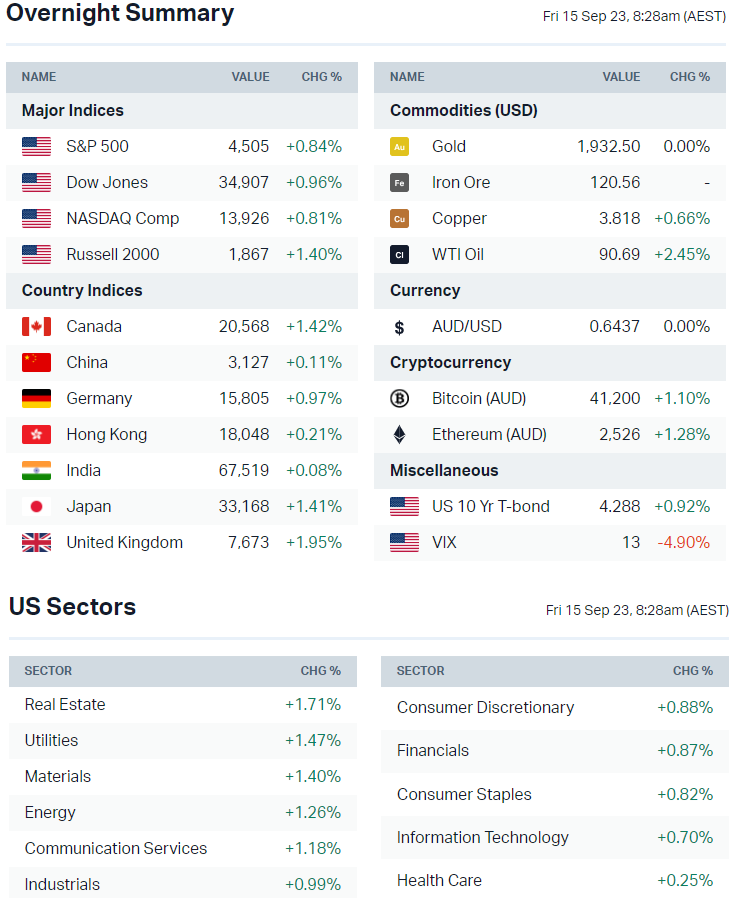

ASX 200 set to rally, Miners jump on China stimulus + Arm IPO pops 25%

ASX 200 futures are trading 88 points higher, up 1.22% as of 8:20 am AEST.

S&P 500 SESSION CHART

MARKETS

- Major US benchmarks higher, closing near best levels

- Bond yields firmer, US Dollar Index up 0.6% to a 6-month high as US producer prices come in much hotter-than-expected in August

- WTI crude settles 2.1% higher, closing above US$90 a barrel for the first time since 8 November 2022

- Commodities bolstered by China’s reserve requirement ratio cut for all banks, by 25 bps from 15 September to 7.4%

- Odds of US government shutdown rising after House Republicans failed to move ahead on a procedural vote advancing a Defence bill on Thursday (Bloomberg)

- Softbank’s Arm soars nearly 25% in market debut to US$65bn valuation (Reuters)

- Arm’s IPO lures in retail traders seeking exposure to AI trend (Bloomberg)

STOCKS

- Disney holds initial talks on sale of ABC to Nexstar (Bloomberg)

- Berkshire Hathaway trims its HP stake as PC maker underperforms (CNBC)

- Exxon Mobil and oil majors traded higher as oil prices surpass US$90 (CNBC)

CENTRAL BANKS

- ECB raises rates by 25 bps but signals end of policy tightening (Reuters)

CHINA

- China cuts reserve requirement ratio for second time this year (Bloomberg)

- China asks big banks to stagger and adjust dollar purchases (Reuters)

ECONOMY

- US retail sales beat expectations as Americans pay more for gasoline (Reuters)

- US producer prices accelerate more than expected in August (Reuters)

- Japan's core machinery orders fell more than expected in July (Reuters)

- Australia's job gains show economy absorbing RBA rate hikes, employment gains driven almost completely by part-time roles (Bloomberg)

Is It Time for Miners to Shine?

China continues to ramp up policy response measures, which is improving global growth sentiment. The overnight RRR cut follows a flurry of support measures over the past month or so including:

- A 10 bp reduction in the benchmark medium-term lending facility rate

- Lowered the floor for downpayment requirements on mortgage rates

- Loosened the definition of first-time buyers to make it easier to secure mortgage credit in tier one cities

We're starting to see a strong response from the Resource space, with Singapore iron ore futures rallying past US$120 a tonne on Thursday, a level not seen since April 2023.

A materials benchmark like the SPDR S&P Metals & Mining ETF rallied 3.4% overnight to a near 6-month high. Other resource-related ETFs also posted strong gains including VanEck Steel ETF (+3.3%), Global X Copper Miners ETF (+3.2%) and Global X Uranium ETF (+3.1%).

Charts of the Week

This segment of the Morning Wrap by Chris Conway brings you weekly technical commentary on the ASX 200 and interesting charts in the market. These are not meant as recommendations and for illustrative and educational purposes only. Past performance is not a reliable indicator of future return. Always do your own research.

ASX 200 – Grind on

.png)

Watching this market right now is akin to watching paint dry and it’s like being in relationship with someone you no longer love… a real grind. If the ASX 200 were a meme, it would be the one below … we’re just waiting for something to happen. Sorry everyone, but when there is nothing to talk about technically, you’re getting memes.

Carsales (ASX: CAR) – Driving higher

.png)

Compounding the lack of activity at the index level is the fact that there are only a handful of stocks – 4 to be precise – that are currently meeting my bullish technical scan. Carsales is one of them. It has really taken off since mid-August when it reported results that were well received by the market. It hasn’t looked back either, pressing up towards the $30 level. I would expect some natural resistance at such a big round number and it will be interesting to see if the bulls can punch through. No doubt they have the momentum right now.

Liontown (ASX: LTR ) – Gina roaring

.png)

LTR is one of the other few names to come up on the list. Like CAR it has had an event recently which has provided a shot in the arm and it is also hovering near a significant round number - $3 in the case of LTR. As for the shot in the arm, it was reported during the week that Gina Rinehart, through her company Hancock Prospecting, has tipped half a billy into the WA-based lithium miner and now holds 7.72% of the company. The move essentially gatecrashes Albemarle’s $6.6 billion takeover party, after the New York listed chemical company lobbed a bid at $3 per share. They should have known better than to play in Rhinehart’s backyard.

KEY EVENTS

ASX corporate actions occurring today:

Trading ex-div: Duratec (DUR) – $0.03, Carsales (CAR) – $0.325, Pental (PTL) – $0.01

- See full list of ASX stocks and ETFs trading ex-dividend here

- Listing: None

Economic calendar (AEST):

- 12:00 pm: China House Price Index

- 12:00 pm: China Industrial Production, Retail Sales and Fixed Asset Investment

- 12:00 pm: China Unemployment Rate

- 12:00 am: US Michigan Consumer Sentiment

This Morning Wrap was written by Chris Conway and Kerry Sun.

2 stocks mentioned

2 contributors mentioned