ASX 200 to fall, S&P 500 wobbles + Gold fades from record highs

ASX 200 futures are trading 38 points lower, down 0.53% as of 8:20 am AEST.

S&P 500 SESSION CHART

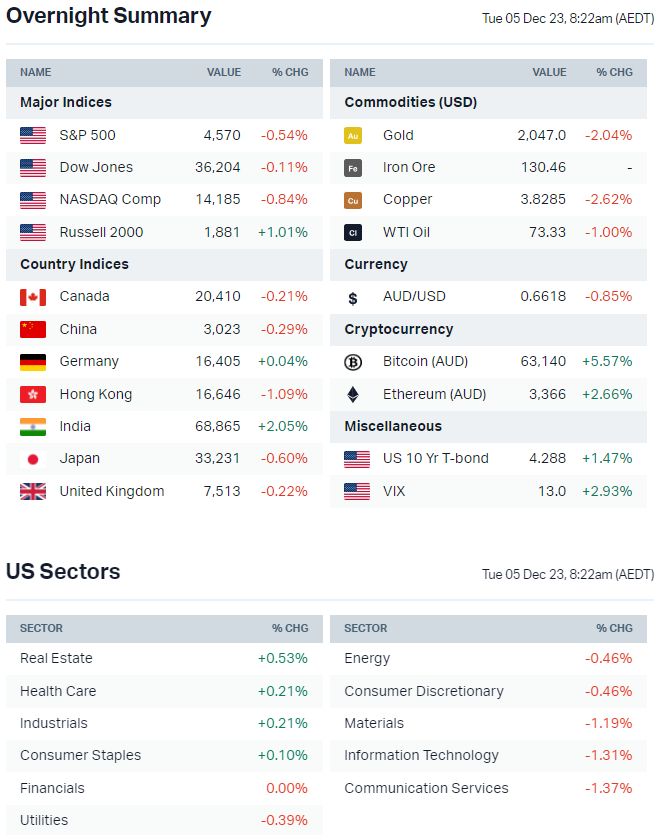

MARKETS

- S&P 500 lower but finished well-above session lows of -1.04%

- Equal-weighted S&P held up better than the official index

- US dollar, US bond yields and VIX all staged a small bounce

- Gold hit a brief all-time high on Monday morning of US$2,146 an ounce but whipsawed back to US$2,030 or a 5.5% drop from highs

- Morgan Stanley's Wilson sees rocky path for US stocks to end to the year amid bond volatility (Bloomberg)

- Stifel predicts S&P 500 will struggle to rise above current levels in 2024 and that the Fed will not cut rates in the first half (Reuters)

- Goldman Sachs says markets remain too optimistic on rate cuts, while JPMorgan survey flags most bullish swaps market positioning on record (Bloomberg)

STOCKS

- Coinbase, MicroStrategy and Marathon Digital rally more than 6% as Bitcoin rallied past the US$41,000 mark to notch a 19-month high (CNBC)

- Uber shares jump on S&P 500 inclusion (CNBC)

- Spotify to cut 1,500 employees in third layoff round this year (FT)

- Roche joins obesity drugs race,. buys drug developer Carmot Therapeutics (Reuters)

- Twilio to cut additional 5% of workforce in third round of layoffs (Bloomberg)

- Chevron and Exxon decline to contribute to COP28 funds (Bloomberg)

- Ford new vehicle sales fell in November, but EV sales a bright spot (Reuters)

CENTRAL BANKS

- Bond market euphoria shifts to debate over how low Fed will need to go, futures signal at least 125 bps of cuts in 2024 (Bloomberg).

- RBA expected to hold rates on Tuesday (Reuters)

- BOJ Noguchi says country yet to achieve a wage-driven rise in inflation (Reuters)

- Powell says it’s too soon to speculation on interest rate cuts (Bloomberg)

GEOPOLITICS

- Israel hits southern Gaza after US warning on civilian deaths (Reuters)

- White House warns US funding for Ukraine set to run out by end of the year (FT)

- EU budget dispute threatens €50B war lifeline for Ukraine (FT)

CHINA

- China Evergrande seeks to avoid liquidation with last-minute debt restructuring proposal which is set to take place on 29 January 2024 (Reuters)

- PBOC Chief pledges to keep growth of money supply in check (Bloomberg)

- Defaults by borrowers in China surge to record high since pandemic (FT)

ECONOMY

- NABE survey of economists predict US inflation will keep cooling and the economy can avoid a recession (AP)

- Eurozone investor mood improves but upswing elusive (Reuters)

- UK economy shows signs of steadying amid pause in interest rate rises (Guardian)

Macquarie’s Buy and Sell ideas for an RBA pause

Since the current inflation targeting regime was introduced 30 years ago, the RBA has had a pretty strong record on nailing a soft landing. In 1995 and 2010, they successfully helped to engineer a soft landing while in 2000 and 2008, a US recession forced them to pause before they ended up cutting interest rates. And we find ourselves at one of these moments again - market pricing suggests the RBA is done while economists are either in the “done” or “one more” camp.

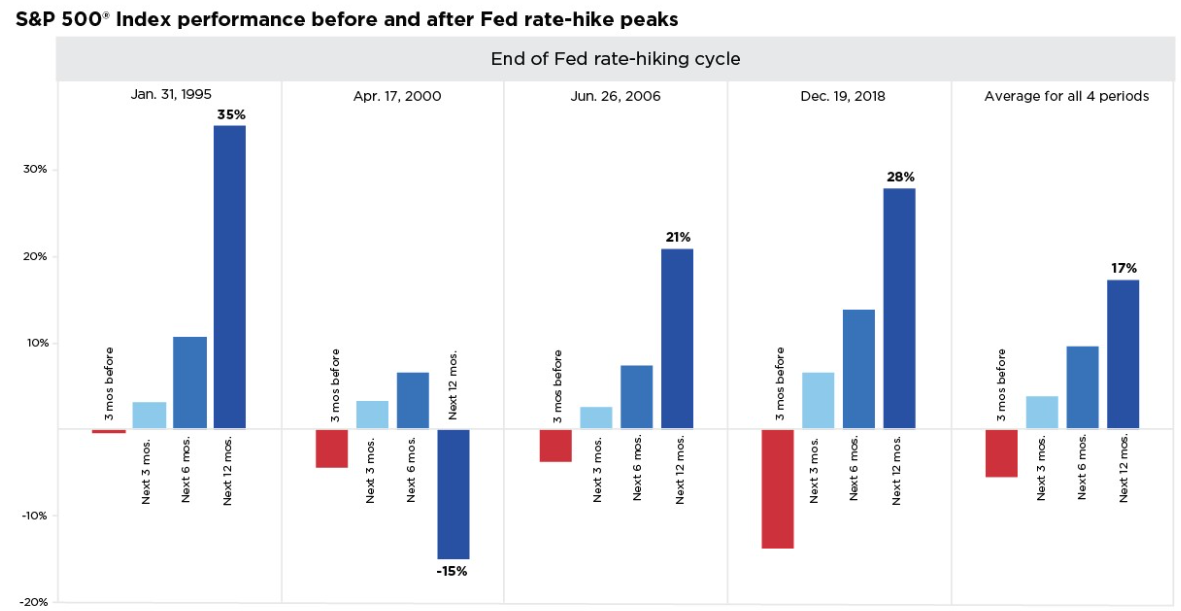

In the US, the S&P 500 tends to rally in the 12 months following the last rate hike:

In Australia, the story is far more nuanced. For instance, in 1995, the RBA paused following the July hike. Interest rates were at 8.75% but the All Ordinaries finished the year up 22%. But in 2008, the Global Financial Crisis far outweighed the RBA’s own impact. The All Ordinaries fell by 47% in the 12 months following the last RBA rate hike. In other words, buying the index following the last rate hike is not a guaranteed wealth winner.

So what does work after a central bank pause? Macquarie’s sell-side equity strategy team has some answers.

“Bond yields typically fall after a pause, which drives the outperformance of bonds over stocks. Whether a soft landing or a US recession, the slower growth that drives central banks to pause (and later ease) also tends to drive the expectation of earnings downgrades and the outperformance of defensives over cyclicals,” analysts wrote.

In past cycles, the Big Four Banks have also outperformed in a falling interest rate environment. But with EPS and margins for all the majors likely to decline, this may not come true this time.

Macquarie’s top buy ideas include Resmed (ASX: RMD), Coles (ASX: COL), Endeavour Group (ASX: EDV) and Northern Star (ASX: NST).

In contrast, its top sell ideas include REA Group (ASX: REA), JBH (ASX: JBH), Scentre Group (ASX: SCG), and Lendlease (ASX: LLC).

Speaking of the RBA ...

It is the last decision of the year today - and as mentioned, every economist and their dog appear to be in the pause camp. CBA puts the chance of a pause at this afternoon’s meeting at 90%! All eyes will actually be on the rhetoric in the statement.

New Governor Michele Bullock has been sharpening her tone on interest rates in the weeks since she took over the job from Phil Lowe. If the meeting statement is decidedly more hawkish and makes more mentions of potential rate hikes than in the past, expect this pause to not go down well with equities.

Here's how the ASX 200 performed during previous rate days:

- 7 Feb -0.46% (in-line)

- 7 March: +0.49% (in-line)

- 8 April: +0.18% (in-line)

- 2 May: -0.92% (unexpected hike)

- 6 June: -1.2% (unexpected hike)

- 4 July: +0.45% (unexpected pause)

- 1 August: +0.54% (unexpected pause)

- 5 September: -0.06% (in-line)

- 3 October: -1.28% (in-line)

the Golden rollercoaster

Gold just posted a ~US$120 drop from its brief US$2,146 peak on Monday, 10:30 am AEDT. This marks gold's largest intraday reversal since 9 November 2020, when it closed 5.7% below its intraday high.

It's a tough look for gold as it failed to hold the key US$2,100 level. This continues its habit of fake breakouts (which is then followed by a massive puke).

What's interesting is that this is taking place in parallel with growing rate cut expectations. Markets are now pricing in a 13% chance of Fed cuts in January and a 52% chance of cuts in March. Just four weeks ago, markets expected hikes in early 2024.

Conditions are becoming more accommodative for the yellow metal. But price action is volatile. Let's see if it can shape up for its fifth crack at breaking out (and holding those gains).

More Room to Run?

The million dollar question: After such a powerful and extended bounce from October lows – Does the market have more room to run?

Markets have quickly turned from oversold to overbought (S&P 500 on a five-week rally) as well as a continued rotation out of the Magnificent Seven, fading positioning/sentiment tailwinds and growing views that the market is too dovish on interest rate expectations.

Here are the latest data points:

- Deutsche Bank says systematic strategies have raised exposure from 'modestly below neutral' to 'modestly above' and are significantly long large-cap US indexes

- It also noted that a decline in medium-term measures of volatility could also allow exposure to rise

- Bank of America says its model implies a continued accumulation in CTA equity index longs this week

-

JPMorgan says positioning is not yet a headwind and there could be further upside for some riskier pockets of the market as the rally broadens out

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: Fisher & Paykel (FPH) – $0.166, Dalrymple Bay Infrastructure (DBI) – $0.05, Qualitas Real Estate Income Fund (QRI) – $0.01

- Dividends paid: Red Hill Minerals (RHI) – $0.10

- Listing: None

Economic calendar (AEDT):

- 10:00 am: Korea Inflation Rate

- 12:45 pm: China Caixin Services PMI (Nov)

- 2:30 pm: RBA Interest Rate Decision

- 2:00 am: US ISM Services PMI (Nov)

- 2:00 am: US JOLTs Job Openings (Nov)

8 stocks mentioned

2 contributors mentioned