ASX 200 to rise + JPMorgan's game plan for CPI data

ASX 200 futures are trading 35 points higher, up 0.49% as of 8:20 am AEST.

S&P 500 SESSION CHART

MARKETS

- S&P 500 finished higher, ending near best levels and 0.4% off recent highs

- Participation was broad-based with all sectors higher

- Oil settles 2% higher at 10-week high on weaker US dollar, rising demand forecast

- Much anticipation ahead of tomorrow’s June CPI and the unofficial start of Q2 earnings season on Friday with BlackRock, JPMorgan, Citi and Wells Fargo results

- Nasdaq plans special rebalance to curb 'overconcentration' as six largest members saw their weights rise above 50% (Bloomberg)

- Investors pile into cash as hawkish Fed bets hammer junk-bond ETFs (Bloomberg)

- Hedge funds slash bullish bets on US stocks, exposure at lowest level in more than a decade and pivot to Europe (FT)

- Demand for European bond ETFs hits all time (FT)

- Goldman says hedge funds buy Chinese stocks for the first time in two months (Reuters)

STOCKS

- Uber CFO plans to leave company, marking most significant departure there since its IPO in 2019 (Bloomberg)

- Shutterstock shares jump on six-year expanded partnership with OpenAI (CNBC)

- Salesforce to raise prices of some cloud products from August (Reuters)

- Amazon kicks off its two-day Prime Day sale – Wells Fargo also named the stock a top pick citing better risk/reward heading into earnings (CNBC)

CENTRAL BANKS

- Three Fed officials back more rate hikes to reach 2% inflation goal (Bloomberg)

- Cleveland Fed's Mester says two more rate hikes this year as reasonable (Nikkei)

- NY Fed's Williams does not expect a US recession but slow growth (FT)

- BoE Governor Bailey says we must see the job through on inflation (BBC)

- Japan's changing views on price hikes open door for BOJ policy tweak (Reuters)

ECONOMY

- UK wage growth hits record high, keeping BoE under pressure (FT)

- South Korea exports down 14.8% in first ten days of July (Yonhap)

- Australian consumer and business confidence bounce higher (Bloomberg)

- German investor morale falls more than expected in July (Reuters)

- Resumption of US student loan payments viewed as a major headwind for consumer spending (Bloomberg)

- US consumer debt rises at slowest pace since late 2020 (Bloomberg)

- Global PC shipments fell 12% in Q2, an improvement from the 30% drop in the previous two quarters (Reuters)

-

PBOC advisor says Beijing should shift stimulus to consumption (Reuters)

DEEPER DIVE

Sectors to Watch

The ASX 200 is in the midst of a bounce but does any of that matter ahead of US inflation data? Overnight, we saw a lot of follow through strength across several commodity and risk sectors.

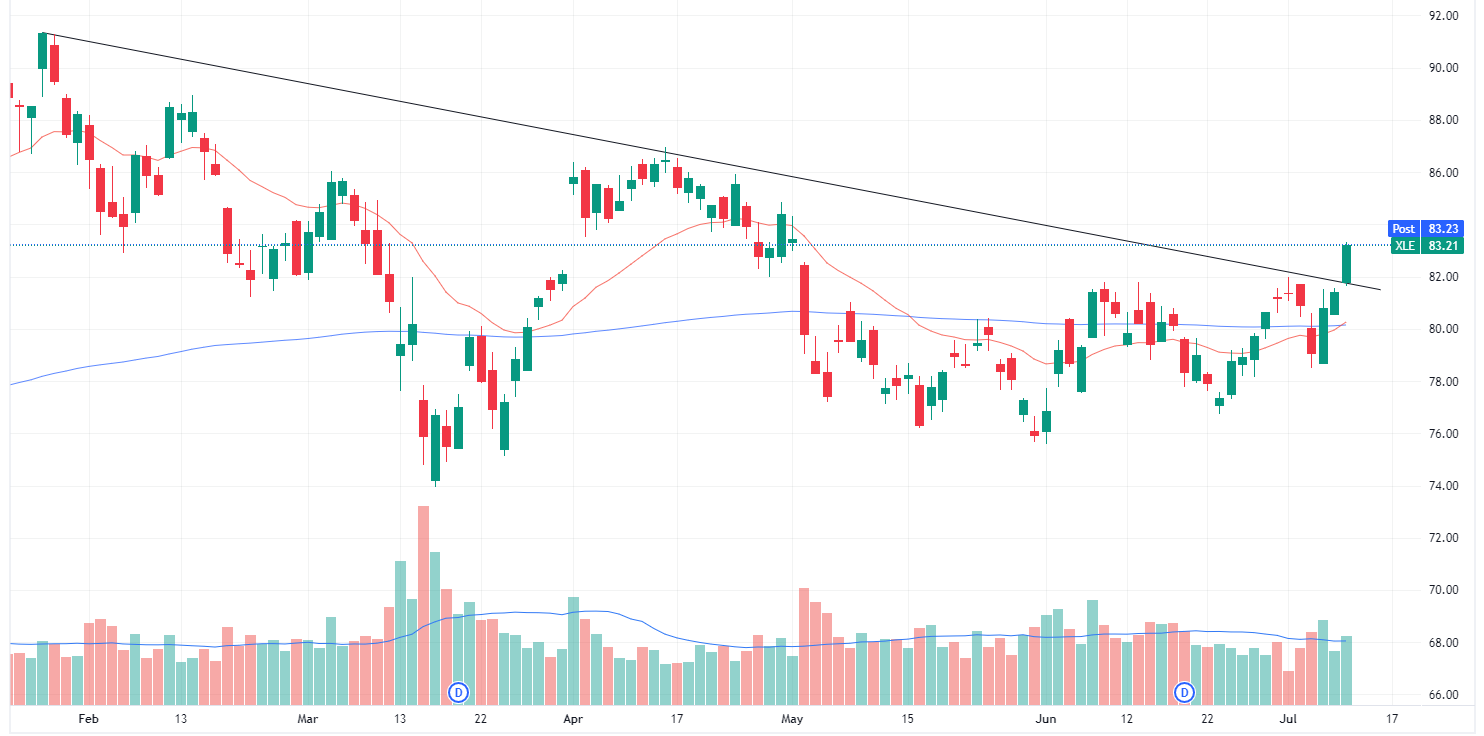

Oil prices settled 2% higher overnight as the US Dollar Index dropped to a two-month low and the IEA said that oil markets should remain tight in the second half of 2023. The Energy Select Sector (XLE) rallied 2.2% to break a 5-month trendline. Do we see some follow through strength for names like Woodside (ASX: WDS) and Beach Energy (ASX: BPT)?

Uranium equities could see some further tailwinds as the Global X Uranium ETF rose for a third straight session, up a combined 5.8%. This follows an almost 13% pullback between 13 June and 6 July. Local names like Paladin Energy (ASX: PDN) and Boss Energy (ASX: BOE) have pulled back but trading largely within recent ranges.

Iron ore miners are poised to have a positive session after BHP and Rio Tinto ADRs both rallied 2.2% overnight. The VanEck Steel ETF also climbed to a four-month high.

JPMorgan's Scenario Analysis for CPI

US inflation data drops tonight and consensus expects:

- Headline inflation to fall from 4.0% in May to 3.1% in June

- Headline inflation to rise 0.3% month-on-month in June

- Core inflation to ease from 5.3% in May to 5.0% in June

As for what'll happen to the S&P 500, JPMorgan expects:

- 15% probability – CPI between 3.0% and 3.2%. "This outcome continues to support the disinflation narrative but is unlikely to move the Fed from hiking 25 bps in July; but may be enough to remove further rate hike expectations for the balance of the year," the investment bank said. Under this scenario, the S&P 500 rises by 0.5% to 0.75%.

- 25% probability – CPI between 2.8% and 2.9%. This would see the S&P 500 rally 1.5% and 1.75%. "We could see rate hike expectations for July fall; in our view, if you saw those expectations fall under 45%, then we may see the Fed capitulate and do another 'hawkish skip' since we would have seen inflation largely normalise ..."

- 15% probability – CPI between 3.3% and 3.6%. "This scenario will do little to assuage concerns that the Fed ends its hiking cycle soon and would call int question inflation forecasts considering the expected rise to Energy prices this summer," the analysts said. The S&P 500 would drop between 1.0% and 1.25%.

- 10% probability – CPI comes in 2.7% or lower. JPMorgan says this would take a rate hike off the table and raise the likelihood of a rate cut in the fourth quarter. This prompts a 2.5% to 3.0% rally for the S&P 500

- 5% probability – CPI comes in 3.7% or higher. This would spark a selloff between 2.0% to 2.5% and flags a "worrying trend for the Fed" as well as raising expectations of 50 bps in July.

US Earnings Season Preview

US second quarter earnings season kicks off this Friday, which means we might see a few 'xyz company drags the Index lower on weaker-than-expected earnings/outlook.'

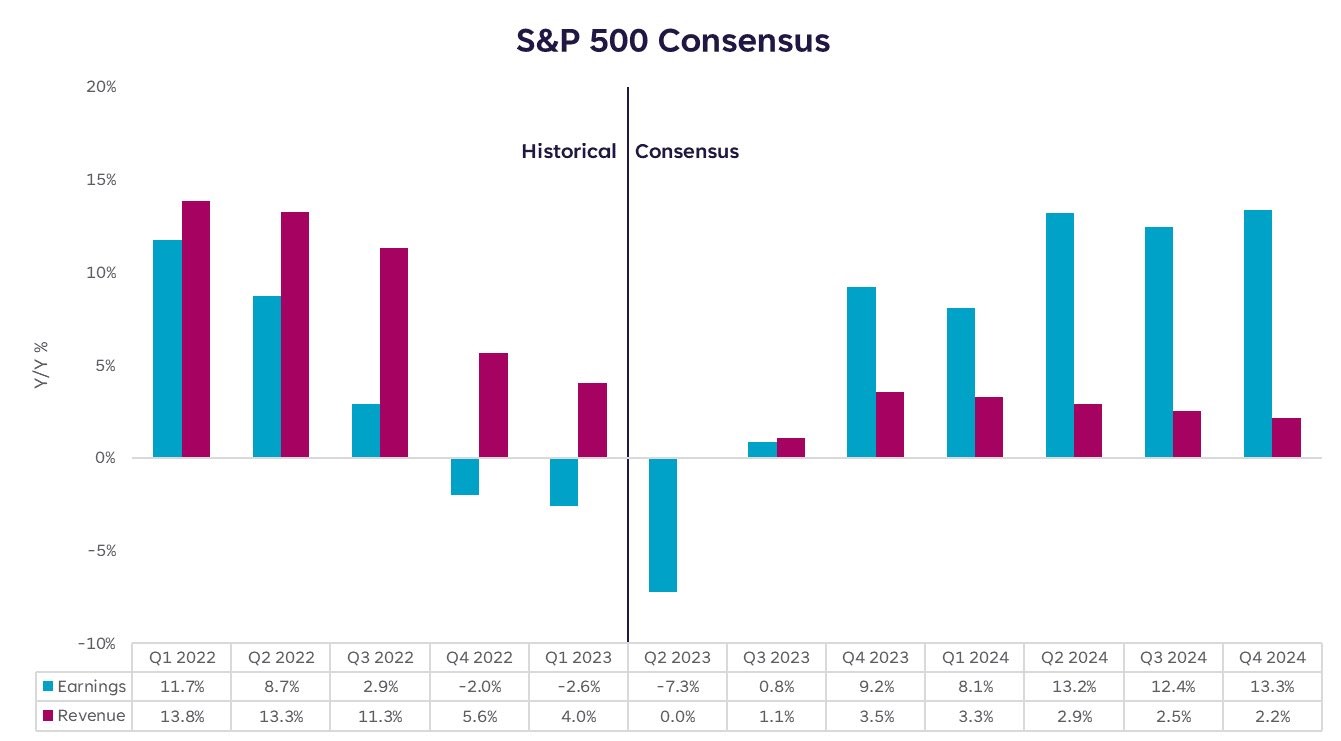

Consensus expects S&P 500 earnings to fall 7.3% year-on-year due to declines in Tech (-4.0%), Healthcare (-17.0%), Materials (-31.0%) and Energy (-48.0%), according to FactSet.

All other sectors are expected to show earnings growth this quarter, notably Consumer Discretionary (+26.8%), Communication Services (+12.6%) and Real Estate (+6.2%).

Earnings are expected to trend higher from Q3 onwards, with implied margin expansion beginning in the fourth quarter. So guidance and outlook will be key.

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: None

- Dividends paid: None

- Listing: None

Economic calendar (AEST):

- 1:10 pm: RBA Gov Lowe Speech

- 10:30 pm: US Inflation Rate

- 12:00 am: Canada Interest Rate Decision

This Morning Wrap was first published for Market Index by Kerry Sun.

4 stocks mentioned

1 contributor mentioned