ASX 200 to rise, S&P 500 hits record close ahead of Fed decision + Oil gains momentum

ASX 200 futures are trading 23 points higher, up 0.29% as of 8:30 am AEDT.

S&P 500 SESSION CHART

ASX TODAY

- ASX 200 to open higher after a strong lead from Wall Street

- Amcor CEO Ron Delia announces retirement, effective 15-Apr

- Imdex CFO Paul Evans to retire towards the end of 2024

- Southern Cross Electrical Engineering receives range of awards in data centre and resource sectors totalling over $70m

- Service Stream Chairman Brett Gallagher discloses sale of 1.6m shares

- Bain Capital weighing competing offer for APM Human Services (AFR)

- NAB and Virgin Money prevail in British lawsuit (AFR)

- Qantas under pressure from big business to find more clean fuel (Bloomberg)

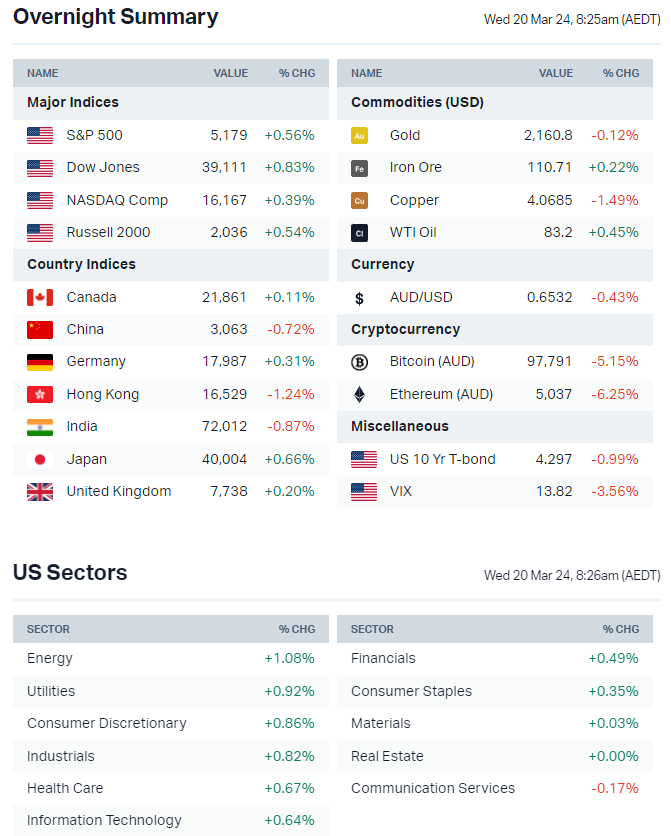

MARKETS

- S&P 500 higher, finished at session highs and marked a new record closing high

- Nasdaq finished at best levels, up from session lows of -0.94%

- Outperformers include big tech, energy, iron ore/steel and discretionary sectors

- Oil prices up for a fifth straight session amid attacks on Russian energy facilities

- Base and precious metals generally under pressure after the US dollar rallied on post-BOJ yen weakness

- BofA monthly fund survey showed the biggest percentage of respondents saying they are taking higher than normal levels of risk since Nov-21 and sentiment is most bullish since Jan-22 (Bloomberg)

- Yen falls and real estate stocks surge after BOJ raises rates for first time in 17 years (Bloomberg)

- Nvidia rally triggers big inflows into AI-themed ETFs (Reuters)

- Fed swaps now pricing less than 50% chance of rate cut in June (Bloomberg)

- FX markets gripped by short volatility trades (Bloomberg)

- Latest Ukrainian drone attack shut down 600,000 barrels of Russian refining capacity (Bloomberg)

- US aims to fully replenish SPR by year-end (Reuters)

INTERNATIONAL STOCKS

- Nvidia unveils new AI chip processor – Twice the size of the H100 and expected to deliver up to 4 times faster training and 30 times faster inference (Bloomberg)

- Exxon CEO says company not trying to buy Hess and only seeking to secure Guyana assets (Reuters)

- UAW moving to unionize a Volkswagen plant in Tennessee (Axios)

- Chinese regulators claim Evergrande inflated revenues by US$78bn (Bloomberg)

- Bentley postpones plan to exclusively sell EVs amid changing market dynamics (CNBC)

CENTRAL BANKS

- BOJ ends large-scale easing policies, including NIRP, YCC and risk asset purchases (Bloomberg)

- RBA leaves cash rate unchanged, drops tightening bias (Bloomberg)

- ECB VP de Guindos says central bank ready to discuss rate cuts in June (Reuters)

- CNBC survey finds respondents see three Fed rate cuts this year as recession probability drops down to 32% (CNBC)

GEOPOLITICS

- Blinken to visit the Middle East this week, seeks to reach a ceasefire agreement between Israel and Hamas (Reuters)

- EU evaluating restrictions on import of Russian agricultural products (FT)

- UK PM Sunak threatens to call a snap general election if rebels try to force a leadership vote (London Times)

- Russian spy chief claims France preparing to send 2,000 troops to Ukraine (TASS)

ECONOMY

- US housing starts rebound in February by the largest amount in nine months (Reuters)

- Canada's inflation unexpectedly slows to 2.8% in February, ramping up June rate cut expectations (Reuters)

Sectors to Watch

Pretty strong overnight session (equal-weight S&P 500 up 0.60%). Although a tough one for commodity-related sectors (ex-iron ore).

Chinese iron ore futures rallied more than 5% on Tuesday amid growing interest for stockpiling thanks to better-than-expected fixed asset investment and industrial production data. Fortescue (+3.6%), BHP (+2.8%) and Rio Tinto (+2.5%) shares bounced on Tuesday to finish at best levels. Let's see if iron ore can continue to muster up some strength around the US$100 a tonne level.

Oil prices are on a five day wining streak to the highest levels since November 2023. I came across an interesting comment from one of the world's largest commodities trading group Trafigura about how geopolitical risk premium is returning to oil markets. Local energy names like Beach Energy (ASX: BPT) and Karoon Energy (ASX: KAR) are starting to poke above 1-3 month highs.

Gold, uranium and lithium weakness: Gold prices eased slightly on US dollar strength but gold equities (VanEck Gold Miners ETF -2.3%) sold off sharply overnight. Chinese lithium carbonate futures fell 1.8% on Tuesday (down only 0.7% when our market closed) so local names could see some downward pressure this morning. Uranium (Global X Uranium ETF -1.4%) snapped a three-day winning streak but closed well above session lows of -3.1%.

KEY EVENTS

- Trading ex-div: Genesis Energy (GNE) – $0.066, Mader Group (MAD) – $0.038, Macmahon Holdings (MAH) – $0.005, Brisbane Broncos (BBL) – $0.015, Supply Network (SNL) — $0.23, Enero Group (EGG) – $0.03, Kelsian Group (KLS) – $0.08

- Dividends paid: Computershare (CPU) – $0.40, Pengana Capital (PCG) – $0.01, Australian Ethical Investment (AEF) – $0.03, SG Fleet Group (SGF) – $0.09, Medibank (MPL) – $0.07, Virgin Money (VUK) – $0.02, MA Financial (MAF) – $0.14, NZME (NZM) – $0.05, Lynch Group (LGL) – $0.04, Redox (RDX) – $0.06

- Listing: None

- 12:15 pm: China Loan Prime Rate

- 6:00 pm: UK Inflation (Feb)

- 5:00 am: Fed Interest Rate Decision

- 5:30 am: Fed Press Conference

This Morning Wrap was written by Kerry Sun.

2 stocks mentioned

1 contributor mentioned