Australian Banks: Are we there yet?

With Australian Banks representing 17% of the S&P/ASX 300 Index, most Australian investors are interested in the outlook for Australian Banks. In the last 5 years the pain associated with owning Australian banking shares has been pronounced with the sector underperforming the broader market by 45%. The sector has come under pressure on a range of fronts including greater regulation and scrutiny, slowing loan growth, slowing housing market, the royal commission and most recently COVID-19. In this monthly note we take a closer look at the outlook and opportunity set for the Australian Banking sector. We ask the question “Are we there yet?”

The continued underperformance of the Australian banks has created some medium term valuation support for the sector. Figure 1 below highlights the 12 month forward price to earnings multiple for the Australian banking sector relative to history. As illustrated it is currently trading below its long term average.

Figure 1. Australian Banking index valuations as represented by the forward price to earnings ratio

Source: Thomson Reuters, State Street Global Advisors as at 30 April 2020. P/E = Price to Earnings Ratio Past performance is not a reliable indicator of future performance. This information should not be a recommendation to buy or sell any security or sector shown. It is not known whether the sectors shown will be profitable in the future.

Further when we consider a range of valuation measures relative to the market and peer stocks we agree the sector does offer medium term value. As at 30 April 2020 we give the Australian banking sector a value score of 70 out of 100. Of course value is only one of many considerations and in order to assess the return and risk of the sector we must consider the quality of the banks and the outlook as well as the risk profile.

COVID-19 impacts cut deep, pressuring capital and increasing risks

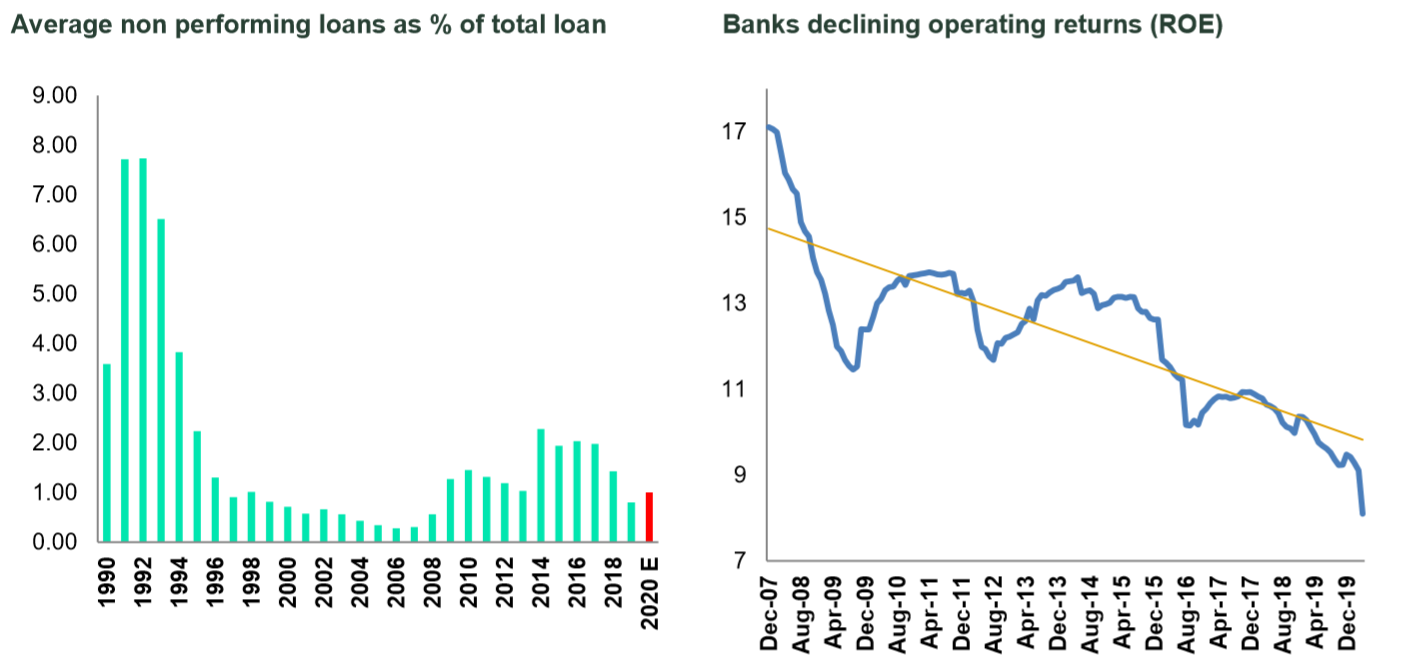

As we know COVID-19 is having significant impacts on the economy, slowing economic growth and increasing unemployment which is placing financial stress on households and businesses. In this difficult economic environment the banks have provisioned for increased impairment charges. Currently the banks are provisioning for increasing impairments in the order of 1% of total loans. At these levels the impact should be contained but should expectations for economic growth deteriorate then further provisions will be required which will put downward pressure on earnings, dividends and capital. APRA has already flagged that the banks can have some temporary flexibility in terms of their capital ratios and some have already indicated they are likely to utilise this flexibility. Figure 2 below highlights the expectations for non-performing loans for the big four banks compared to the last 30 years.

Figure 2. Non Performing loans and the declining return on equity for the Banks

Source: Thomson Reuters, State Street Global Advisors as at 30 April 2020. ROE = Return on Equity Past performance is not a reliable indicator of future performance. This information should not be a recommendation to buy or sell any security or sector shown. It is not known whether the sectors shown will be profitable in the future. 2020 E = estimate only, estimated by the Australian Banks Q3 2020 trading updates as at 15 May 2020. Forward estimates are based on certain assumptions and analysis made by the provider. There is no guarantee that the estimates will be achieved.

Prior to COVID-19 the banks were already seeing lower declining return on equity. A combination of greater regulation and higher capital requirements, lower loan growth, declining interest rates and increased competition has contributed to lower operating returns for Australian banks. How likely are those trends to reverse in the current environment?

Operating environment remains negative

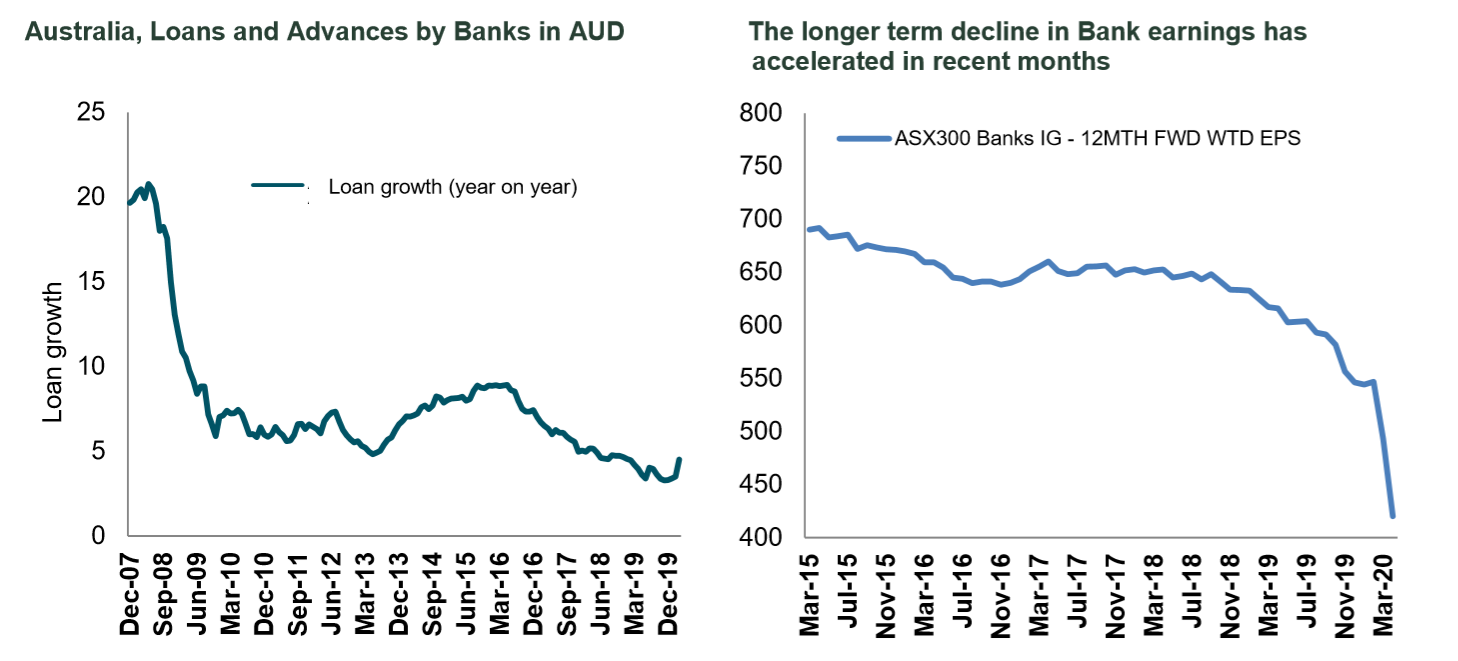

The current environment remains difficult for the banks globally and Australian banks are no exception. Lower rates put downward pressure on net interest margins. Loan growth has stepped down in recent years and continues to be significantly lower than prior periods (see figure 3 below). Interestingly loan growth did pick up temporarily in March due to many businesses drawing down on credit facilities to sure up their liquidity positions. Not the reason you want loan growth to increase!

Figure 3: Historical non-performing loans and the declining return on equity for the banks

Source: Thomson Reuters, State Street Global Advisors as at 30 April 2020. Past performance is not a reliable indicator of future performance. This information should not be a recommendation to buy or sell any security or sector shown. It is not known whether the sectors shown will be profitable in the future.

With economic activity subdued, the majority of households and corporates are less likely to take on new debt obligations. Should house prices decline further we would anticipate this to place downward pressure on loan growth. In the current environment it is less palatable for the banks to drive lower expenses with reductions in staff especially as they are currently experiencing a higher level of staff servicing from existing customers.

The Bottom Line

The underperformance of the banks has opened up some medium term valuation return potential but we assess that it is still too early at this point in time. Are we there yet? Sorry, not yet. The economic back drop has deteriorated and is especially uncertain and will likely flow through to negative news with regards to operating returns, greater loan loss provisions and pressure on lower dividends. Until sentiment stops deteriorating it will be difficult to see a sustained re-rating for Australian Banking stocks.

Learn more

Stay up to date with our latest thoughts by clicking follow below and you'll be notified every time we post content on Livewire.

1 topic

4 stocks mentioned

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.