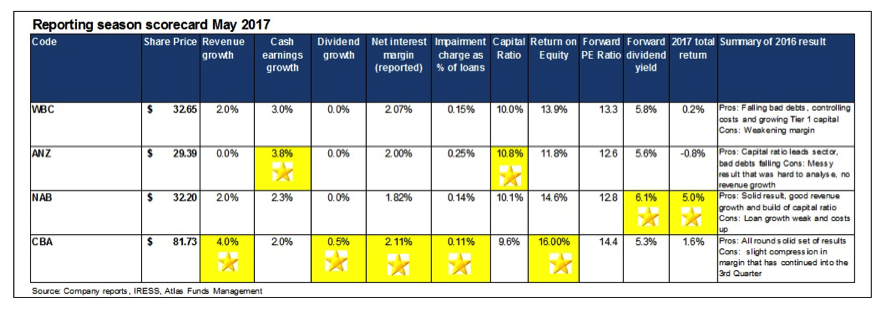

Banks Reporting Season Scorecard 2017

Over the last two weeks, investors had a wild ride following bank reporting season. In addition, in last night’s Budget a surprise levy of 0.06% on the liabilities of Australia's five largest banks was announced. This move sparked a big sell-off in the shares of the four major banks on Tuesday in anticipation that this tax will reduce bank profits. Whilst this may occur, historically banks have been very successful in both passing on additional costs and using public relations muscle to alter government policy.

Prior to the 2013 election, the Gillard government attempted to introduce a 0.05% levy on bank deposits which was shelved in the face of a very impressive campaign from the banks. We expect that this tax will result in increased monthly loan repayments and cuts to term deposit rates, despite claims that shareholders will bear the brunt of this impost.

Key theme: profit growth

Across the sector profit growth was stronger than recent reporting seasons with ANZ leading the pack. ANZ reported headline profit growth of 8% in a complicated set of financial statements, but this reduced to a still respectable 3.8% when backing out the impact of the sale of the bank’s Asian retail businesses, Esanda and property gains. Across the sector solid profit growth was achieved by robust economic conditions and cutting costs.

Gold star to:

Key theme: bad debt charges still very low

One of the key themes across the 4 major banks and indeed the biggest driver of earnings growth over the last few years has been the significant decline in bad debts. Falling bad debts boost bank profitability, as loans are priced assuming that a certain percentage of borrowers will be unable to repay, and that the bank will lose money where the outstanding loan amount is greater than the collateral eventually recovered. In 2016, we saw some evidence that bad debts were starting to rise to a normal level of around 0.3% of loans, though 2017 has actually seen another fall in bad debts that can be attributed to a buoyant housing markets and a recovery in commodity prices easing pressure on the mining sector. CBA gets the gold star courtesy of their higher weight to housing loans that historically attracts a low level of loan losses.

Gold star to:

Key theme: dividend growth stalled

Across the sector, dividend growth has essentially stopped, with CBA providing the only increase of a mere 1c. With relatively benign profit growth, a bank can either increase dividends to shareholders or retain profits to build capital protecting a bank against financial shocks; but not both. In the recent set of results the banks have held dividends steady to boost their Tier 1 capital ratios. Whilst dividend growth across the banks is likely to be meagre in the near term, the major Australian banks in aggregate are sitting on a tasty grossed up yield of 8.3%.

Gold star to:

Key theme: interest margins

Net interest margins in aggregate slightly declined in 2017. This was attributed to higher wholesale funding costs, increased competition for deposits and lower margins in lending to corporations. In May 2017 CBA and Westpac had the highest and most stable net interest margins, whereas NAB and ANZ both delivered lower margins. This reflects the two Melbourne-based banks having greater relative exposures to business banking and CBA/Westpac’s greater weighting to housing.

In late March 2017 the big four banks raised loan rates on average to investors, interest-only owner-occupiers, and businesses, with politically-sensitive principal and interest home loans remaining steady (for now). This followed rate rises that were pushed through in December 2016.

One of the key things we looked at closely during this results season was signs of expanding net interest margin [(Interest Received - Interest Paid) divided by Average Invested Assets], but this was not apparent. At the full year results in October and August (CBA) we may see signs of rising margins, as the full year impact of repricing loans upwards in December and March flows though.

Whilst Australian banks can be viewed as expensive globally, Australia is an attractive banking market which leads to strong and stable profit margins. For example, the major banks reported an average net interest margin of 2%, whereas European banks such as Credit Suisse earned only 1.2%. Small numbers that makes a large difference on a loan book in the hundreds of billions!

Gold star to:  Australian banking oligopoly

Australian banking oligopoly

Key theme: total returns

In 2017 only NAB has outperformed the S&P ASX 200 total return (capital gain plus dividends) of 4.5%, as investors were concerned about potential new capital issues and a cooling of the housing market. NAB has been rewarded by investors as it has been both the cheapest bank (in price earnings terms) and has jettisoned its UK issues with the spin-off of the Clydesdale Bank and Yorkshire Bank.

Gold star to:

The Australian banks have been very successful over the past few years in generating record profits from their domestic franchises which operate in a cozy banking oligopoly. Competition from non-bank lenders is significantly less than it was 10 years ago and bad debts are now at historically low levels. Australian banks (whilst offering high dividend yields) are likely to face a pretty constrained environment, increased political scrutiny and higher loan losses should the economy slow. Neverthess on the results we have seen over the past two weeks from NAB, ANZ and Westpac and a trading update from CBA, our domestic banks are still very profitable and well run compared with global peers

1 topic

4 stocks mentioned