“Be as overweight Australia as possible” – Auscap's mid-caps set to outperform

With a remarkably upbeat outlook in an investor webinar hosted by Auscap Asset Management, Tim Carleton believes we’re in the growth stage of the investment cycle and sees plenty of reasons for optimism. This is particularly the case for Australian equities, which he regards more favourably than the US or European markets.

“There is a massive push to diversify out of Australia, but I think you want to be as overweight Australia as you can possibly stomach for the rest of our lifetimes,” said Carleton, senior portfolio manager and principal of Auscap Asset Management.

“That’s certainly been the right way over the last 100 years, with the Australian market delivering the best returns of any developed market, at around 12% a year, and I see no reason for that to change and if anything, we’re in a better position now than we have been.”

He cites Australia’s natural resource advantage, that should position Australia well for the green energy transition, relatively strong population growth over the medium term, Australia’s proximity to the high growth and rapidly developing Asian economies, and the democratic and rules based political system including the protection of property rights as reasons to expect Australia will continue to provide one of the best investing environments in the world.

Carleton believes the rise in inflation and wage growth has seen the “goalposts move” for the Federal Reserve and the Bank of England, who have been forced to respond by kicking off a sustained period of tighter monetary policy.

He believes that at the moment Australia is on a different glide path for a number of reasons. These reasons include our lower wage growth of about 2.3% and core inflation of 2.6%, which aren’t far away from the Reserve Bank of Australia’s target ranges.

Turning to equity markets, Carleton’s far more bullish on cyclical stocks than those companies in the healthcare, infrastructure, technology, and consumer staples sectors.

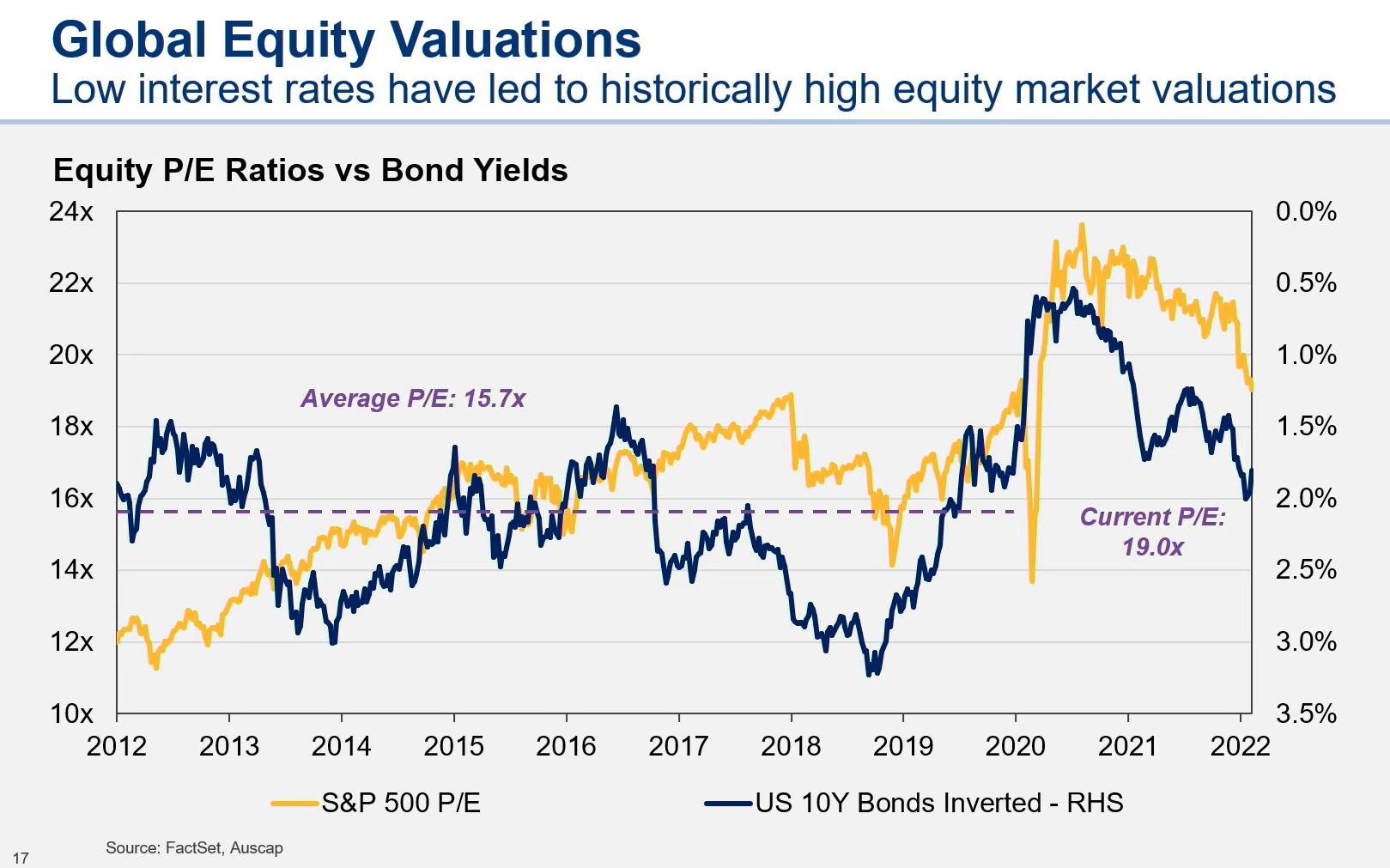

“Even after the recent selloff, P/Es in those sectors are still much higher than they were between 2012 and 2015. People are willing to pay twice the amount they were 10 years ago for a particular level of earnings for these businesses,” Carleton said.

“We think these businesses are quite expensive and the unwind still has some way to go.”

Has the market missed a trick?

Carleton believes the opposite effect is evident among cyclical stocks – a view that’s unsurprising given Auscap’s value and quality style bias.

“If we’re going into a period of strong economic growth, as we expect, the market would normally price this in. But today, many of these companies are trading at lower multiples,” he said.

Before delving into how his portfolio is currently positioned, Carleton elaborated on his positive economic view. Among several structural reasons he cites Australia’s:

- high accumulated household savings,

- average net debt levels at near 20-year lows,

- low unemployment with record job vacancies and the highest participation rate on record, and

- very strong terms of trade.

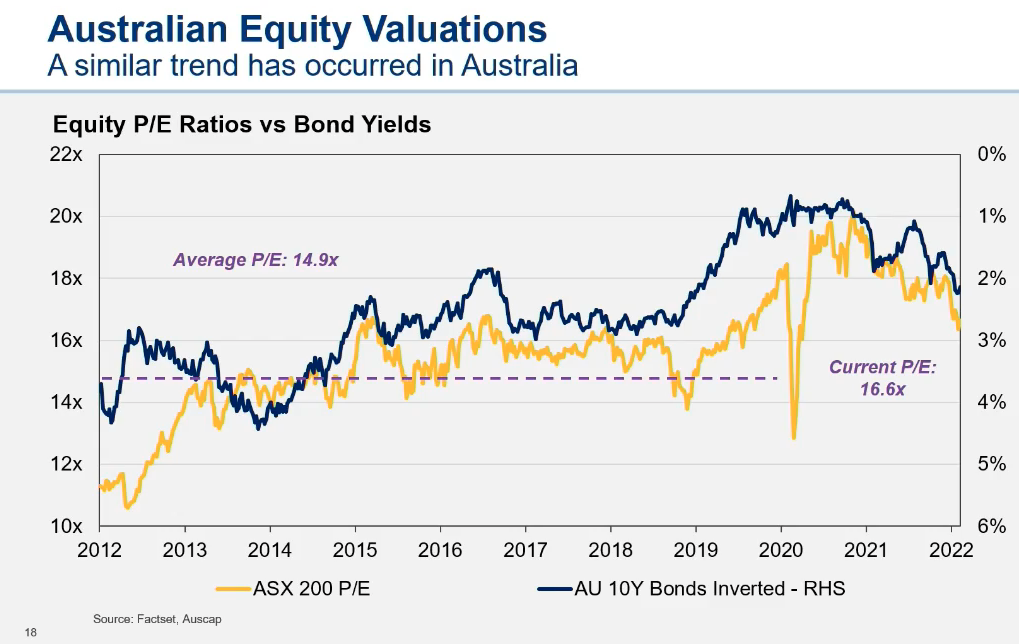

“Overall, the market P/E is slightly elevated but that’s a result of a small number of sectors. In relative terms the spread of what you can get as a dividend from the ASX 200 and what you might get on a term deposit has only been briefly higher during the initial COVID selloff,” Carleton said.

“You are being paid an appropriate risk premium to invest in Aussie equities now and we’re seeing plenty of opportunities.”

What and when to buy?

Carleton believes now is the time to buy. Auscap was holding a little over 10% cash earlier in 2022 but has since redeployed the majority of this post the recent selloff. The Auscap portfolio currently holds around 39 companies, around three-quarters of which are founder-led. Some of the stocks his team has been either adding to the portfolio or increasing their holdings include:

Macquarie Group (ASX: MQG)

Lauding the financial group’s track record, Carleton ranks the company alongside the best of its global peers for its diversified geographical exposures and “exceptional returns on invested capital.”

Held by the fund almost since inception, MQG has delivered consistently strong earnings per share growth – something Carleton is confident will continue.

Mineral Resources (ASX: MIN)

Another long-held stock, the mining company is the world’s fifth-largest lithium producer, a business Carleton described as “the excitement engine for Mineral Resources going forward.” He cites Albermarle estimates that lithium demand will be 8 times higher than it is today at the end of this decade.

MIN’s other two business units produce iron ore – of which it is Australia’s 5th largest producer – and provide mining services to some of the world’s biggest companies including crushing, processing and open pit mining. The latter is another highlight for Carleton and his team, its high regard in the global industry being reflected in its unusually long contract durations. And while iron ore currently provides good upside because of elevated commodity prices, this business only comprises around 5% of the total value Auscap sees in the group.

Nick Scali Limited (ASX: NCK)

“This is probably my favourite company right now,” says Carleton, referring to the furniture retailer’s 10-year average return on equity of more than 50%.

He acknowledges concerns from some corners of the market that sales volume growth is a short-term phenomenon spurred mainly by pandemic lockdowns, but highlights record sales in the last two months of 2021, which continued into January, “and we think this is likely to continue.” More importantly, the business has many company specific drivers of growth in revenue and earnings over the medium term, including the opportunity to nearly double the company’s store foot print, margin expansion opportunities within the recently acquired Plush business, and a continued push into the ecommerce channel at very attractive margins.

HomeCo Daily Needs REIT (ASX: HDN)

This listed commercial property firm owns 51 homemaker centres around Australia, whose tenant mixes are dominated by either ASX-listed firms or large international brands.

The forecast dividend yield of 6.6% and fixed rent escalations built into the majority of tenant leases that average 3.6% “provide a very attractive base return, even before we consider anything else,” Carleton said. “We think there is a long runway of above-market rent increases over time.”

Another sweetener includes the REIT’s site coverage of just 38% - which means 62% of the land it owns remains ripe for further development.

With a development pipeline of $500 million, we expect them to be working on between five and 10 projects per year to develop some of that surplus land for the next decade and beyond.”

“These will be incremental to an already very attractive total return of around 11%”

Would you like to hear from Tim whenever he publishes?

Tim is the Principal and Portfolio Manager of the Auscap Long Short Australian Equities Fund which targets solid absolute risk-adjusted returns, looking to invest in companies that generate strong cash flows and are trading at attractive prices. If you would like first access to his insights please click on his profile here and hit follow.

2 topics

4 stocks mentioned

2 contributors mentioned