Opportunity or emergency? A guide to assessing capital raisings

In 2019, nobody would have expected the likes of Cochlear to hold a capital raising anytime soon, but in the midst of a severe and sudden collapse in earnings, they are all the rage. In this extended interview, Michelle Lopez of Aberdeen Standard Investments and Ben Rundle from NAOS Asset Management discuss:

- Golden rules for assessing a deal (0:45)

- Deal breakers in an offer (6:25)

- The preferred structure of a capital raising (9:29)

- How they manage subscribing to offers in their portfolios (11:55)

- Current capital raising opportunities and the ones they're participating in (13:53)

Notes: You can access the video, podcast or edited transcript for this Buy Hold Sell episode below. A table of equity raisings including deals that Michelle and Ben are participating in is provided below the video. This video was recorded on 22 April 2020.

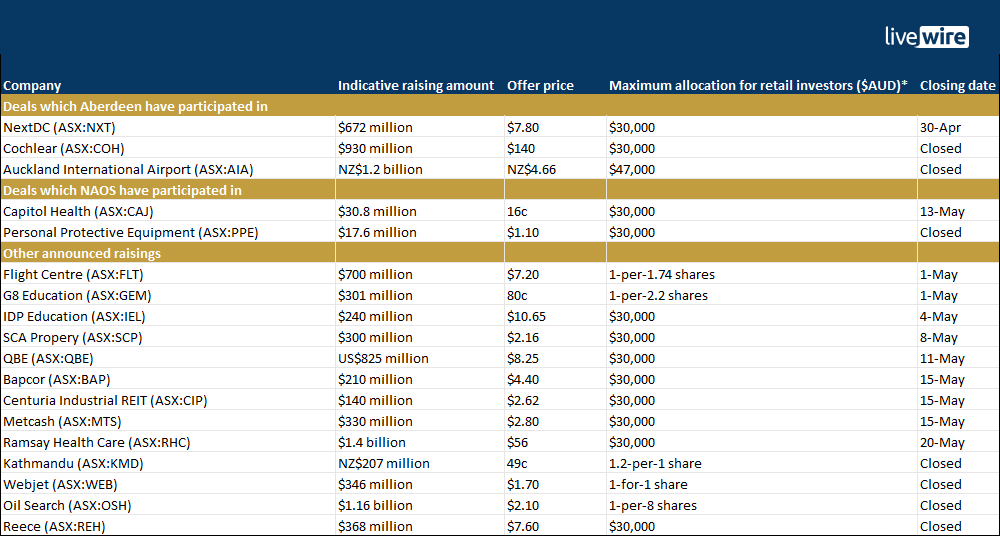

Table: Over $9 billion and counting... equity raisings due to COVID-19

Click to enlarge

Source: Livewire, ASX announcements (as at 23 April 2020). *Some offers may be subject to scale backs

Listed to the podcast

Edited Transcript

Vishal Teckchandani: Welcome to Buy Hold Sell brought to you by Livewire Markets. My name is Vishal Teckchandani and today we're going to be talking about the great pandemic capital raising rush. More than a dozen companies have come cap in hand to the market. For some it's an emergency. For others it's an opportunity, but how do you tell what's a good deal? To help you separate the wheat from the chaff, we have two very experienced operators with us today. Michelle Lopez from Aberdeen Standard Investments and Ben Rundle from NAOS.

Michelle, I might kick off with you. You've got a prospectus on your desk. You've got many capital raising opportunities in front of you. How do you assess what's a good deal? What are some of the key factors that you look at?

Finding the good deals -

Michelle Lopez: Thanks Vishal. I think at the outset it's really important to understand that we only look to participate in capital raisings in companies that we want to own for three years rather than three days.

Golden rule 1 - Take a long view

So we're not in it to make a quick buck or a quick flip. We really are investing in those companies, come capital raising that we want to be long term shareholders in.

So for us, the process is quite organic in the sense of it's not just about the discount, which is typically where people focus or spend a lot of their time focusing on.

Golden rule 2 - Understand the use of capital

First and foremost the use of the capital that is being raised is where we spend most of our time. And there's typically two buckets here. So we've got the balance sheet risk that they're solving for, or you've got the growth aspect. And the growth aspect typically is organically or by acquisition.

So if it’s the former, so looking to shore up the balance sheet, what we want to see within the capital raising is enough to see them through at least the next 12 to 18 months given the very sharp dislocation that we're seeing in the markets at the moment. Because what we know is that once the balance sheet risk has been removed, companies tend to rerate and that's where you see the strong share price appreciation.

Golden rule 3 - Consider the dilution of returns

If it's the second bucket, which is the growth aspect, then we look at the dilution of returns from the raising, and what our expectations are around the level of returns that they can generate. So if we feel that over the longer term, the capital is being put towards growth ambitions that's going to fast track earnings growth, then that dilution should be temporary. And we tend to look through the short term dilution of the returns and look towards what returns are possible.

Golden rule 4 - Consider management alignment

So they're the two. The other things that we look out for as well is whether insiders are backing their money. And by insiders, I mean majority shareholders. These could be founders of the organisations. And really that shows alignment from that perspective. And then the other part of it is also how large the raising is and the construct of the register. Because we know that there is going to be an aftermarket and we want the capital raise to be well supported.

Golden rule 5 - Consider the discount

And obviously the discount, it is important. And generally speaking, the larger the discount, the more enticing that the capital raising is and more likely to participate. But you do need to be careful with the rate, with the discount, and not just look at the closing price, but really the lead up to the capital raise.

Vishal Teckchandani: Ben, how do you look at it? So Michelle mentioned the two to three year view, looking at the balance sheet, looking at growth, thinking about things like management alignment. What's your process?

Ben Rundle: We have a similar time frame in, so far as that when we put a new position into the portfolio or even add to an existing one, we're really trying to take a three to five-year view.

Most of the money that will, in fact all of the money that we manage is in listed investment companies. So it's in closed-end vehicles where we have the luxury of being able to take a very long term view in a company which might not be that liquid, simply because management hold a significant stake of the company, and we won't have the issue of potentially having a redemption and a forced selling environment. So look, I think Michelle hit the nail on the head with a lot of those points and a lot of those points are very similar to the things that we look at. So obviously the reason for the raise. A lot of the companies that we've seen raise money so far, particularly in the early stages were for balance sheet repair.

Unfortunately for a lot of these businesses, a COVID-19 scenario just wasn't part of the possible range of outcomes and I think Ramsay Health Care is a great example of that where it's typically a very defensive business capable of running high gearing levels, and intuitively you would have thought if we had a medical emergency then the hospitals would be full, it would be good for their business, not the other way around where hospitals are half empty due to the social distancing rules.

Golden rule 6 - Where the raising isn't primarily for balance sheet repair, understand the growth strategy

The other thing we're sort of focusing quite heavily on is the quantum of the raise and particularly if that raise is coming about for reasons of growth. Particularly in the last few days, there's been companies that are raising money because they want to take advantage of acquisition opportunities. Now that's fine, but you're raising money when your share prices come off quite a long way.

Golden rule 7 - If the proceeds are being used for M&A, look at management's track record for success

That dilution is significant and it is real, and I think it speaks to a lot of CEO's ability to allocate capital properly. I think for a CEO it's one of the key jobs to be able to allocate capital efficiently and you've got to look at the scenario where not only are you raising money in quite a dilutive way and at a discounted price, but if you're going to make an acquisition with it, then we're focusing on what the track record of acquisitions that that particular management team has had in the past. Because a lot of acquisitions in our view don't actually work despite the fact that there will be distressed assets out there and there might be a huge amount of opportunity. If the management team doesn't have a great track record in acquiring businesses, then that's something we're very cautious of.

The deal breakers - track record, track record, track record

Vishal Teckchandani: So Ben, I just want to hone in on that a bit further. If we think about the current landscape now and as I mentioned at the start, some companies are raising money as an opportunity. NextDC for example wants to fast track at Sydney Data Centre. You look at some of the travel stocks, they're raising money merely to survive. Is that underlying premise, that fundamental premise of why they're raising money, is that an immediate deal breaker for you? And if not, what is? What's one thing that could turn you off from a capital raising immediately?

Ben Rundle: Look, I think in the case of the travel companies, to be fair to them, they have been caught by a situation which no one really would've predicted. I guess where we are cautious of a capital raise is if... I mean the key one, as I mentioned, if they don't have a good track record of allocating capital, but potentially sometimes if they're not raising enough money. I don't know how long this situation will last or how long travel restrictions will last. But for some of these companies, if they don't raise enough now, they're going to be coming back to the market cap in hand and between now and then the share price wouldn't have done much either. So that's kind of an area I guess we're cautious of too.

Vishal Teckchandani: And Michelle?

Michelle Lopez: Look, I think Ben touched on a very important point, which is track record. With every capital raising that's come into the market, and there has been many over the last couple of weeks, you really need to look back at what the discipline has been from a management perspective and the returns that they've been able to generate. So for us, one of the key things we look at is how often, how regularly capital has been raised in normal environments. And then from that you can see whether the discipline and the allocation is one that fits with our investment process. So I think track record's very, very important. And the other aspect of it as well, and again to Ben's point, is the size. So we want to ensure that the digestion, I guess, the ability for the market to digest a very large capital raise is there in the aftermarket.

One of the interesting things that we've seen play out over the last few weeks, and again this comes back to what we were talking around time horizons and investment horizons, and as Ben mentioned, we're quite aligned to taking that three to five year view. But you can take a short term view and if the stock is off 70% and it's really on its knees, they do a deep re-capitalization and the stock jumps 50%. You need to be clear whether you want to be owning a stock like that long term because even though it's up 50%, you're still down 50% from the original investment. So again, you have to have quite a very, very clear strategy around investing, around capital raisings as well, not just in within the board portfolio.

Does the type of offer really matter?

Vishal Teckchandani: And Michelle, how much does the type of offer matter to you? An accelerated share purchase plan versus entitlement offer? How much does that matter?

Michelle Lopez: Oh look, I think at the core you've got to think about fairness across the market. There's been quite a bit written around retail shareholders and are they being sidelined by a lot of these capital raisings. So a share purchase plan is obviously a lot more beneficial and one that we look to do, so we'd encourage companies to do.

But I think the key issue is just allowing and giving investors enough time to digest the news, and also look through and be able to assess whether the capital is being allocated correctly. So we've seen a number of companies actually announce capital raisings after market closes and provides a couple of hours at best to digest the news. And I don't think that's probably the best way of doing it. And there the turnaround is required. So I fear that given what the regulator and the government have come out with, the raise in the cap, sorry it's moved from 15% to 25%, the amount that a company can raise in the next 12 months, that's really provided a bit of a free ride. The companies just to come out and announce a capital raise to be opportunistic because they don't know how long this will go for.

Vishal Teckchandani: Great points there Michelle and Ben, what about you? Do you like to see the deal structured in a certain way and announced in a certain way?

Ben Rundle: I don't have a particularly strong view on structure, but I like to see existing shareholders looked after whether they're retail or institutional. And to be fair, a lot of the capital raisings that we're seeing so far have taken that approach. New shareholders to the register are really not getting a large allocation, which I think is right because the existing shareholders have taken the pain of the share price fall. They're taking the pain of the dilution. I think they need to be rewarded for that. And so far as they have demand to increase their share holding, I think that they need to be looked after first.

How to structure your portfolio around capital raisings

Vishal Teckchandani: So let's move on to how you manage capital raisings within your portfolio. Investors only have so much cash and there's a lot of deals coming across your desks, their desks, and a lot more deals presumably to be announced. Ben, what happens if there's a deal you really like but you don't have enough cash to participate in it? Do you sell down on another position to take that offer up? How do you manage it?

Ben Rundle: Well, we run portfolios that are quite heavily concentrated in stocks that we know and have followed for a long time. So for us to raise capital quickly isn't really an option. What we're finding as well with a lot of these capital raisings is if you're not already on the share holder register, then you're probably not getting access to too much stock. So, I mean I guess it probably provides a catalyst for us to certainly look at a company, but we're not selling down existing positions that we like, and that we own, and want to own for the long term to take advantage of a short term trading opportunity.

Vishal Teckchandani: And Michelle, what about you? Same question.

Michelle Lopez: Similarly. So we do run fully invested portfolios and by fully invested we tend to hold cash levels below that 5% mark. But to Ben's point, I mean the raisings that we've participated in have been very well supported and we haven't received our full allocation even as existing shareholders. So we haven't had an example to date that we have had to sell down a large proportion. Having said that though, we do run a watch list I guess of stocks where we feel that they've held up exceptionally well over the period and have outperformed quite materially. And if we do need to take profits, we tend to do it from that bucket of stocks that have done well and recycle that into the names that we'd like to participate in.

Capital raisings to keep your eye on

Vishal Teckchandani: Okay. So let's hone in on some of the current opportunities available. Michelle, what are a couple of names that you're liking who have announced capital raising offers?

Michelle Lopez: We have participated in a few but just to be very clear here, the way that we invest money, we're not running the ruler over companies that we feel are in a distressed situation and that need to come to the market for solvency issues or to shore up the balance sheet as such. It's quite the reverse. So we are looking for those high quality companies that we feel have got long term potential for compounding returns, and that's really underappreciated by the market.

Cochlear (ASX:COH)

So with that in mind, the companies that we have seen come to market and that we've participated in, the likes of Cochlear. We hold Cochclear in two of our strategies, so our large cap and our mid cap strategy, and we participated in that one. Again, why we liked Cochlear, it really solved for the two buckets that I mentioned at the start, so the balance sheet that removed all the risk that could potentially play it out.

So it wasn't a certainty but they really wanted the buffer to be able to continue to invest, particularly through this period of dislocation where a lot of elective surgery has been deferred. So they were seeing quite a fall in their cashflows. That was done at a discount. I can't remember off the top of my head but it was a quite decent... I think it was about 12% or thereabouts. So again we participated in that one.

NEXTDC (ASX:NXT)

The other ones which were interesting, I mean you mentioned NEXTDC. We are owners of NEXTDC and we participated in that capital raising.

Auckland International Airpot (ASX:AIA)

The other one which we recently participated in as well and we've recently completed was Auckland International Airport. Again, that's another company and that was very much around balance sheet concerns and just not really having a firm view around how long the travel bans are going to be in place. This is a strategic asset that is imperative to the future of New Zealand, the nation. And we felt the intrinsic value of that company wasn't being reflected in valuation trading at good value. So that was one that we participated in and I've got very strong confidence in the long term.

Vishal Teckchandani: And Michelle and what's one you're avoiding?

Michelle Lopez: Look to be frank, there's not many companies that we own in the portfolio that we wouldn't be supportive of should they do a capital raising. We don't participate in capital raisings of companies that we don't own, but it comes back to the things we look for and if we don't already own it, then whether it's at a 10% discount to current price, the valuation is irrelevant for us if we haven't done the work around the company.

Vishal Teckchandani: And Ben, same questions to you. What are some capital raising opportunities that you're really liking at the moment and perhaps any tips on ones to avoid.

People Infrastructure (ASX:PPE)

Ben Rundle: Well, the only two that we have participated in so far are in microcap stocks. The first one is PPE, which is a labour hire business. They have about 50% of their earnings are exposed to providing nurses to hospitals. Now obviously that's come under a little bit of pressure lately because a lot of the hospitals are actually empty while they prepare for a potential onslaught of patients to come from COVID-19. And then obviously elective surgeries have been delayed as well, so the need for nurses has been reduced. So in the case of that capital raise, it's a company that we already owned. It's partly for balance sheet repair. They carried a little bit too much debt coming into this and it's also partly to take advantage of acquisition opportunities and the management team has a fantastic track record of doing so.

Capitol Health (ASX:CAJ)

The other one that we participated in only in a small way was Capitol Health, which is a radiology business. Radiology for us, we think it's a fairly stable business and that, post COVID-19 world, will come back pretty quickly. So we think that coming out of this with a strong balance sheet, those assets will be certainly sought after. In terms of raisings we're avoiding, it's really stocks that we don't know, that are outside of our circle of competence, or we don't have any shares in. There's no specific stocks, which we... I mean the travel sector is one that we don't really have any exposure to. I wouldn't be able to tell you how long those guys are in distress for and whether they're raising enough money to get through this situation. So that's certainly an area that we've avoided for the time being.

Vishal Teckchandani: Maybe capital raising's galore, but if you're not comfortable with the deal, then keep your money in quarantine.

Enjoying Buy Hold Sell?

- Hit ‘follow’ below to get notifications of when we publish Buy Hold Sell

- In case you missed it, Michelle and Ben discuss '5 pandemic-resistant growth stocks' here

- Next week, they'll discuss ex-20 stocks that are popular among investors right now

- View the full Buy Hold Sell archive here

3 topics

5 stocks mentioned

1 contributor mentioned