Big brokers most bearish on BHP in 2 years, strong preference for RIO

Investors in BHP Group (ASX: BHP) have endured a frustrating stretch over the past two years, with the company’s share price largely stagnating amidst volatile commodity markets. BHP’s shares closed at $40.24 yesterday, that’s compared to the corresponding day two years ago of $44.34 (-9.2% or -4.6% p.a.).

Adding back dividends and franking credits, this improves to a total return of 1.7% p.a., but that’s still a far cry from the benchmark S&P/ASX 200’s total return of 16.7% p.a. over the same 2-year period.

The world’s biggest miner is a stalwart of most Aussie portfolios, whether actively managed by investors themselves, or via passive investments in superannuation due to its large weighting in the S&P/ASX 200. This means a decent chunk of our collective portfolios has been substantially underperforming the rest of the Australian share market.

A new research note from global investment bank Citi suggests that this trend may continue as the broader broking community has turned more negative on BHP than at any point since September 2023. Consensus ratings across the sector have shifted sharply, and the “Big Australian” has been singled out as the most notable casualty.

Broker sentiment toward BHP turns cautious

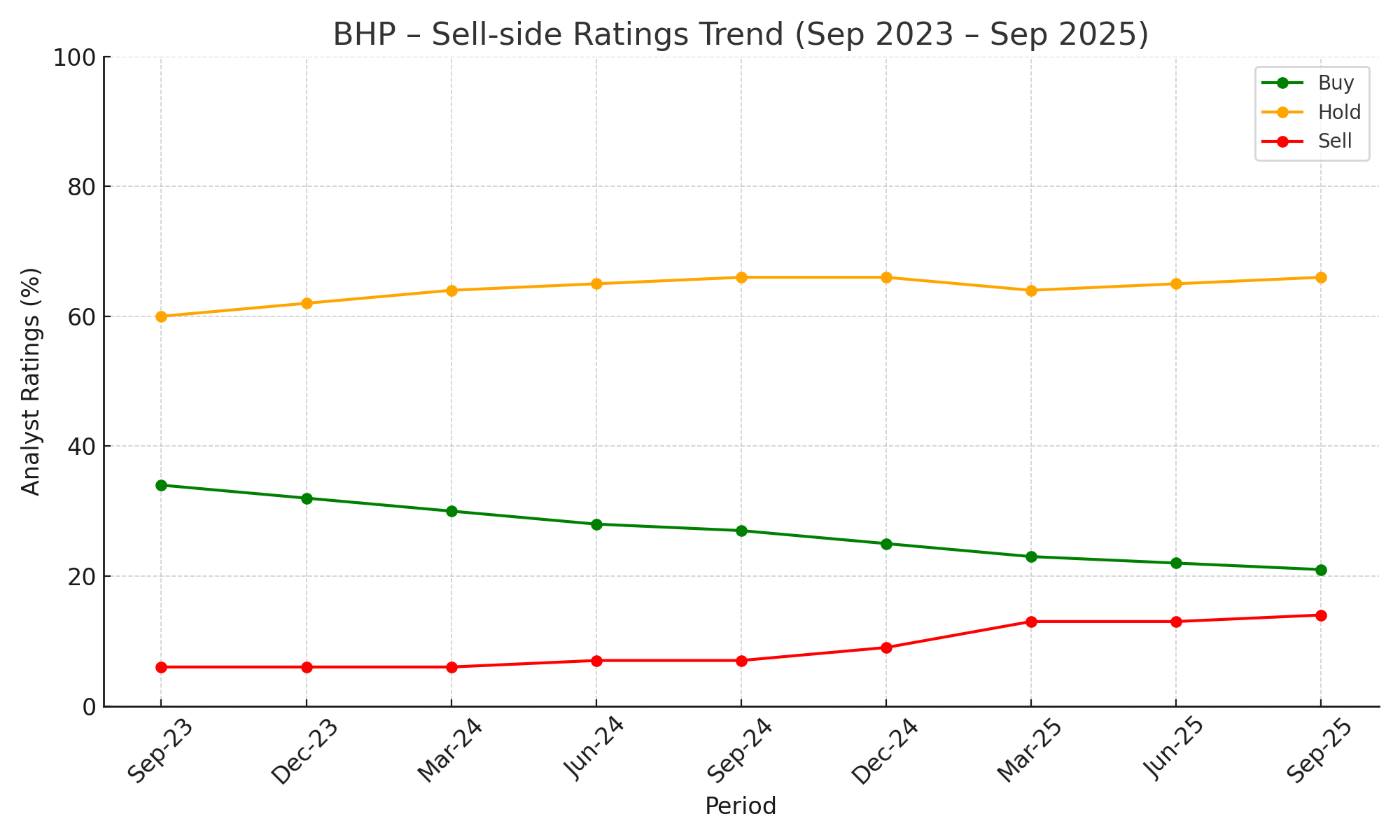

Citi’s latest Mining Minutes report released earlier this week highlights that sell-side sentiment has become more cautious across big global diversified miners like BHP and Rio Tinto (ASX: RIO). Back in May, the average analyst stance was still relatively supportive for BHP, with 38% Buy, 59% Hold and just 3% Sell recommendations. By September, however, those numbers had deteriorated to just 21% Buy, 66% Hold and 6% Sell.

This deterioration has occurred despite commodity markets showing resilience since April. Citi notes that “company-specific operational challenges, combined with concerns around iron ore price in the face of ramp up of production at Simandou, have resulted in the sell side staying more cautious than usual”. Iron ore remains the largest profit driver for BHP and its peers, so growing doubts about pricing sustainability weigh heavily.

Amidst this backdrop, BHP and UK-based counterpart Anglo American have borne the brunt of analyst downgrades, with a rising number of Sell recommendations attached to both. Citi’s team describes the shift as the sharpest swing in positioning among the major diversifieds, pointing to a fundamental reassessment of risk-reward for BHP in particular. Even with undemanding valuations on forward EV/EBITDA multiples, big brokers appear reluctant to back the company given uncertainty around production costs, volumes and earnings visibility.

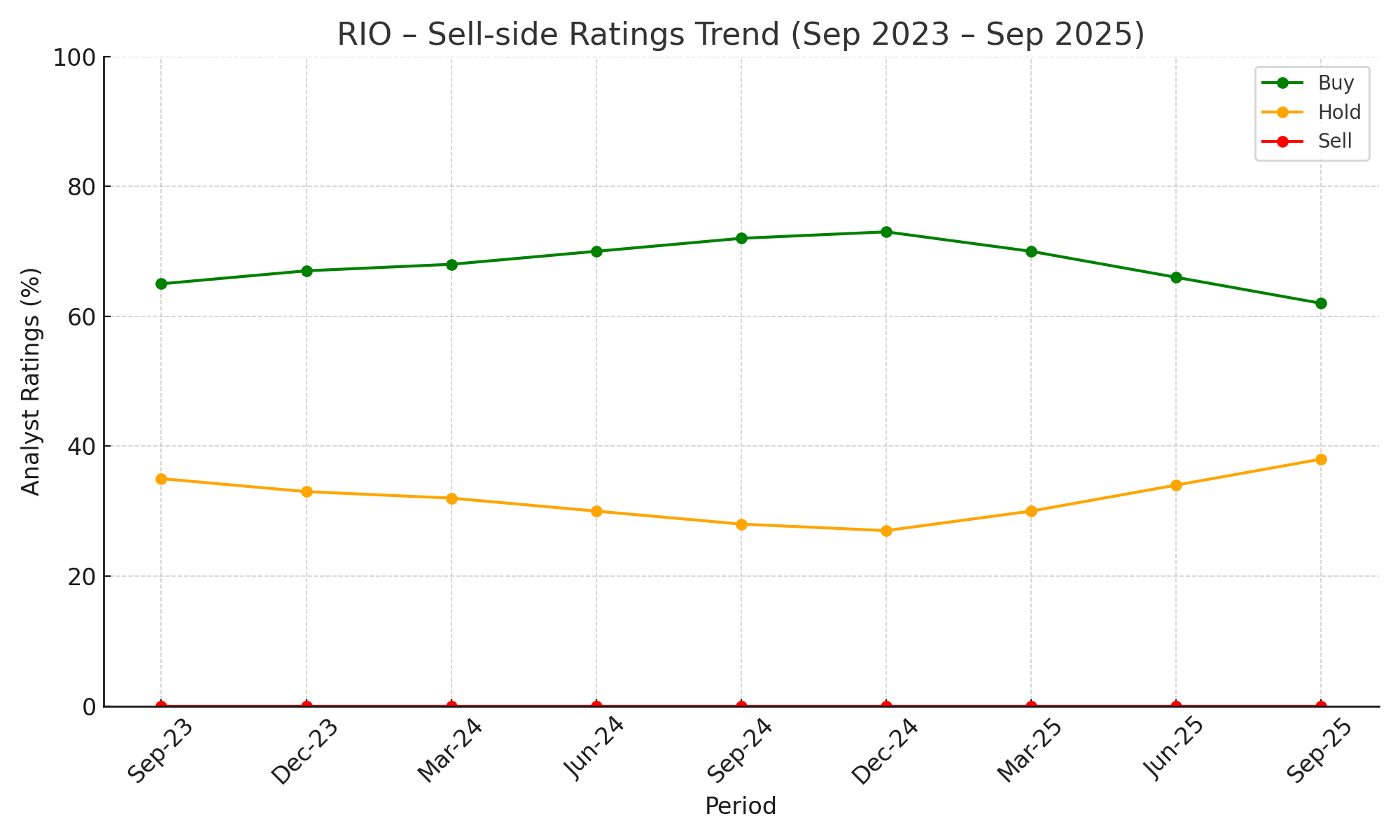

RIO, by contrast, has seen its average buy, hold, sell rating mix remain largely the same, and very supportive. In February, it enjoyed an average rating spread of 63% Buy, 33% Hold and 4% Sell. By this month, that had evolved to 62% Buy, 38% Hold and 0% Sell. While Buy support has softened very slightly, the absence of any Sells is striking. Plus, the difference compared to BHP is stark: Nearly three times as many brokers presently prefer RIO to BHP.

But this is not a recent phenomenon. RIO has generally been the better tipped of our two major diversified miners for a long period, and the divergence between the two stock’s average buy ratings has grown to its widest in two years. I should point out here that the brokers have been correct in their preference for RIO over BHP given its superior total return over the last two years of 6.3% p.a. (still well shy of the benchmark!).

BHP – Ratings trend Sep 2023 to Sep 2025. (Source: Citi Research, “Monday Mining Minutes”, 22 September 2025)

Conclusion: BHP or RIO? The choice seems clear!

The latest consensus snapshot is unambiguous: The world’s biggest brokers now see far greater challenges ahead for BHP than at any point in the last two years. Concerns about iron ore oversupply, cost control and operational risk have fed into a wave of cautious ratings, leaving the company isolated within the diversified miners’ universe.

For investors, however, the message is not simply to abandon the space. RIO continues to command strong backing, with no major broker prepared to issue a Sell. For those seeking large-cap, diversified exposure to global resources, the broking fraternity is signalling that RIO remains the stronger bet of our two “Big Australians”.

This article first appeared on Market Index on Thursday 25 September, 2025.

5 topics

2 stocks mentioned