Bitcoin: A solution looking for a problem

Fidelity International

In my recent note, I discussed how listening to the world’s top CEO’s, CFOs and CTOs and their strategies in navigating this pandemic has allowed us to start to build a mosaic of what could be potential paradigm shifts for the zeitgeist of the future.

Identifying the zeitgeist (like personalisation, simplification, collaboration, trust, decentralisation) is just step one of the process. Step 2 is thinking about how companies are reflecting it into their business models and what the enabling technologies (shovels and pickaxes) are. For e.g. personalisation at scale was possible only once we had significant developments around the cloud, along with significant improvement in security technology which gave organisations greater comfort (and trust) to store their precious data outside their own walled gardens. In technology land if you were on the scent of personalisation, the trail would lead to cloud technologies, and by extension, Microsoft, Facebook, Amazon, Apple, etc.

One of the potential trails on the path of collaboration and decentralisation takes us down the development of blockchain and digital currencies. This note is an early (and possibly half-baked, like its subject) exploration of the same. The hope is that putting this note out there, will push more thinking and debate and lead to better ‘open & crowd sourced’ conclusions on the evolving implications of these for equity investors as we evaluate not only new business models but also the threat to existing ones.

Why Now?

Depending on where you stand in your journey of understanding digital currencies/blockchains you will classify me as either too early or too late in asking these questions.

Here are some reasons why I think we need to focus on this area.

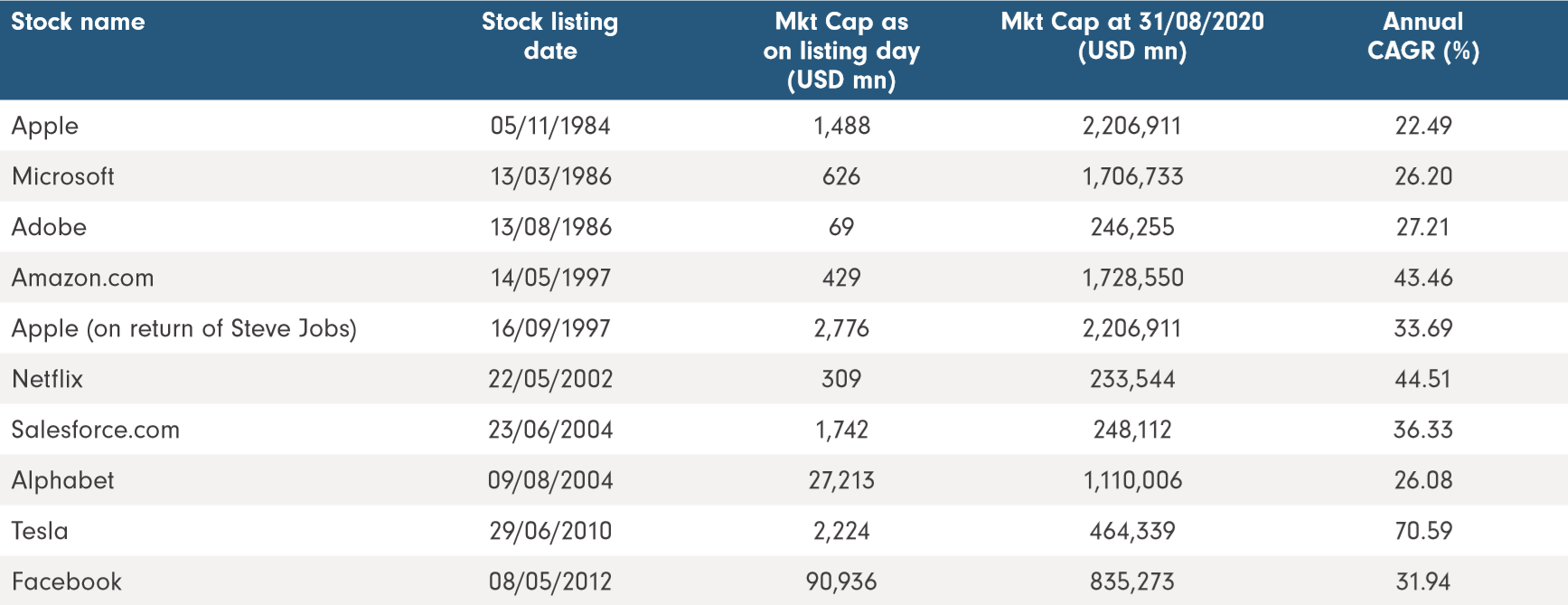

A. The digital currency/blockchain world reminds me of the internet in 1998-1999 i.e. a solution looking for a problem. If you look back to the creation of any of the top companies of the world today as per this table below, the first few innings of any trend are always unclear.

Table 1: Key stocks - Compounded annual growth rate since listing

Source: Fidelity International, Bloomberg, Press Releases, 31 August 2020. Data compiled using different secondary research sources.

- It was unclear in 1997 that Amazon was going to be the everything store and a global logistics powerhouse (it was effectively selling books by e-mail order at the time) or when 23 years back to the day, 16 September 1997, Steve Jobs came back as iCEO of Apple (the real birth of today’s Apple) that it would be the smartphone powerhouse it is today. Similar can be said of Microsoft or Netflix at the time of their listing and potentially blockchain and digital currencies (like bitcoin) today.

- With the growth in private equity and alternative sources of capital over the past few years, companies are listing later and later in their life cycle. To understand technological change at a fundamental level, even if public market investors may not have the ability to invest, we still need to engage with private companies to understand their disruptive impact on the ecosystem and business models of those we may be invested in.

B. Currently, Fidelity equity funds are not permitted to invest in bitcoin and there are few listed companies which exclusively use the blockchain technology. For companies like Nvidia/Taiwan Semiconductor Manufacturing Company (TSMC), bitcoin are now a negligible part of revenues and an even more irrelevant part of the investment thesis. If I use our internal keyword search engine on conference call transcripts for Q2, there are about five companies that talk about bitcoin in their calls (of which three are gold companies answering questions as to why bitcoin is not a better investment versus gold).

If digital currencies/blockchains are likely to be truly disruptive, then from an equity market perspective, we have not even padded up for the first innings.

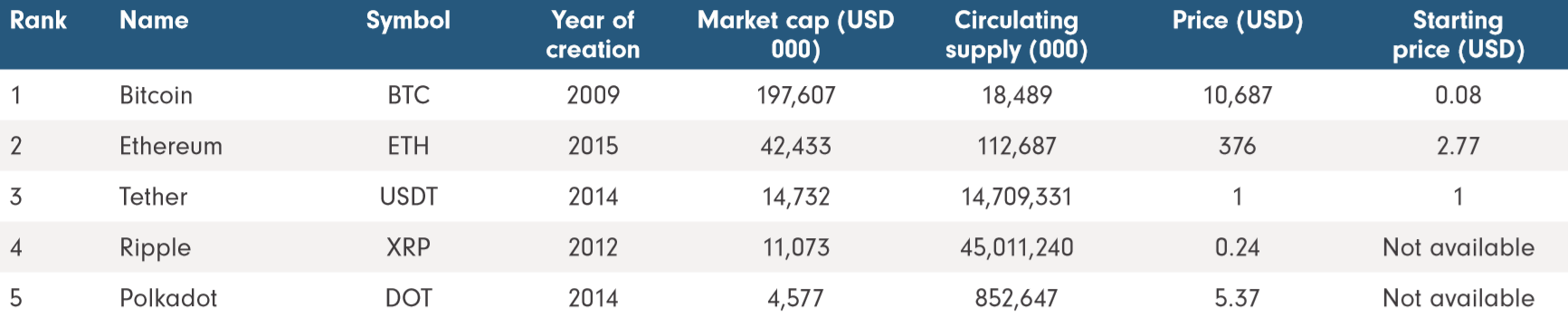

Table 2: Top 5 digital currencies by USD market capitalisation

Source: Fidelity International, CoinMarketCap, various news sources, 14 September 2020, 1900hrs BST.

C. If bitcoin was a company, at a market cap of USD 197 bn. (see table above) it and by extension blockchains (so far) would have been deemed a success. The interest of players around the world to launch stable coins (Facebook’s Libra for e.g.) tells us that the visionaries like Mark Zuckerberg see something here. Yet institutional quality research on the subject and the various developments is minimal. While there is some on bitcoin there isn’t much on Ethereum (completely different investment thesis to bitcoin), Tether or Polkadot. All these platforms while competing are also trying to solve problems differently just as Amazon, Cisco, Google and Microsoft were all part of the internet economy but solving different problems.

D. For all the past naysayers (me included), bitcoin also continues to thrive and this anti-fragility (to use a Nassim Taleb term) gives more confidence as time passes. The system grows in resilience with every hack attack, and as more compute power gathers behind it. As Satoshi Nakamoto covers in his white paper, the probability of a ‘life-threating’ hack decreases further as time passes given the compute resources continue to increase on the side of the now honest nodes which requires bad actors to have significantly higher compute power on their side to disrupt the program. Probabilistically speaking, we seem to have crossed that threshold for bitcoin and by extension the concept of digital currencies.

E. The finance industry (and professionals like me) continue to talk about innovation and disruption whilst being very slow to disrupt ourselves (personalisation & simplification are crying business needs in our sector). Blockchain/digital currencies seem like technologies sitting on our doorstep ready to disrupt our businesses in ways unimaginable today with just a COVID-19 like trigger standing between them and prime time.

Just like airlines and airports never looked at Zoom as a potential disruptor, we need to mindful that the disruptors to our business could come far afar from the left field.

F. Lastly, governments around the world seem to be working on digital currencies with China, Dubai, Sweden and Singapore seemingly in the lead. Over the next few years it would be safe to expect that many central banks (my bet is on Chinese to be the first of the G7) will embrace digital currencies. Conceptually, most of them will be based on the building blocks of bitcoin. To understand these digital currencies, it is therefore helpful to understand the basics of blockchain/bitcoin as enabling technologies. Digital currencies also probably deserve a wider and deeper discussion as they will also have significant implications on bank and financial business models. From our discussions with financial companies, this is an important topic on every financial company’s board meeting agenda.

Key Points of Interest on Digital Currencies & Bitcoin

As per the short nine page original creation document of bitcoin (Bitcoin: A Peer-to-Peer Electronic Cash System), Satoshi Nakamoto’s purpose of creating bitcoin was to solve for a need for an electronic payment system based on cryptographic proof rather than trust. This would allow two willing counterparties to transact directly (peer to peer) with each other without the need for a trusted common third party as a common digital ledger distributed record (blockchain) would be maintained.

The problem sounds simple enough, but the answer was infinitely complex. The innovations around bitcoin and blockchain have given us some interesting enabling technologies over the last 10 years which in my view are set to prove themselves out over the next 10 (analogous to how developments in battery technology, touch and GSM technology were critical for the iPod to make the leap to iPhone).

However, what is clear from the first iteration is that whilst bitcoin is unlikely to ever replace our current electronic payment system (due to issues of speed on transaction verification), it does have a fair shot at becoming a digital store of value.

Digital Scarcity

Scarcity in the real world is omni-present - whether you have a piece of real estate in a unique location (like the Tokyo Imperial Palace in Tokyo) or the Mona Lisa by Leonardo da Vinci - you can be assured that these will be forever keep their relative value as there is no further supply likely.

In the context of the above, digital scarcity almost sounds like an oxymoron. Copy, cut & paste has been the bane of intellectual property protectors the world over and coming from a generation which grew up on ICQ/BitTorrent & Napster, you could not have convinced me 10 years ago that we had solved that problem (the double spending problem - that a digital coin hasn’t just been copied and pasted and used twice).

However, bitcoin, through the genius of its creator and subsequent hard work from its open source community has solved that problem. Effectively, the computer algorithm has made an unbreakable commitment which can now be trusted. Using a clever combination of computing, technology, game theory, incentive structures and a little bit of luck (on being the first), bitcoin has achieved that fine equilibrium.

This is particularly noteworthy and downright amazing because another barrier on the difference between the physical and the digital world has been broken by this innovation.

Characteristics that Support this Digital Scarcity

Incentive Structures Favour Scarcity: It has been coded into the bitcoin program (since inception) that there will never be more than 21 mn. bitcoin in the world (we are at 18.5 mn. currently). The incentive structure of the network makes certain that a consensus is required to change that and given that the price of bitcoin will surely fall if supply increases, the incentive structures are against anyone logically agreeing to this.

Bitcoin are granted to computer programmes (miners) for solving tough mathematical problems. These are released every 10 minutes via blocks paid to miners with block reward halving every 210,000 blocks until we reach the 21 mn. number. The third halving occurred in May 2020 resulting in a 50% decline in the block reward from 12.5 to 6.25 which reduced bitcoin’s rate of issuance from 3.5% to under 2%. This unique method means that as the computer process speed increases, the compute power required to mine bitcoin also increases - keeping the system forever in equilibrium from linear technological innovation (innovations like quantum computing though remain an unknown long term risk to the AES 256 advanced encryption standard).

No centralised dependency: Given that it is based on blockchain technology the bitcoin network is resilient and not dependent on a single centralised computer database. It has been estimated that in January 2017- the processing power behind the bitcoin network was equivalent to that of 2 trillion consumer laptops making it 2 mn. times larger than the processing power of the world’s largest supercomputer and more than 200,000 times larger than the world’s top 500 super computers combined.

Rising marginal cost of production and rising stock to flow ratio: Having been a commodity analyst in my past life, I have learnt the importance of going beyond thinking about just demand and supply factors while valuing commodities. One also needs to consider the marginal cost of production and the commodities stock to flow ratio characteristics (its rarity) to gain a full understanding.

A rising marginal cost of production generally means rising commodity prices. The stock to flow ratio is a metric used to quantify the scarcity of a commodity. Stock is the existing supply of a commodity less what has been consumed or destroyed. Flow is the annual incremental production. Obviously if you are not adding to stock that is a good thing.

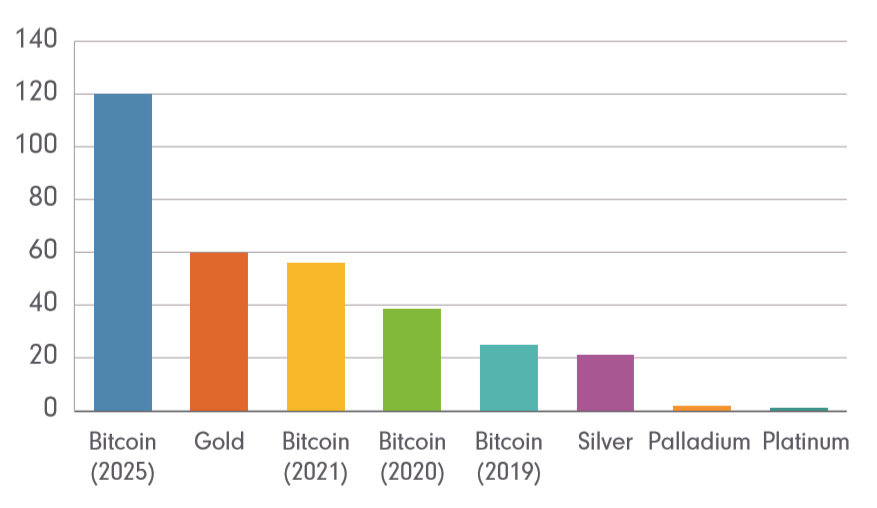

Again, by the unique codification above, bitcoin’s marginal cost of production continues to rise due to a combination of ‘the halving’ plus more and more computer resources devoted to the problem making the network more expensive to recreate (so marginal cost of production continues to rise). The stock to flow ratio (as represented by Saifedean Ammous in his book The Bitcoin Standard) shows that bitcoin’s stock to flow ratio will eclipse that of gold following the next halving (2024) making it one of the most scarce asset (digital or physical) in the world based on what we know today, suggesting some merit in its digital gold/scarcity properties.

Chart 1: Stock to Flow Ratio of various commodities v/s Bitcoin

Source: PlanB (March 2019), Coin Metrics (April 2020). Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. Note: A Goldman Sachs report from 2015 estimated that the last of gold from known reserves will be mined by ~2035 and the last of platinum will be mined ~2055. The last bitcoin will be mined around 2140.

The purpose of the above discussion was not to write an investment thesis on bitcoin or the blockchain technology (really you need to consult financial experts and advisors for the same) but to highlight why bitcoin is so interesting as a concept.

Valuing Bitcoin: Ultimately linked to Digital Scarcity

Investing is a bit like time travel for money. You want to send USD 100 away today and receive at least a similar or higher amount at a future date. Simply put, that is the concept of store of value in stocks, bonds or investment in assets like property, gold or potentially bitcoin.

Ask a young analyst how to fundamentally value a business and they will be ready with a variety of spreadsheets based on future earnings and cash flow projections, discounted cash flows, price earnings multiples and the like. Ask them to come up with a fair value for gold or a Monet or a Blue Period Picasso and they will stare at you in disbelief. That’s simply because while the authoritative book on equity financial analysis has been written (Ben Graham’s ‘The Intelligent Investor’), the same is yet to be written about valuing gold or art (or more likely I just haven’t found that book yet).

Yet anyone who has ever walked through a museum, instinctively knows that, just because you don’t understand how to value a work of art (as it doesn’t fit neatly into your discounted cash flow/price earnings models), doesn’t mean that it has no value

The rarity and store of value is possibly the only investment thesis behind bitcoin (as there will only be 21 mn. bitcoin ever). In the context of an ever-growing supply of money/other commodities, this should theoretically allow bitcoin to keep its value relative to the other commodities. Unfortunately, as with every investment, nothing is certain & only time will tell.

Other Notable Characteristics

No centralised management: Given the distributed infrastructure, the bitcoin network is the epitome of a decentralised organisation (no one knows who Satoshi is and he has possibly long moved on from the project). This means that there is no centralised authority to change the rules of the game. The rules are set in stone (or code). Rules can be changed by consensus but that would require all the incentives to be aligned and for the rule change to increase the value of the ecosystem/network. In some ways, this stability of rules enhances trust.

A distributed structure: As of May 2020, some unverified estimates suggest that the bitcoin network runs on approximately 41,000 globally distributed nodes. The bitcoin transaction ledger is copied on all these 41,000 nodes, which means for 3rd party to logically disrupt the network all these 41,000 nodes need to be switched off. As long as even two nodes remain connected and functioning on the network the network cannot be disrupted.

Opensource structure: Think of blockchains as open source ledgers/databases which under certain conditions everyone can read/ write to. Further given the cost of the compute power involved to write to these, there is little incentive to write incorrect stuff which allows the network to work effectively as a collaborative tool in a zero-trust world. If you forget the jargon, effectively blockchain technology is an important first iteration to unbundle collaboration from the presence of a trusted third party.

Talent: From a talent perspective, tokenisation, blockchains, Ethereum, Decentralised finance (DeFi) all seem to be attracting the best Polymath coders. To code for a new coin/token, it is not enough to understand software. As the discussion above might have shown you, besides knowing how to write code, you also need to understand game theory, probability theory, incentive theory and economics.

As a seeker of under-valued management talent, this is probably the most important reason why blockchain/bitcoin are now firmly on my radar given the best minds seem to be working in this technological area (AI is not the only game in town!).

However, talent is not the only thing. Several things are required to create sustainable corporate success. The right team, corporate structure, industry tailwinds, circumstances, luck all in different degrees at different times. As a side note, to go back to Table 1, 16th September is an important date in Apple’s history. 16th September 1985 was when Steve Jobs was first ejected out of Apple. He went on to create NeXT with many ex-colleagues from Apple. Yet due to various reasons NeXT was never the success he hoped it would be. 16th September 1997 was the day he came back as Apple iCEO (after the acquisition of NeXT by Apple). The rest as they say is history as everything slowly fell into place.

Blockchain and digital currency technology feel a bit like that early stage. For example, there is a fair amount of discussion between informed circles as to whether it is bitcoin or blockchains that were the superior invention. To my eyes it doesn’t really matter. Bitcoin has some interesting applications in the ‘store of value’ investment thesis. Bitcoin was also an interesting first successful iteration of the blockchain technology but is unlikely to be the last. Like in the case of Apple, many things will be required to come together but what is interesting is that we are in the very early innings with several potential use cases which will only get better as the feedback loop continues to work well.

The Use Cases that I am Keeping a Firm Eye On

Payments: The global payments infrastructure is a hotbed of innovation. While it is becoming easier and easier to send money and pay for goods digital/physical the reverse (receiving money) is not yet so true. However future iterations will undoubtedly work both ways. Facebook’s interest in Libra can be appreciated in this light as imagine getting paid for likes on your Instagram post through stable coin/real money. Potentially this would also give the user real control over how their data is treated and monetised and would go some way in solving the problem of users not getting adequately compensated for their time/data.

Decentralised Finance: The topic of decentralised finance, like the topic of digital currencies possibly deserves a note on its own. The core concept is that finance as an industry is based on trust. That trust manifests itself in the form of an organisation or a corporate structure (like a bank or an asset manager) which sits as the guardian of trust between two parties who are unknown to each other. DeFi basically sets out to disrupt the necessity of the presence of that guardian of trust using the technologies explained above with applications today in all parts of finance. The industry today is in some ways like the social media industry with Orkut, Myspace and the like - before Facebook came along.

Just like investors in long duration transportation assets should have paid attention to Zoom, those investing in the retail real-estate to Amazon, long term investors in financials should make sure that the management teams they are investing with are alive to these oncoming challenges & opportunities.

Health care infrastructure in the US: Of all the things I need to spend time understanding in a global portfolio manager role, understanding how the US healthcare reimbursement system works must rank near the top in terms of ‘unnecessary complexity’. Transparency is completely lacking and with all the rebates and middlemen involved, a consumer has no real clue how much she is really paying for medication, a doctor’s service or a surgery. This along with the issue of electronic medical records is a problem waiting to be solved (though given the politics involved, I am not holding my breath).

Smart contracts: So much of global judicial time is wasted in interpreting contracts and contract law. This remains one of the frictions in business which ultimately the end consumer pays for. Smart contract enabled through computer algorithms which can make unbreakable commitments is another area where blockchain technology could have some interesting applications.

Democratisation of financial asset ownership and Tokenisation: One of the innovations out of blockchain/bitcoin is the ability to issue a digital equivalent (token) of a real physical asset. Think of this as what joint stock ownership did for the equity markets, tokenisation as a concept could do for alternative asset classes where size and illiquidity commands huge entry barriers. Concentration of asset ownership remains a big underlying issue driving inequalities and there is potential for tokenisation as a technology to solve for that. Most of us will never really own a Monet or a Picasso but like today we can own 0.001% of Amazon. If tokenisation were to reach its logical conclusion, one day it might be possible to own 0.0001% of a Picasso painting with significant implications for the alternative’s asset class.

So why isn’t Blockchain an Unmitigated Success Already?

In one word, the problem is of trust. Paradoxically a technology and proof of concept which seek to disrupt ‘trust’ are not yet ‘trusted’. Various reasons from volatility of bitcoin, to the 2017 bubble association, to too much jargon (as if finance wasn’t bad enough now, we have decentralised finance) are cited. Building trust takes time even in a digital world.

While the rest of the financial industry faces the problem of too much regulation, one of the reasons for lack of trust, is the lack of regulation which reminds many of the wild west. Also as is typical in hype cycle technologies, the underlying plumbing (back office, compliance, finance, custody - the boring but super important stuff), takes time to catch up. However, with time and with participation of more regulators (digital currency is a case in point) and trusted financial entities plus all the investments made in plumbing over the past few years we would expect this to be solved over the next few years.

Concluding Thoughts

Covid-19 has undoubtedly been an accelerant of change and as Microsoft’s CEO, Satya Nadella commented, two years of digitisation have been seen in less than 2 months. As with the airlines getting disrupted by Zoom, disruption can appear from anywhere. As equity market participants, it is incumbent on us to engage widely with the global ecosystem (both listed and unlisted) to better appreciate the changes happening around us.

Blockchain and digital currencies (like bitcoin) are potential early stage technologies where I think investors need to pay more attention as they are trying to disrupt the very concepts of trust which is at the core of every 21st century financial business model.

To adapt a favourite Satya Nadella quote - Success in the corporate world today, is like a formula 1 race. Winning the race is not only about driving the fastest on the fairway but about negotiating the turns well. COVID-19 represents such a turn for every global corporate with the only difference being that the potential disruption is so dramatic that everyone needs to make sure that not only are they speeding in the right direction but also participating in the right race. Companies going down the personalisation, simplification, collaboration and decentralisation route with a focus on the chequered flag of trust, are in our view likely to at least be on the right race-track.

Please note: Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities.

Never miss an insight

Stay up to date with our latest thought pieces by hitting the follow button below and you'll be notified every time I publish a wire.

5 topics

Amit Lodha has been Portfolio Manager of the Fidelity Global Equities Fund since 2010 and has over 16 years of investment experience. He is a qualified accountant from the Institute of Chartered Accountants (India) and a CFA charterholder.

Expertise

Amit Lodha has been Portfolio Manager of the Fidelity Global Equities Fund since 2010 and has over 16 years of investment experience. He is a qualified accountant from the Institute of Chartered Accountants (India) and a CFA charterholder.