Bowser prices to bananas: What is inflation, why should investors care?

Some seasoned investors haven’t had to grapple with high inflation for more than three decades. For others, they’ve never experienced it at all. It is for this reason, prudent investors need to understand the inflationary outlook and consider how they can adapt their investment strategies. This is part 2 of a 3-part series on how commercial property plays very nicely into the environment we are in.

What is inflation? It's a measure of the change in the value of something over a period of time. This could be anything from petrol at the bowser from June to September, or the price someone pays for bananas now versus a year ago. In order to maintain economic stability, central banks typically lift interest rates to moderate any radical movements in price.

Regardless, Cromwell’s view is that the best inflation mitigation is to ensure real estate portfolios comprise well specified, well-located stock suitable for modern occupiers.

This article looks at the current inflationary environment and outlines the implications for investors.

What is inflation?

Inflation refers to the average rate of price increases over a given period, typically a year. A moderate rate of inflation is considered desirable for growth and stability. Inflation that is perceived as too low may prevent business and consumer spending due to the expectation that prices will fall. On the other hand, inflation that is perceived as too high creates pricing uncertainty and limits expansionary activity. (1)

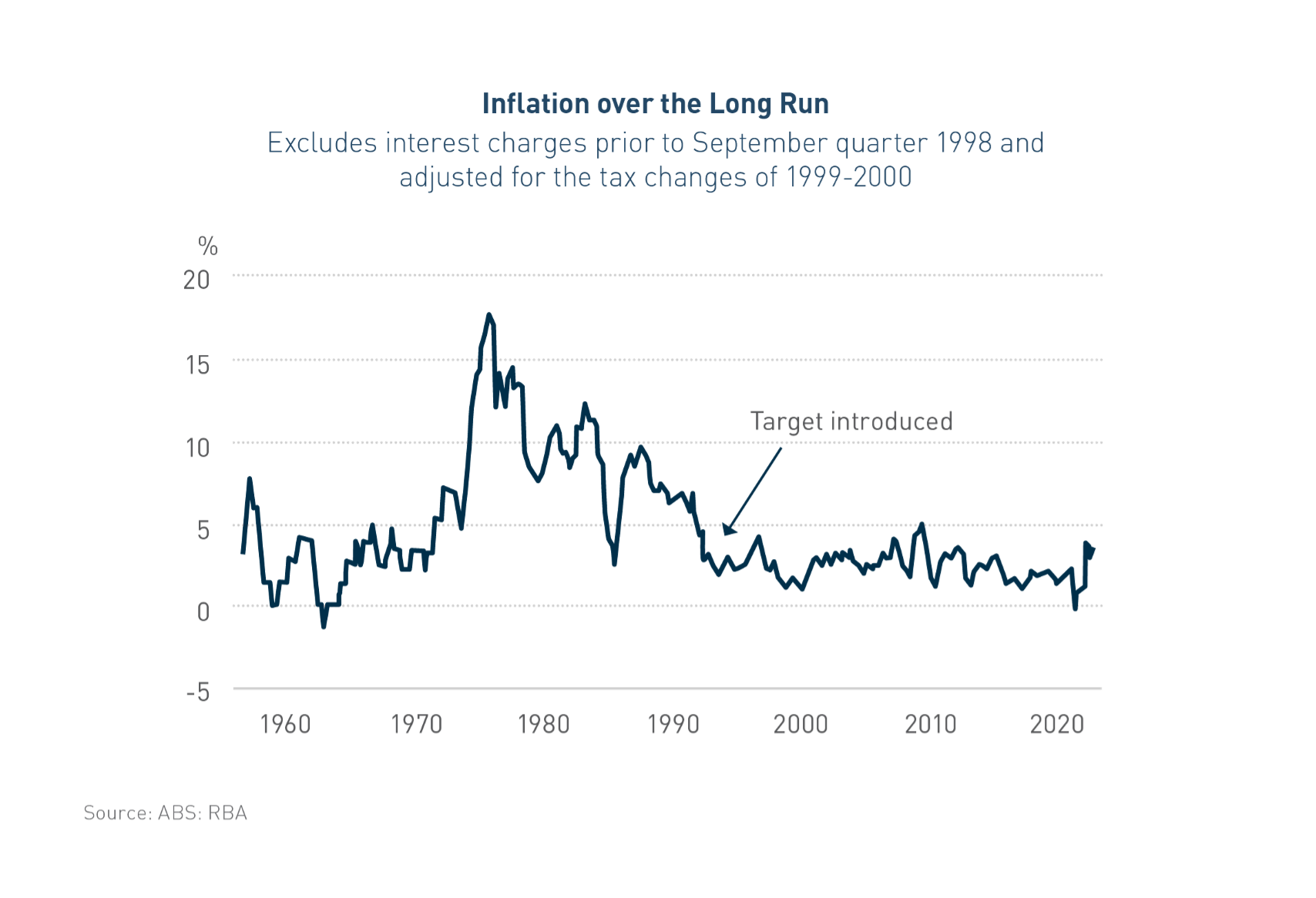

The Reserve Bank of Australia (RBA) has a duty to contribute to the stability of the currency, full employment and the economic prosperity and welfare of the Australian people. As such, the RBA has outlined the appropriate target for monetary policy is to achieve an inflation rate of 2% to 3% on average, over time. This is a rate of inflation sufficiently low that it does not materially distort economic decisions in the community, provides discipline for monetary policy decision-making and serves as the anchor for private sector inflation expectations. (2)

Implications for investors (3)

For an individual, inflation results in a deterioration of their purchasing power over time.

A dollar today will be able to buy more than it will at a future point in time. This is of particular concern for those nearing or in retirement, as they can no longer rely on wage growth to counteract increases in inflation.

The consumer price index (CPI) measures household inflation and includes statistics about price change for categories of household expenditure. In Australia, CPI inflation rose 3.5% across the 12 months to December 2021. This means a basket of goods which cost $100 in December 2020 cost $103.50 in December 2021.

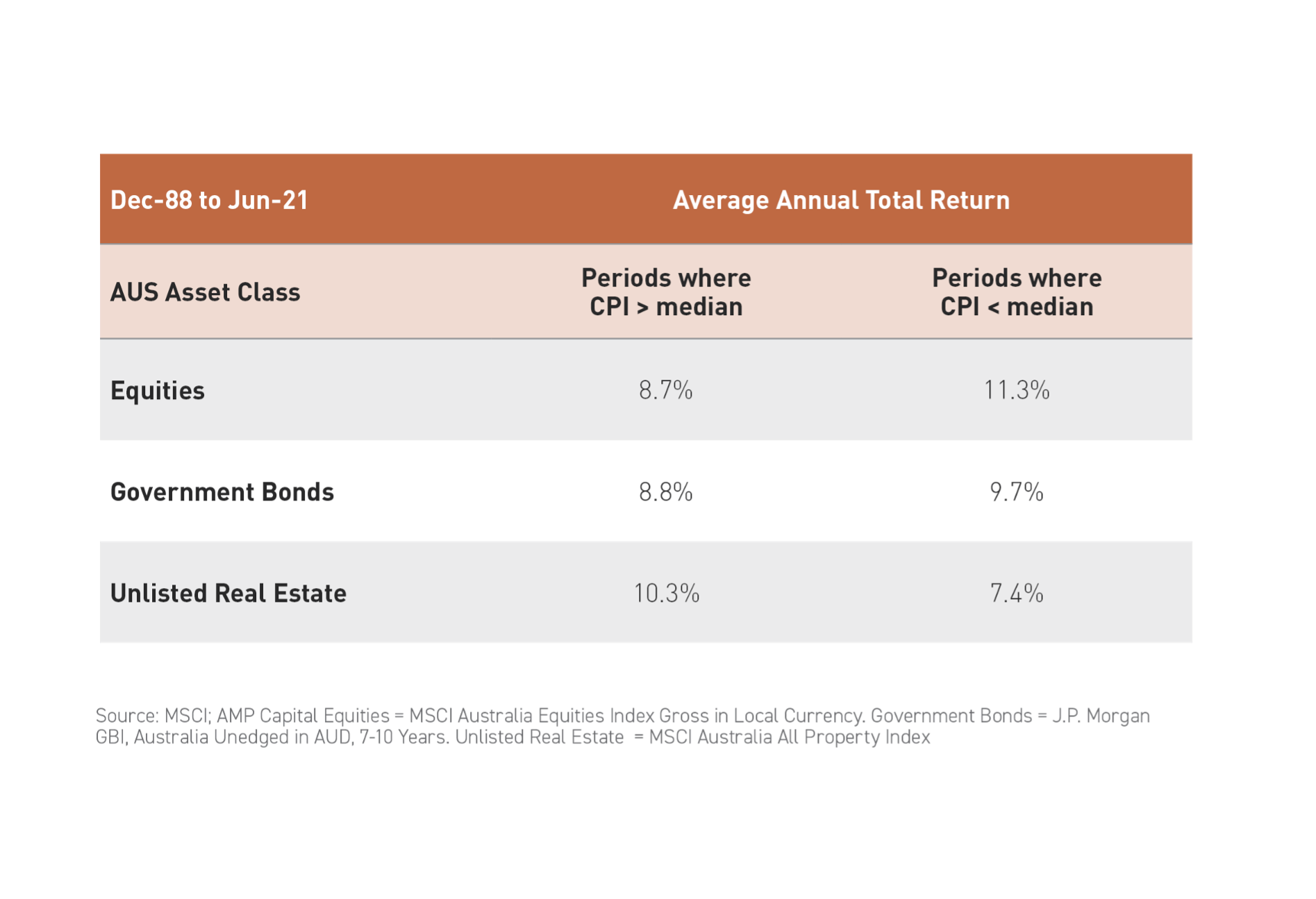

The impact of inflation varies across asset classes and investment types.

Fixed income

Investors typically buy fixed income securities such as bonds due to their stable income stream in the form of regular interest payments.

However, since the rate of interest remains the same on most fixed income investments until maturity, the purchasing power of the interest payments declines as inflation rises.

A bond’s stated, or nominal (before inflation), interest rate does not take inflation into account, so investors only earn that amount when inflation is zero. As a result, bond prices tend to fall when inflation is increasing. For example, a bond paying 2% annually in an environment where inflation sits at 3.5% means the real return (after inflation) is -1.5%.

As such, the big worry for investors is whether their return can outpace the rate at which their purchasing power declines amid mounting inflation.

The nominal return needed to generate a positive real return rises during inflationary periods. This is more pronounced in a low-rate environment, as investors holding higher-quality government bonds could see their purchasing power diminish with fairly low inflation.

Stocks

Inflation that rises modestly and in line with expectations is generally seen as a positive for the broader share market, given it is consistent with an economy growing at a sustainable pace.

However, inflation above a certain level, or inflation that spikes unexpectedly can be negative. The impact may also vary across different sectors.

When inflation rises significantly, it is generally seen as a negative for stocks as the associated increased borrowing costs, higher costs of materials and labour and reduced expectations of earnings growth tend to put downward pressure on stock prices.

Real assets

Real assets – including real estate, land, precious metals, commodities and natural resources – tend to fare well in times of high inflation.

Income from real assets is generally inflation-linked.

For example, it is common for commercial real estate leases to have annual rent increases tied directly to increases in inflation. This is why commercial property is regarded as an inflation hedge.

Over the long term, unlisted property, a real asset class, has outperformed other sectors such as equities and government bonds.

What is causing inflation?

A lot of debt, not a lot of correlation

Australia’s total debt reached $855 billion at the end of 2021, with an additional $60 billion expected to be issued over the first half of 2022. Debt is anticipated to continue climbing over the coming years to reach an all-time high of $1.2 trillion by 2024-2025, with the budget remaining in deficit until at least 2031-2032. (4)

Australia is comparatively faring well with central government debt at the end of 2020 (the most recent figures available) totalling 44.1% of GDP, particularly compared to the United States (199.01%), United Kingdom (103.5%) and Japan (221.07%).

At a glance, it would appear as though mammoth fiscal spending by the Australian Government in response to COVID-19 is the primary cause of Australia’s inflationary spike (5). The 2021-22 Federal Budget committed an additional $41 billion in direct economic support, bringing total support since the onset of the pandemic to $291 billion as of May 2021. This included economic stimulus initiatives such as the $89 billion JobKeeper program, as well as $1.9 billion for the vaccine rollout and additional spending for the emergency response to the pandemic and Medicare.(6)

However, this is not a typical case of overall demand in the economy, supported by fiscal policy, being unusually high. High inflation is not attributable to fiscal policy when economic activity has yet to fully recover, as is the case in the current landscape.

That’s not to say ballooning government debt isn’t an inflationary concern, but the fundamental constraint at present is that supply capacity is unusually low. This indicates we may not be in the midst of a normal cyclical recovery.(7)

What this means for you as an investor

Over the course of the last two years, COVID-19 restrictions have hit the global economy in a number of ways. The start of the pandemic saw a supply shock as activity was deliberately brought to a halt in an effort to stop the spread of the virus. As restrictions were lifted, production was unable to kick off as quickly as it had initially shut down.

As it became increasingly apparent lockdowns would be more prolonged than initially hoped, consumer spending was reallocated across sectors, shifting towards goods and away from contact-intense services. This has seen bottlenecks in some places and spare capacity elsewhere.

There are signs the worst has now passed, and any further turbulence as a result of the Omicron variant appears manageable. While global shipping costs remain at all-time highs, they have begun to plateau and are anticipated to begin receding. This, however, will take time, and is likely to mean supply disruptions will not be fully resolved until the back end of 2022.(8)

Inflationary pressure has been building in goods sectors which have seen the largest price rises as a result of being hit hardest by bottlenecks. This stands to reason why there is rising inflation overall, despite economies not yet reaching full capacity.

An economic landscape shaped by supply constraints will carry with it greater macro volatility. For example, where inflation is predominately demand-driven, stabilising inflation also stabilises growth. There is no trade-off. However, where supply constraints drive inflation, monetary policy cannot stabilise both inflation and growth – it must choose between them.

Spared the worst

Despite experiencing the impact of supply chain disruptions, comparatively, Australia has been spared the worst. Supply chain bottlenecks have been milder in Australia and neighbouring Asia compared to the United States, who have borne the brunt of the supply chain issues.

Relatively speaking, this is good, but the looming inflationary threat will persist for some time yet.

Outlook (9)

At their 1 February 2022 Board meeting, the RBA announced a willingness to be patient and live with some higher inflation while domestic price pressures are less severe than those abroad. Headline consumer price index (CPI) inflation sits at 3.5% and is being affected by not only supply chain disruption, but also higher prices for petrol and newly constructed homes.

Underlying inflation sits at 2.6% and is forecast to continue rising to 3.25% over the next few quarters, prior to declining to 2.75% in 2023 as supply-side problems are resolved and consumption patterns normalise. However, the persistence of these supply chain disruptions and the resulting effects on prices will continue to cast uncertainty on these forecasts.

Regardless, Australia’s underlying inflation figure (2.6%) is less than half of the United States (5.5%) and comfortably under the UK (4.2%) and Canada (3.4%). (10)

Despite bringing its quantitative easing program to an end in early-February, the RBA insists this does not imply a near-term increase in interest rates. The RBA have stated it remains committed to maintaining highly supportive monetary conditions to achieve its objectives of a return to full employment in Australia and inflation that sits sustainably within the 2% to 3% target range.

While inflation has increased, it is too early to determine whether it currently sits sustainably within the target range. This has largely been attributed to the uncertainties around how persistent the inflationary spike will be as supply problems are resolved. As a result, while interest rates rising is inevitable, a rise is unlikely in the immediate future.

Did you like this wire?

I am Cromwell's Head of Retail Funds Management and will be publishing regularly on Livewire. Look out for the final part of this series zooming in on how commercial property can act as an inflationary hedge in your portfolios. Hit follow for first access to my insights or click the fund card below to fund out more about the Cromwell Direct Property Fund. You can also find out more information at our website.

3 topics

1 fund mentioned