Buying opportunities in critical minerals stocks

The Opportunity

Over the past eight months we developed a series of thematically constructed buy lists of stocks that we believe will play a role in the energy transition.

- Australian Critical Minerals (ACM)

- Australian Rare Earths (ARE)

- Australian Iron Ore (AIO)

- Australian Sustainable Portfolio (ASP)

In our previous research notes,

- Why I like the good Carbon (Graphite)

- Decarbonising cement with Calix

- Introducing the Graphite Kid

- What the heck is Terbium?

- The Magnificent Seven of Electric Vehicle Metals

We introduced each of the above thematic ideas on a standalone basis. Here we examine the correction in the Australian Critical Mineral stocks.

Our analysis of estimated investor cost-basis shows that several our favoured names are just touching break-even levels. Given our positive long-term view, we are adding to core holdings in Lynas Rare Earths, IGO, Allkem and Pilbara Minerals. These were sold down in a round of profit taking but are reaching price levels which will likely find technical buying support.

Cost-Basis as a Timing Tool

Our proprietary cost-basis method for estimating the average entry price of investors in their stocks can be very useful as a trade timing tool. The way in which we use the method involves the monitoring of the unrealised profit buffer in our favoured stocks.

The basic idea is simple: we like to own those stocks we think are participating in a long-term up move due to favourable structural trends. So long as the valuation of these stocks remains okay, we then seek to add to positions in market corrections. One good rule of thumb, in our experience, is to add to positions that remain good value, but which have fallen due to short-term profit-taking. In a sharp correction, short-term traders will often take profit until there is none left to take, which, on average, is the break-even point for the typical investor.

Since we do long-term research to build our case for stock selection, we are happiest to add our holdings when our favoured names hit break-even. This is now happening across the stocks mentioned, and so we are recommending action to add to holdings.

Current Opportunities

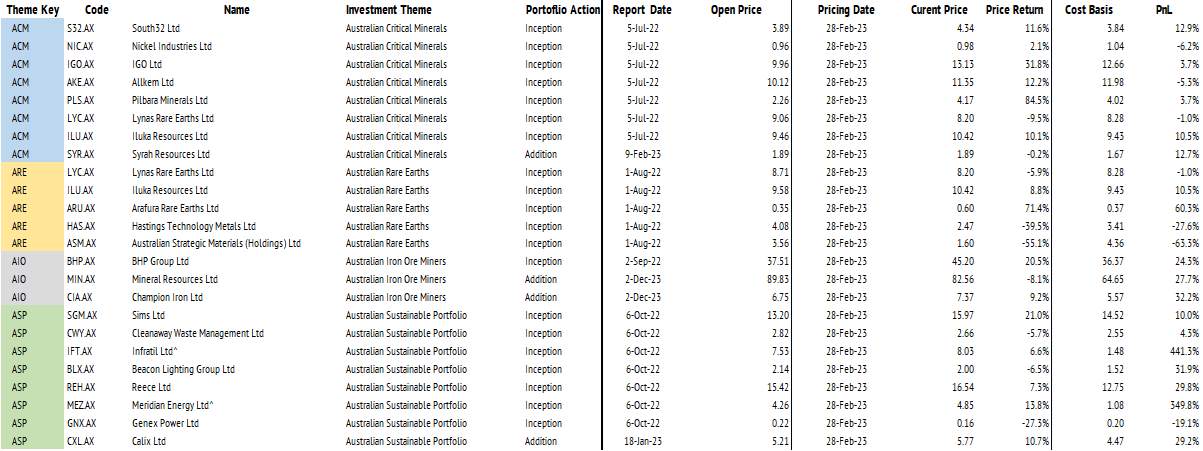

The current set of model holdings for energy transition sustainability themes are shown below.

The attached PDF document has this table and more, for easier reading.

Among the better performing sub-themes has been the Australian Critical Minerals (ACM) basket. This consists of eight names across the leading battery materials:

- Lithium (Li)

- Nickel (Ni)

- Cobalt (Co)

- Manganese (Mn)

- Rare Earths (REE)

- Graphite (C)

In the above table, we show the estimated cost-basis and unrealized investor profit and loss in the last two columns. In long-running structural trends, we stay alert for when positions reach break-even, or close to that level. So long as they remain favourable on valuation grounds, we look at such opportunities as timely moments to consider adding to positions.

This may seem a little simple-minded, but investor behavior is often predictable.

The break-even for average investor cost-basis is that price level where (on average) there is no more profit left to take in a general profit-taking correction. So, that is where we buy.

You can make trade timing more difficult than this, but we do what works for us.

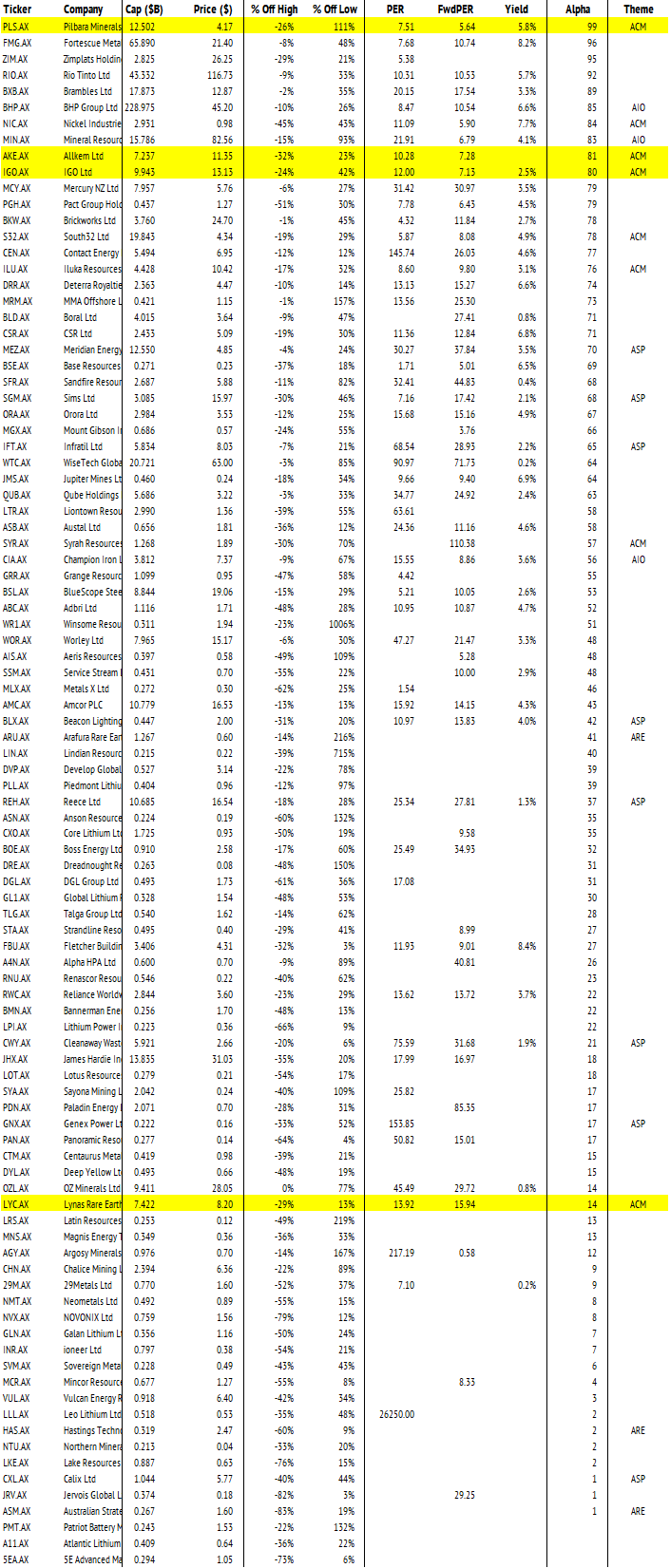

Valuation Considerations

This simple strategy can fail miserably when the target stock is over-valued, at the average investor break-even price. Obviously, we can deal with this issue, as far as you can in an uncertain world, by combining fundamental analysis with technical analysis.

Not many professional investors do this. I like to think that is why I am still in the business at 60 years old, when many others are not.

Choosing what you will pay attention to is the key to a long and happy life. In the combination of data in both of the preceding tables, I looked specifically for stocks hit by nervousness over lithium prices, which are within around 5% of cost-basis. This led me to look at the four stocks in yellow. Of course, Lynas is in rare earths, but I also like to pay attention to any panic that hits the headlines. Everyone is worried about what happens to the Gebeng cracking and leaching plant in Malaysia. We know this already, it shuts down.

We also know that Lynas is building a new plant in Kalgoorlie, and that the plant is delayed. The prospect of a delayed plant is neither new nor novel for any business that does things.

In the meantime, Lynas will stockpile the material it can now process through Gebeng in amounts in excess of what it can currently push through the separation plant. This approach is neither new nor novel. It is called contingency management and seems like a good idea.

In short, we think the market is doing what markets often do.

Ker-plunking in a ker-funk about something that will likely go away, as any well-managed problem might do. Amanda Lacaze has this, we think.

As for the lithium stocks mentioned, Pilbara Minerals, Allkem and IGO, the market is worried about falling lithium prices. Well, they did go up a lot, so that is reasonable. However, folks in the electric vehicle game keep talking about growing EV sales at a CAGR around 40% p.a. The rising size of battery packs means that Lithium Carbonate Equivalent (LCE) demand is likely to grow at a similar rate.

Folks do not have such growth rates in their current models.

There is an emerging threat to hard-rock spodumene miners from China-based lepidolite. That is interesting, and we may write about it in another wire. However, for now we think this market remains tight enough to warrant buying this dip.

Prognosis from the Chicken Entrails

The interpretation of stock price charts has an ancient history going back to Japanese rice traders in the 1600s. One good way to tell who has not been in markets very long is to ask the room who never looks at a chart of stock prices. That is the new hire in a large super fund.

The reason that professionals look at price charts is to gauge sentiment. They want to know what others are thinking. You might think the best way to do that is to read the news. Indeed, when I first started investing, with my partner, back in the mid 1990s we thought that. The attitude did not last very long. The news is usually quite late to the party. Stocks generally move well ahead of news, because the purpose of a market is to forecast events.

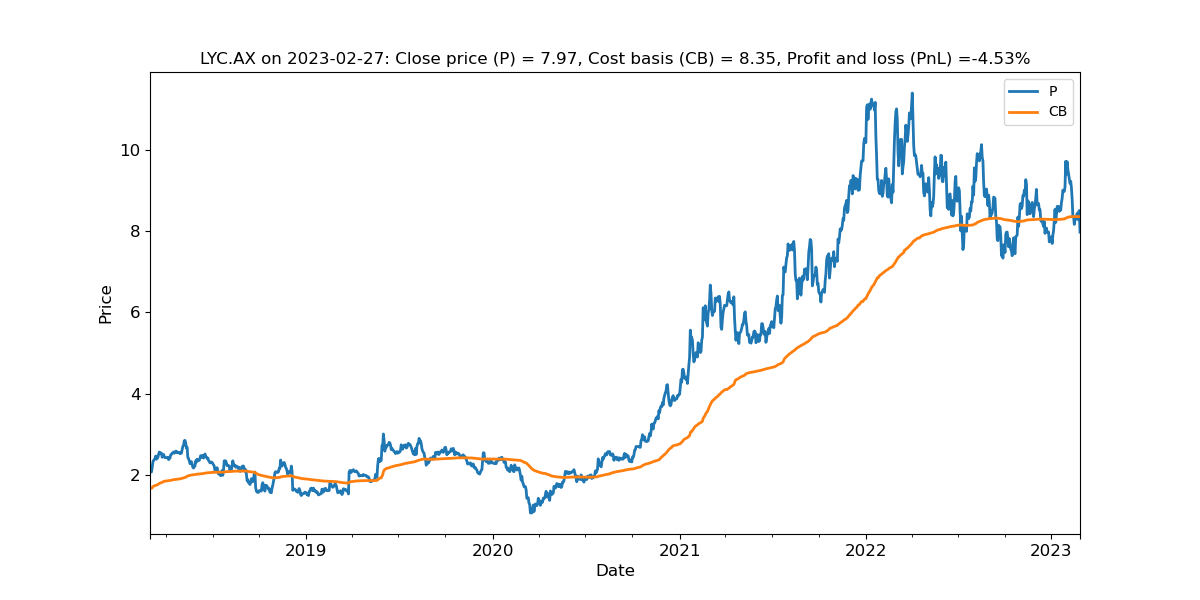

You can see that in the above chart of Lynas Rare Earths. The price started weakening way back in early 2022, when investors first realized that the Gebeng crack-and-leach plant transition would likely be a drawn-out process. Hence, we are trading sideways.

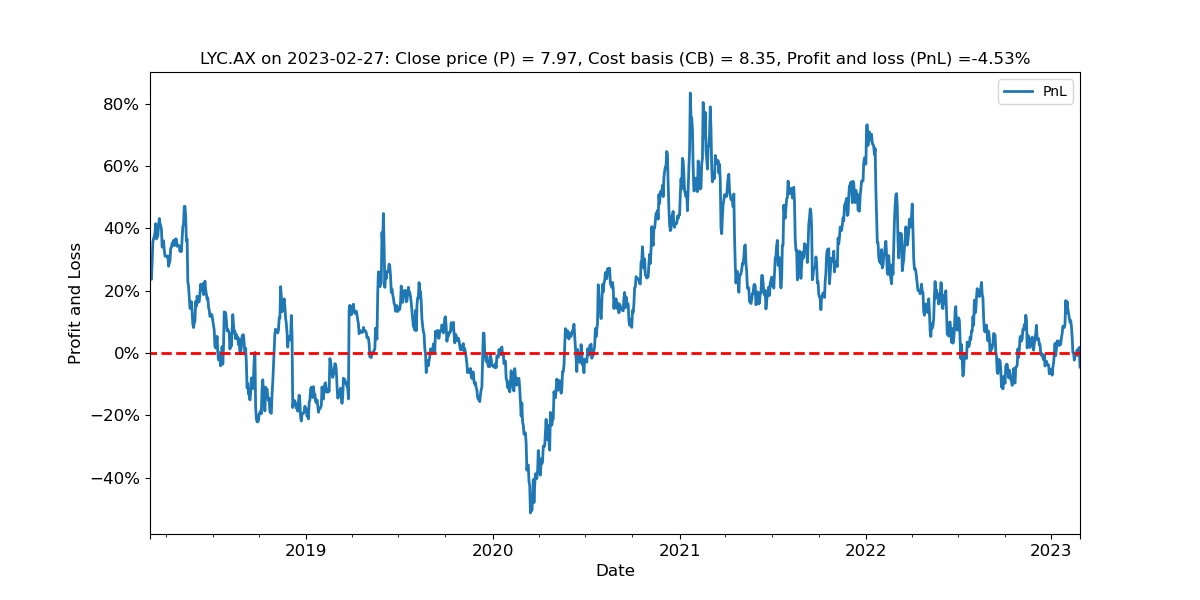

However, you can see from the above profit and loss chart, that the period of poor sentiment at this time is nothing like as bad in drawdowns as that in 2019 or during the COVID crisis.

Old hands like me don't worry much about the news, journalists, or anything they print. The important thing, to me, is this continuous mineralisation report from 1-Mar-2022. What it says is that the mineralisation at Mt Weld continues for 1,000 metres below surface.

Sometimes, you put a buy on a stock. Sometimes, you just point out a forgotten fact. Mt Weld is the best rare earth mine outside of China.

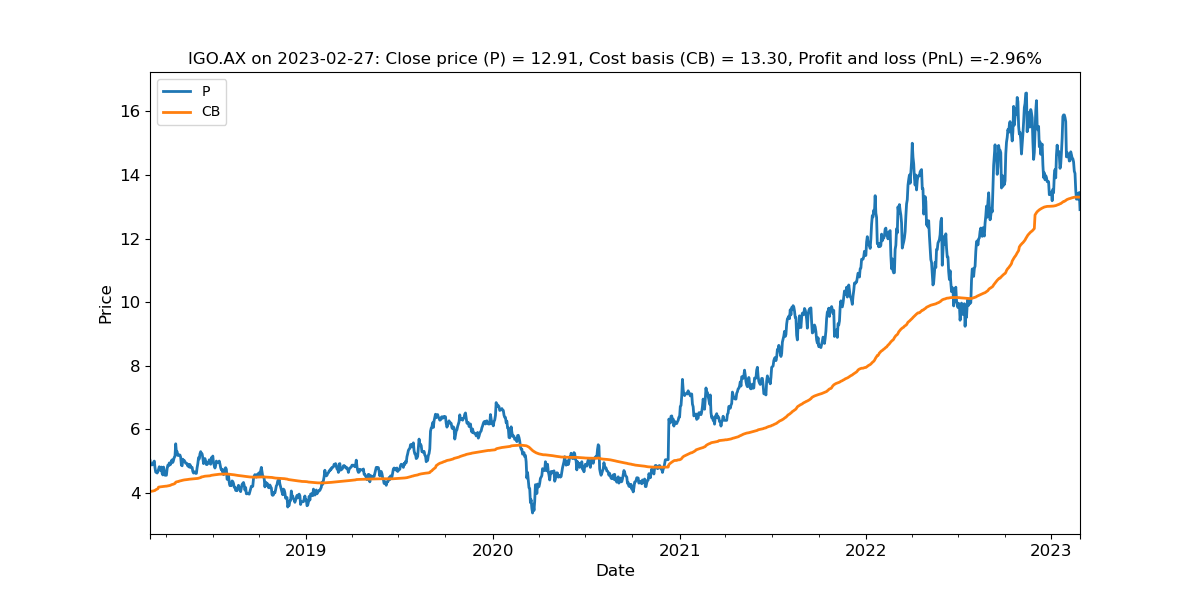

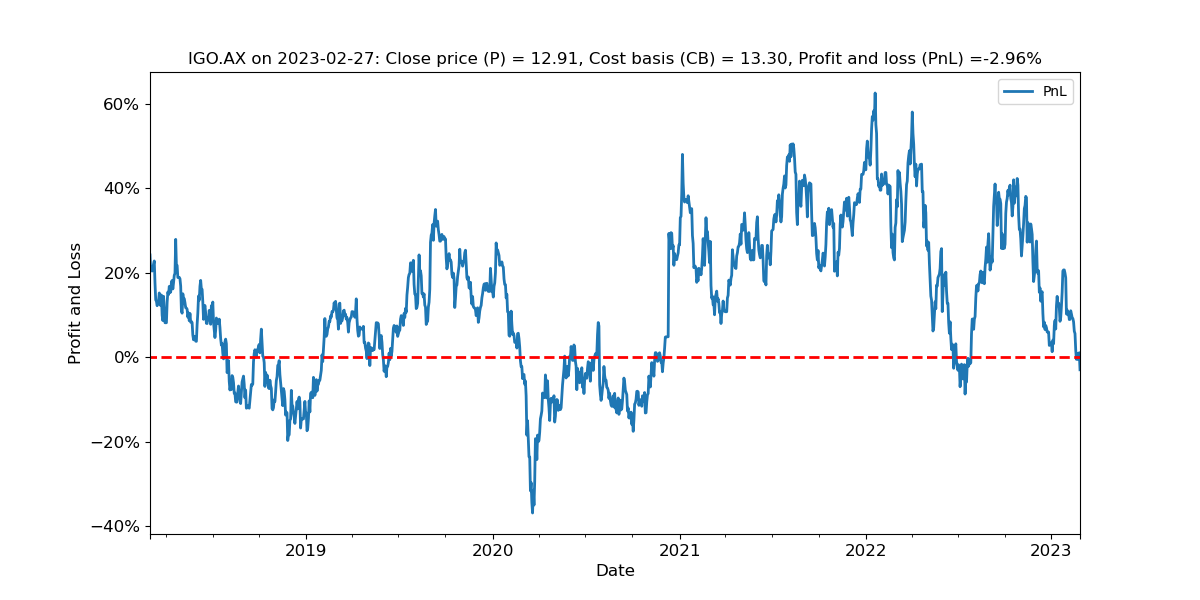

The situation over at IGO Limited looks fine to me.

Tragically, they lost their CEO Peter Bradford late last year, who will be sorely missed by all of those who knew him in the industry and watched him build the firm into what it is today.

However, the firm has around 25% ownership of the Greenbushes lithium mine. This is the best grade and largest producing spodumene mine worldwide. Enough said.

There are some brokers who think everything will fall in a screaming heap. Since I have actually been a stockbroker, I think I can well send a bouquet with a thank you card for this correction.

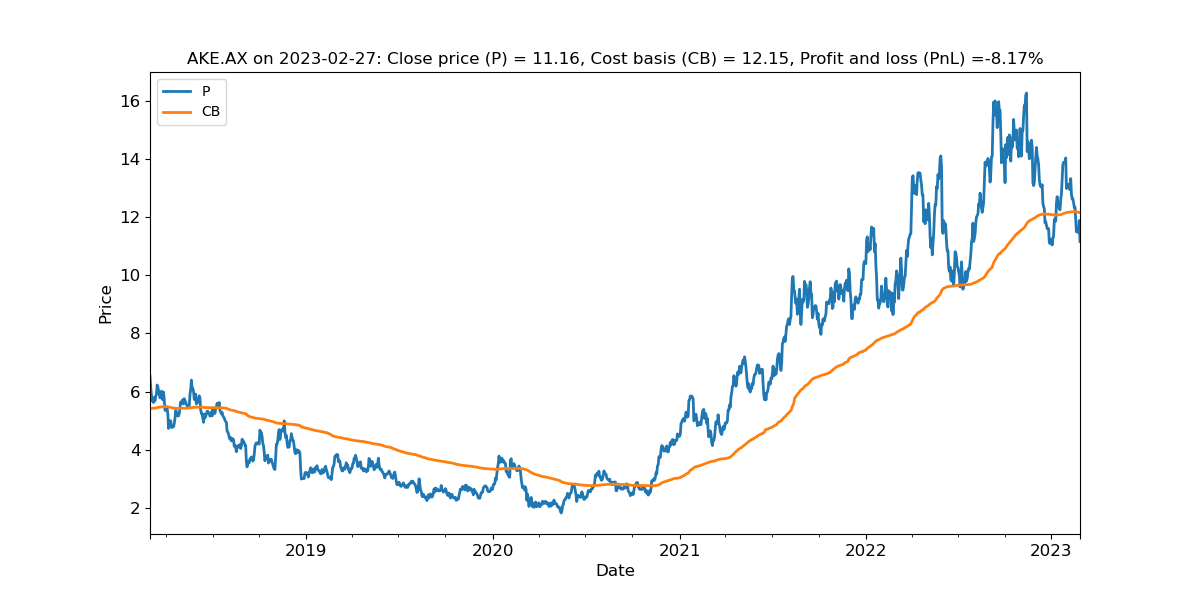

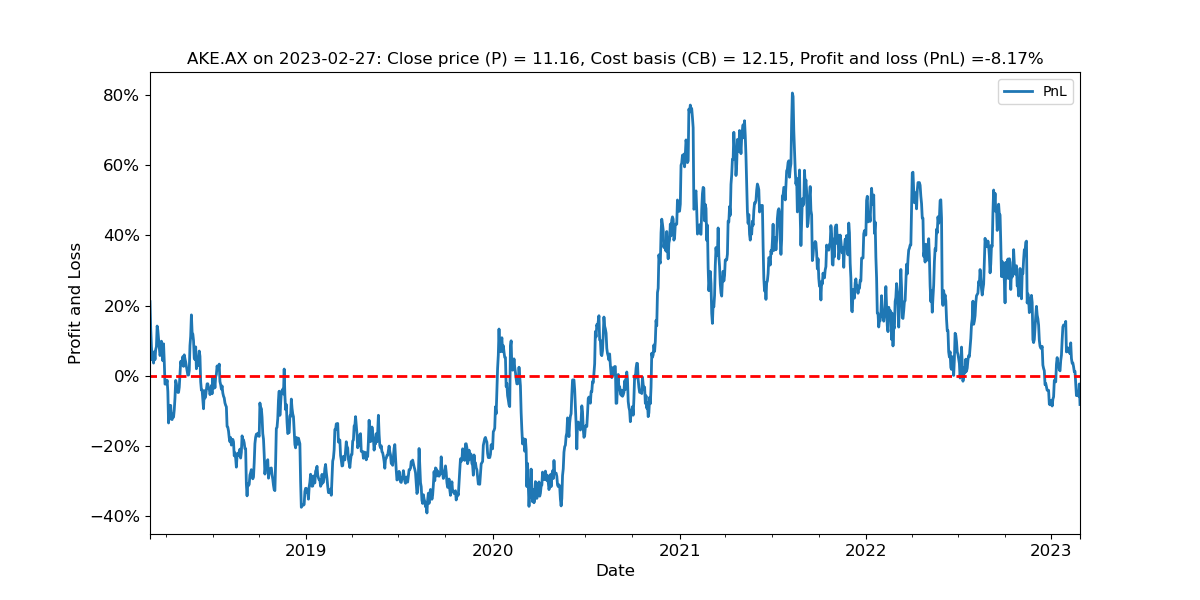

Allkem also appears fine, so far as the technical trading is concerned. Note that this business is more diversified across lithium mine types and geography. We like that, but it makes the stock harder for analysts to reduce to a simple story of buy or sell. Patient accumulation is the go.

Of course, an asteroid laden with emigrating alien dinosaurs could wipe out the energy transition tomorrow, but we think that the growth rates in EV uptake will support lithium a while yet.

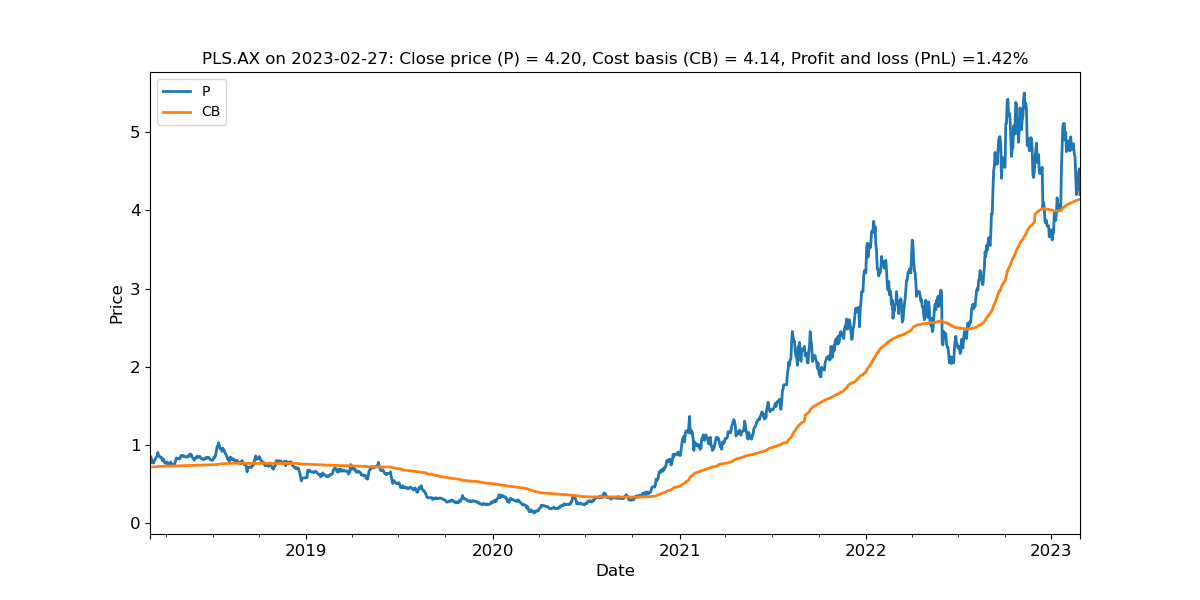

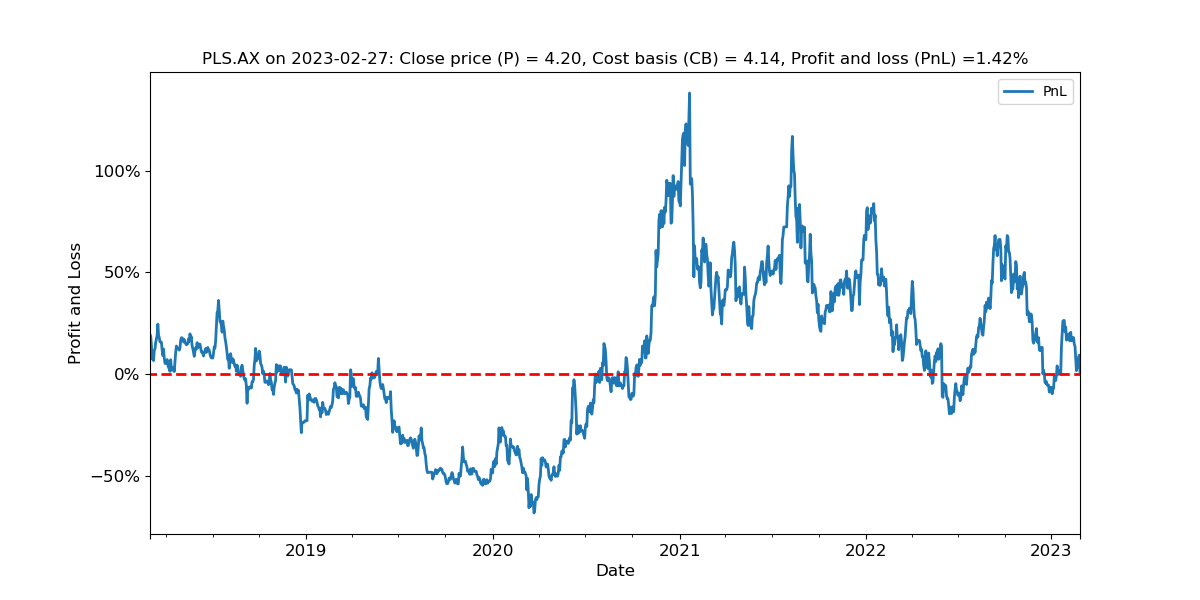

Among all of these, the last stock, Pilbara Minerals, is technically the strongest.

One way to shut out the noise, and have some quiet time for appraisal, is to block out the blue line and just look at the orange one. That shows the upward progress of investor cost-basis.

This is the method of the three-year-old. Works for me.

If you do that, and compare among all of the above charts, you can see that they are all rising quite steadily, which is what you look for in growth commodity names. Remember that this is the average price folks played for their stock. It keeps rising because investors are over-trading. This means that they cannot make up their minds whether to stay or go.

Investors are just like that hyper-hormonal Clash Fan in a Mosh Pit of Yore.

"Darling, you got to let me know. Should I stay or should I go?"

This means they are in and out of good stocks way too often.

The point is this.

If the stock is a good catch, just hold on to it.

When it corrects, like now, just buy some more.

Then go read a good book and turn off the news.

Conclusion

The purpose of this note was to highlight some present opportunities we see in the Australian market among our favoured Australian Critical Minerals names.

We are adding to:

- Lynas Rare Earths LYC.AX

- IGO Ltd IGO.AX

- Allkem AKE.AX

- Pilbara Minerals PLS.AX

Happy trading and may the Chicken Entrails be with you!

5 topics

4 stocks mentioned