C.R.A.P.

Can't Recommend A Purchase

The broking house I worked for in 1990 lost their number one rated media analyst. We were in the UK and he had just written a brilliant piece of research on Maxwell Communications.

The research lifted the lid on one of the most powerful media moguls in the country and exposed the company for what it was. An opaque listed play thing with corporate governance standards that would curl the toes of the British “establishment” that invested in it. It was bust, and our man was pointing at the King with no clothes.

It was all good, except for one unfortunate thing. Our man he could not contain his own wit, something rarely encouraged in broking let alone broking research. He titled his note “Can’t Recommend A Purchase” (get it?).

Robert Maxwell rang up and insisted he be sacked. He was, even though he was right.

Of course, Robert Maxwell later fell off the back of his boat (or did he) and disappeared forever, leaving his sons to pick up the flak for a massive £440m misappropriation of funds from the company pension fund. It was an ignominious end for the Maxwells and a development that vindicated our man. But he was not reinstated. Instead he got picked up by another major broker and remained the number one rated media analyst, his salary even higher for the publicity over Maxwell.

It seems being right is just not enough. There is an etiquette in research, unwritten rules that have to be respected, landmines that have to be avoided, and the truth is no defence. As the old motorcycle adage goes, “It’s no good being in the right if you’re dead”. Analysts take note.

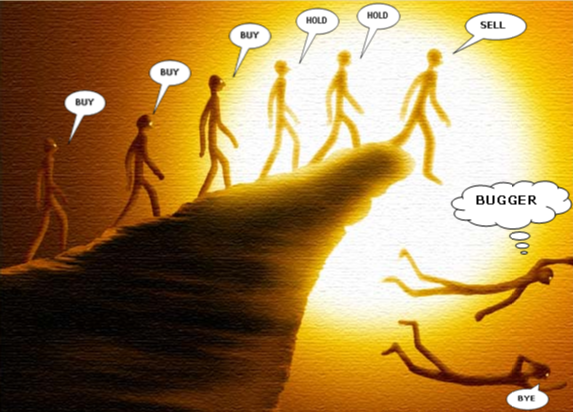

One of the biggest land mines, of course, is the “Sell” recommendation. There is a reason 80% of broker research says buy. In fact, there are a few reasons. Saying sell is one of the lowest return recommendations a broker can publish. Here’s why:

- Sell recommendations are more likely to be wrong than right because of the long term upward trend of the market. The price of any company that doesn’t go bust (a tiny minority) is almost certain to one day rise again. If you advise someone to sell something, especially a big stock, you are bound to look stupid eventually. Just leave it long enough. And as any broker can tell you, clients have tremendous powers of recall when it comes to money they didn’t make. They will remember and blame you decades later.

- The other blatant fact about sell recommendations from a business point of view is that the audience for a sell recommendation is limited to shareholders. It only appeals to a limited number of people. But the audience for a buy recommendation is the whole world. Which one do you think is going to generate more business.

- If you put out a sell recommendation, you have to ring people who have bought the stock and tell them they were wrong. It’s a hard sell, especially when they are one of the long term faithful. Not sure they’ll think you’re doing their share price any favours and woe betide you if you’re wrong. A good way for a broker to upset a few clients and do no business.

-

Because they are promoting their corporate fee paying client. A lot of broker research is "Marketing Material" written in support of their corporate client. You need

to know if you are reading objective analysis and a genuine research

opinion, or whether you are reading ‘marketing material’. Its hard to

tell most of the time. Read the small print at the bottom of a bit of research to see whether the broker has a relationship with a company. You might be surprised. And it might explain why they like the company, because they they IPO'ed it, raised capital for it and have a duty to play an investor relations role for it. And of course, the higher the price, the more likely they are to raise capital again, and whoever supports the company the most, gets the deal.

- One of the main ones, however, is this. Companies don’t like it when brokers suggest their painstakingly acquired shareholders sell. It is not good for relationships between company and analyst. An analyst’s lifeblood is the relationships he builds with his researched companies. The access he has to management. Why would he want to screw that up?

- Even if the analyst doesn’t care, writing sell is one sure way for the analyst to screw up the chances of his corporate department ever doing a deal for the company in question. Getting corporate deals is hard work, it can take years. Corporate departments are there to support companies and their share prices, not kill them. A sell recommendation from your own analyst is an Exocet missile for any corporate ambition.

- Finally, from the adviser’s point of view, no-one remembers when you save them from losing money. Only when you make them money. And even then they tend to believe it was their own good judgement. There’s less mileage in a sell recommendation when it comes to reputation, even if you do get it right.

It is a fact of life. Brokers almost always recommend a purchase, at least on the front page.

Special offer for Livewire subscribers

Take advantage of this exclusive offer for Livewire Members - buy a Marcus Today membership today using the following promotional code - MT20JW - and the prices will miraculously change. Click here to SUBSCRIBE or sign up for a FREE TRIAL

3 topics