Can dividends deliver outperformance?

It's no secret that Australian investors love their dividends. But recent Morningstar research has found that a portfolio of higher dividend-paying shares actually meaningfully outperforms over the long term.

But by how much, you ask? Great question.

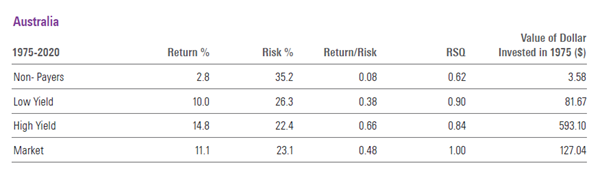

Over a 45 year period, the research house found that Aussie dividend payers beat the S&P/ASX 200 benchmark by 3.7%, on average, every single year, delivering investors a return of 14.8% per annum.

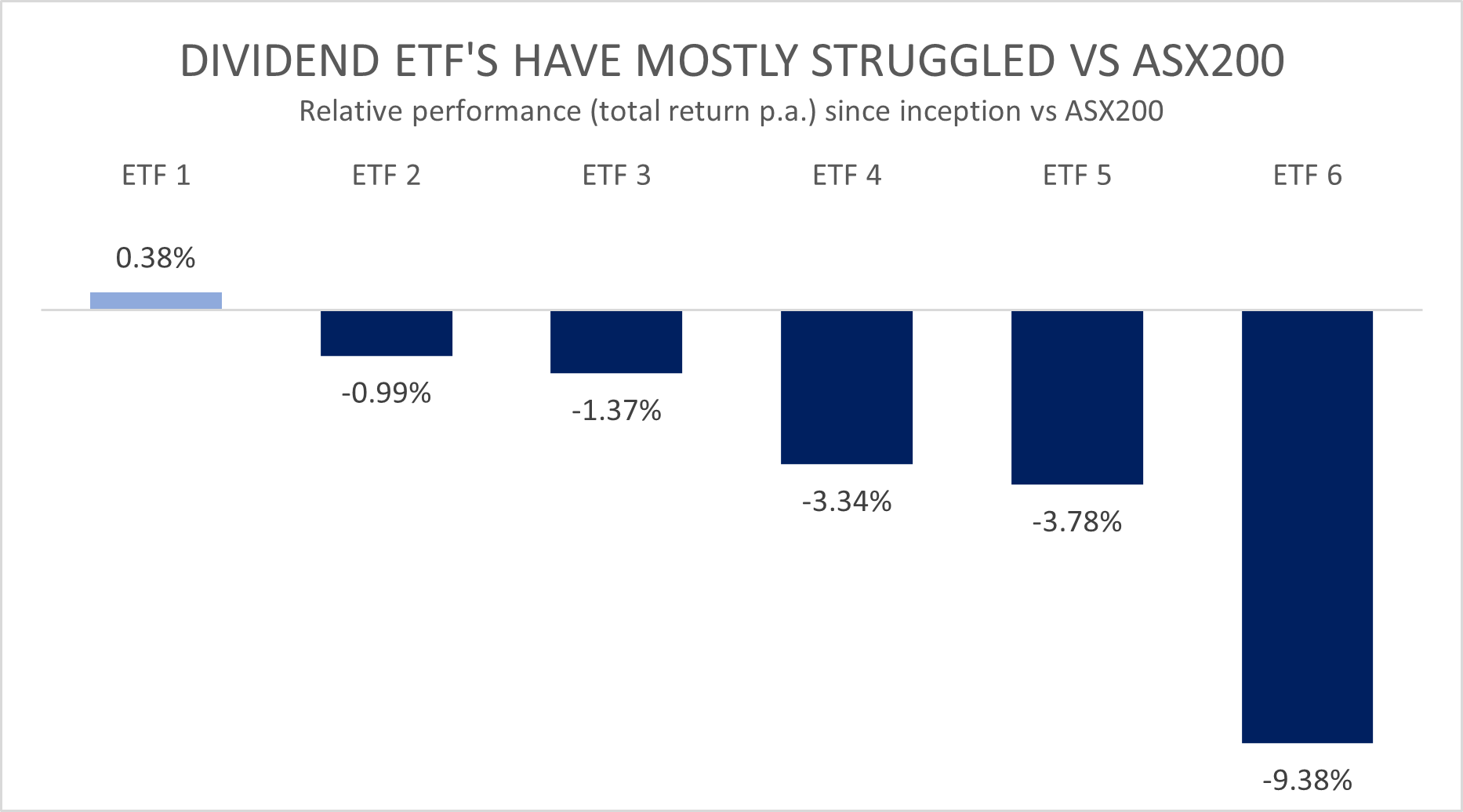

Unfortunately, getting the right exposure to these Aussie high yielders isn't as easy as one may think. We reviewed the performance of the largest six "dividend" or "high yield" ETFs available locally, and all but one have underperformed the S&P/ASX 200.

.png)

In this article, I outline a probable cause for this underperformance, as well as why an alternative strategy to target dividends may be investors' best approach to taking advantage of this long-term opportunity.

Dividends and long-term equity returns

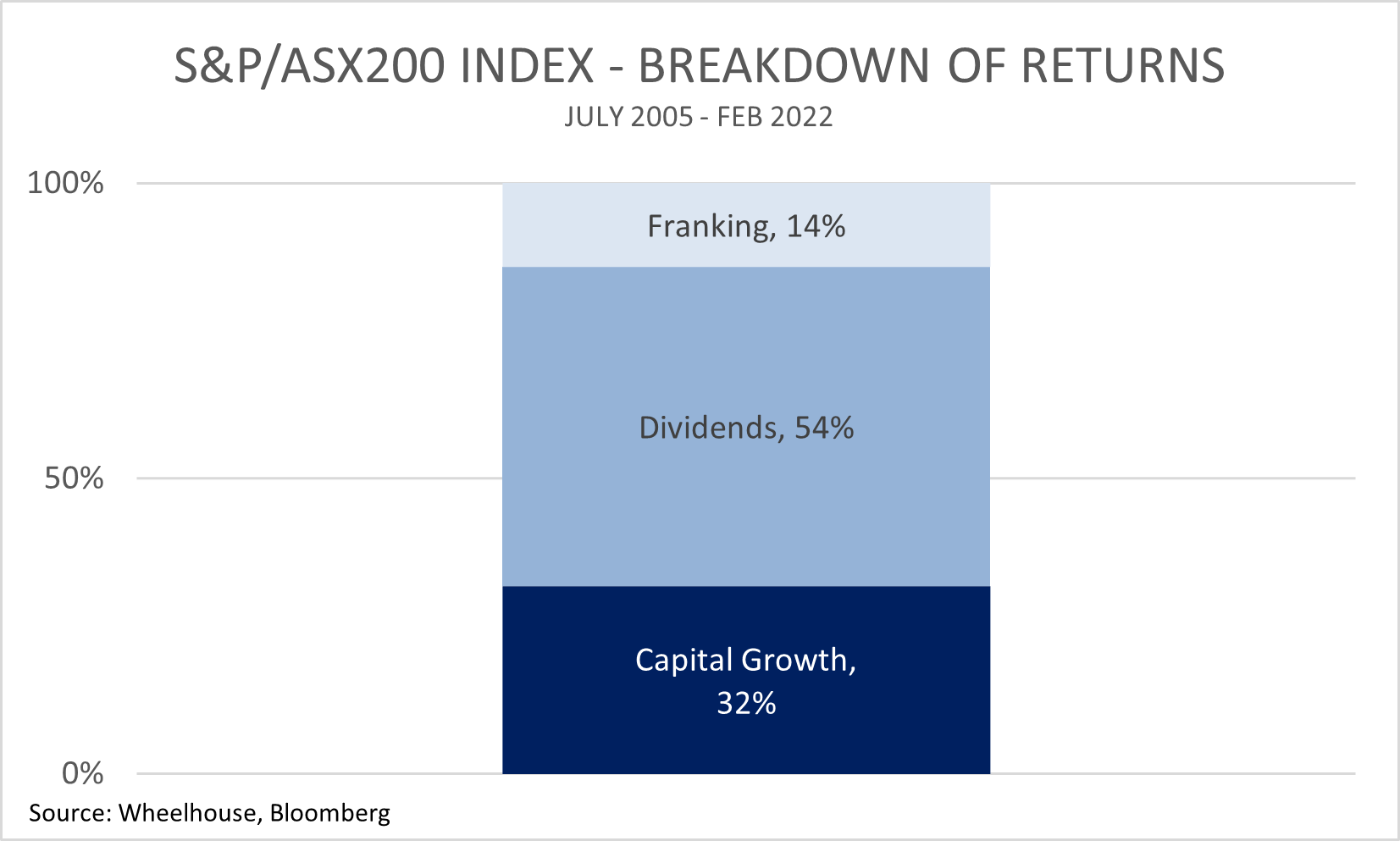

Most investors recognise the importance of dividends in terms of delivering robust long-term equity returns. In Australia, where dividend yields lead the world, this is particularly relevant with fully franked dividends generating nearly 70% of the market’s return since 2005.

Given this efficient source of return relative to capital growth, it may make sense to investigate alternative ways to maximise exposure to this income stream in the pursuit of outperformance.

According to recent Morningstar research, over the long-term higher-yielding shares have delivered meaningful outperformance.

In a recent report, Morningstar highlighted that higher dividend-yielding shares for the Australian market have delivered meaningful outperformance of 3.7% annually over the 45-year period from 1975-2020. Massive! The returns are summarised in the table below.

Indeed, this is a consistent conclusion from Morningstar’s research across all major markets globally and not just Australian equities. Based on the pervasiveness of this evidence, it seems likely that exposure to higher dividend-paying shares, or in other words the dividend “factor”, has been a meaningful generator of equity market outperformance. This conclusion is also supported by a number of other independent research papers that are cited in the Morningstar report.

What is the real-world experience?

Unfortunately for local investors, it doesn’t appear to be as easy to generate outperformance as simply buying a portfolio of high-yielding securities. We reviewed the performance for the largest six ‘Dividend’ or ‘High Yield’ ETFs available locally, with relative performance since inception illustrated below.

To provide some additional colour, all of these ETFs have slightly different methodologies in terms of selecting higher dividend-yielding securities. Furthermore, the returns of these strategies span differing periods ranging from one to 12 years, and therefore cannot be reliably compared with one another. However, they all target higher dividend-paying shares, and with one exception have all underperformed the ASX200.

Why has the dividend factor failed to deliver?

The time period over which these performance returns were calculated differs from that used in the Morningstar conclusions, which are based on 45 years of investment returns (1975-2020). The Australian ETFs in the sample above were measured over much shorter periods.

A probable cause – Value?

Often when investment strategies target a narrow objective or factor, they can also introduce other, perhaps unintended exposures.

The criteria that often helps identify high dividend-paying securities can also be very similar to the criteria for identifying Value securities. Low price/book and price/earnings multiples are often associated with higher dividend yields, so it makes sense there is a high degree of overlap between ‘High Dividends’ and ‘Value’ securities.

During the time period that many of these ETFs have been running, Value investing has endured one of its worst relative performance runs on record. So while the Dividend factor may have been present, it may well have been outweighed by the great surge in Growth over Value experienced over the past decade.

On a brighter note, with the Value factor appearing to have turned in the past 12 months, returns in the future for these ETFs may look much more attractive and more consistent with the Morningstar research.

What seems clear however, is that the pursuit of a single characteristic such as higher dividends can often introduce other risks into a portfolio, which can affect investment performance materially over shorter periods.

Can higher dividends be targeted without introducing Value?

As an income manager, we recognise the importance of dividends as a vital component of investment returns. However, we also prefer to avoid large factor exposures, such as Growth/Value, which can materially alter the way investment returns are delivered. Is it possible to square this circle and receive higher dividends without the usual Value bias?

We believe so. And alternative strategies can help here. The Wheelhouse Australian Enhanced Income Fund is designed to deliver income-driven outperformance, along with a fully franked dividend yield of close to 2x the market.

To achieve this, we employ a completely unique strategy that is mostly systematic in nature. This rules-based approach means returns are highly predictable relative to the benchmark S&P/ASX 200 with low tracking error, despite targeting 2-3% in annual outperformance. Like all investors we want the market to go up and dividends to get paid, but we don’t mind which stock or sector leads the charge.

Looking for a unique source of dividend-driven alpha?

For investors seeking a completely unique source of dividend-driven alpha for their portfolios, without the unwanted noise of Growth/Value, the Wheelhouse Australian Enhanced Income Fund targets 7-8% income from Australian equities (including franking).

Please click here to find out more

4 topics