Can gold stay at record highs?

Global X ETFs

With the gold price re-approaching record highs, many are wondering what will happen next. While no-one knows for sure which way the gold price will go, there are two key things investors can use to inform their judgement. They are:

Speculative positioning.

The opportunity cost of money.

Both of these suggest that the gold rally is on stable footing.

Speculative Positioning is Low

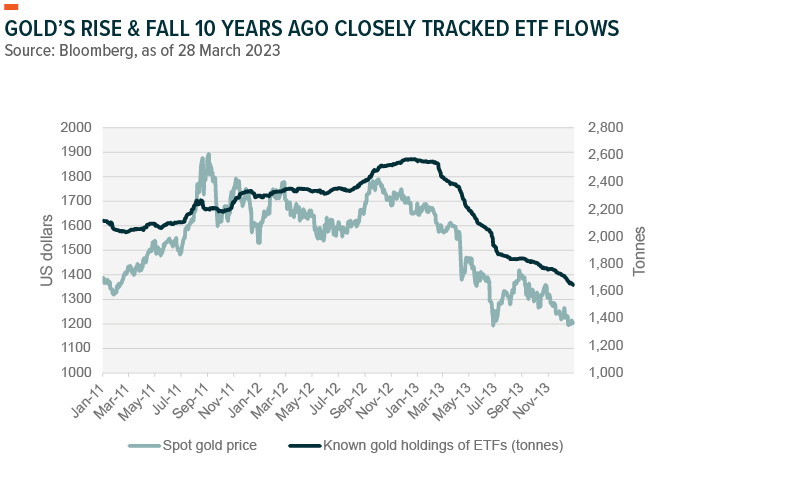

The lesson of the rise and fall of the gold price from 2011 to 2013 is that gold investors must be wary of speculators—like everyone else. In those years, speculators pumping money in and out of gold ETFs is widely believed to have been the primary cause of volatile prices. (Unlike most equity ETFs, gold ETFs do not have any liquidity filters restricting how much of their underlying assets they can buy. Meaning flows from gold ETFs can, at times, dominate the order book and ultimately shape the gold price).

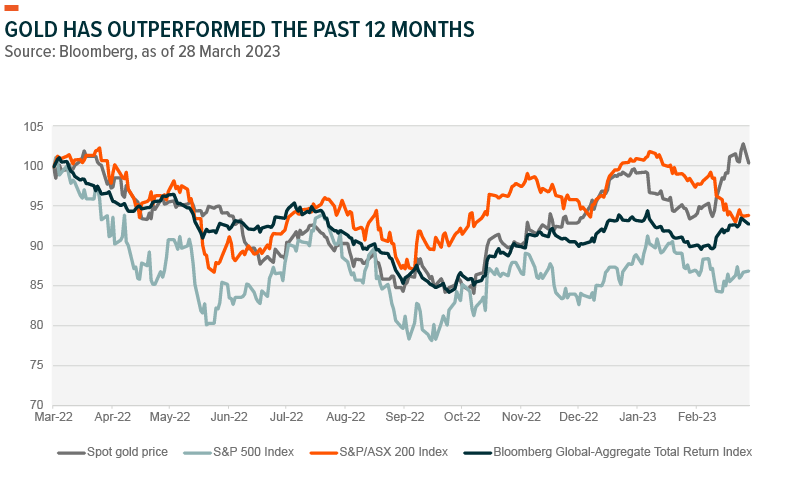

Gold investors may take comfort therefore in knowing that speculators have not contributed to high gold prices the past 12 months. The mute role of speculators shows up in both the ETF and derivatives markets, which are the main ways that speculators trade gold.

As can be seen in the graphs above, gold ETFs have seen outflows the past 12 months, as is reflected in the declining tonnes of gold held by gold ETFs. These outflows have only just begun to reverse in March. This strongly suggests that gold ETF flows in the past 12 months have not driven prices in the way they did 10 years ago.

Source: World Gold Council. Data as of 28 March 2023.

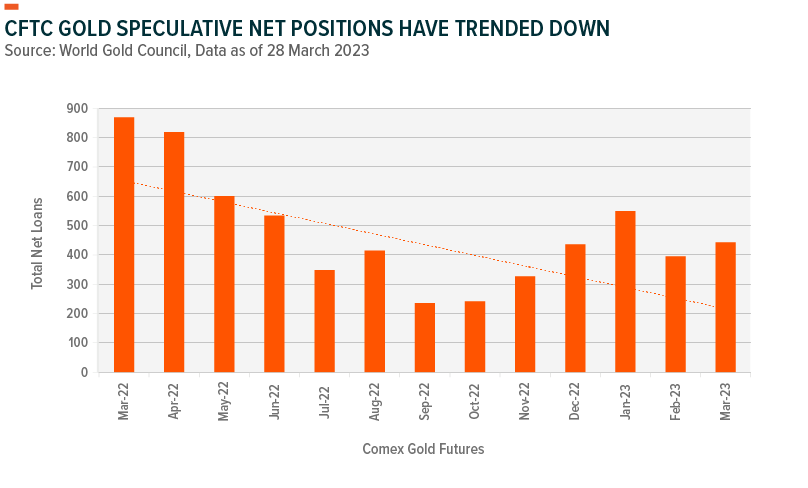

The same thing can also be seen in futures markets. Net long positioning – which refers to how much futures traders are betting that gold prices will rise – has trended down the past year. This suggests speculative futures trading is not the cause of gold price strength the past 12 months either.

A more likely culprit for the high gold price would be central banks—data on whose purchases is made public by the World Gold Council. Central banks – especially in China, Russia and Turkey –added more tonnes of gold to their reserves in Q4 2022 and Q1 2023 than in any six-month period on record. And central banks are different to speculators in that they tend to hold gold long-term and therefore do not contribute to rapid runups and falls in the gold price.

The opportunity cost of money

Gold investors may also draw comfort from the fact that the price of money is falling. Like every asset, the price of gold is determined by the cost of capital. And as a general rule, gold does best when money loses value, as gold is seen as a hedge against currency debasement. For this reason, any serious model looks at real yields – either on Treasury Inflation-Protected Securities (TIPS) or on the US 10 Year treasury – when trying to predict the gold price. Relatedly, models also look at the US dollar exchange rate which measures the global cost of cash.

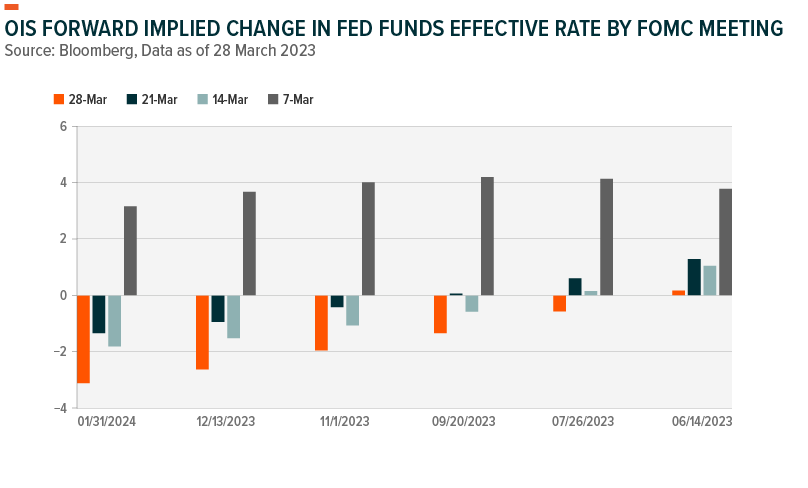

Here, again, there is comfort for gold investors. With the collapse of Silicon Valley Bank and deposit flight hitting regional US banks, markets expect the price of money to fall and interest rates to have peaked. These expectations are perhaps best reflected in the overnight index swap (OIS) futures market, which shows how Wall Street is betting on the Fed funds rate at each committee meeting. As can be seen in the graph above, bets on rate hikes disappeared in March.

Source: Bloomberg. Data as of 28 March 2023.

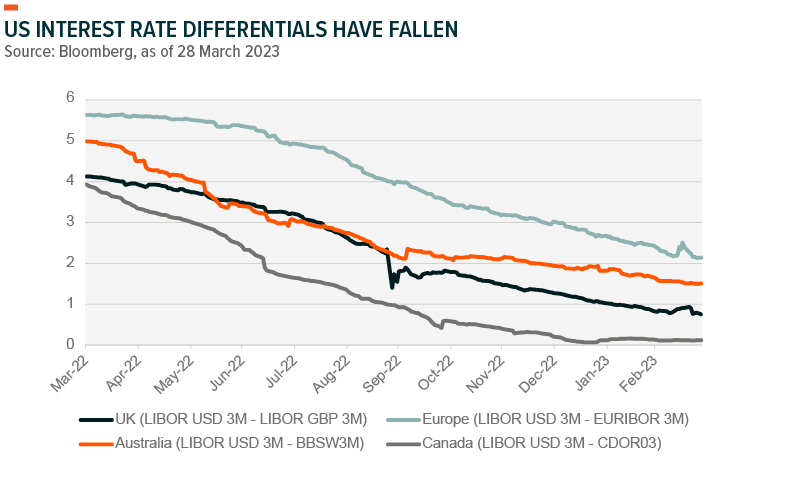

The US dollar meanwhile has given up most of its gains the past year. While the future direction of the US dollar is as unknowable as the gold price, best evidence here suggests that the dollar is more likely to fall than rise. Traders’ bets on a rising US dollar have fallen. But perhaps more crucially so too have interest rate differentials – which show the differences between interest rates in the interbank market – between the US and other countries. When these differentials fall, the extra income received from holding US dollar cash falls too, lowering its appeal.

Conclusion

One of the ironies of buying gold, for many investors, is that they hope it underperforms. After all, the times in which gold shines tend to be times like now—when something is going wrong in the world. Nevertheless, best indicators at the moment suggest the gold price is well supported. But what the future holds no-one knows.

Beyond Ordinary ETFs

For more than a decade, our mission has been empowering investors with unexplored and intelligent solutions

To learn more about what Global X ETFs can do for your portfolio please visit our website.