Can private markets be the alternative to lofty public market valuations?

After two consecutive years of stellar performance in the equity market and further tightening of credit spreads, valuations in public markets are currently well above their long-term averages.

Such an environment, especially as inflationary pressure points to interest rates likely remaining higher for longer, creates a challenging situation for investors considering how to adjust their portfolio in 2025.

A key question needs to be asked: What can one do to enhance potential returns, improve diversification, and mitigate volatility?

The answer might be found in private markets.

The current state of public markets

Public markets are looking expensive.

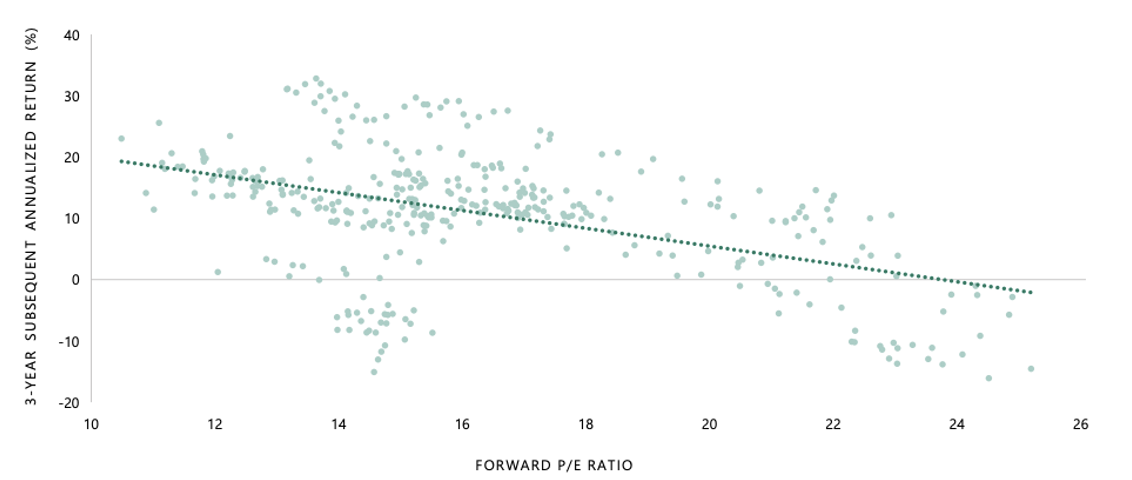

The S&P 500’s forward P/E ratio of 21.7 implies annualised 3% returns over the next three years. (Source: Bloomberg, Apollo Chief Economist)

Historically, the relationship between the S&P 500’s forward P/E ratio and subsequent three-year returns for the benchmark averages 6.4%. However, the S&P 500’s current forward P/E ratio of around 22x implies an inflation-adjusted annualised return of only around 3%.

In addition, the risk premium for holding public stocks – the difference between the S&P 500 earnings yield and the 10-year treasury yield – is negative. In other words, investors are paying to take risk as opposed to being paid to do so.

Public credit markets are also facing tight valuations. High yield spreads are currently near the lowest levels seen in decades.

The compression in credit spreads reflects a combination of a heightened risk appetite among investors. However, it underscores the fact that investors are not being adequately compensated for the risks they are taking.

Where has the diversification gone in equities?

In addition to high valuations, diversification is much harder to achieve.

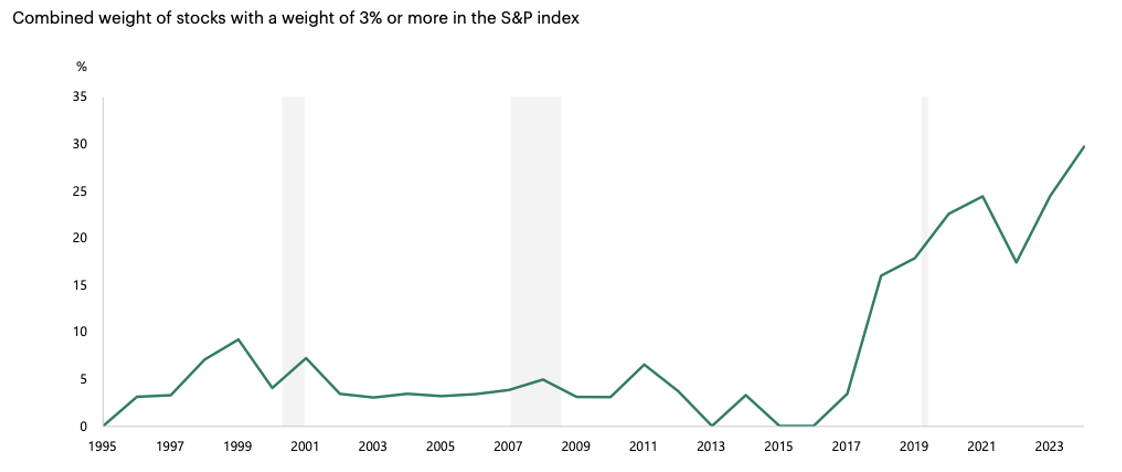

The S&P 500 has become increasingly concentrated, with a handful of stocks disproportionately driving market performance. As of the end of 2024, for example, the combined weight of stocks with a 3% or greater share in the index is at the highest level it has been in decades.

With increased concentration of the S&P 500, a handful of large stocks dominate its recent performance.

For example, simply removing the semiconductor company, Nvidia (NASDAQ: NVDA) from the S&P 500 reduced its 2024 annual return from around 25% to 20%. If you then strip out the remaining of the popular “Mag 7” stocks, this return drops further to around 12%.

“In our view, this level of dependency on NVIDIA and a few other stocks underscores the fragility of the current market landscape, where performance hinges on a narrow base of contributors."

The bottom line is that investors in public markets are effectively over-leveraged to the earnings and growth prospects of a handful of stocks.

Stocks and bonds remain highly correlated

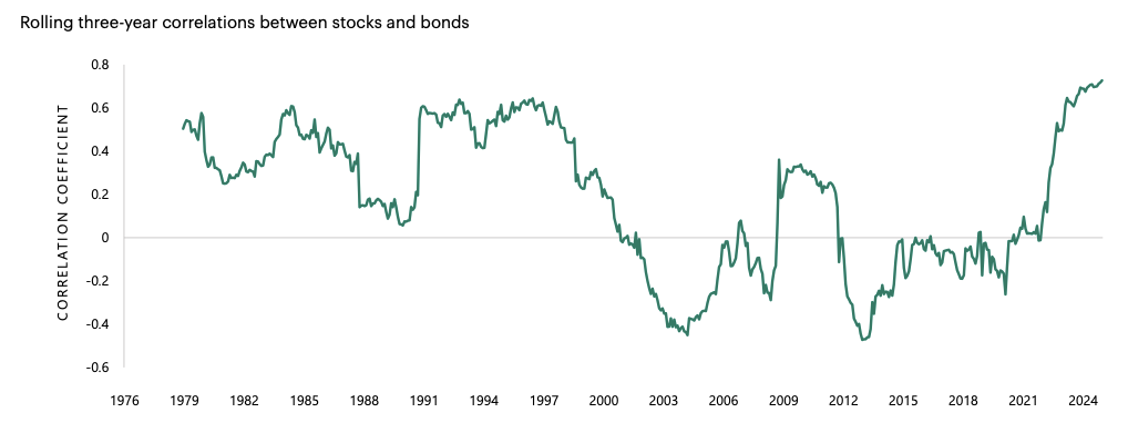

Adding to the challenge of elevated valuations and concentrated returns is the rising correlation between public stocks and bonds.

Historically, the negative correlation between these two asset classes provided diversification and a natural hedge within the traditional 60/40 portfolio framework, where a portfolio is split between 60% stocks and 40% bonds.

That relationship has broken down in recent years. For example, in 2022, stocks and bonds fell together, and, in 2023, they rose together. The three-year rolling correlation between these two asset classes has now reached its highest levels in decades.

The case for private markets

High valuations, concentrated equity markets, and the convergence of public bond and stock performance have, in our view, eroded the diversification benefits of a traditional 60/40 portfolio.

This leaves investors more exposed to systemic risk, especially during periods of market stress.

Enter private markets.

By shifting allocations from public to private assets, investors can gain access to an expansive and increasingly diverse universe of investment opportunities. In fact, private markets have become an increasingly important component of the broader economy.

“87% of US companies with revenues greater than $100 million today are private. At the same time, the number of publicly listed companies in the US has declined from a peak of more than 8,000 in 1996 to just over 4,000 in 2024”.

Within this growing space, we believe that the focus in 2025 should be on private market strategies across equity, credit, infrastructure, and hybrid opportunities that can deliver tailored solutions and potential enhanced, risk-adjusted returns.

Rethinking asset allocation

The 60/40 portfolio became the standard allocation for investors for one reason: it worked.

However, in today’s environment, which includes elevated valuations, rising correlations between stocks and bonds, and concentrated equity markets, challenges the effectiveness of this traditional approach.

Instead of reallocating 10% of a portfolio from one highly correlated public asset to another, the diversification potential offered by private markets could be considered, which can offer differentiated return drivers, lower correlations with public markets, and opportunities to enhance portfolio resilience in periods of market stress.

By rethinking traditional asset allocation and embracing the flexibility and potential diversity of private markets, investors can unlock long-term growth and resilience, allowing portfolios to be well-positioned for the challenges and opportunities ahead.

For the full report, “Can private markets be the alternative to lofty public market valuations”, including a deeper look at each private asset class from Apollo Global Management, click here.

5 topics