Chart of the day: Evidence still supports short (and very sharp) recession

“It [is] far better to light the candle than to curse the darkness” William L. Watkinson, 1907

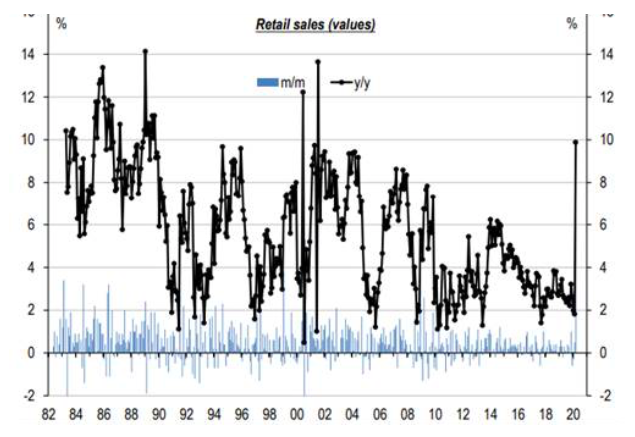

Australia is almost certainly experiencing a recession. Yet, while consensus expects it to be so, there remains some chance that the usual definition of ‘two consecutive quarters of negative growth’ might not be met. Take yesterday’s retail sales data—an 8.2% jump in March, the strongest on record, and driving annual growth to about 10%, its fastest in almost 20 years (see our chart of the day). You have seen the videos on the internet (and probably stood in a queue). So, no surprises that a 20% jump in food was the key driver— 100% growth in sales of toilet paper, flour, rice and pasta, and a 50% jump for canned food, medicines and cleaning goods. Then there was also strong demand for home office set-up (if you have tried to buy a web cam lately, you will know there’s virtually no stock).

Retail sales is 30% of consumption, which is about 55% of total output. So, yesterday’s strong (almost certainly one-off) finish to Q1 means retail sales will add about 0.5% to real growth in Q1. Last week’s better-than-expected jobs report (that missed the massive job loss occurring late March and early April) will also support Q1 growth data. So, even if Q1 scrapes by with a tiny positive, what about Q3—surely that then will be negative? Too early to know, but not implausible that if ‘stay-at-home’ orders are eased (but not social distancing rules) by end Q2, that activity rebounds enough in Q3 to also eke out a small rise.

Time will tell. And more importantly, what’s the point? The point is not that Australia may avoid a technical recession based on the standard definition. Other less popular definitions focus on the change in the unemployment rate. More recent data suggests strongly that the unemployment rate is going to jump over 5% (to 10%) in the next few months, and more than a million workers may have lost their jobs. There is no doubt that with retail foot traffic 90% below normal, many retailers (not selling groceries) are in recession. Tourism, entertainment, media…all these sectors are experiencing historic recessionary conditions. And there are many other indicators which will eventually argue the same, including job ads, wages growth, housing activity (including prices). As Reserve Bank of Australia Governor Lowe noted yesterday, Australia will likely drop 10% of its growth in H1 2020, mostly in Q2. That’s a recession in anyone’s language.

The point is simply to highlight that this is not the garden variety recession that can take a year to unfold and another year to emerge from. Assuming recent evidence that the virus is contained in Australia, and there is a gradual return to work through late Q2, this is likely to be a short, sharp downturn. And while the soon-to-be released monthly data for Q2 will be horrible, confronting and noisy for investors to interpret, our focus will need to be on the leading indicators for late Q2 and Q3 that potentially flag a turn up (however modest) in activity. While a return to the prior level of output may still be a couple of years away, a positive trend in H2 2020 has the potential to be both cathartic and calming for confidence and markets.

Retail sales jump a record 8.2% month-on-month in March

Source: ABS, UBS.

Be the first to know

I’ll be sharing Crestone Wealth Management's views as new developments unfold. Click the ‘FOLLOW’ button below to be the first to hear from us

1 topic

1 contributor mentioned