Chart of the Week - The housing market is at risk

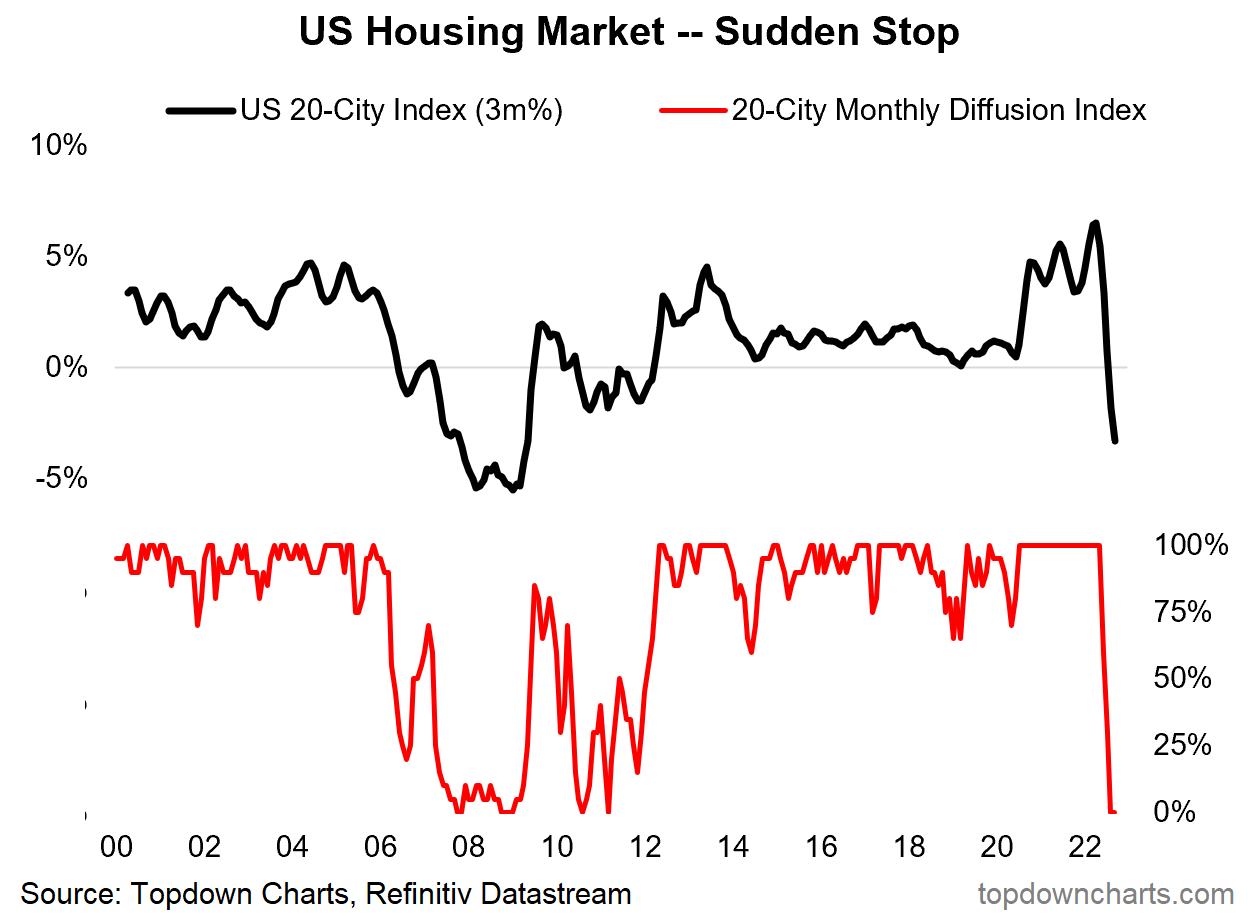

US Housing Market — Sudden Stop: As a result of the rate shock (a 3x jump in indicative servicing costs for a new mortgage), inflation shock (surge in living costs across the board), and portfolio shock (stocks, bonds, crypto, etc! all dropping significantly in value) — the purchasing power of home buyers has taken a massive hit, and it is showing up clearly in the house price data.

As of the latest data, the US housing market is undergoing what amounts to a sudden stop as prices collapse at the fastest (and most widespread) pace since 2008.

I continue to think that this will not be as systemic a risk as during the subprime crisis due to somewhat lower debt-to-income ratios and a lower proportion of adjustable rate mortgages… but it comes from a starting point of record high valuations (extremely stretched vs history): which creates the hungry bear situation of an overvalued market meeting a downside catalyst(s).

In that sense the decline in prices could extend much further than people expect and it is certain that this will have material negative wealth + confidence effects on the consumer. This will dampen spending plans in general, and have adverse knock-on effects across the housing and peripheral industries. Overall it’s just another piece of evidence adding weight to the 2023 recession thesis.

Key point: The US housing market is coming to a sudden stop.

NOTE: This post first appeared on our NEW Substack: (VIEW LINK)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

5 topics