Charts and caffeine: UBS' seven "buy" stocks in the mining space

Welcome to Charts and Caffeine - our daily markets wrap featuring the best charts and reads from across Livewire's team of expert editors. Let's get you caught up on the overnight session.

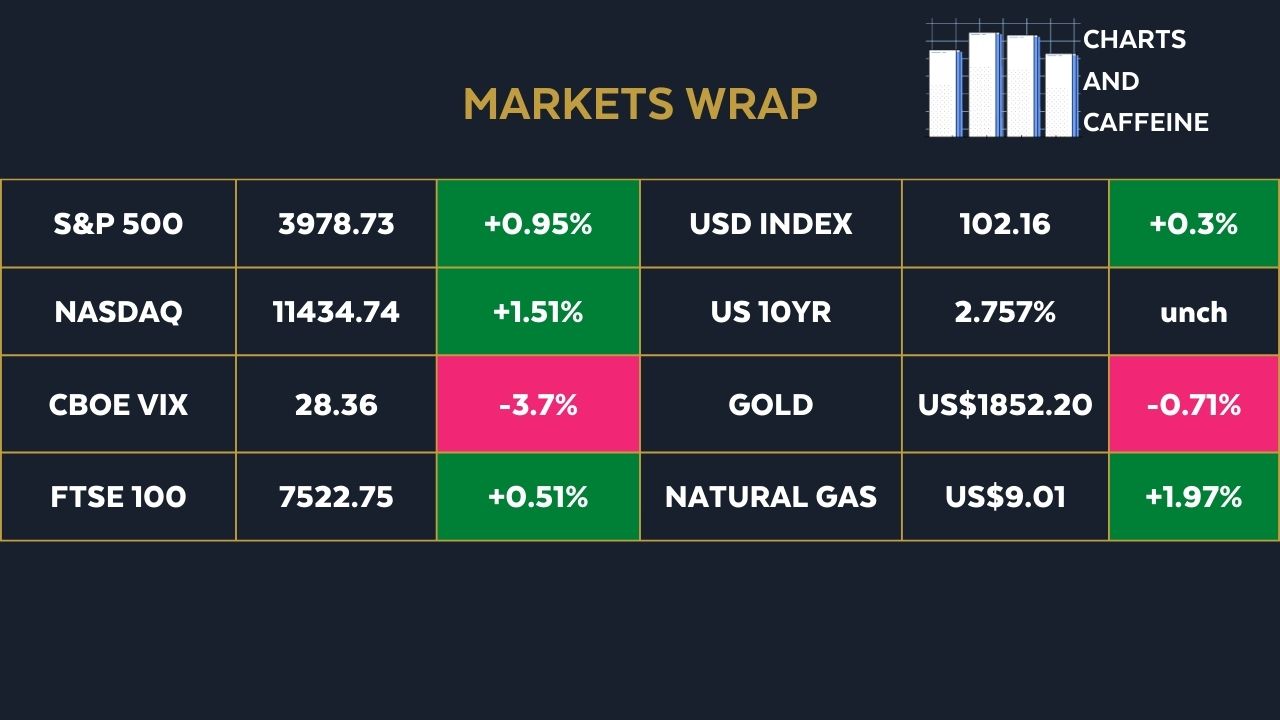

MARKETS WRAP

Only three of the S&P 500's sectors finished in the red today. While tech stocks should normally rally when the Federal Reserve is less hawkish than expected, Apple and Alphabet actually finished flat on the session. One thing to note is natural gas prices which are now at 14-year highs.

STOCKS WRAP

.jpg)

Semiconductor chip maker NVIDIA is down sharply in after-hours trade after posting disappointing earnings guidance. The company says it will miss out on some $500 million in revenue next quarter due to the war in Ukraine and the impact of COVID lockdowns in China. Zoom continued its fine form from the last session of its earnings - but is still down nearly 45% in the year-to-date.

Speaking of earnings, Intuit shares also on the rise following its earnings report which topped analysts' estimates. Finally, Snap saw some bargain hunting - or perhaps to be more correct - bottom feeding. It was up 11% but after the losses of the last two sessions, that's not much reprieve for those who haven't already sold.

Macro Calendar

The Federal Reserve minutes offered few, if any, surprises on officials’ thinking. The entire committee backed the 50 basis point hike from two weeks ago with "participants" (as they are so dubbed) agreeing on more hikes of that size coming over the next couple of meetings.

With no extra shocks or considerations for more huge rate hikes beyond July, equity markets breathed a sigh of relief.

Today, we will get two key data prints from the US - the Q2 GDP preliminary print and pending home sales. Both numbers are significant because the first quarter showed an unexpected contraction in the world's largest economy. Two straight periods of declining growth are defined as a recession, as I'm sure you won't need reminding.

Remember - the Federal Reserve has not even begun unwinding the balance sheet yet and already prospective buyers are feeling the pinch.

Finally, Canadian retail sales will give us more clues about how different consumers in the global economy are dealing with soaring inflation.

STOCKS TO WATCH

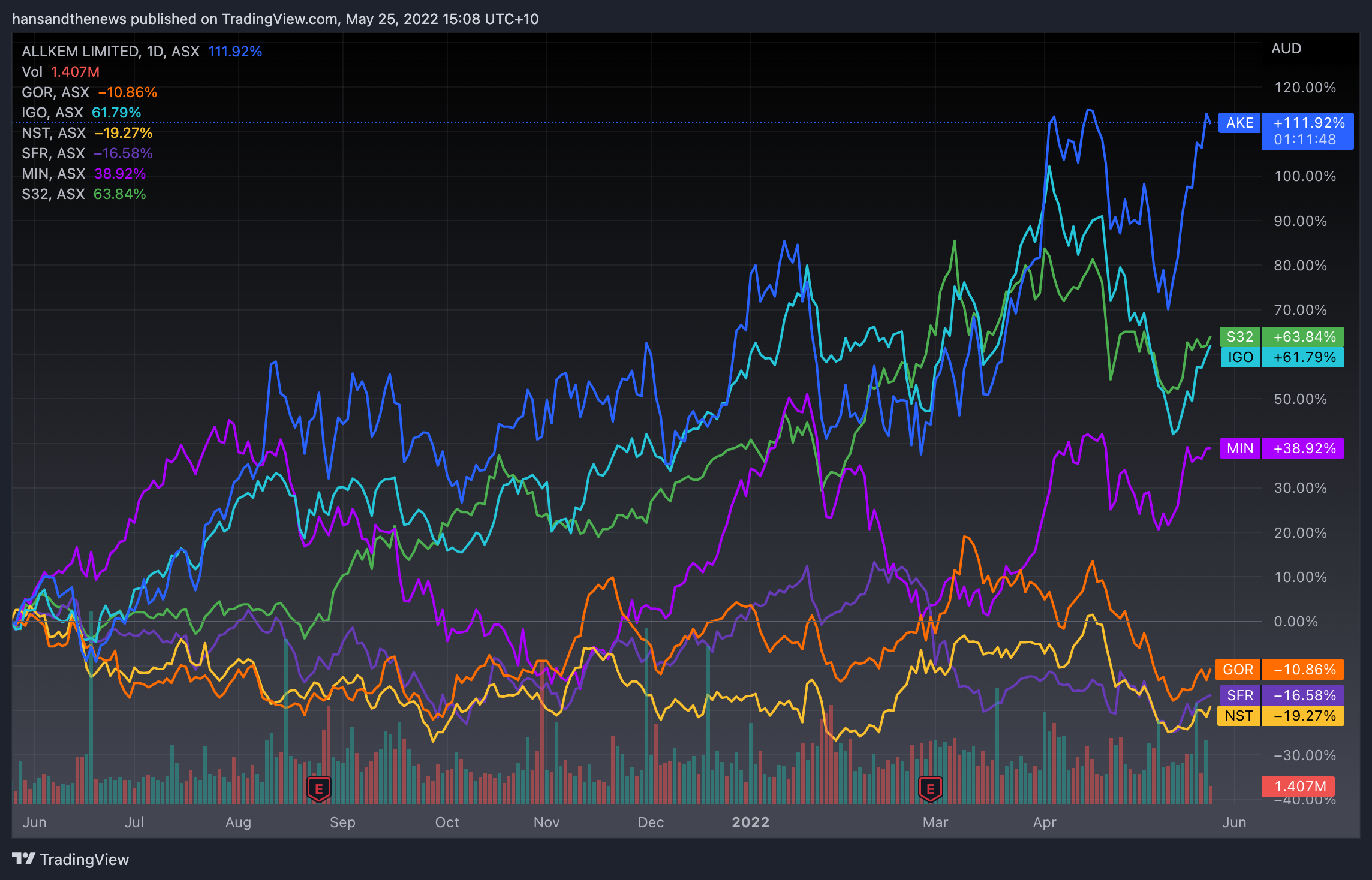

Today, our seven (!) stocks to watch are courtesy of UBS co-head of mining research Lachlan Shaw (ex-NAB, CBA). I find these names particularly interesting because they are the buy ratings in spite of the same broker's Chinese economy team downgrading its GDP growth forecast for 2022.

Our 2022 China GDP growth forecast is now 3.0% (prev 4.2%) with a much shallower V-shaped rebound in Q3. Investors should watch closely for any refinement or signs of change in the zero-COVID policy, any unexpected large stimulus, and property sector development. (UBS)

So what does that do for ASX commodities stocks? Lachlan argues there is still plenty of upside for coal, lithium, and oil. With this in mind, Lachlan's list of buys include:

- Allkem (ASX: AKE)

- Gold Road (ASX:GOR)

- IGO (ASX: IGO)

- Northern Star (ASX: NST)

- Sandfire Resources (ASX: SFR)

- Mineral Resources (ASX: MIN)

- South32 (ASX: S32)

There's just one caveat to Lachlan's thesis - his base case "assumes the global economy avoids a material downturn/recession." If a global downturn does materialise - as other learned market observers suspect - then it will be interesting to see if any/all of these calls change.

THE CHART

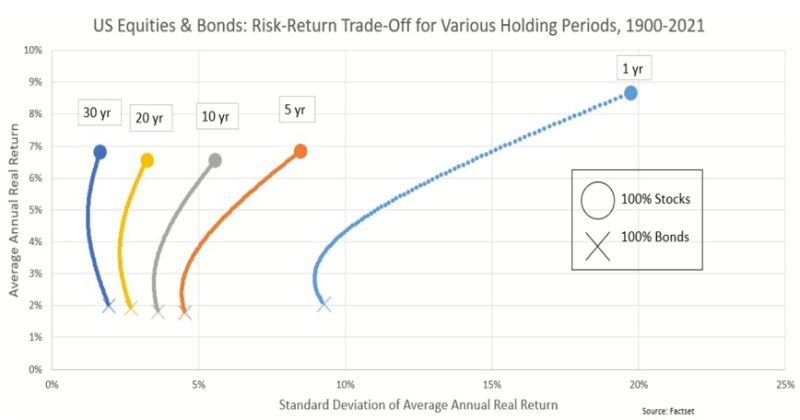

"I reckon this could be my favourite investing chart of all time…", writes Andrew Mitchell of Ophir Asset Management. Big call there!

He does have a point. This chart is a demonstration of why stocks may not always be inherently riskier than bonds. Here is his thesis:

Historically, as your holding period has moved from 1 year out to 30 years, the riskiness of a 100% US stock portfolio has radically decreased such that by the time you reach a 30-year holding period - nirvana happens. Stocks have provided not only higher average real returns than bonds but they are also less risky.

Apparently, this thesis also checks out for Australian stocks - and frankly, we're curious!

THE STAT

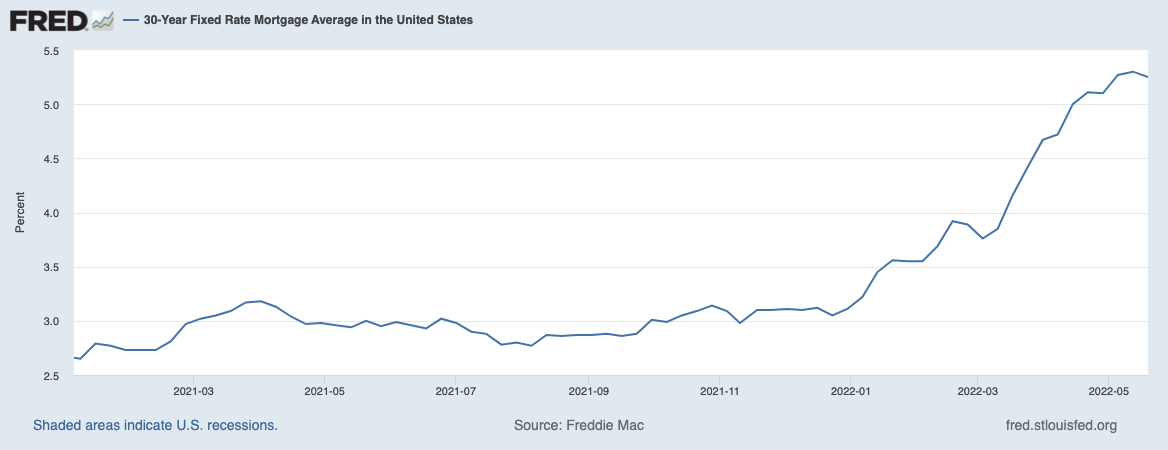

95%: The increase in a monthly mortgage repayment in the US since January 2021

Today's favourite statistic comes from Charlie Bilello on Twitter and to me (at least), it demonstrates how quickly the markets are responding to the Federal Reserve's language about rate hikes.

As Charlie explains, the 30-year mortgage rate was 2.65% at the beginning of last year. Today, that same mortgage rate is 5.25%. The price of new homes is also soaring - which explains why new home sales recorded their biggest monthly decline in a decade yesterday.

Assuming a 20% down payment on these conditions, homeowners have seen a 95% increase in the monthly payment. How crazy is that?

THE QUOTE

The invasion may have been the beginning of the Third World War and our civilisation may not survive it.

Some people are just really good for a headline quote and George Soros, the man who broke the Bank of England, is one of those. In case you need a refresher, here is what Soros managed to do:

In quite the war of words at the World Economic Forum, Soros warned that autocratic regimes were on the ascendant and the global economy was heading for a depression. He said the Russian invasion of Ukraine may be enough to tip society off the edge.

His solution? Defeat Vladimir Putin as soon as possible.

THE BEST IN BUSINESS NEWS

The Island Where a Russian Oligarch Kept $7 Billion (WSJ): Speaking of Russia, officials from the tax haven of Jersey are in an awkward standoff with one of Russia's most infamous oligarchs - former Chelsea owner Roman Abramovich. No one's been accused of any wrongdoing yet but it's quite a fascinating read.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

4 topics

13 stocks mentioned