Charts of the Week: Resilient recession stocks, US oil reserves and European inflation

.png)

This week’s charts alternate between pessimism and optimism: a contracting PMI figure prompts historic lessons on resilient stock sectors, the IMF is continuing a 13-year pattern of reducing its growth forecast, and European bank lending is shrinking – a historically recessionary sign. In emerging markets, funding burdens are climbing ever higher.

On the bright side, Spain’s rapidly cooling inflation might set the trend for the rest of Europe, and Norway producer prices are experiencing outright deflation due to the plunging price of gas. In the US, the government’s petroleum reserve remains near a multi-decade low, while stocks are lagging historic electoral trends as Joe Biden’s presidency moves into its second half.

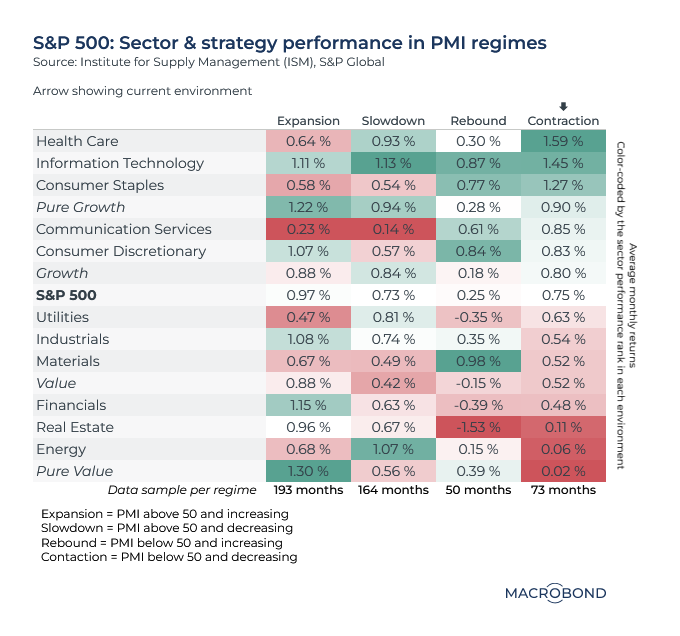

Stock picking when PMI's contract

.png)

With an end to Fed rate hikes not quite in sight, stock investors might be turning their thoughts to a sectoral rotation.

One leading indicator pointing towards recession is the Institute for Supply Management’s purchasing managers index (PMI), which surveys manufacturing executives. Readings below 50 indicate economic activity is contracting, and the PMI figure for March worsened to 46.3. That’s the fifth straight month of contraction.

We measured 40 years of PMI “regimes,” tracking how different sectors in the S&P 500 performed when the indicator was expanding, slowing, contracting or rebounding.

Healthcare stocks were the clear winners during times of contraction; real estate and energy fared worst. It’s notable that tech stocks were among the best performers in any environment, including the “rebound” scenario investors might be hoping for.

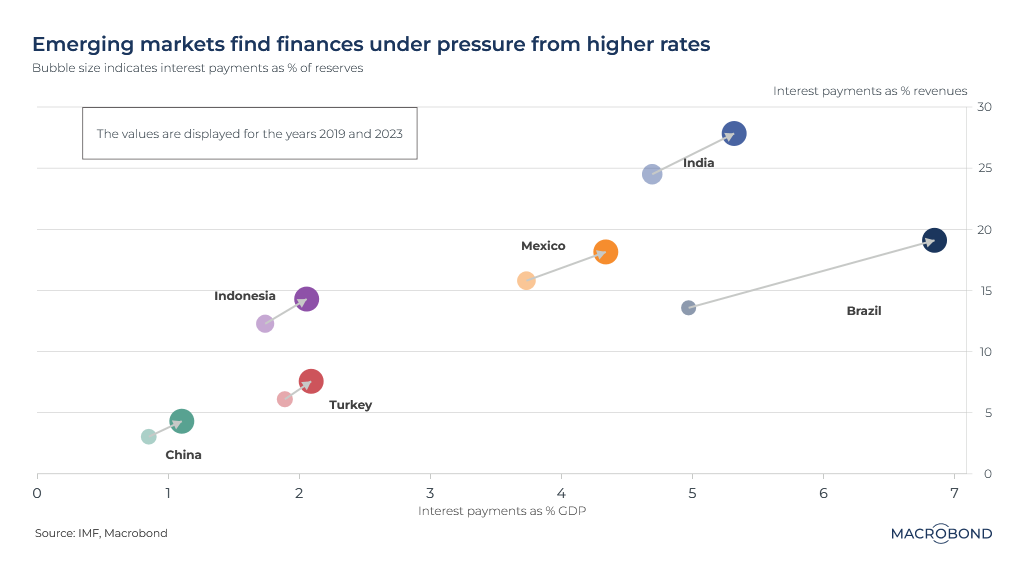

Emerging market debt burdens revisited

.png)

Last year, we discussed how the stronger dollar was problematic for emerging markets’ funding needs.

Global interest rates have kept on climbing since then. We have updated and enhanced an August 2022 chart of the biggest emerging-market nations that track their interest payments as a share of GDP (x-axis), revenue (y-axis) and reserves (bubble size). In all cases, that proportion is rising. The arrows show the direction of travel since 2019.

Some of these nations are facing their biggest bills for servicing foreign debts in a quarter of a century. India’s burden is the highest as measured by its share of government revenue; Brazil’s interest payments account for the biggest share of GDP, at 7 percent.

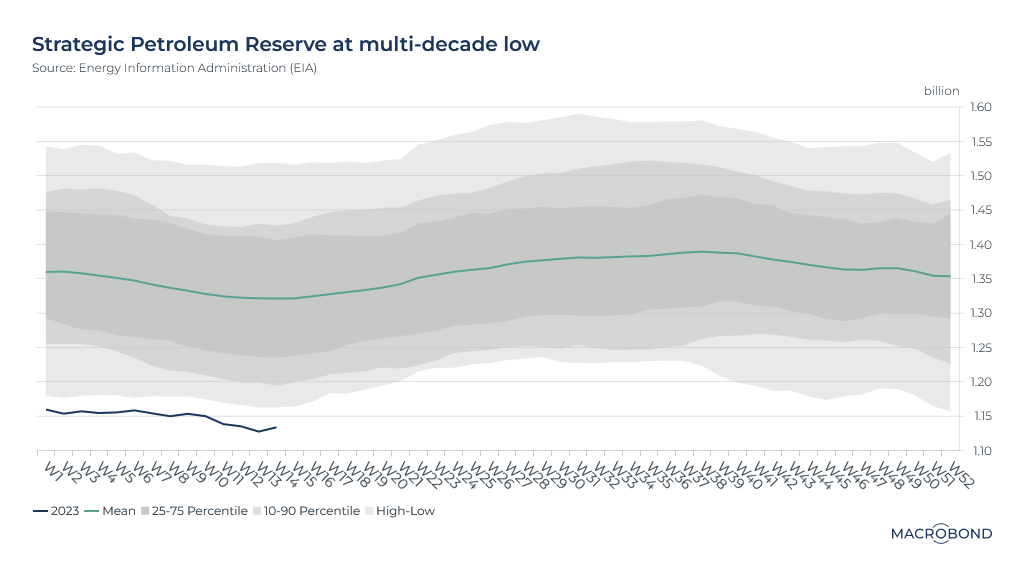

Strategic Petroleum Reserve remains drained as OPEC cuts back

.png)

President Biden might be wishing that he refilled the US Strategic Petroleum Reserve (SPR) earlier this year. Since OPEC’s surprise production cut in early April, prices have climbed to a five-month high.

After Russia invaded Ukraine a year ago, the president ordered the SPR’s largest-ever sale, aiming to make trips to the gasoline pump less painful for American drivers.

The SPR fell to its lowest level since the 1980s – and has stayed outside its post-1990 range for all of 2023 so far, as our chart shows.

The Biden administration still plans to refill the SPR when it’s “advantageous to taxpayers,” Energy Secretary Jennifer Granholm said this week. It’s unclear when that will be. US international benchmarks are above USD 80 a barrel, compared with about USD 70 a month ago – a price where the administration had reportedly aimed to gas up.

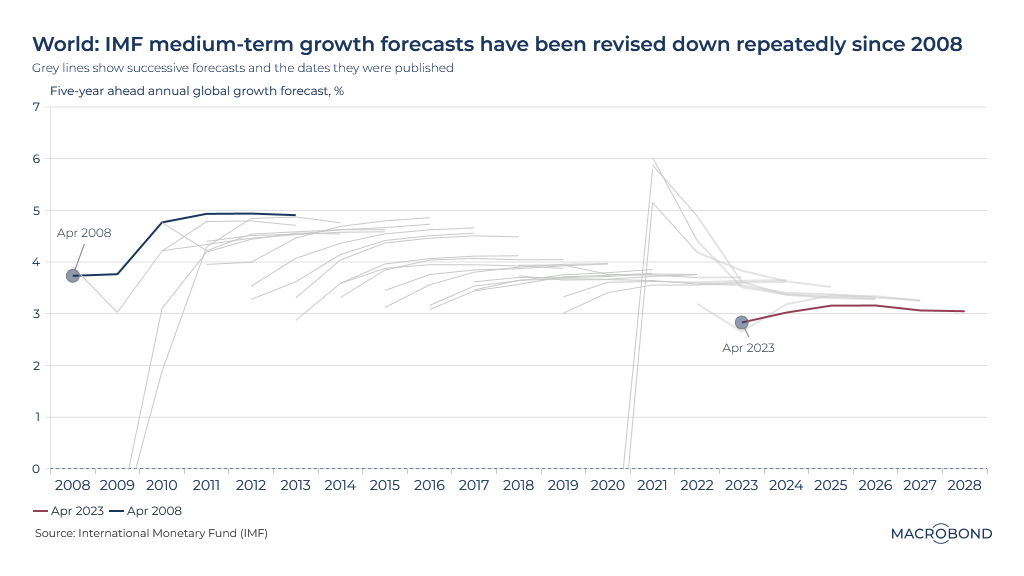

13 years of ebbing IMF optimism

.png)

The International Monetary Fund recently sounded the alarm about the prospects for global growth, citing risks to the financial system. What might be surprising is that the institution has steadily whittled down its outlook ever since the global financial crisis.

Our chart displays IMF global GDP growth forecasts since 2008 as grey lines starting from the date they were released. The trajectories usually called for an increase from the then-current level.

The IMF predicts global economic expansion at an average rate of about 3 percent over the next five years. That’s well below the average 3.8 percent over the past two decades, and the weakest projection for medium-term growth since 1990.

While decades of globalisation have pulled hundreds of millions of people out of poverty, increasing economic fragmentation, geopolitical tensions and higher borrowing costs are clouding the outlook.

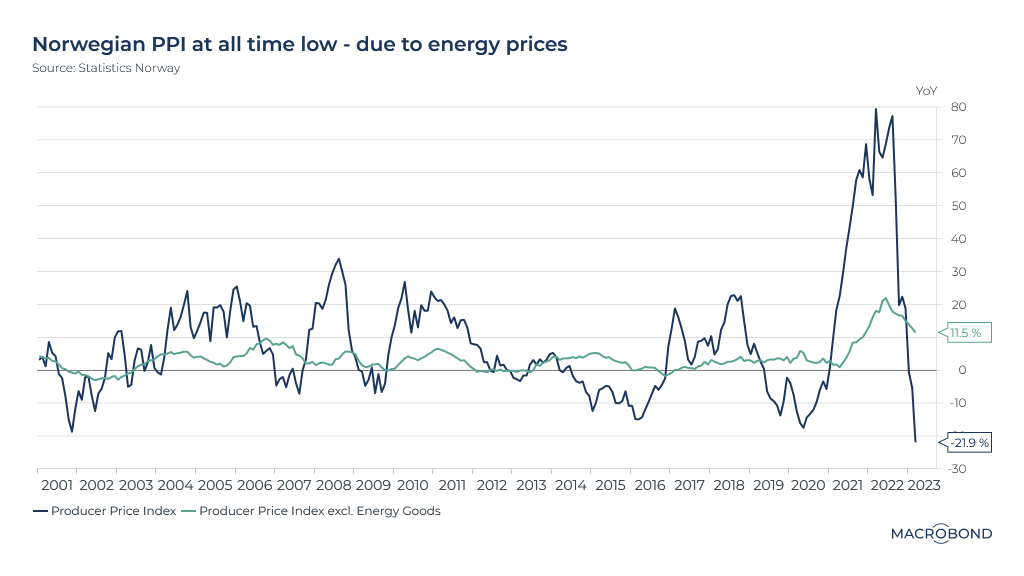

A unique case of European hyper deflation in Norway

.png)

Most recent macroeconomic narratives consider whether inflation is slowing or not. In Norway, one measure of prices is showing not just outright deflation, but the steepest decline ever.

The producer price index (PPI) is a measure of the average change in prices that an economy’s domestic producers receive for their output. It’s often considered a leading indicator for consumer price inflation.

Norwegian PPI fell an unprecedented 21.9 percent year-on-year in March. Of course, there’s a catch: Norway’s energy-oriented economy. Norwegian gas became crucial for Europe’s energy needs after Russia invaded Ukraine and flows from the Nord Stream pipeline ground to a halt. Gas prices soared, but LNG boats and a warm winter came to the rescue. Prices are down more than 80 percent from their August peak.

If we exclude energy, Norway looks a lot more like the rest of the developed world – with PPI rising more than 11 percent.

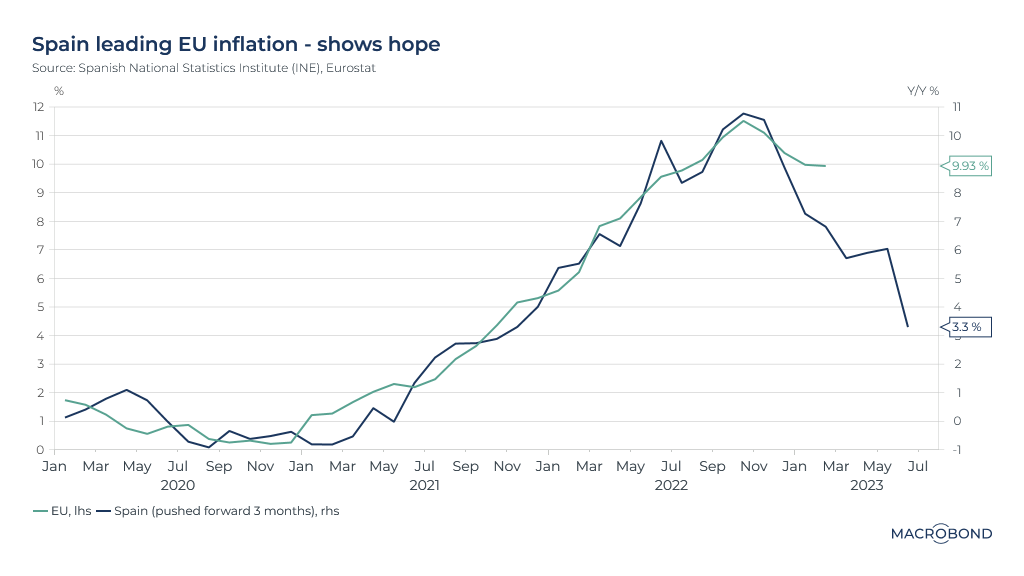

Spain might be an optimistic leading indicator for European inflation

.png)

At least one economy in Europe is showing a pronounced drop in consumer prices: Spain. CPI growth has retreated to 3.3 percent after peaking above 10 percent last autumn.

That’s optimistic for the rest of the EU because the Iberian nation has been an interesting leading indicator over the past three years, as our chart shows.

The Spanish CPI line tracks the EU line quite closely when it’s pushed forward three months. That could be because Spain moved more quickly to apply and phase out consumer subsidies during the pandemic.

To be sure, Spanish “core” inflation – which strips out food and that plunging natural-gas price – remains fodder for inflation hawks, standing at 7.5 percent.

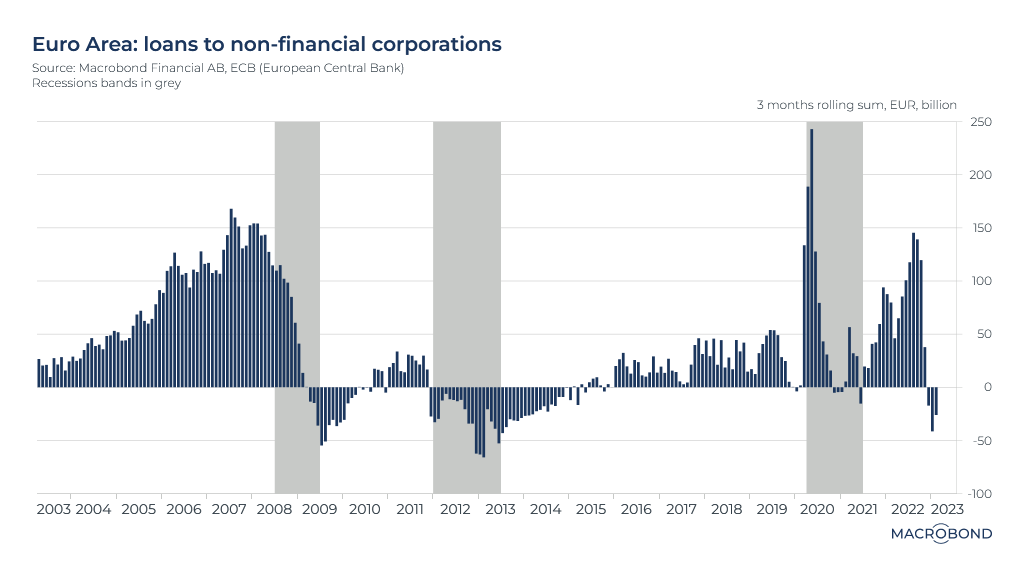

Keeping an eye out for another credit crunch in Europe

.png)

As concerns about a recession mount, it’s worth watching bank lending to companies in Europe. With securitisation playing a much smaller role than it does in the US, bank loans are a key conduit of credit – and monetary policy – to the real economy.

Our chart tracks the three-month cumulative lending flow to non-financial corporations. The ECB’s rapid rate hikes have pushed this indicator into negative territory: i.e., credit is being cut back.

The historic precedents are ominous. Bank loans shrank during the 2008-09 global financial crisis, and this indicator stayed in negative territory for years after the European debt crisis. (The shaded areas indicate recessions.)

The quite different trend during the pandemic recession is notable. As the economy ground to a halt with little warning, companies rushed to tap their credit facilities as authorities offered historic levels of support to the financial system.

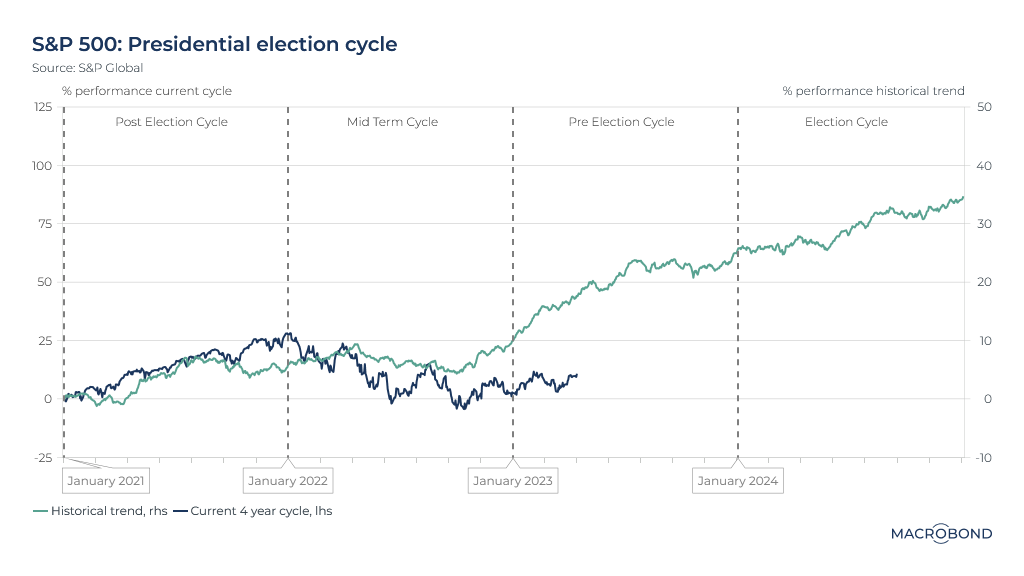

Stocks at the midway point for presidential cycles

.png)

Tip: Use the change region function to graph other nations’ stock markets against the US presidential cycle.

As President Biden signals that he plans to run for re-election, it’s worth revisiting history to assess how the S&P 500 typically behaves in the second half of a presidential term.

The S&P 500 is barely higher since Biden took office, but it roughly tracked the historic trend of a mid-term lull last year. History would suggest a rebound is overdue.

But with stress in the financial system, recession worries lingering and the Fed still tightening, the president might have to hope the bulls make a return in 2024.

3 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)