Chinese manufacturing PMI rose marginally to 49.3, Bank of England hiked interest rates by 25 basis points

Let’s hop straight into five of the biggest developments this week.

1. Chinese manufacturing PMI rose marginally to 49.3

The all-important manufacturing sector in China showed signs of recovery after rising in July from the June reading of 49. The report surprised the market that had priced in a slump of 48.9. This was the second consecutive month of rises. Markets remain cautious as these readings are still in contraction.

2. RBA held interest rates steady at 4.10%

The RBA left interest rates unchanged at 4.10%, which marked the second consecutive pause. The decision caught the market unaware, as expectations were for an increase of 25 basis points. Despite inflation easing across board, there is still a long way to go to attain the RBA's inflation target, and markets consider the sluggish growth in demand the key reason for the hold.

3. Bank of England hiked interest rates by 25 basis points

The BOE tightened their monetary policy a notch higher as they raised interest rates to 5.25%, in line with market expectations. With the UK having the highest inflation rate among major economies, the central bank is leaving nothing to chance in its concerted effort to achieve its 2% inflation target.

4. New Zealand Q2 unemployment rate nudged higher to 3.6%

The effects of price and wage inflation are slowly working their way into the NZ labour market. NZ still has record employment and labour participation rates, however this week we saw a marginal tick up in the unemployment rate. The inference is that more family members are seeking part time work, as pricing pressure hits household budgets. The labour participation rate hit a new record of 72.4%.

5. US manufacturing PMI rises to 46.4

Manufacturing in the US narrowly improved but remains uninspiring after its ninth consecutive month in contraction. Despite rising to 46.4 in July from the previous reading of 46.0, it fell short of the market expectations of 46.8. The downturn in the housing sector in the most part responsible for the continuous underperformance of the manufacturing sector due to restrictive lending conditions.

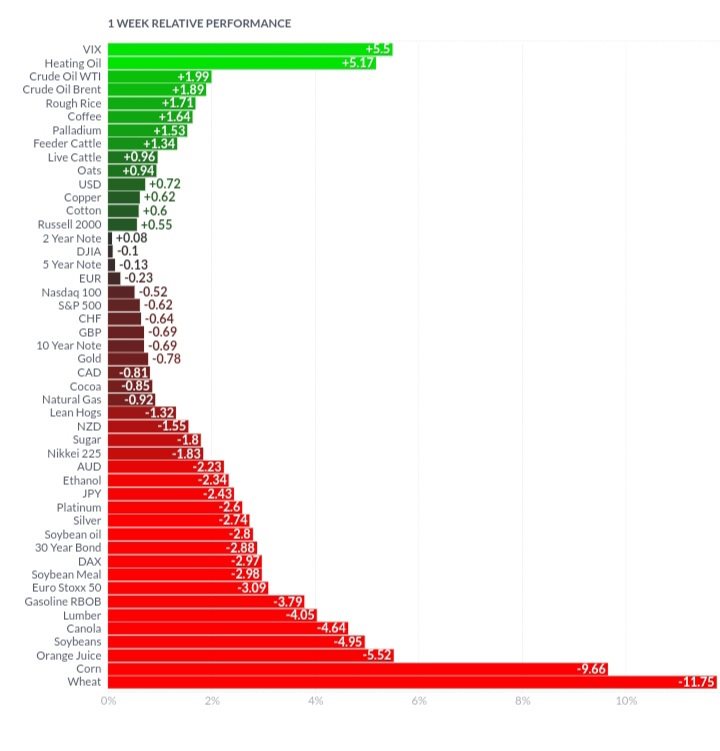

Here is the one-week performance of a variety of futures markets.

The fast-approaching winter in the Northern Hemisphere kept heating oil moving high for another week. The VIX added to last week’s gains as recession fears in Europe and the protracted war in Ukraine injected further uncertainties in the global economy. Petroleum products also held steady on dwindling supplies. Gradually improving manufacturing statistics in China kept copper demand high while grains and cereals prices contracted after a period of choppy performance. The ending of the cyclone season in the East Coast of the US also enhanced orange supplies. All in all, a net negative week for commodity markets. Fixed income markets need to be monitored closely as US 30-year Treasuries have continued to hit lows.

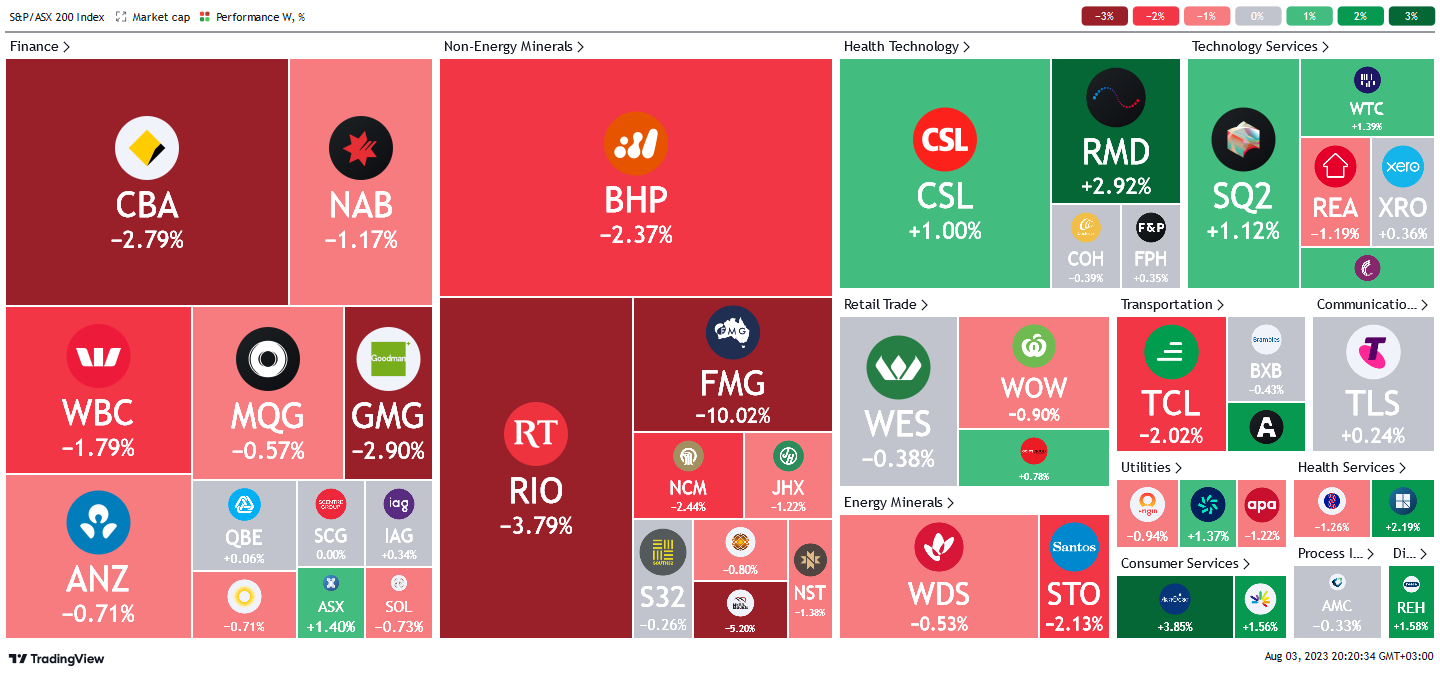

Here is the week's heatmap for the largest companies in the ASX.

The ASX retraced most of the gains of the last week. Financial stocks dragged on performance significantly after the RBA held rates steady. Generally speaking, a pause in interest rates is like giving a child a slice of chocolate cake for breakfast. Great for short term energy, but not so good if you want to keep the child riding their bike until lunch time. CBA, WBC and NAB led the selling pressure. Mining stocks continued to drag with FMG experiencing the most selling pressure. RMD and CSL provided some support over the week as a rotation back into defensive names occurred.

Below shows our proprietary trend following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics