CIO View: Upbeat bond opportunities, European investors’ optimism and China’s new five-year plan

Rising active opportunities in fixed income

The bond outlook remains positive and more monetary easing is expected in 2026. Passive carry-based strategies are one option, but choices for active strategies should be plentiful given yield curves’ potential evolution, cross-market spreads and credit premiums. Short-dated government bond yields reflect policy expectations, but prevailing risks may create volatility in longer-dated bonds. Curves have steepened and could extend given fiscal policy and heavy government bond issuance.

Interestingly, longer-duration bonds have outperformed in 2025, breaking a four-year run of underperformance. Active management of duration and exploiting yield differences will be key to delivering performance. As curves steepen, adding duration will be more enticing. A narrowing of the gap between dollar, sterling and euro interest rates will be another opportunity to boost returns. Credit spreads remain tight, but volatility is likely to increase as concerns about broader credit trends emerge.

Active investors should be able to add credit risk exposure at better levels than today during likely periods of macroeconomic uncertainty.

European investor optimism

European investors have been buying equities at a steady pace; between January and August fund inflows reached €164bn, outpacing 2024’s €144bn total, according to industry data. Notably, European investors’ risk appetite was not affected by US President Donald Trump’s Liberation Day: equity inflows exceeded €15bn in April, while bonds endured almost €21bn in outflows. However, while inflows are on track to match 2024’s €276bn there has likely been a shift away from government bonds to credit.

Unsurprisingly, the ICE Bank of America Euro Corporate index is on track to outperform the Euro Government Bond index by almost 200 basis points. Furthermore, multi-asset strategies have hit almost €40bn of inflows after two consecutive years of outflows. A risk-on tilt to European portfolios has rewarded investors – year to date a standard 60/40 strategy of government bonds and Stoxx 600 equities delivered a total return of some 7.4%. By comparison, the same allocation would have generated 4.6% for 2024 as a whole.

China: Leaning into what works

China’s Fourth Plenum concluded on 23 October, with the communiqué providing initial guidance for the 15th Five-Year Plan. While committing 2035 objectives, policymakers face ongoing structural imbalances, cyclical headwinds, and uncertain geopolitical conditions. Weak private sector and consumer confidence, along with demand-supply imbalances, are becoming an increasing challenge.

Reviving domestic demand is key for sustained long-term growth, however, redirecting China toward higher levels of domestic consumption will take time. For now, the strategy is to rely on investment and trade-led growth, emphasising the development of a modern industrial system and technological self-sufficiency.

This approach is both strategic and pragmatic, rooted in the thinking that investment will create new jobs, drive income growth, and, by extension, boost demand.

Yet, future macroeconomic and geopolitical developments, along with policy implementation, will be critical - especially given China's need to consume more of what it produces. Weakness in producer prices spans from overcapacity and affects export prices, raising the risk of exported deflation, ultimately challenging other manufacturing economies’ growth.

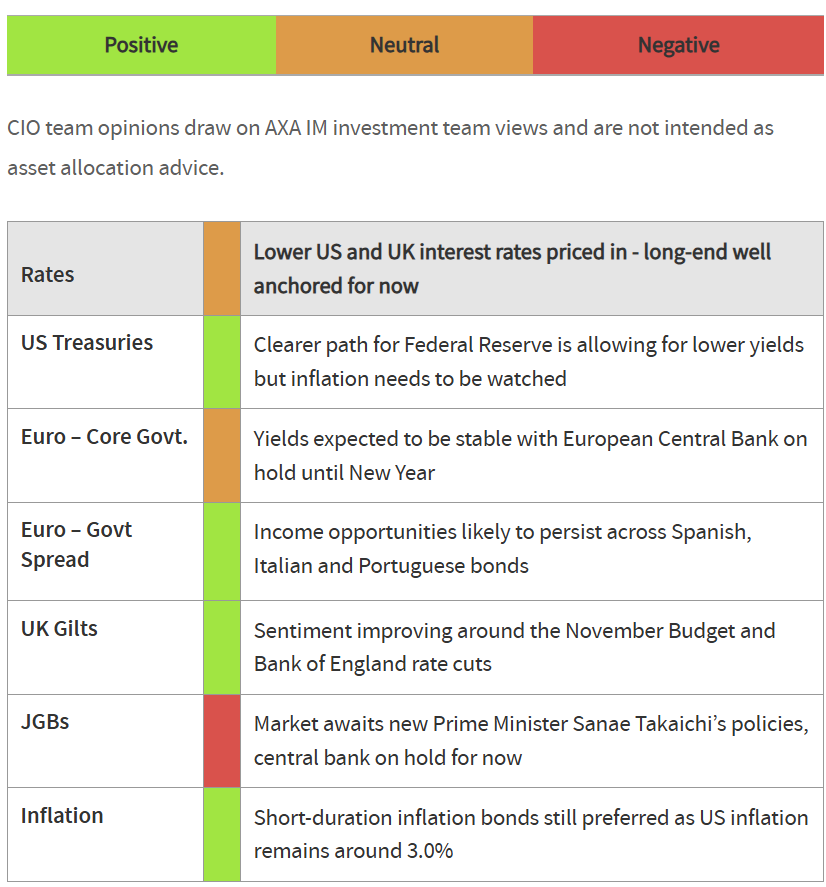

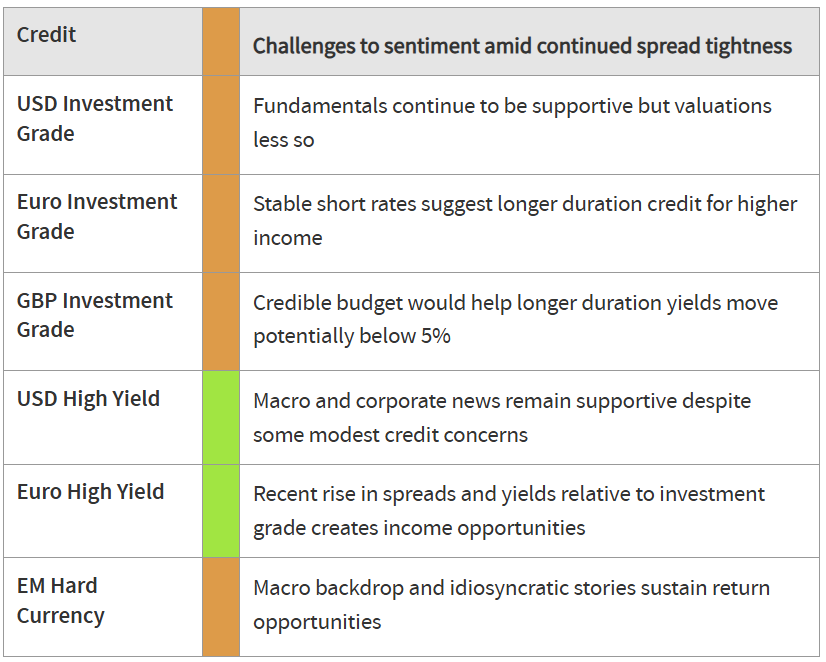

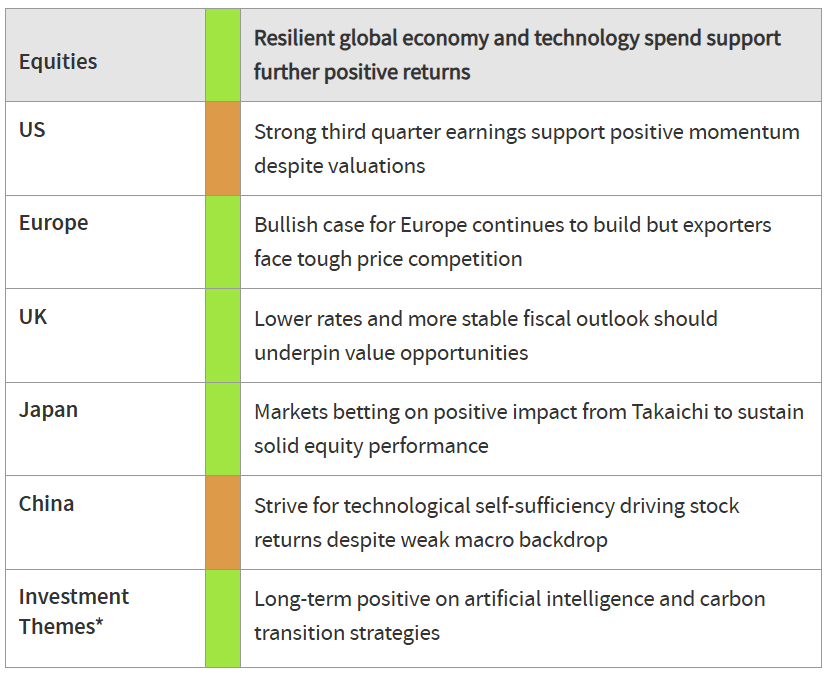

Asset Class Summary Views

Views expressed reflect CIO team expectations on asset class returns and risks. Traffic lights indicate expected return over a three-to-six-month period relative to long-term observed trends.

*AXA Investment Managers has identified several themes, supported by megatrends, that companies are tapping into which we believe are best placed to navigate the evolving global economy: Automation & Digitalisation, Consumer Trends & Longevity, the Energy Transition as well as Biodiversity & Natural Capital

Data source: Bloomberg

4 topics