CommBank’s tanking share price shows we should move beyond ASX 200 ETFs

With CommBank (ASX: CBA) down 10% the past week, it’s worth taking a fresh look at buying the banks – and by extension, buying ASX 200 ETFs.

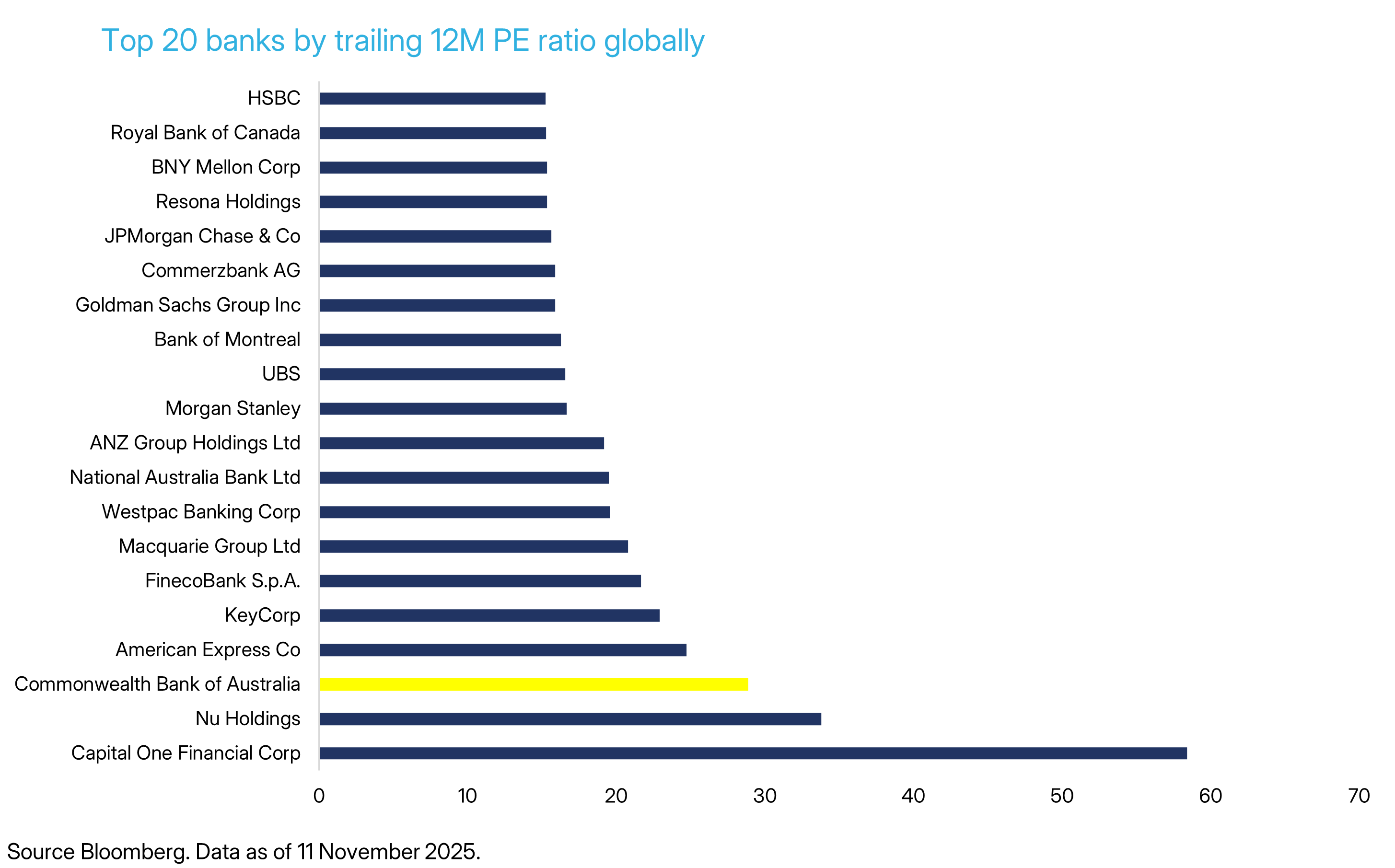

This week’s drop stems from results showing CBA’s costs growing faster than its revenue, undermining profit growth. That makes its valuation – the third-highest for a major bank globally – difficult to justify.

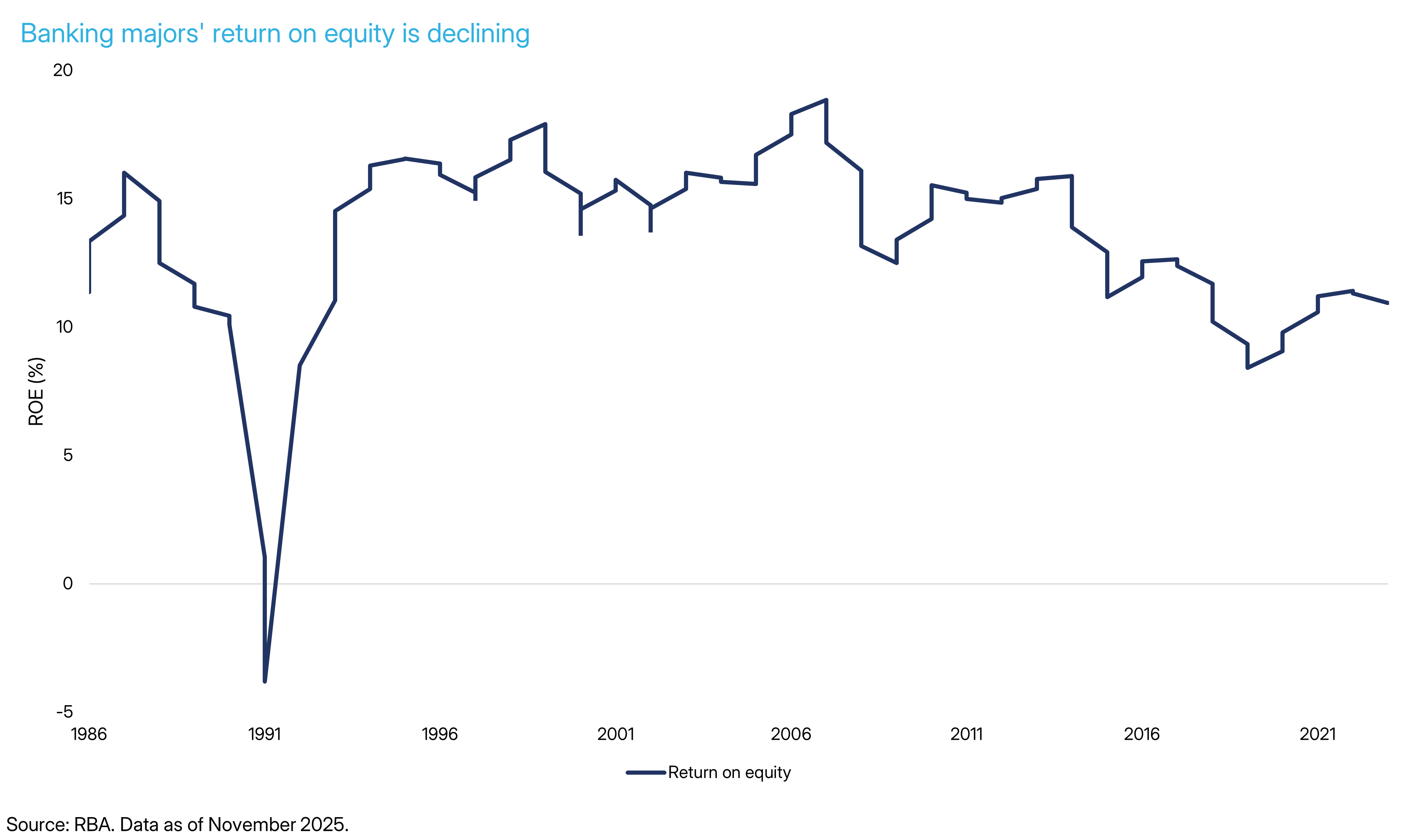

Its lending and deposits are growing, yes, but only in line with industry averages. And according to the RBA, net interest margins and returns on equity are declining for the big banks across the board.

Were these challenges unique to CBA, or the banks, they may be waved away. But in many ways, the banks’ challenges are a synecdoche for the challenges facing the ASX 200 itself. And CommBank’s falling share price is cause for reflection on the habit of buying ASX 200 ETFs.

CBA, like the ASX 200 itself, is an income instrument

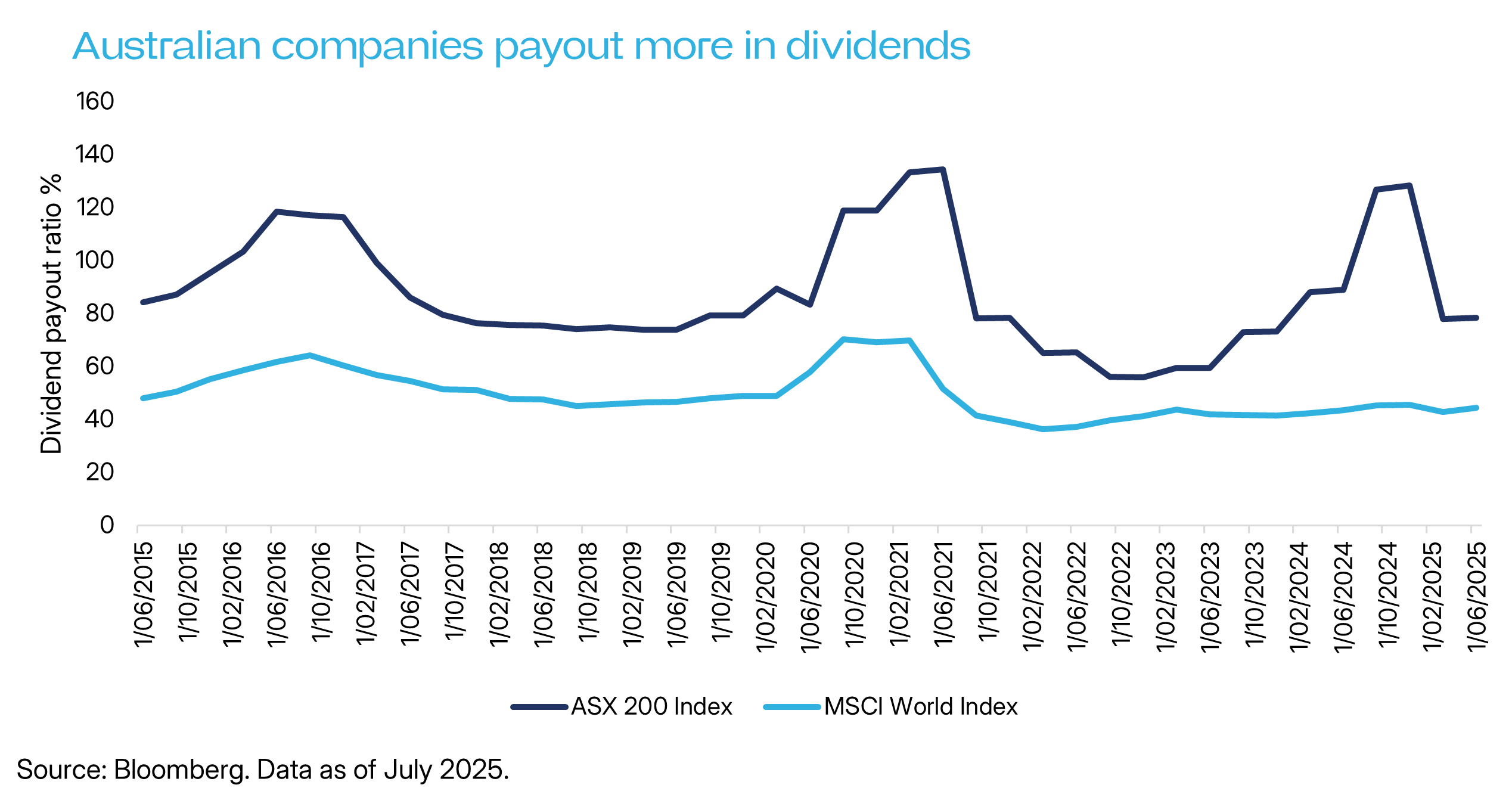

Australian tax and superannuation law have entrenched a dividend-first investment culture. Franking credits and compulsory super contributions mean most domestic capital flows chase yield, not growth.

CBA, like the ASX 200 itself, behaves more like a high-yield bond than true equity. That’s what local investors want – and company boards deliver. Management teams across the ASX 200 are built for incremental operational improvements, their north star being maintenance or expansion of dividends.

This has created a peculiar equilibrium. Operations-focused executives make the ASX 200 behave like a bond index for superannuation portfolios. It’s the end product of routing the nation’s savings pool through domestic financial markets. (Alternative pension models exist: such a defined benefit model funded by direct taxation).

The result: ASX 200 companies are optimising for predictability, not progress.

BHP (ASX: BHP) and Rio (ASX: RIO) don’t centre their businesses around exploration and discovery – the wealth creation engine in mining. They behave instead like financial utilities – extending mine lives through acquisitions and focussing laser-like on cost control. Australian banks stick to bread-and-butter mortgage lending, avoiding more scalable businesses like asset management or custody that their global peers embraced years ago.

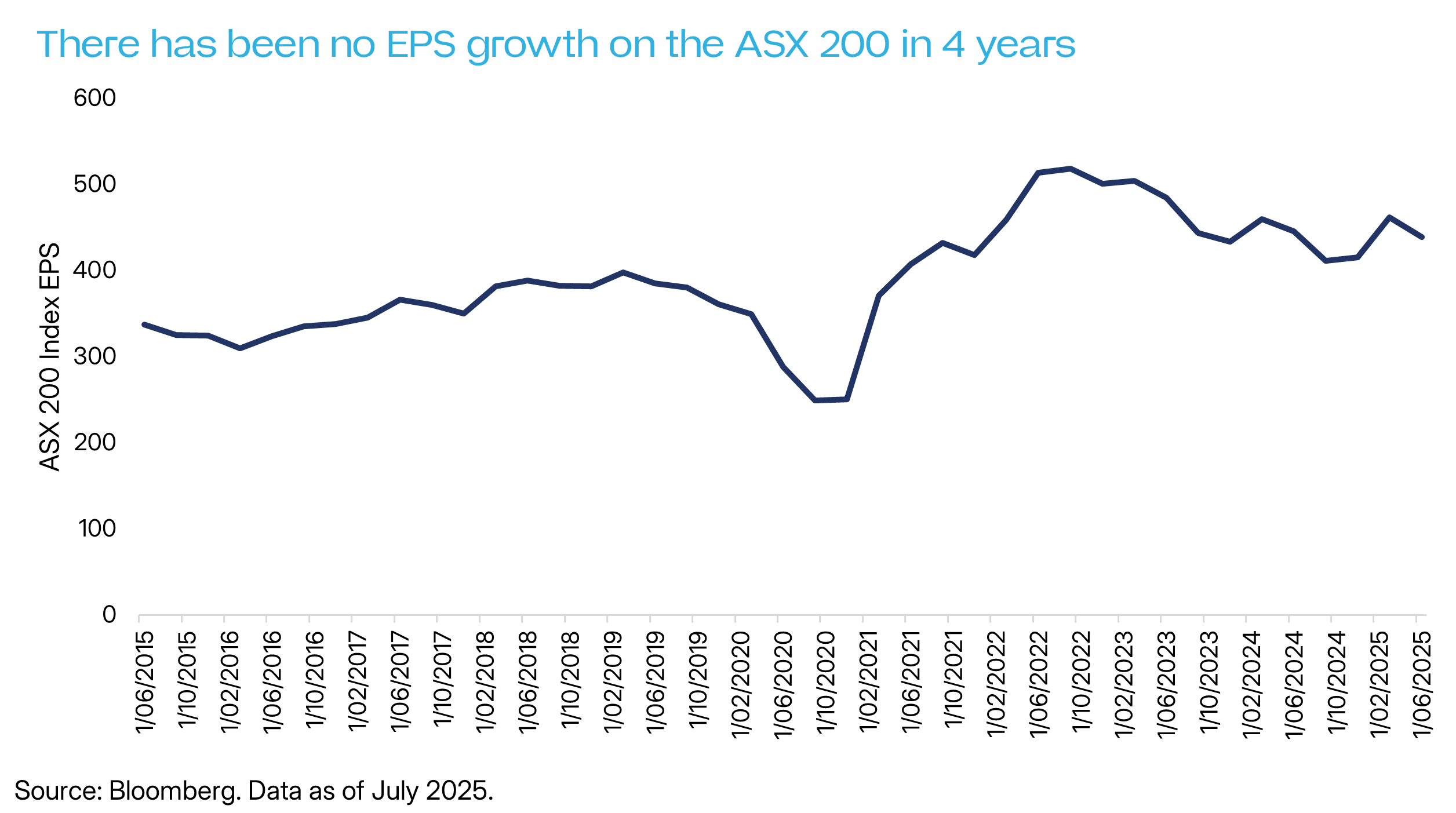

This dividend obsession, combined with softer commodity prices, has left ASX 200 profits barely above pre-GFC levels. Price appreciation in ASX 200 ETFs – much like CBA’s share price – reflects multiple expansion. It is causing the yield on the ASX 200 to decline.

The lesson here in our view is that Australians need to start investing more offshore – particularly in the US. And rethink these cookie cutter growth portfolios that reflexively allocate 30% to Aussie equities.

Why the US?

Whereas the ASX 200 is built for income, the US market is built for growth.

American companies are incentivised to spend on capex and scale their businesses rather than spend on dividends. US tax incentives are much more generous on capex – something Trump has increased.

The result is more US companies build more for the long term and compound earnings. This is obvious with tech but holds across sectors: compare Costco with Woolworths; or Ameriprise Financial with AMP.

The numbers tell the story. Over the past decade, the S&P 500’s earnings per share have grown by roughly 9% per year, versus just 2–3% for the ASX 200.

That difference in earnings growth explains the difference in returns. The S&P 500 has delivered total returns of over 200% since 2015, compared with roughly 90% for the ASX 200.

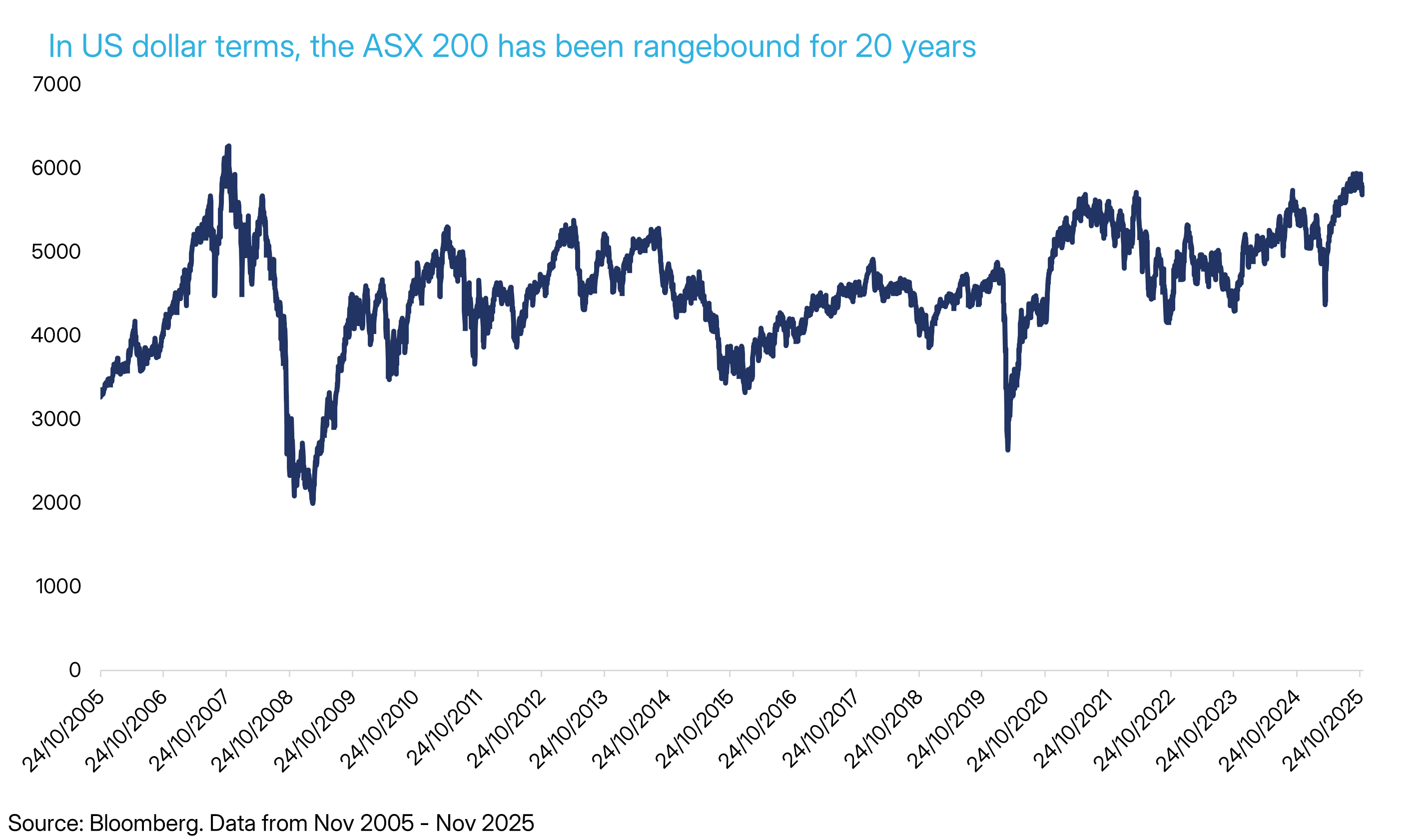

And that’s before factoring in the Aussie dollar weakening against the US dollar. If we look at the ASX 200 in US dollar terms, it has been rangebound for 20 years.

Australians seeking real long-term wealth creation, need to avoid the siren song of fully franked dividends.

The next generation of compounding businesses – in AI, semiconductors, biotechnology, and digital infrastructure – won’t be paying them.

The lesson from CBA’s result isn’t just that the banks are expensive. It’s that the ASX 200 is becoming a yield trap. For investors chasing opportunity rather than dividends, it may be time to look elsewhere.

About ETF Shares

ETF Shares is a low-cost index ETF issuer, based out of Macquarie University. We specialise in US-focussed ETFs, such as the Magnificent 7 and US Quality ETFs.

4 topics

3 stocks mentioned