CommSec Financial Year Wrap

Online Stockbroker

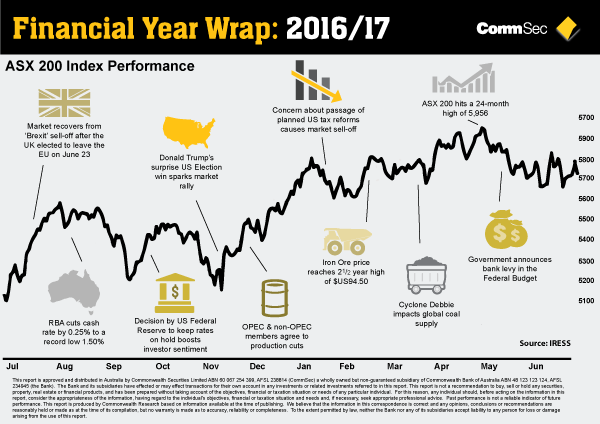

Overall, the year was remarkable for being unremarkable. At least as far as the economy and financial markets performed. The year started with the fall-out from Brexit. There was a domestic election and the US Presidential election. In 2017 there has been a raft of elections in Europe. And there was the OPEC production agreement.

But despite the challenges, returns on shares, residential property and bonds have all lifted over the past year while interest rates are lower and the Aussie dollar is little changed from a year ago. In fact the Aussie dollar has tracked a range of US6.25 cents – the least volatile year in 27 years. The sharemarket has had the least volatile year in 16 years. And the record (and world-leading) Australian economic expansion continues.

The economy has grown by around 1.75-2.00 per cent in 2016/17 and we expect growth of around 3.0 per cent in 2017/18. Infrastructure will be a key driver of growth in 2017/18 with exports, while home building continues, especially in Sydney, Melbourne & Brisbane. Underlying inflation may lift from 1.7 per cent to 2.0 per cent over the coming financial year while unemployment may ease modestly from 4-year lows of 5.5 per cent currently to the 5.0-5.5 per cent range. Official interest rates may remain on hold for another year.

Get the insights at (VIEW LINK)

EOFY Series: Outlook for bond yields & interest rates

CBA Head of Fixed Income & Rates Research, Adam Donaldson provides his outlook for US bond yields and Australian interest rates.

EOFY Series: Outlook for energy prices

CBA Mining & Energy Commodities Analyst Vivek Dhar speaks with CommSec Market Analyst Tom Piotrowski about the outlook for oil, gas and electricity prices.

EOFY Series: Currency outlook

CBA Senior Currency Strategist Elias Haddad speaks with CommSec Market Analyst Tom Piotrowski about the outlook for the US dollar and the Australian dollar.

EOFY Series: Economic & sharemarket outlook

CommSec Chief Economist Craig James provides his outlook for the year ahead, including his forecasts for the Australian economy, local share market, Aussie dollar and RBA cash rate.

EOFY Series: Outlook for commodity prices

CBA Mining & Energy Commodities Analyst Vivek Dhar speaks with CommSec Market Analyst Tom Piotrowski about the outlook for gold, iron ore, coal, nickel and bauxite prices.

EOFY Series: Options Insights

CommSec Exchange Traded Options Dealer, Omid Shakibaei speaks with CommSec Market Analyst Steven Daghlian about potential strategies for investors with a bullish, bearish or neutral outlook.

EOFY Series: The Australian Economy

CommSec Market Analyst Steven Daghlian speaks with CBA Chief Economist Michael Blythe about the performance of the Australian economy over the past financial year, and the outlook for the 2017/18 financial year.

9 topics

CommSec is Australia's leading online broker. CommSec has been committed to providing the best in online trading since 1995. CommSec helps make informed investment decisions with comprehensive market research, free live pricing and powerful...

Expertise

No areas of expertise

CommSec is Australia's leading online broker. CommSec has been committed to providing the best in online trading since 1995. CommSec helps make informed investment decisions with comprehensive market research, free live pricing and powerful...

Expertise

No areas of expertise