Earnings season could surprise to the upside, and these stocks are in the box seat

Wilsons Advisory

After renewed optimism at the start of this year, can earnings deliver over the next few weeks? That is the question on most investors’ minds as we enter reporting season.

We believe the reporting season will be relatively positive. The cyclical sectors may provide more positive results than the market expects after continued strength in the global and domestic economies in the last half. However, management outlook statements will be key for the direction of earnings upgrades.

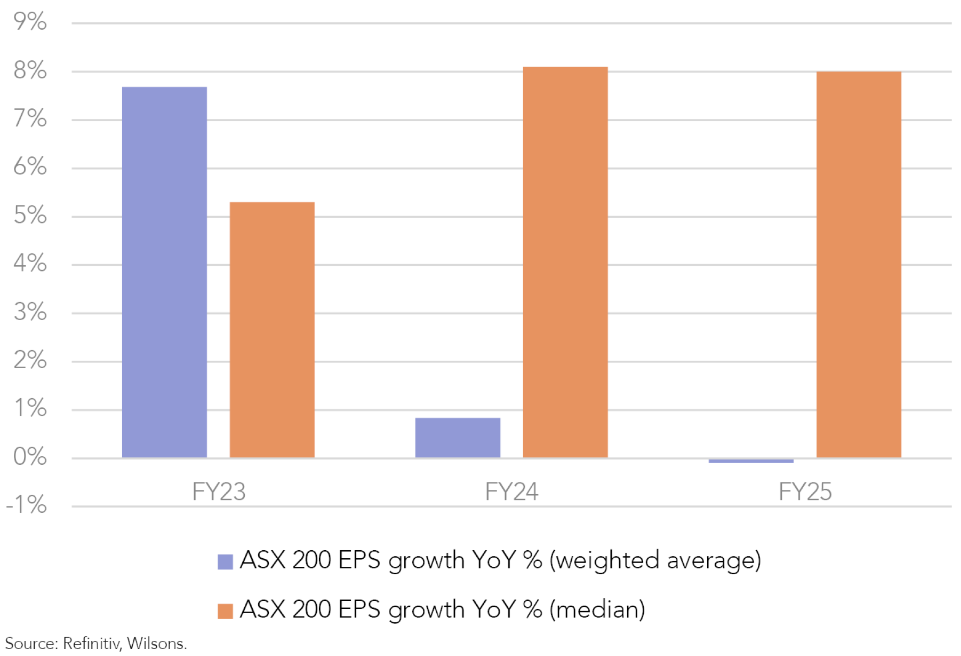

Consensus expects ASX 200 earnings to grow 7.7% in FY23 (YoY). Trading updates and outlook statements provided this reporting season will hold the key to this expected growth being downgraded/upgraded.

The median EPS growth for FY23 is 5.3%, while the median FY24 EPS growth is 8.1%. Therefore, once discounting the weight of the financials and resources sectors (which represent ~60% of the index), FY24 earnings growth is still expected to be strong for the industrials. More broadly, FY24 earnings may have risk to the downside over the next 12 months.

Key Points

- On balance, the reporting season should be positive as the domestic economy remains buoyant.

- A resilient consumer should support consumer discretionary. However, this is likely peak earnings for many retailers.

- We prefer to hold quality cyclicals like Nine (NEC) or Seek (SEK) that should grow earnings over the cycle but provide protection against a milder than expected slowdown.

- Healthcare should be back on track after COVID.

- Travel could surprise – China reopening adds fuel to the fire.

- CBA has no room for mistakes given its elevated valuation.

Figure 1: Consensus forecasts for the ASX 200 point to a strong aggregate EPS growth in FY23; Resources (30% of ASX 200) driving down the weighted average growth for FY24

The Aussie consumer: Strong (but peaking)

The expected slowdown in consumer spending has been more subdued than anticipated. The sector has seen earnings upgrades in January while outperforming the ASX 200.

Retail trading updates have been relatively buoyant in January. Super Retail (ASX: SUL) and JB Hi-Fi (ASX: JBH) presented strong updates, albeit relative to a subdued 2022 Christmas due to Omicron. JBH stated that sales growth was driven by continued elevated customer demand for electronics and appliances. Sales in SUL were up 11% across the board on a like-for-like basis and pointed to strong Christmas trade. Both stocks saw broad-based upgrades to earnings after these updates.

We think this may be the last round of upgrades for consumer discretionary before a tougher period over the next 12 months as higher rates take hold and spending patterns normalise post-COVID.

The share prices of retailers have already moved with the inflow of more positive data, so positive updates may not translate into material share price appreciation on the day companies report. The trading updates and outlooks for retailers will be closely watched. Any signs of less-than-impressive outlooks are likely to be punished. The market typically dislikes evidence of peak earnings.

We hold a preference for other cyclical sectors with higher quality companies to protect the portfolio against a milder-than-expected slowdown, like Media and Diversified financials.

Figure 2: ASX 200 Retailers performed well last month – some positivity may already be priced in

Opportunity in Nine (NEC)

A tactical opportunity may exist in media stocks. The resilient domestic consumer has left cash for companies for ad spend. We may see upgrades in the sector over reporting season as higher-than-expected consumer spend corresponds to higher-than-expected ad spend. Currently, the market thinks the media sector earnings will contract 6% in FY23.

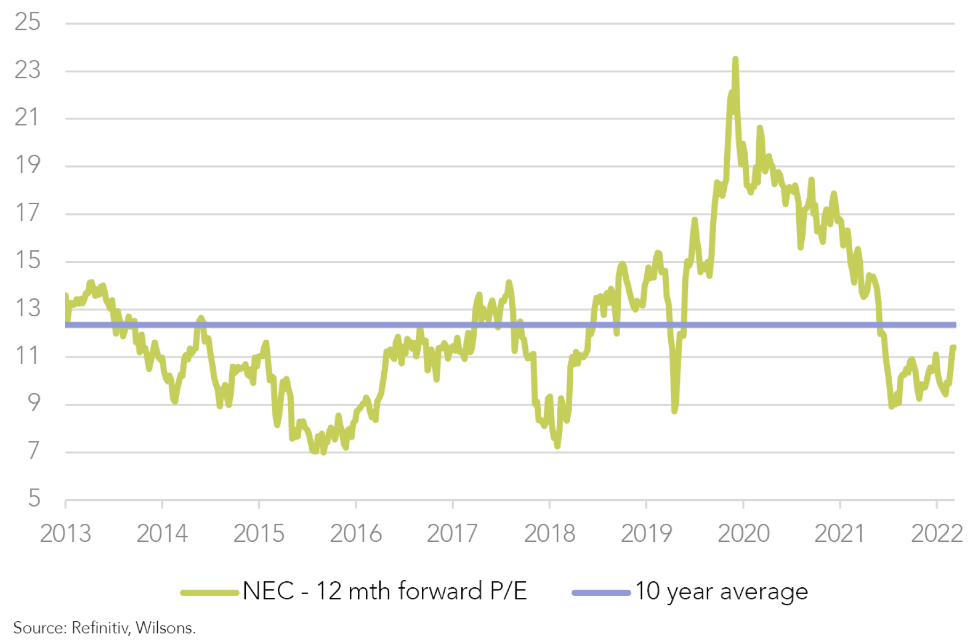

Nine (ASX: NEC) should be a key beneficiary of this opportunity, especially as the stock derated over 2022 and currently sits on a relatively modest PE of ~11x.

Figure 3: NEC looks to be priced for low earnings expectations

Tight Job Market to Support Seek (SEK)

There is still room for Seek (ASX: SEK) to surprise the market. The stock has rerated since the beginning of the year. However, we expect a strong showing from SEK as it benefits from a resilient jobs market. FY23 guidance for EBITDA of $560-590m ($575m midpoint) was reaffirmed in Nov 2022, though consensus expectations currently sit below the bottom end of this range at $559m. We are looking for a reiteration of full-year guidance and commentary on continued strength in the ANZ labour market. A strong interim result could lead to consensus earnings upgrades for FY23/FY24.

We also like the structural story for SEK (significant upside from dynamic pricing model, strategic initiatives and growth fund), which should mitigate any fallout in a cyclical peak in the job market.

Figure 4: Job vacancies are still at elevated levels – this should support SEK’s earnings

Healthcare: Vital Signs Improving

We expect CSL's earnings recovery to be a beat, driven by better-than-expected plasma collections.

CSL (ASX: CSL) was impacted by lower plasma collections during the pandemic. Without a key input, CSL's revenues and gross margins were adversely affected. Positively, collection volumes are recovering and now exceed pre-pandemic levels as fears of the virus have faded and stimulus cheques have dried up. The market has typically underestimated these post-pandemic recoveries, and we don’t think this time will be any different.

Figure 5: The ASX 200 healthcare sector (led by CSL) still has low earnings expectations vs pre-COVID. We think this can get back to pre-COVID levels over the next 12 months

This, coupled with new product approvals, could lead to a possible guidance upgrade. This could be the start of an earnings upgrade cycle for CSL. We are overweight CSL (8.5% weighting).

Travel Stocks: Qantas to Fly Higher

Qantas (ASX: QAN) is set for a bumper earnings season. After being forced to postpone travel plans due to the pandemic, consumers are shrugging off 15-year high ticket prices. The market continues to underestimate the pent-up travel demand that still continues to drive strong cash generation for QAN. The business has the capacity to surprise the market positively, and we do not think the valuation is pricing a further upgrade. (see Qantas – Flying Below Global Peers)

China reopening another tailwind

Qantas (QAN) could be a key beneficiary of a China reopening, which may add another tailwind to impressive earnings momentum.

Trading updates may be better than expected due to inbound Chinese tourism. We think the market underestimates the recovery in Chinese tourists as it did for domestic travel over the last 12 months. This could be discussed in trading updates of travel or international education stocks.

We expect companies like EVT (ASX: EVT) QT, Rydges hotel operator) and IDP Education (ASX: IEL), international education placements) to indicate an improving demand picture after the reopening of China.

Banks: Can CBA Keep Defying Gravity?

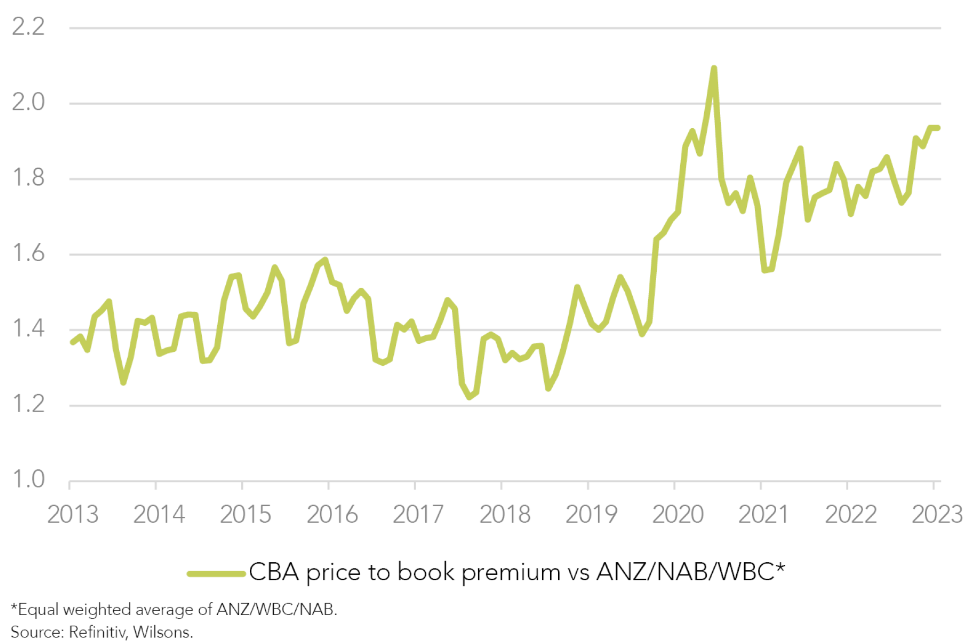

With a lofty valuation, any negative aspect of the result could be detrimental to CBA in its result on 15 February.

CBA (ASX: CBA) still sits on a high premium relative to the other big 4 banks. Outside of March 2020, the disparity between the price to book of CBA vs the other big 4 has never been larger.

The other big 4 banks saw higher costs and a NIM (net interest margin) outlook that slightly underwhelmed the market. The market will likely punish any indication that CBA is being impacted by cost pressures or that competition is keeping NIMs lower than expected.

Figure 6: CBA premium at elevated levels – any misstep in earnings could lead to a correction

We prefer the other big 4 banks (NAB (ASX: NAB), Westpac (ASX: WBC), ANZ (ASX: ANZ) on valuation grounds. We remain underweight the banks relative to the benchmark as we expect higher interest rates to slow housing/the domestic economy and adversely impact housing markets that which will slow likely translate to softer credit growth over the medium term.

Want more insights like this?

WILSONS thinks differently and delves deeper to uncover a broad range of interesting investment opportunities for its clients. To read more of our latest research, visit our Research and Insights.

12 stocks mentioned

Expertise