Explainer: Why Australian investors should care about the Bank of Japan's latest shocker

We are in the lull period between central bank mayhem and the ASX earnings deluge. But it has been anything but quiet in financial markets. This week, one of the biggest research houses in the world, Fitch Ratings, downgraded the United States' credit rating. It's only the second time in history this has happened and while the market reaction was fleeting, it still certainly gave the markets a shock.

Last week brought other surprises, too. After more than a decade of easy monetary policy and mass bond buying over the last seven years, it appears that the Bank of Japan is finally loosening its grip on that country's bond market.

Now, before you all start groaning and telling me that this is boring and irrelevant, let me stop you right there. It's important, and very relevant, with Japan's move representing something far greater than many realise. And even if the ripple effects take a while to reach our shores, Australian investors need to keep one side-eye on Tokyo. In this wire, I'll tell you why.

The story so far...

Japan's stock market is one of the developed world's best-performing in 2023 so far. The Nikkei 225 is up more than 25% year-to-date and is trading at levels we have not seen since 1990. Foreign buyers are flooding into that market like a pack of hyenas - and everyone from institutions to Warren Buffett himself is hoping this won't be another false dawn.

"Another" is the operative word here. In the last 30 years, Japanese stocks have tried to ink a sustainable rally twice and both times, the rally fell over.

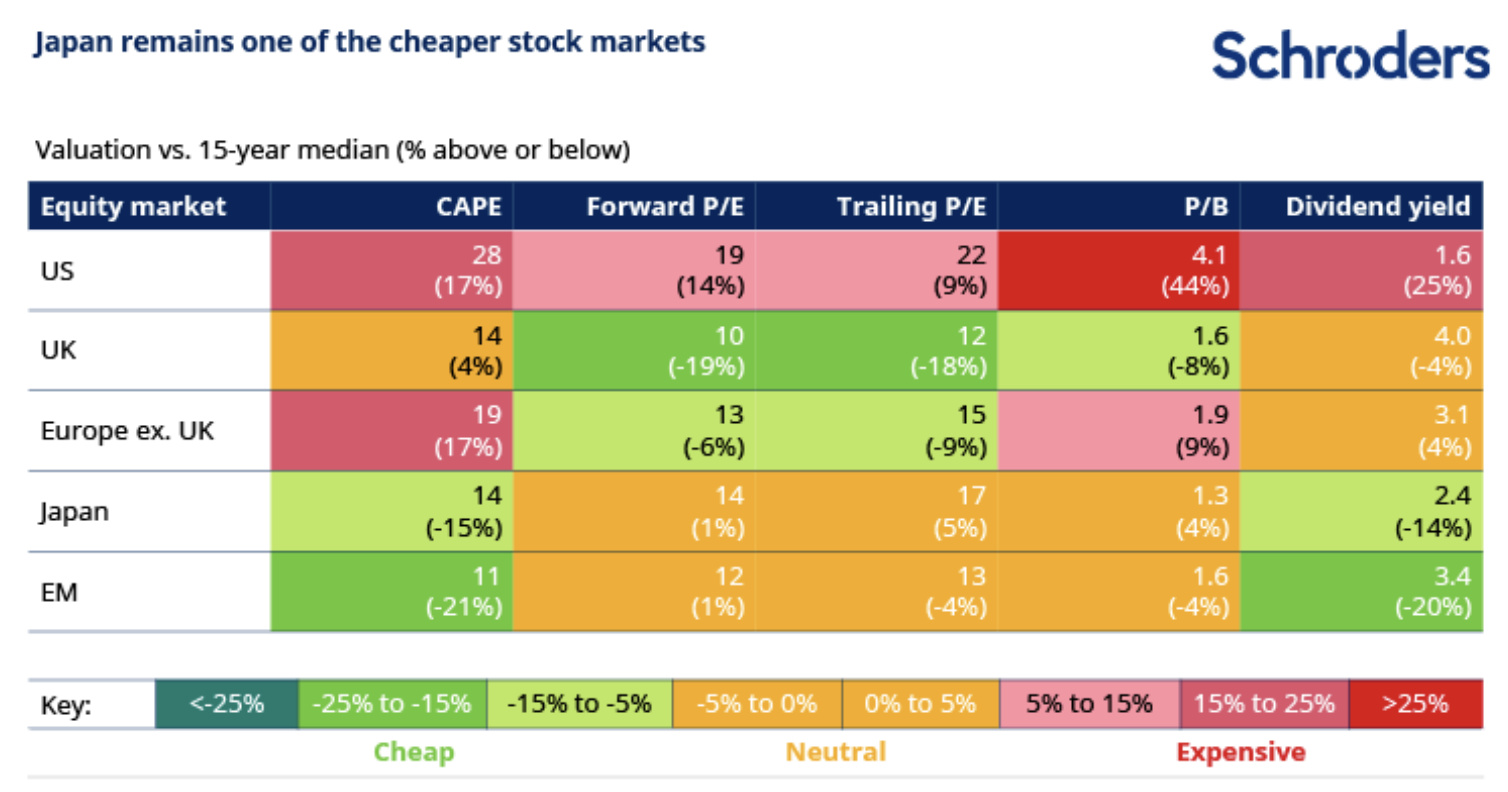

But people are saying this time is different. Schroders says the return of inflation is welcome and the post-COVID reopening boost has stuck around unlike in China. At the corporate level, companies are buying back more of their own stock (a relatively new phenomenon there), paying out more dividends, and valuations are still relatively cheap.

Someone else who agrees is Shane Woldendorp of Orbis. Woldendorp argued that this bull run is now "too good to miss".

"Japan is changing, and in a good way," he said but added "it’s been a tough market for passive investors, but an outstanding stock picker’s market. Company fundamentals are improving, and a cheap currency provides additional upside potential. And above all, valuations are attractive."

Note that 13% of the Orbis Global Equity Fund is in Japanese stocks. So, it has a lot riding on this bet.

Outside stocks, the Japanese Yen also remains a massive force among currency traders and anyone who is invested in an export-dependent business. After this recent move was handed down, the Yen whipsawed while bond and stock prices slumped. In other words, very few people saw this coming and it shows.

What did they do?

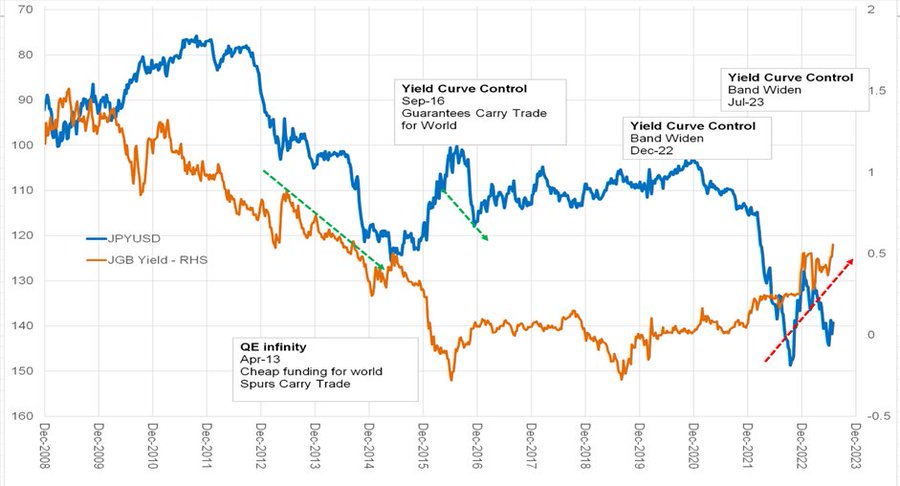

Last Friday, the Bank of Japan decided to shock the world by making "pre-emptive" adjustments to its yield curve control policy.

What is yield curve control?

Yield curve control is when a central bank targets a specific longer-term interest rate by buying or selling as many bonds as possible in order to keep that interest rate there. The RBA implemented this policy throughout the COVID-19 pandemic while Japan has had it since well before the pandemic.

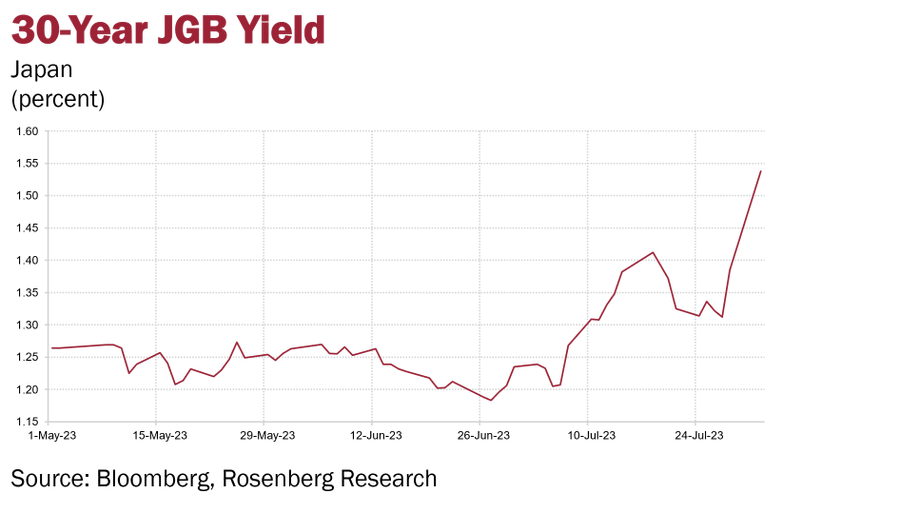

But after years of having a concrete 0.5% upper-limit, it said that it would allow a gradual rise to 1% over time. But when you play with fire, expect sparks to fly. The Japanese stock market sank while volatility surged in the bond market.

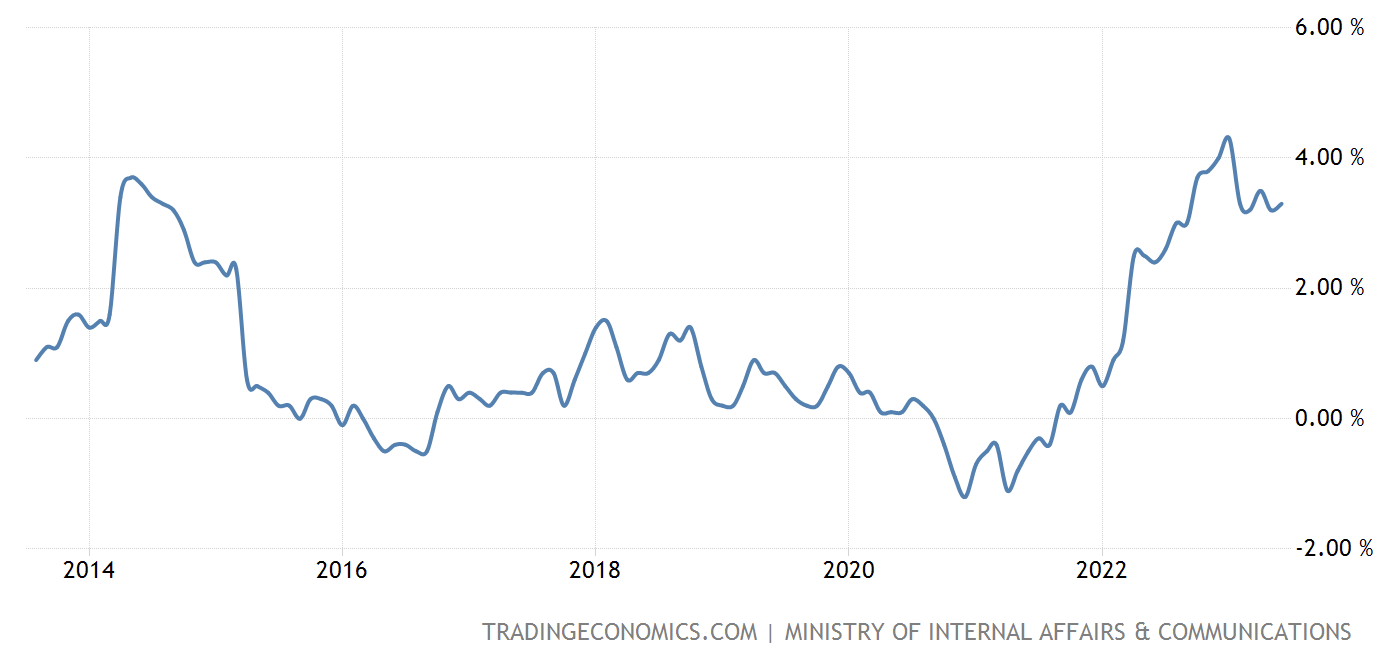

The reason Japan has run this unconventional form of monetary policy for so long is that inflation has remained very low for a long time - almost deflationary. Between 2015 and 2022, the Japanese inflation rate never (yes, never) breached 2%. In fact, for a period of time during the pandemic, there was actually deflation in Japan.

It seems that after 10 years, easy money has finally flowed through to the Japanese economy.

The moves from the Bank of Japan are a sign that the beleaguered economy is finally making some headway. Inflation in the country is at 3.3% on a headline basis. The Bank's own economists believe that core inflation could be as high as 2.5% by March next year. You may think that's not that high but remember, this is an economy that was dealing with negative price growth just three years ago.

It's also a very important clue that the last of the developed world's central banks may finally be about to give up on near-zero interest rates.

“Fighting inflation was not the official reason for the policy tweak, as that would surely imply stronger tightening moves, but the Bank recognised obstinately elevated inflationary pressure by revising up its forecast,” Duncan Wrigley, chief China+ economist at Pantheon Macroeconomics, said in a note.

Westpac's international economics team adds that while this move was unexpected, don't expect that anything more drastic will happen anytime soon.

"In our view, a virtuous loop between wages, price-setting and expectations must be established for Japan to exit its low-inflation malaise. This will take years. In the meantime, the BoJ will need to keep policy extraordinarily accommodative," Illiana Jain, Westpac economist for Asia and Europe wrote recently.

But a word of caution...

So you think this all sounds pretty rosy right? Before you think about buying Japanese shares or ASX-listed ETFs with exposure to the Japanese market (e.g. ASX: IJP and ASX: HJPN are two major ones), you may want to know about what happened the last time Japanese stocks rallied this hard.

In 1990, Japanese stocks were trading at incredible highs thanks to easy access to credit and a booming economy. The Bank of Japan was forced to raise interest rates to cool the asset bubble developing in real estate and stocks. It also came inconveniently at a time when earnings were near their cyclical peak. What followed was a long period of slow to negative economic growth.

It's called the "lost decade" and it's during this time that China built itself up to become the defining force in Asia over the 2000s and 2010s. That's just something to consider in case you're thinking of chasing this rally which (still) looks and sounds cheap.

A version of this piece appeared in The Morning Wrap on Thursday 3 August. You can read more about Japan's yield curve control policy here:

.png)

3 topics

2 stocks mentioned

3 funds mentioned

1 contributor mentioned