Finding a carbon solution: 7 stocks fronting the net-zero surge

The world has enjoyed more than a century of “progress” which has seen developed market industrialisation, huge population growth, globalisation, and the emergence of a growing middle class. But this progress has created several climatic challenges which, if left unaddressed, could see the planet struggle to sustain a liveable future.

Investors wanting to be part of the decarbonisation investment thematic should look to infrastructure as a way to participate. Here is my three-part guide to harnessing this megatrend - along with some stock ideas to make your portfolio (and our planet) better.

1. Saving humanity from itself

Concerns over climate change and rising levels of CO2 emerged in the mid-1990s, culminating in the United Nations Climate Conference of Parties (COP) in 1995. International climate policy fundamentally changed following the 21st COP in 2015, at which the Paris Agreement was ratified.

The Paris Agreement’s central aim is to strengthen the global response to the threat of climate change by keeping the global temperature rise this century to well below 2 degrees Celsius above pre-industrial levels. Broadly speaking, Paris Agreement signatories are looking for net-zero emissions by 2050.

As of November 2021, 193 states and the European Union are parties to the Paris Agreement, covering approximately 98% of the world’s man-made emissions.

2. Progress creates challenges

There have been several crucial drivers in increasing CO2 in the atmosphere over the past 100 years.

- Industrialisation: The Industrial Revolution, between 1760 and 1840, saw the introduction of power-driven machinery that brought huge growth in transportation needs and electrification.

- Globalisation: Advances in transportation and technology have seen rapid globalisation, starting with the IR and the advent of international trade, leading to enhanced standards of living.

- Population growth: Humans consume around 40% of the Earth’s land-based net primary production, so carbon emissions are directly correlated with population growth.

- Demographic trends: The emergence of the middle class puts pressure on carbon emissions, as improved standards of living are correlated with increased individual carbon footprints.

3. Challenges create progress

Infrastructure provides the basic services essential for communities to function and for economies to prosper and grow. At 4D, this equates to the publicly listed owners and operators of essential services (regulated utilities in gas, power and water) and user-pay assets (toll roads, airports, ports and rail, where a user pays for the service).

Infrastructure, on the face of it, could be considered part of the carbon problem – its build-out has certainly supported the economic progress mentioned. However, at 4D, we truly believe infrastructure is now a core part of the climate solution, as there will be no Net Zero without increased investment in infrastructure.

While the speed of ultimate decarbonisation remains unclear, there appears to be a real opportunity for multi-decade investment as every country moves towards a cleaner environment. Energy transition and decarbonisation of the power sector is an obvious thematic and will have the greatest impact on countries looking for Net-Zero. But other forms of infrastructure, namely transportation, also have a key role to play.

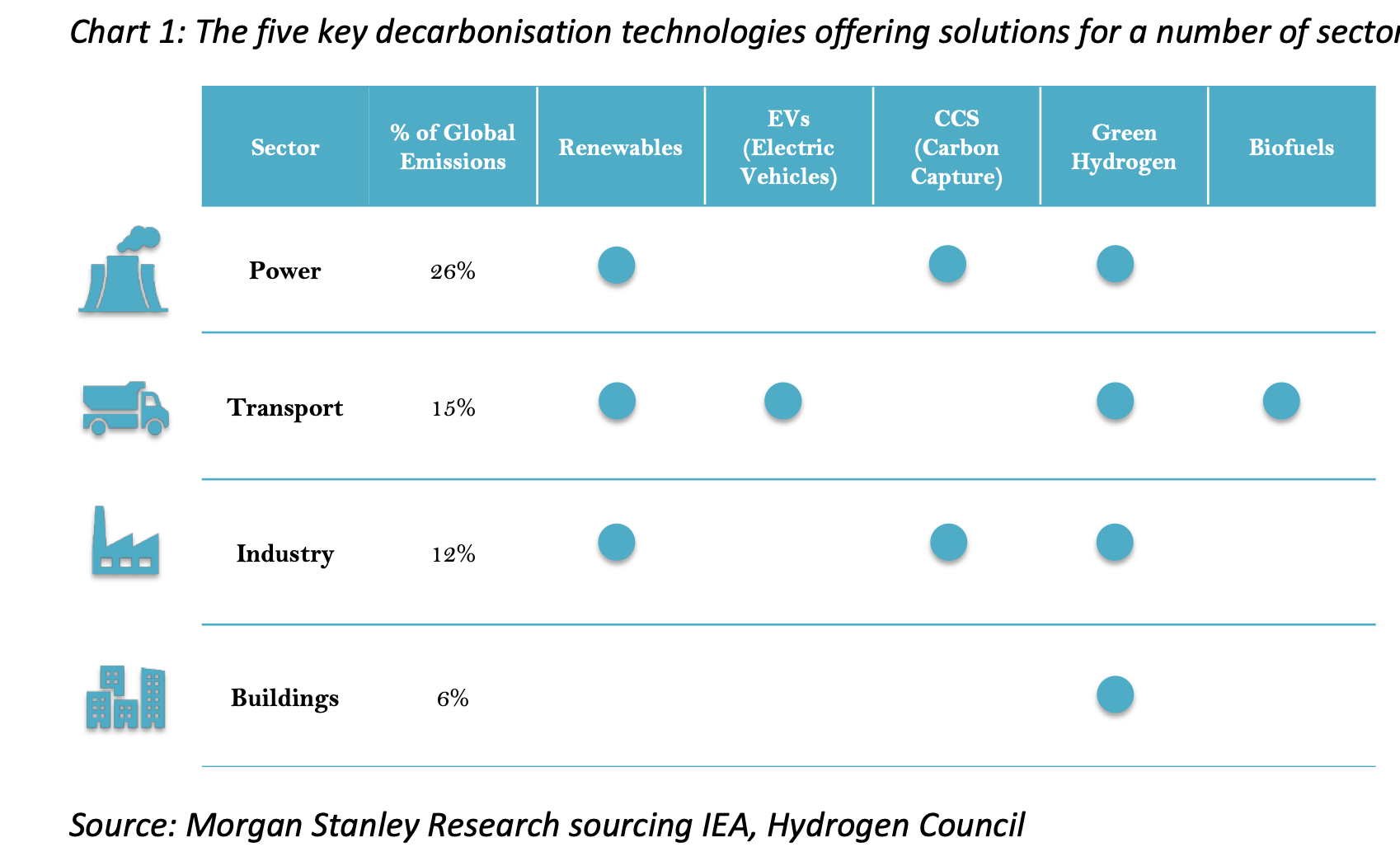

In 2019, Morgan Stanley estimated US$50 trillion of investment is required across five key decarbonisation technologies (primarily in the energy space) over the next 30 years if we hope to meet the Paris Agreement objectives. This equates to investment of US$1.6 trillion a year.

In this wire, we focus on two key carbon-emitting industries: energy/electricity and transport.

Power sector

Electricity generation is a core contributor to CO2 emissions, averaging around 25% of all global carbon emissions. Transitioning to a net-zero world is near-impossible without a commitment to decarbonise the power sector.

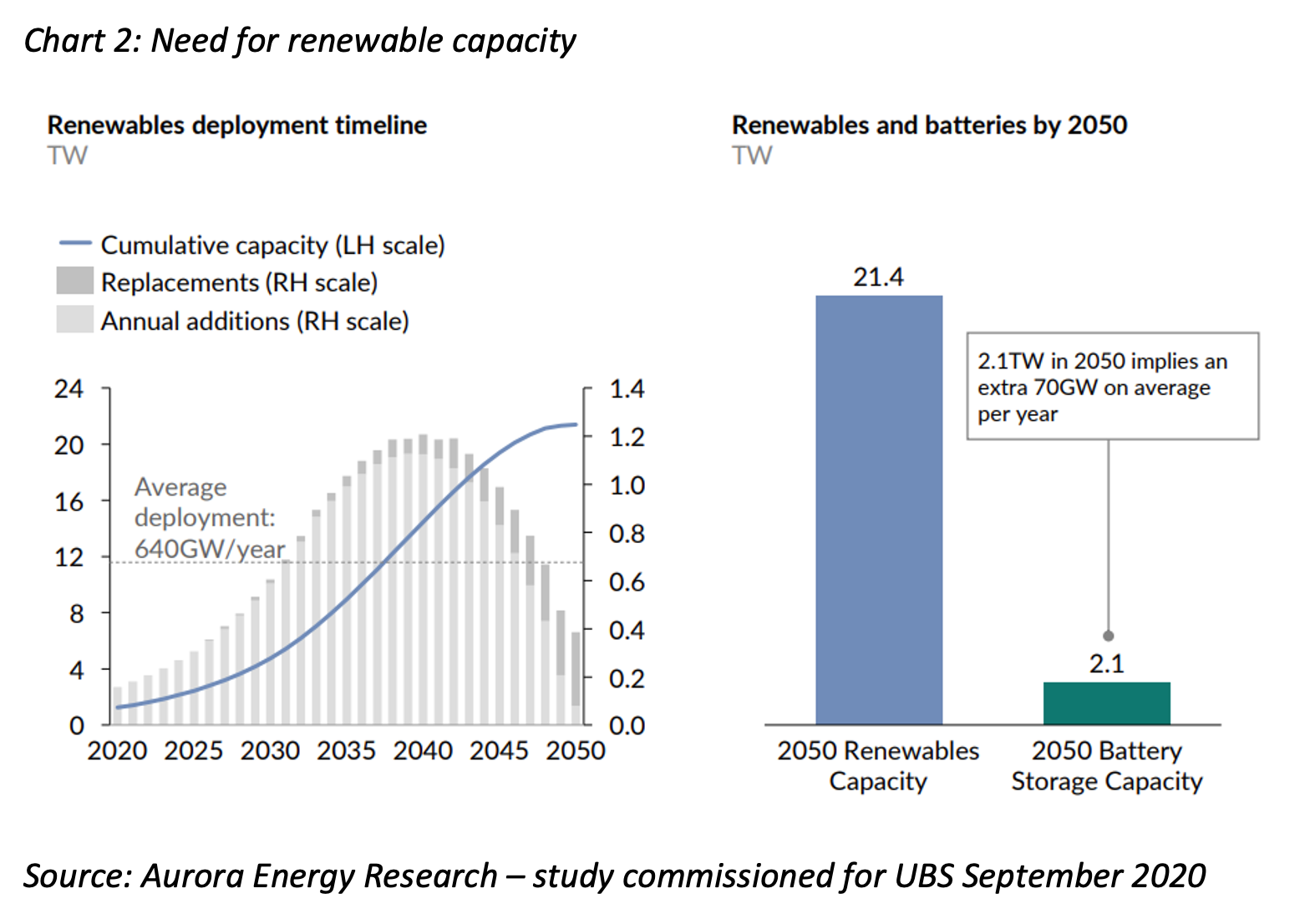

The commitment to the target is real and has increasing political and social support, despite the ongoing scepticism about the world’s ability to achieve this. Doing so will require significant investment in the form of increased green energy capacity (wind, solar, and hydro), transmission and distribution infrastructure to get zero-emission electricity where it is needed, as well as strengthened security of supply through large scale energy storage.

It is also widely accepted that this challenge of carbon neutrality cannot be practically met with the cost and capability of technology as it is today. In other words, we must assume some major improvements in technology, and a continued lowering in its cost to feasibly implement carbon neutrality by 2050, while ensuring electricity affordability for customers (balancing environmental goals with social obligations). New clean technologies such as utility-scale batteries, green hydrogen, and carbon capture and storage all need to play a role.

Utility stocks globally are recognising the important role they need to play in this transition. 4D favours those that have been forward-thinking and are capitalising on the opportunity, such as:

- pure-play renewables companies (e.g. EDPR), or

- companies that are integrated along the value chain (e.g. Iberdrola in Spain, and US company NextEra Energy).

Transportation

The transport sector is another big emitter, accounting for around 15% of global CO2 emissions. Energy demand from the transportation industry is expected to grow rapidly between now and 2050. Most of this increased demand will come from road transportation but aviation will grow at the fastest rate, as a result of an emerging middle class. As such, to deliver a greener world, focus must also be directed at greener transport. We believe this will largely come at a cost to users. But investment in infrastructure can help reduce this burden and create greener mobility; for example, catering for electric vehicles and ‘clever roads’.

Motor vehicle penetration has grown rapidly over the last century. This has environmental ramifications at several levels, including:

- the sheer number of emitting cars on roads;

- congestion levels compounding emissions; and

- demand for materials and more roads.

Today, cars account for around 7% of global greenhouse gas (GHG) emissions. Again, without a revamp of the sector, decarbonisation targets are, in our view, unachievable.

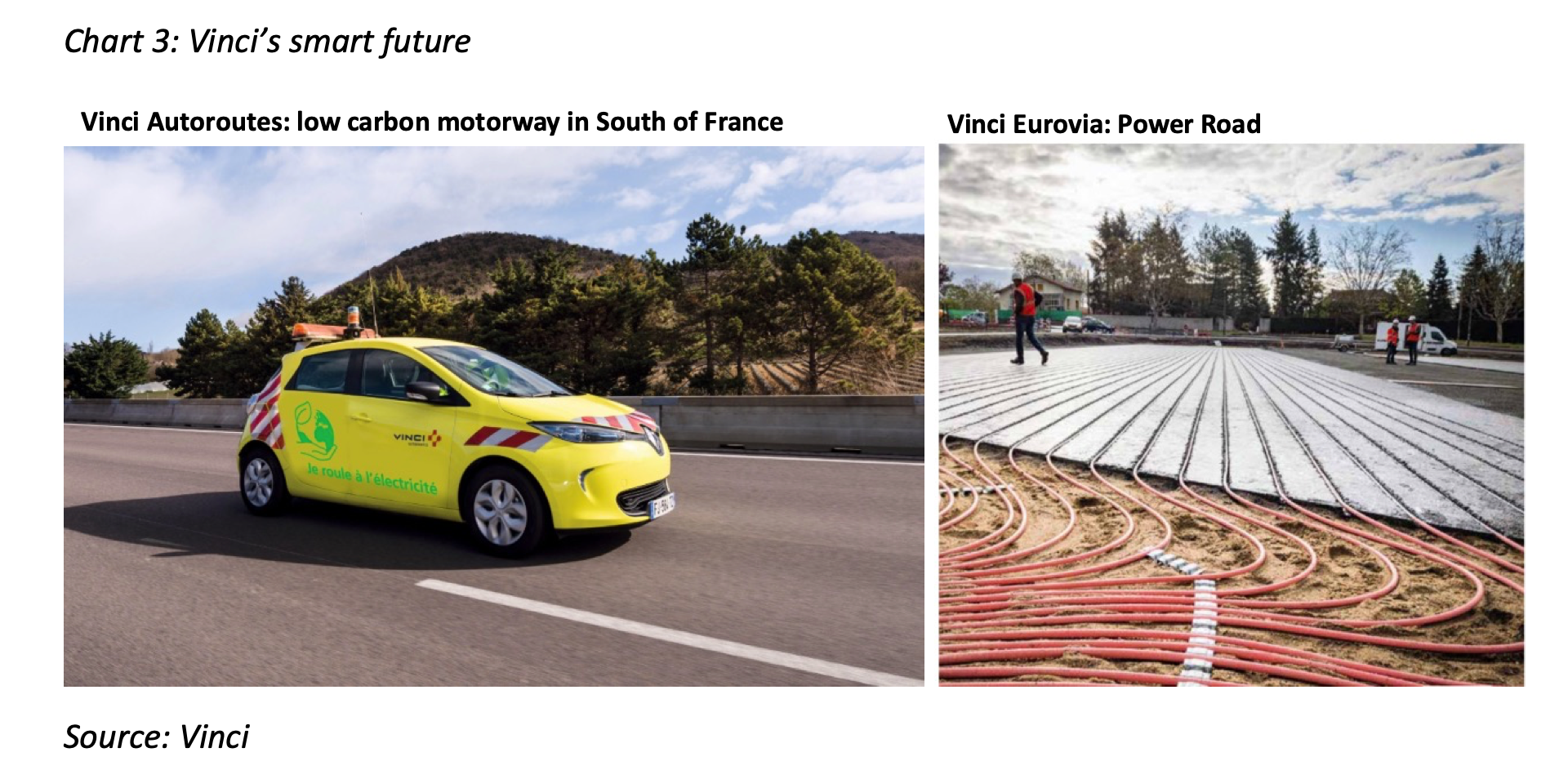

As infrastructure investors, we seek to identify those companies that are thinking ahead to the future of road transportation. This includes Ferrovial and Transurban (ASX: TRS), which are both heavily involved in the build-out of managed toll roads across the USA that facilitate dynamic tolling, allowing operators to manage traffic flow with tolls to optimise the user experience and reduce overall travel times/congestion. Vinci (Europe) has very ambitious environmental targets at the group level, including a 40% reduction in its carbon footprint by 2030.

Source: Vinci

Air and sea must also play a role, and we see green hydrogen as a game-changer in these areas.

- We favour airports that adhere to climate goals and support overall industry emissions reduction. For example, Vinci’s airport group was among the first airport operators to develop a global environmental policy to reduce its airports' carbon footprint. Fraport is considered an environmental leader (according to ESG provider ISS), with CO2 emission targets of -65% by 2030, and an aim to be carbon-free by 2050 in Frankfurt.

- In the maritime sector, support from infrastructure players will be needed to ensure facilities are in place to cater for larger vessels or newer designs supporting alternate fuel sources.

Decarbonisation is going to happen, and the goal of Net Zero is not achievable without the right forms of infrastructure investment across both the energy and transport sectors. This represents a significant, multi-decade investment opportunity for infrastructure investors such as 4D. We want to be part of the solution.

Livewire's Decarbonisation Megatrend Series brings you feature articles that go deep on carbon-neutral investing, alongside special episodes of Buy Hold Sell, a megatrend investing podcast and interactive panel sessions with leading fund managers. You can find all the articles, videos and the podcast on our dedicated Series page.

2 topics

1 stock mentioned

1 fund mentioned