Five reasons we’re backing Qualitas

What makes a good small cap investment? For us, it starts with two non-negotiables: 1) earnings forecasts that are in line with or ahead of market expectations, and 2) valuation upside.

But what makes a great investment? Add three more to the list: 3) a strong, shareholder-aligned management team, 4) supportive macro tailwinds, and 5) a fundamental market misunderstanding of the business. ASX listed private credit firm Qualitas (QAL) has all 5 in spades.

Qualitas is a specialist private credit investment manager focused on real estate and infrastructure, and a key holding in the Firetrail Australian Small Companies Fund - Active ETF. It provides funding to borrowers who are often underserved by traditional banks—typically property developers and commercial real estate owners. In this piece, we break down the five reasons why Qualitas stands out in our portfolio.

1) Qualitas is set to beat market expectations for earnings growth over the short and long term.

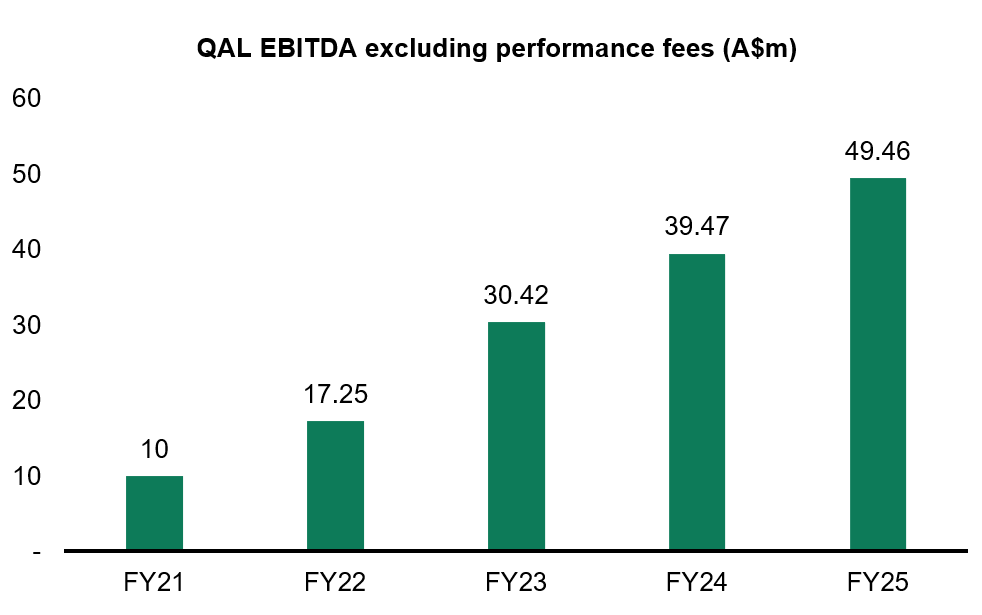

Qualitas listed on the ASX in December 2021. At the time of listing, a whopping 53% of earnings were from performance fees. Fast-forward to FY 2025 and this ratio has fallen to just ~10%. Over the past 4 years, funds management EBITDA excluding performance fees has grown 48% pa - a clear indicator of underlying performance.

Put simply, since IPO, not only has the business achieved extraordinary compound growth against a subdued macroeconomic backdrop, but the earnings quality has improved markedly. Looking forward, we expect earnings growth can be maintained at greater than 20% over the next 3 years, well ahead of market expectations. Short term, QAL’s update at the Macquarie Conference highlighted FUM deployment up 30% year on year and hence we see potential for a performance fee driven beat to FY 2025.

Figure 1: Earnings excluding performance fees has grown significantly over the last 4 years - a clear indicator of underlying performance

2) Qualitas has ~50% valuation upside from current levels.

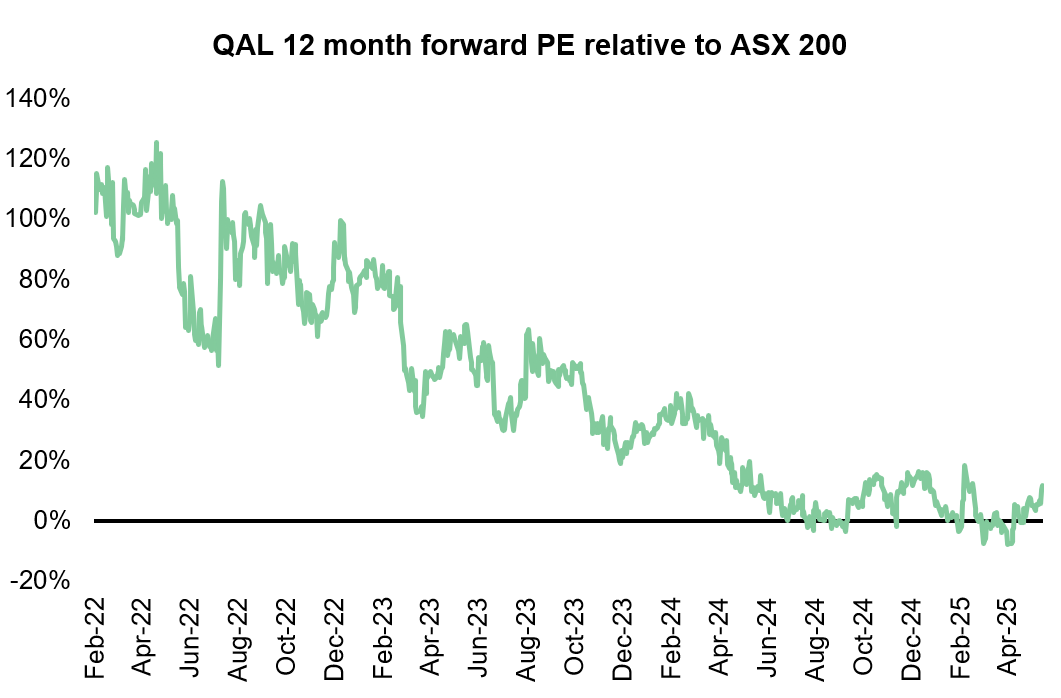

Despite Qualitas growing earnings strongly over the past several years, the stock has derated from a ~100% PE premium to the market at IPO to a ~10% premium today. With such a wide historic trading range, what is fair value?

Comparing Qualitas to both local and global peers we believe a PE premium of 30% to the ASX200 is appropriate. On this basis we see ~50% upside should our FY 2027 earnings forecasts be delivered. Bullish? Maybe.

However, we need not look far back to see a transaction in the private market to justify this. In March, NPS (Korean pension service) and Townsend (global investment manager) acquired a ~4.2% interest in fellow private credit operator Metrics on an implied PE multiple of ~36x. Given the strategic nature of that deal, we suspect the multiple was favourable to the buyer—suggesting a supportive benchmark for valuations in the private market.

Figure 2: Qualitas has derated from a ~100% PE premium at IPO to a ~10% premium today, but we see a 50% upside from here

3) Qualitas has a strong & aligned management team who are managing the business for the long term.

Qualitas was founded in 2008 by Andrew Schwartz and Mark Fischer. Since this time FUM has grown by ~36% CAGR (compound annual growth rate). Andrew and Mark own ~27% of shares on issue.

There are many reasons why companies seek to list their businesses. In our experience the best opportunities come from coinvesting with founders who need additional capital to accelerate growth. On listing, the company raised A$335m to do exactly that. By December, Qualitas had ~A$180m of cash invested alongside clients with another ~A$153 ($105m in cash + $48m in short term underwriting positions) available to support future growth via co-investment.

What does this tell us? Qualitas is taking a long-term approach to growth, focusing on per share value creation rather than short term wins.

Desktop research will only get you so far. Before making any investment, we speak to as many people in a company’s ecosystem as possible—whether this be customers, suppliers, or competitors. In an industry that often prides itself on scepticism, the feedback on Qualitas was, and continues to be, unanimously positive.

4) Qualitas will benefit from 4 key macro tailwinds in the next 5 years.

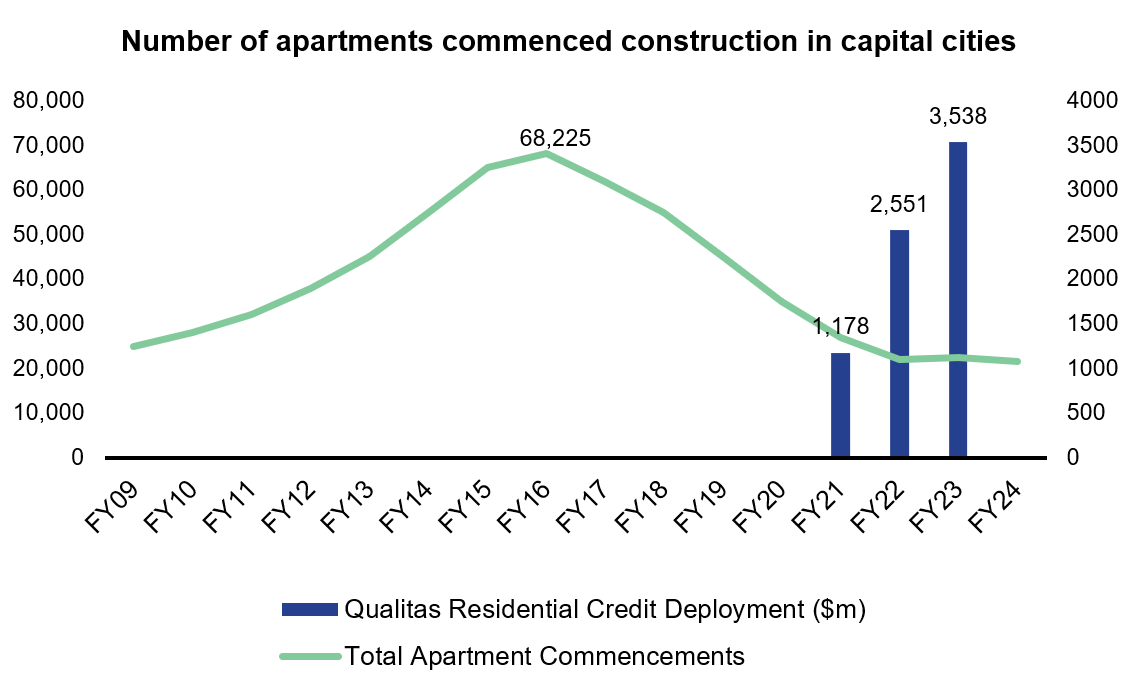

As mentioned, Qualitas is an alternate lender focused on lending to residential property developer. It should come as no surprise then that past few years have been tough. The number of apartments commencing construction in capital cities has fallen ~70% since the peak in 2017, as rising costs and oversupply made many developments uneconomical.

Meanwhile, demand remains strong—estimated at ~75,000 new apartments per year— yet current industry plans are set to deliver less than half that. This imbalance is not sustainable, and prices will need to rise to incentivise new supply. We're already seeing this play out: in Q4 2024, off-the-plan apartment prices rose by 34% year-on-year.

Beyond housing, Qualitas stands to benefit from three additional macro tailwinds:

- Structural growth in Australia’s private credit market

- Margin expansion as interest rates fall

- Increased capital flows into non-US markets, driven by global economic and policy uncertainty

Figure 3: A housing undersupply is building—one of four macro tailwinds driving long-term demand for Qualitas’ capital

5) Qualitas is fundamentally misunderstood – and mispriced.

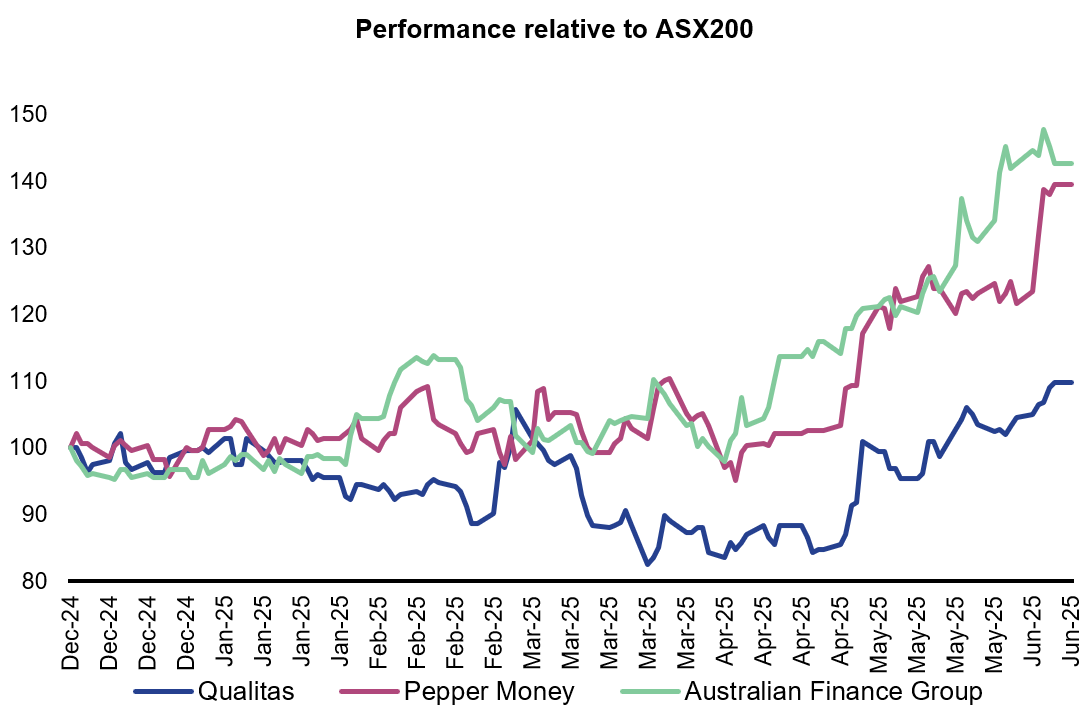

Like much of the private credit market (and small cap financials in general), QAL is a fundamentally misunderstood business. Based on recent share price performance, it seems the market views Qualitas as a high-risk, leveraged net interest margin (NIM) lender—fully exposed to bad debts—rather than a high-growth, high-return-on-capital fund manager. This view is reflected in the company’s relative underperformance compared to peers (figure 4).

But that perception doesn’t align with reality. Given the structural growth opportunity and QAL’s institutional client base—who understand risk-adjusted returns—we believe it’s only a matter of time before the market re-rates the business appropriately.

Figure 4: Despite strong fundamentals, Qualitas has lagged peers—pointing to a market mispricing

Summary

With strong earnings momentum, a clear valuation re-rating opportunity, founder-led alignment, structural tailwinds, and persistent market mispricing—we believe Qualitas offers a compelling opportunity for long-term investors.

4 topics

3 stocks mentioned

1 fund mentioned