Forager's five ways to catch the best fish

Livewire Markets

"You're not going to catch any fish with your hook in the bottom of the boat," said Steve Johnson CEO of Forager Funds.

For Johnson, the investing world of international equities is as deep and vast as the ocean itself, and finding the best stocks means sticking to the fishing holes you know. With 98% of all equities listed on exchanges outside Australia, there are more places to fish for investors looking for the next big catch. So, Forager has laid out a few of its best strategies for stock picking.

In Forager's recent investor webinar, Johnson alongside two co-portfolio managers Gareth Brown and Harvey Migotti provided a rundown on their biggest wins from the past quarter. With recent one-year returns of 86.88% (with 17% pa since inception) for the International Shares Fund, Forager is building formidable momentum in both stock picking and knowing when to sell.

Here are the lessons they shared on how to catch the best fish:

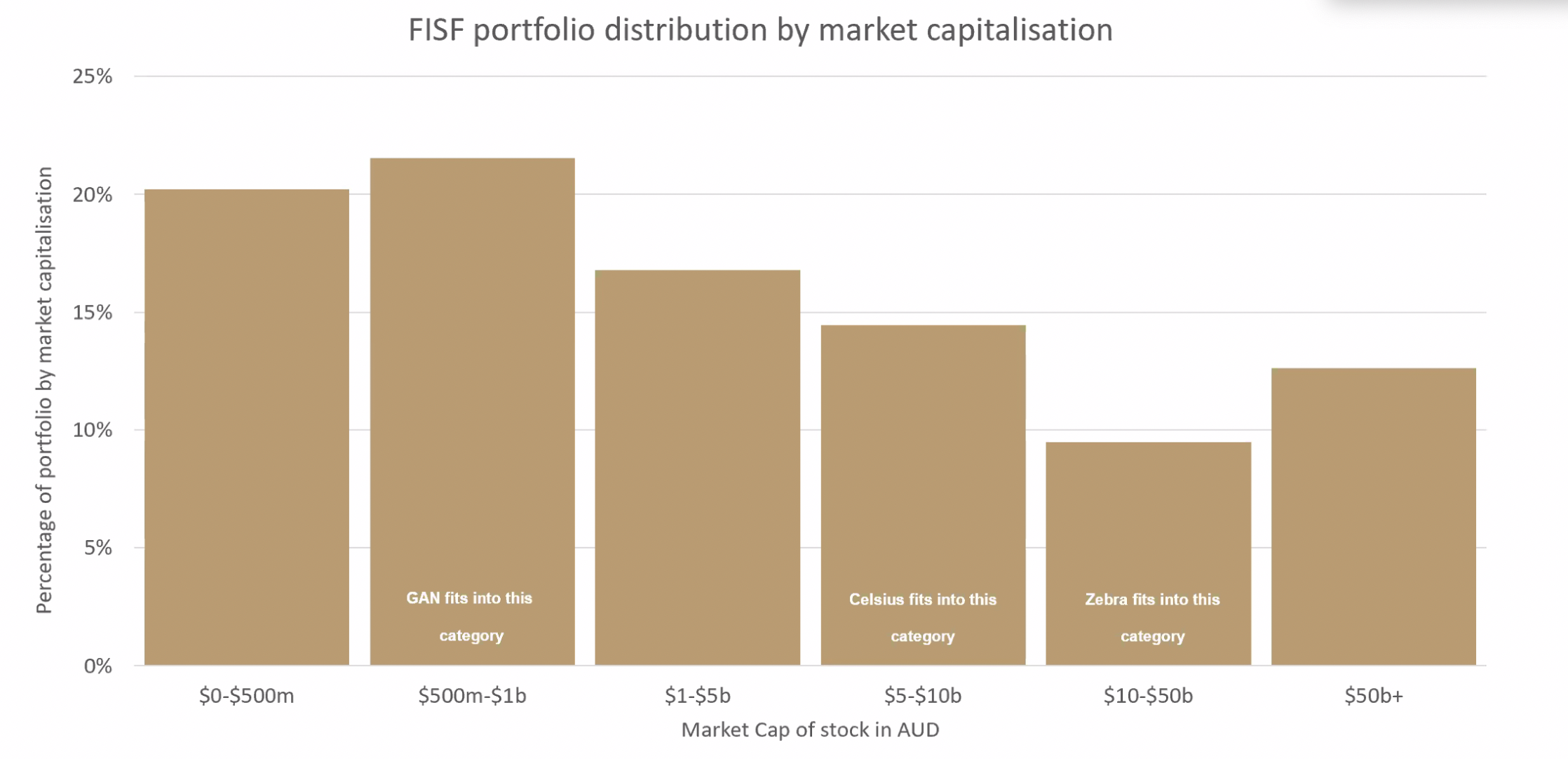

- Broad market cap mandates have kept them agile... So don't be constrained by a small-cap vs large-cap dichotomy. Forager invests across a range from less than $500 million to over $50 billion market cap

Source: Forager Funds.

-

Volatility creates opportunities - you need to stay nimble to take advantage of market movements.

- Expand your expertise. Create "ponds" for yourself where your primary knowledge overlaps with investment strategy and leverage that knowledge globally. Johnson gives an example:

"The more erraticism we've seen in markets, the better the chances are for finding good businesses trading well below fair value," said Brown.

"Volatility also gives us the opportunity to upgrade the investment portfolio. Selling, for example, a good stock that might offer a perfectly respectable 10 to 12% per annum returns and upgrading that into another that is offering a 20% perspective return."

"You've got one business listed on the ASX in the online lotteries business.

(But) if you take that expertise globally, you've got 10 or 20 businesses where you can use that expertise and find the best of those opportunities, and continually recycle your capital into new ones over time," said Johnson.

- Create a concentrated portfolio of the best ideas Sticking to your best ideas doesn't mean following macro trends off the edge of a cliff.

"We're not thematic investors, we're not out there trying to pick macro themes. We're out there trying to buy stocks and preferably find stocks that have got some macro tailwinds behind them. But we're out there trying to find individual businesses that are materially mispriced by the market. And we think those businesses can earn us well above average over long periods of time," said Johnson.

- Know when to sell. This is often the hardest part of investing and one that investors agonise over. For Forager, it comes down to one question: what do you want your portfolio weighting to be?

"Let's not buy or sell it, let's get the weighting to where we want the weighting to be," said Johnson.

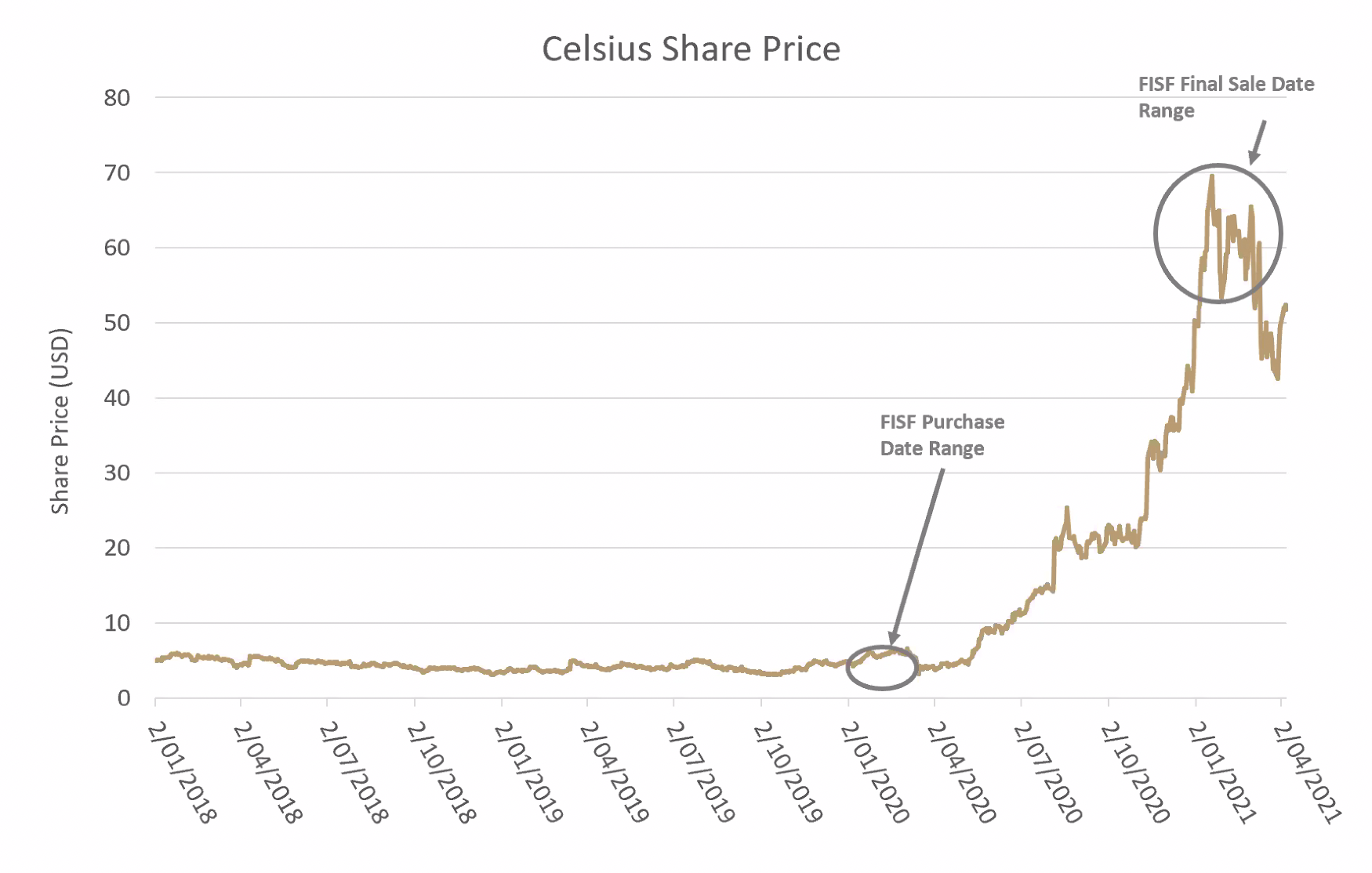

And this is what they did with one of their biggest earners. Celsius, which you can see in the chart below, provided over 800% return for Forager over a relatively short period. For Celsius, Johnson said, he didn't think about selling it down but rather reweighting the portfolio "taking it from seven down to five, then five down to three, and then three down to one".

"We've had a very, very busy conveyor belt of new ideas over the last 12 months. And so, once the stock is trending closer to fair value you don't think it's as asymmetrical an opportunity as it was...the sell can be a very easy process," said Brown.

Two stocks to fold and one to hold

As value investors, Forager seeks out businesses that are misunderstood, distressed or perhaps under-researched and all are within their realm of expertise.

"They outline some of the sorts of different investments that we aim to put into the portfolio, different market cap, different industry, different geographies, different risk, but they're all stocks where we feel we have an edge," said Brown.

Forager gave investors a detailed run-through on some changes over the past quarter, including two stocks they've recently divested, Celsius and GAN Ltd, which were timely exits. What was interesting about Forager's strategy was their self-admitted interest in acquiring more of Celsius should the stock price pullback. They also hinted that GAN Ltd was replaced by a mystery stock in a similar industry.

Celsius Holdings

NASDAQ:CELH + 850%

"It's hard to find businesses like this in Australia, and the market doesn't have a lot of companies that are listed and certainly not some of these smaller pure plays," said Migotti, which is why they have had to go hunting on the Nasdaq for this particular stock.

Celsius' primary product offering is energy drinks (like Red Bull or Monster) which are targeted towards a health and fitness scene.

"Even though 99 out of 100 of these startups in these kinds of spaces fail, particularly the drinks sector, the ones that succeed can succeed big time. We're talking about 40-50% EBITDA margins and tremendous growth as you penetrate and gain that consumer love and presence across the space," he said.

The above chart shows the rapid growth of Celsius and a timely exit from the stock. Forager acquired the stock when it was still considered a small-cap.

Source: Forager/ Bloomberg.

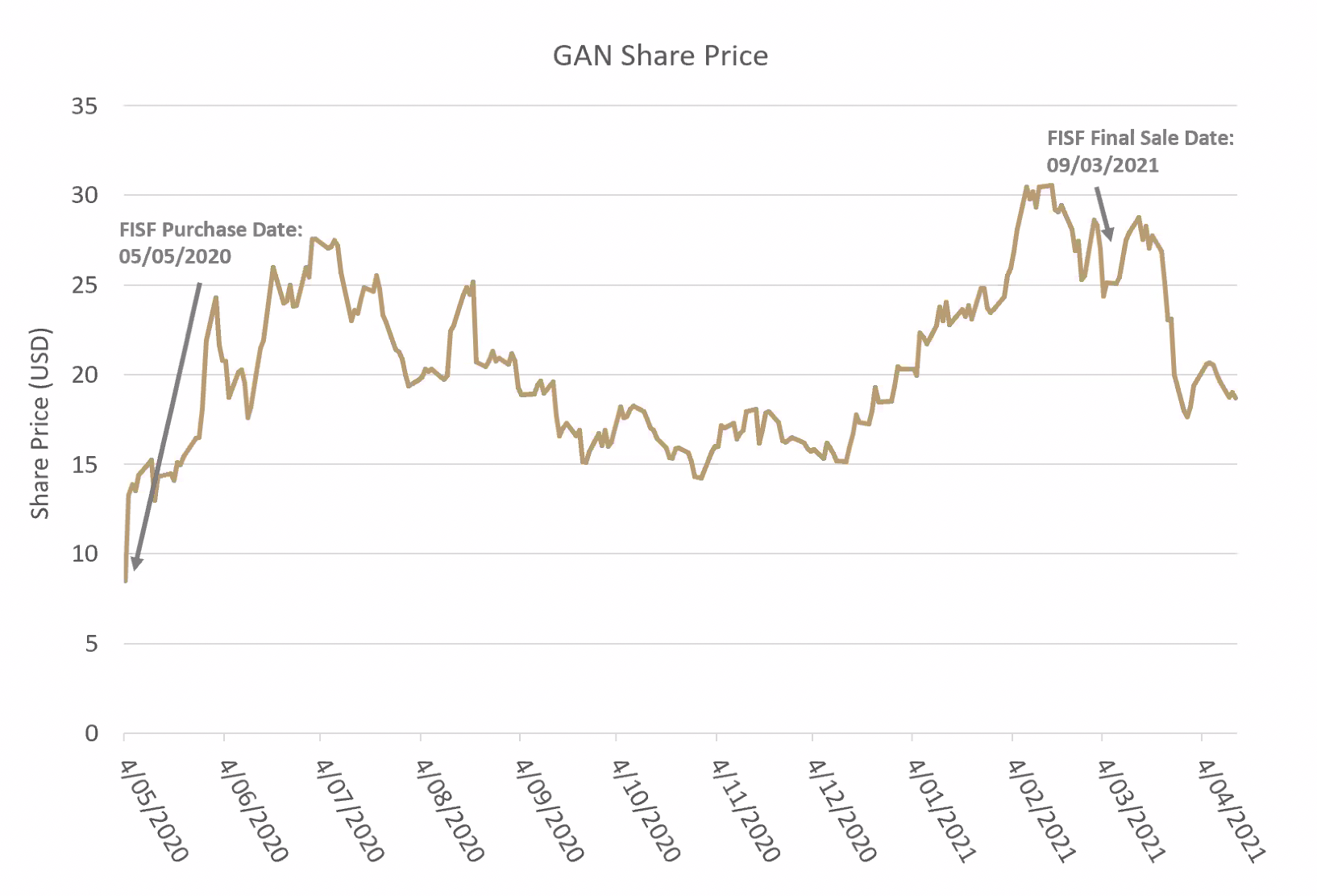

GAN Ltd

NASDAQ:GAN +48%"GAN is a gambling software business that we did very well out of, particularly in the last financial year," said Brown.

But, once the well had run dry, Brown had no qualms about divesting from this asset and into another similar one.

"We recently bought another stock that reminds us quite a lot of GAN, it's in a similar industry, it has a similar growth profile and hopefully we also do very well out of that, we'll name that when the time comes," said Brown.

Sadly, we'll have to wait to discover what it is.

GAN was acquired by Forager when it listed on the AIM, before re-listing on the NASDAQ. Source: Forager/ Bloomberg.

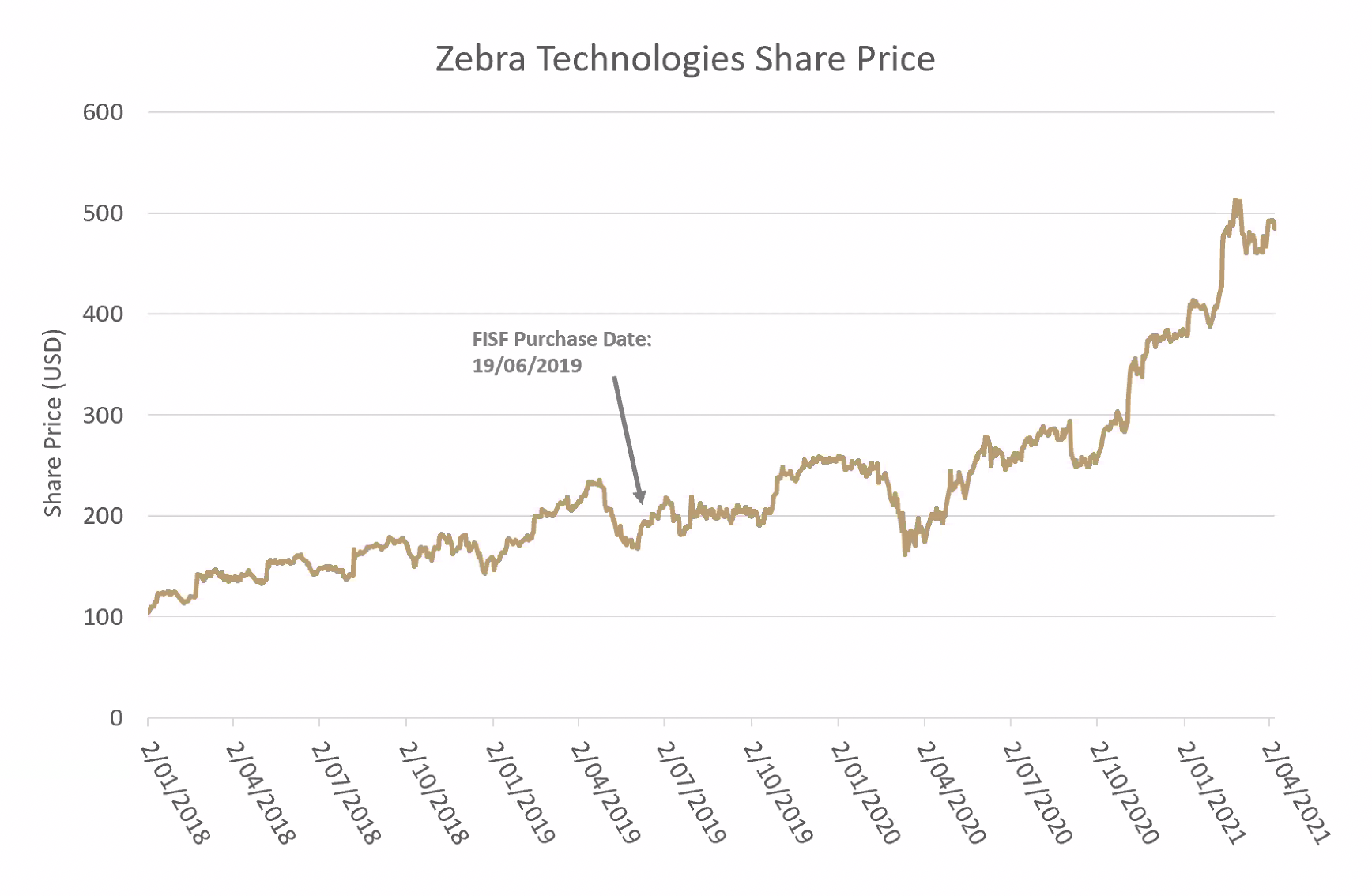

Zebra Technologies

NASDAQ: ZBRA +167%

"I love this company over the long term. It's a really large business... $25 billion market cap, but very under-researched," said Migotti.

"It's also a huge beneficiary of the whole e-commerce drive. Whether it's warehouse automation, where the products are used, or even some of these mail carriers like US Postal Service," he said.

Zebra Technologies provides the scanning technology for check-outs like those at Coles and Woolworths. It has a $25 billion market cap.

Source: Forager/ Bloomberg.

Conclusion

Back to Johnson's analogy about international equities and fishing, I think the key takeaway from Forager's strategy isn't necessarily about having a knack for stock-picking. It's having a knack for something and applying it to stock picking.

"We don't have any intention of covering that whole ocean of equities," said Johnson.

"We're out there trying to find fishing holes that we know, that we understand, that we have experienced and we want to find as many of those as we can. But then we want to assess the weather conditions and the tides and work out where the most appropriate places to be fishing at any point in time," he said.

"Now the difference between Australia and globally is those fishing holes tend to have a lot more fish in them."

As the saying from well-known value investor, Warren Buffett, goes "invest in what you know... nothing more" and it has served him well.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

3 contributors mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...