Four new stocks from Morgan Stanley's quant screens

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

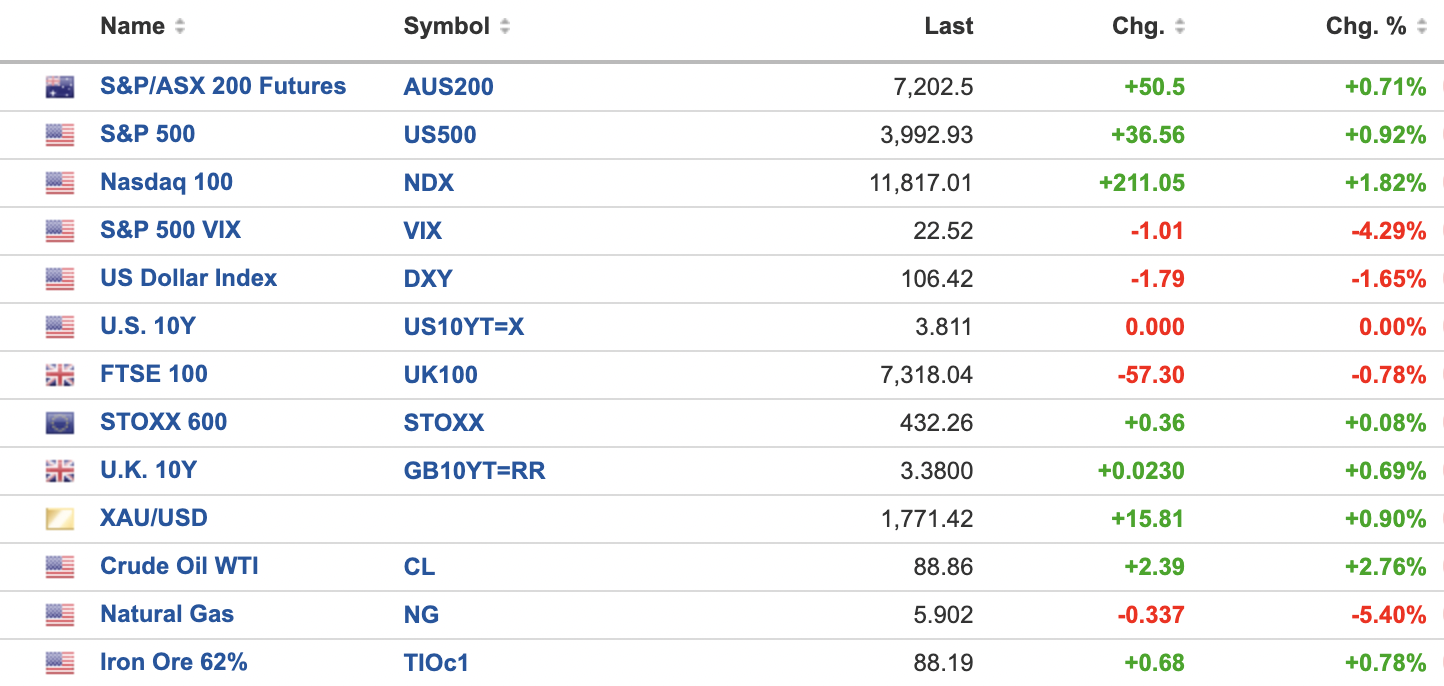

MARKETS WRAP

S&P 500 TECHNICALS

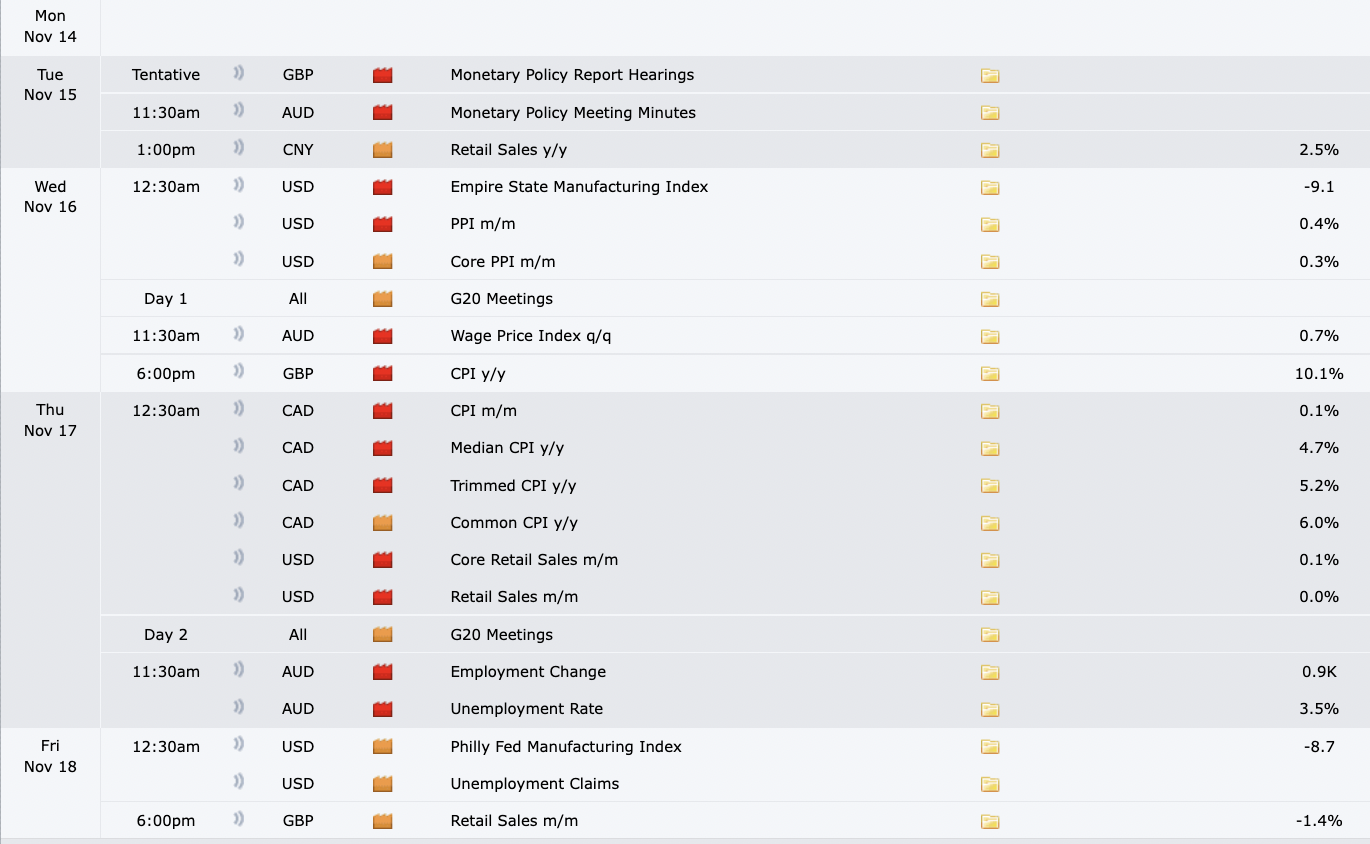

THE CALENDAR

If you were hoping for a quieter week, then I'm sorry to say it's not getting much quieter. After the RBA's latest meeting minutes on Tuesday, we get the wage price index and labour force figures on Wednesday and Thursday respectively. If the RBA's mantra of "keeping inflation expectations anchored" and its dream of a soft landing with flat to little growth in the unemployment rate are going to come true, then it needs to be reflected this week.

Overseas, US producer prices and Canadian inflation will dominate the chatter.

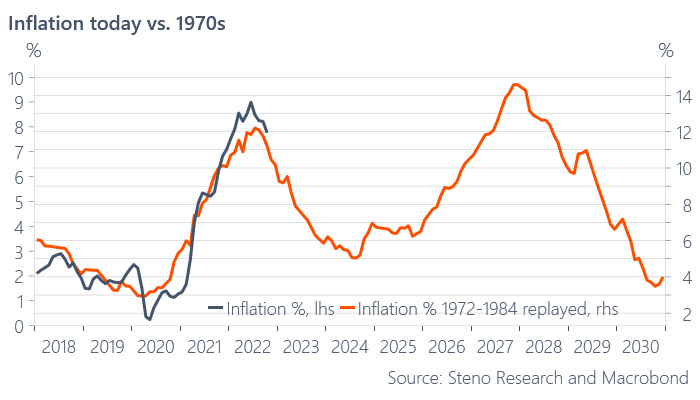

THE CHART

All through the last year, people have been saying how this period both reflects and not reflects the experience of the early 1970s. But if history is indeed going to repeat itself, then I have some bad news for you. The 1970s stagflation experience was actually two-fold before it finally dissipated. So while inflation is coming down now, you may want to hold that champagne before we know for sure we won't see a double top.

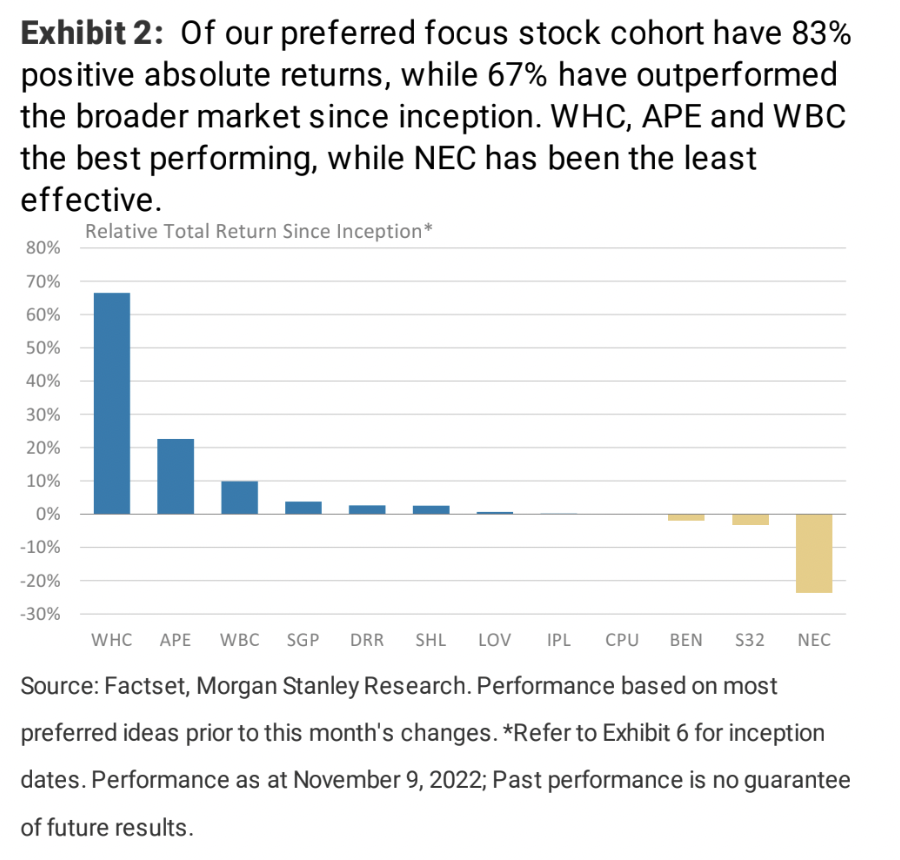

STOCKS TO WATCH

Today, we're getting all mathematical with you as we look at four changes to the model portfolio run by the quant team at Morgan Stanley. And if you're not normally a fan of math or you prefer another means of investing (qualitative, technical analysis, etc), then Morgan Stanley is proud to show what you're missing out on:

It should be said that their quant paper model is a mix of the team's qualitative analysis (i.e. all their best idea recommendations are overweight-rated) and sit near the top of its proprietary quintile system.

So let's delve into the ideas - first, the best ideas consisting of Telstra (ASX: TLS) and Altium (ASX: ALU). Incidentally, these two took out Stockland (ASX: SGP) and Westpac (ASX: WBC).

For Telstra, it's all about the increase in postpaid customers as well as what they believe is an undervalued InfraCo business. Plus, who doesn't love an increased dividend?

At Altium, it's all about the structural growth story given its leverage to the growth of Internet of Things (IoT), shorter product life cycles, and big data through its printed circuit board (PCB) design software. Plus, premium and resilient pricing is good news for this inflationary environment.

And making their way into the worst ideas list are AdBri (ASX: ABC) and Boral (ASX: BLD). The story here is well-known: the end of stimulus for construction companies, tighter lending standards, and the property insolvency issue.

TODAY'S TOP READ

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

6 stocks mentioned

1 contributor mentioned