Four of Nikko AM's favourite ESG investments

There's no longer room for scepticism: doubt, and you'll miss out. The trio of concerns at the heart of ESG investment now have the attention of world leaders, and global capital is sniffing the wind and stepping into line.

The big issue is climate change. Governments are spending trillions of dollars to meet global targets that will require massive responses from markets.

In a recent webinar hosted by Yarra Capital Management, we took viewers through the top-down approaches to ESG that are shaping demand, providing case studies of bottom-up responses from four nimble companies making the most of this rapidly changing field.

We look to the EU and the US to discern trends in the global ESG movement and break down the immense spending packages they have set up. We then zoom in on examples of adaptive companies like John Deere and HelloFresh, plus a couple more you probably don't yet know but will want to.

In this wire, we'll walk you through the compelling case for ESG as a sphere of investment exposed to unstoppable and accelerating change.

Look past threat to opportunity

There's potential for great reward in ESG, but there's more to it than merely making money. The best of ESG thinks broadly, analyses deeply and is founded in hope. Governments and businesses can recognise problems and opportunities, and strive to improve things.

The smartest governments and corporations know business as usual is no longer an option and are making adjustments to save the planet.

Voters want change

Electorates in the West have been of that opinion for some time, and the pandemic has accelerated that demand for change, specifically as it relates to the climate.

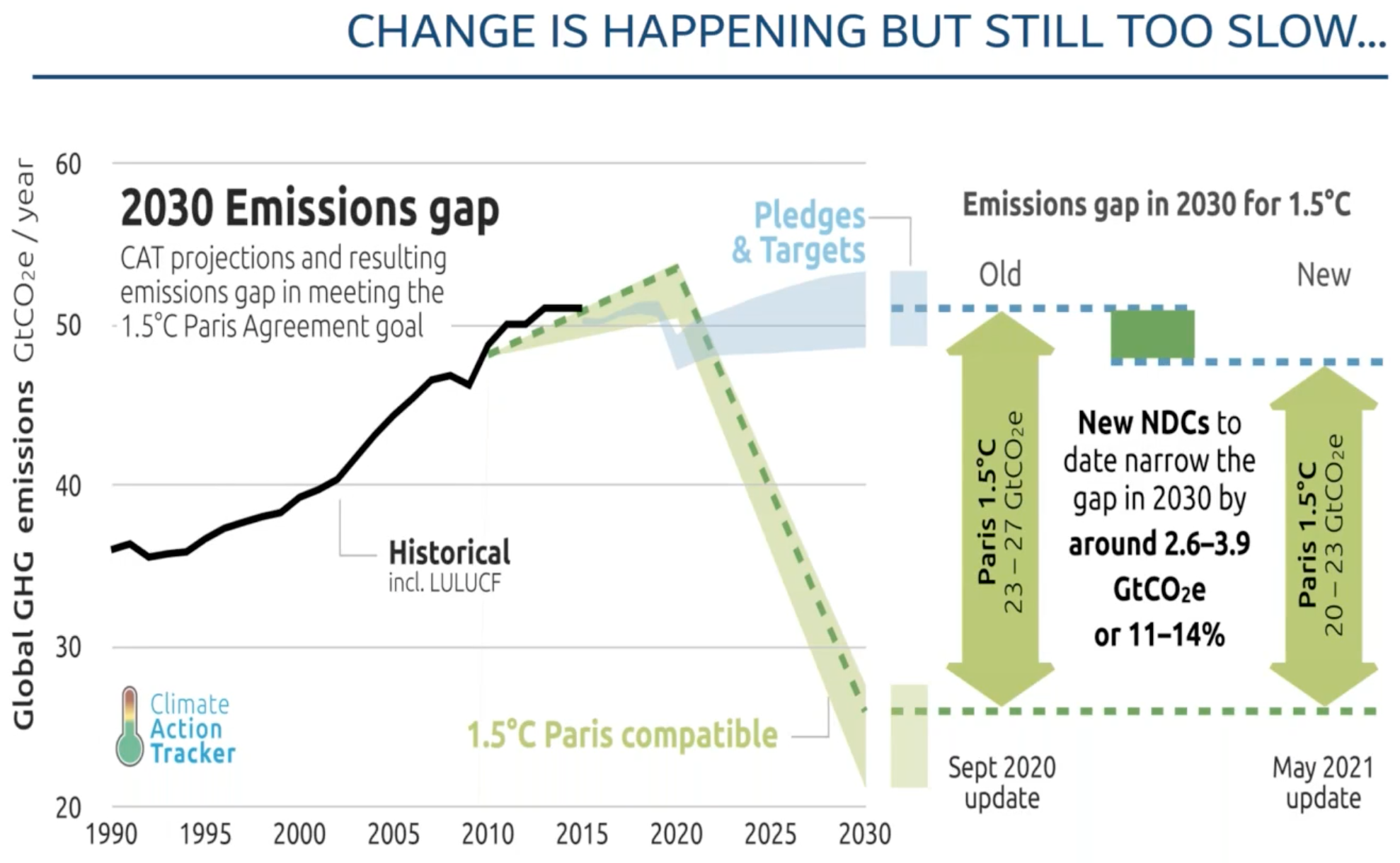

Source: ClimateActionTracker.org, May 2021

We're talking trillions

Government can be seen as the top-down regulatory element that shapes demand. The EU Green Deal, for example, has identified US$1 trillion in spending priorities.

Signatories to the 2015 Paris Agreement, intended to limit global warming to 1.5 degrees, have so far failed to control carbon emissions.

The chart above shows the gap between Climate Action Tracker projections of greenhouse gas (GHG) emissions and the 2030 goal of the Paris Agreement.

At the moment, we're turning up to an earthquake to tidy up with a dustpan and brush. There's lots going on, but there needs to be a heck of a lot more.

We think with that underlying strength of opinion within electorates, it can only go in one direction and that's going to cost money. It's also going to need new technologies, new solutions and new ways of consuming, and delivering the services that we've all grown accustomed to throughout our lives.

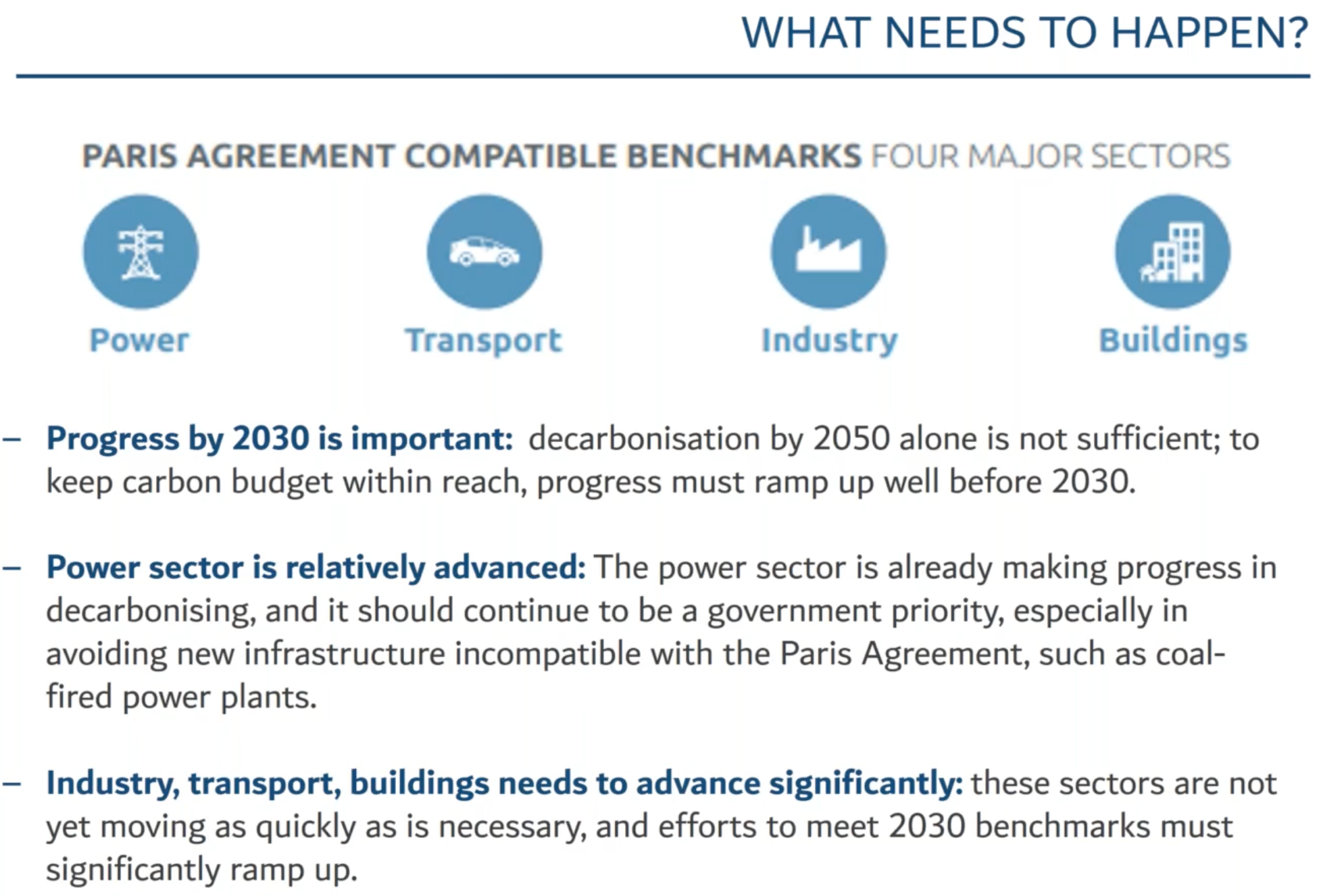

Source: ClimateActionTracker.org, May 2021

The main offenders

As the above Climate Action Tracker image shows, there are four main offenders when it comes to global warming.

1. Power

De-carbonisation and energy transition within the power sector is progressing but must accelerate.

There's absolutely no point in buying a Tesla car if it is powered by a coal-fired power station. We need to shift that energy infrastructure, and there is good progress being made.

There are many companies we think that can benefit from the additional spending on grid infrastructure, but also in the renewable sources of energy.

2. Transport

We can make a good deal of headway in reducing the emissions of transportation, and the electrification process will continue.

3. Industry

The adaptation of heavy industry to modern environmental requirements is a long-term trend that is less spoken about.

How do we tackle areas such as cement production and steel production, and reduce the carbon intensity of these? That's incredibly difficult.

The segments of power and transport require a lot of new infrastructure, which has implications for heavy industry. There's a chicken and egg here. There's going to be a lot of steel required and there's going to be a lot of materials that need to get dug out of the ground. How do we do that in a way that's compatible with these targets?

4. Buildings

Serious gains should be made in the buildings we live and work in, a sector that is often overlooked.

Factors include climate control via insulation and air-conditioning, stormwater runoff, and energy use. There are new products coming that can really transform that — in roofing in particular.

There are some big construction markets where a lot of change is required or otherwise we're just not going to get towards our targets.

Importantly, this backdrop provides an excellent hunting ground for some great companies that can get exposure to some of these positive trends.

The American approach

There are major spending increases planned for US infrastructure, totalling US$1,209 billion in new spending plus baseline spending over the next eight years. This increased spending is being allocated to some of the key carbon emission heavy sectors such as power infrastructure, US$109 billion; and public transportation, US$50 billion.

The US also aims to reduce water waste by making treatment and sewerage systems more efficient, and plans on spending US$21 billion to improve water infrastructure.

Then there are traditional elements in the infrastructure budget, such as roads, cement and steel production which will need to be more environmentally friendly.

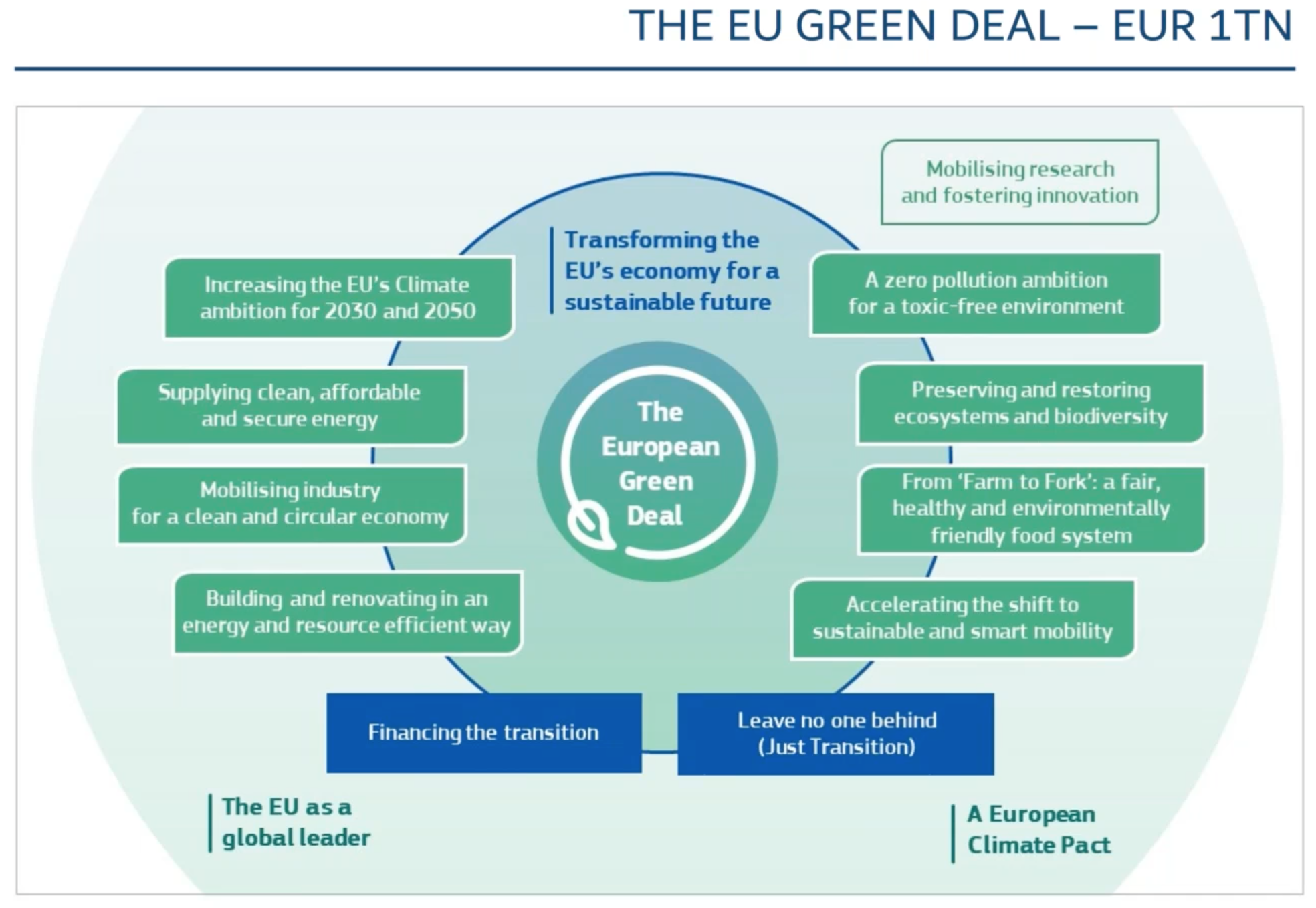

Source: The EU, December 2019

The EU goes back to the farm

The EU’s US$1 trillion Green Deal has ambitious climate targets and a transition plan towards clean, affordable, and secure energy.

The left side of the above graph shows that the EU is pressing industry and construction to move towards a clean, circular economy, with greater reuse of recyclable and renewable materials. A similar drive is also underway in construction.

The right side of the graph shows the EU's special attention to farming and food provision, and mention of ecosystems and biodiversity.

The farm lobby has obviously been very powerful over the years, but there are some interesting and very specific targets that the EU have, which is to make organic farming more prominent and to reduce the emissions profile of farming overall.

The objective is to improve at the supply chain from the farm to the plate, making it more efficient, healthy, and environmentally friendly.

There are some very powerful forces that will be brought to bear in terms of change within that supply chain and where the profit share is going to be, and which business models may thrive and which may not.

Eating better

The EU's emphasis on farming and food provision moves the discussion in the direction of ecosystems and biology.

Improving the supply chain from farm to plate will also strengthen food quality, sustainability, and affordability, while reducing emissions.

The EU also aims to preserve biodiversity and to improve the richness of the soil, which is often degenerated through intensive industrial scale farming. And it wants to make sure there's a fair economic return in the food chain and to increase the use of organics.

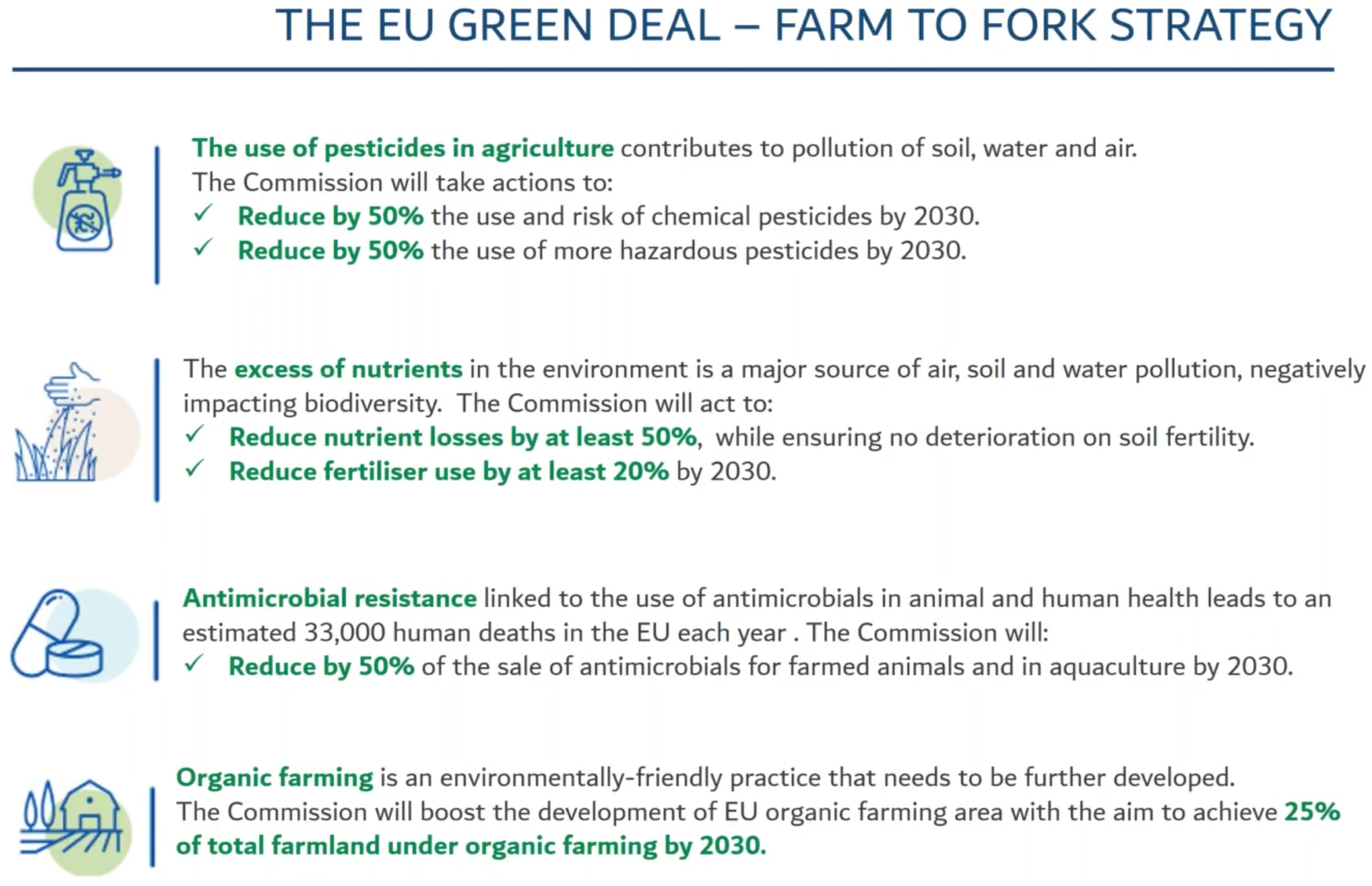

Source: The EU

These are big goals, and delivering them on an industrial scale brings a major challenge. The image above shows how the EU also aspires to huge reductions in the use of fertilizers, pesticides, and antibiotics in farming.

They're looking for a far lower use of antibiotics in farming and for much better animal husbandry to be put in place. And that will likely have some powerful ramifications for some chemical companies.

The pandemic has placed the issue of contagion — between people and between species — front and centre. The EU Green Deal aims to reduce the sale of antimicrobials for farming by 50% by 2030.

Anti-microbial resistance is not something you hear many fund managers talking about, but we think this could be a very big theme within the food industry.

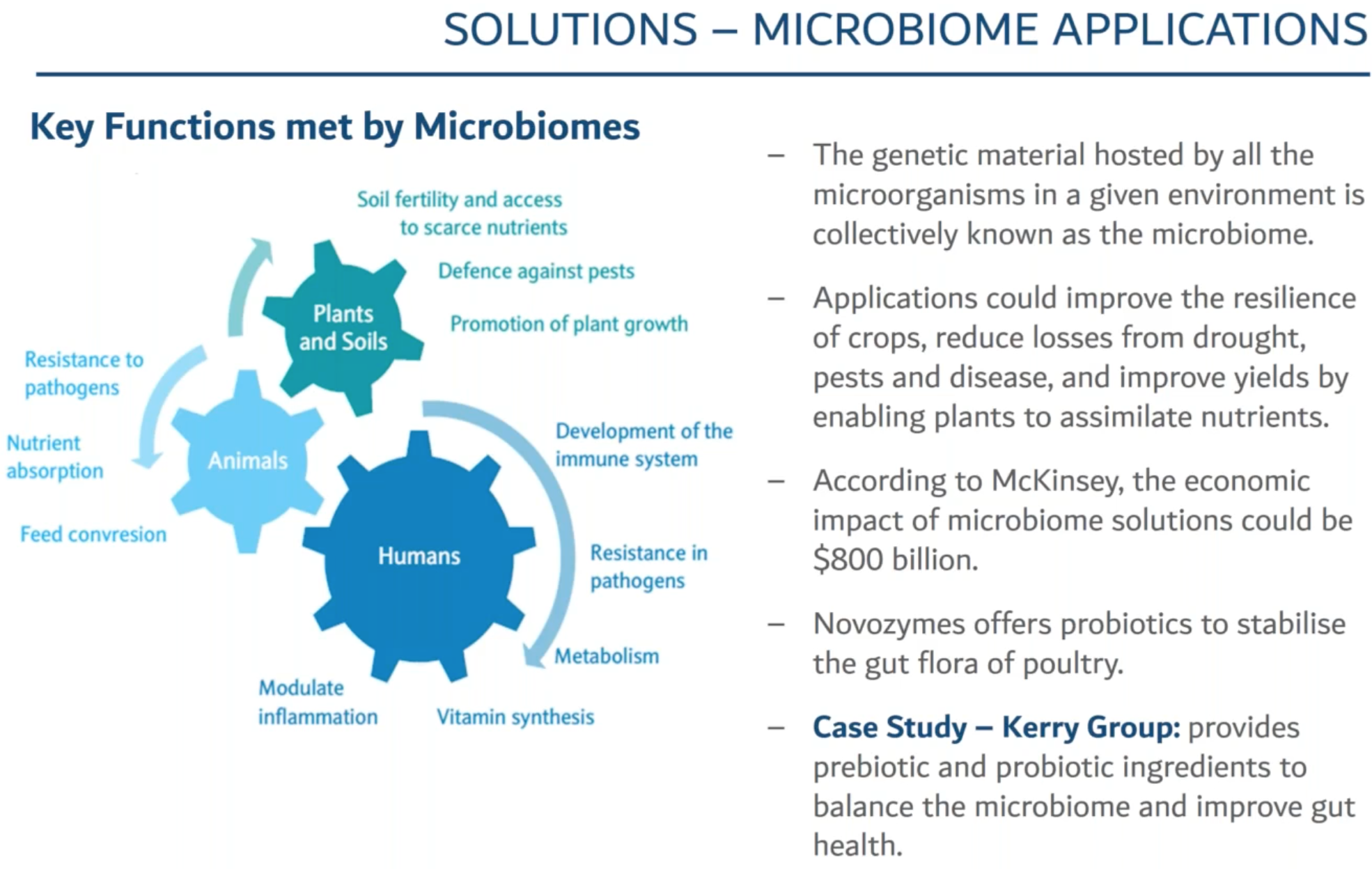

Source: Barclays, "Science of tomorrow: microbiomes", January 2021

The gap left by reduced antibiotic use and the scientific attention being paid to the microbiome (the world of microorganisms, particularly as it relates to animals and people) will create opportunities for food and chemical companies, as seen in the image above.

Learning from the innovators

Let's switch from a top-down view to consider the bottom-up activity of four of our current ESG investments. These are some of the stocks we've been investing in which we believe are well placed to benefit from some of this change.

Carlisle Companies

The American industrial conglomerate Carlisle Companies has made some surprising adjustments to its business model.

The business is investing in roofing to make the built environment much more environmentally friendly and resource efficient.

Source: Carlisle Companies, August 2021

The image above shows some of Carlisle's products, including popular roof-garden assemblies that can be fitted to existing and new buildings. They're seeing huge demand for these.

Roof gardens can dramatically reduce the storm water that runs off and improve the insulation of a building and increases its energy efficiency.

We aim to buy into businesses like Carlisle at sensible valuations. They offer strong and visible growth and improving returns on capital.

And because they've historically been industrial companies, people generally don't think of them as secular growth stocks.

With the requirement to improve the energy efficiency of the built environment and the grants that are there to install many of these systems, we can see great long-term potential for these businesses.

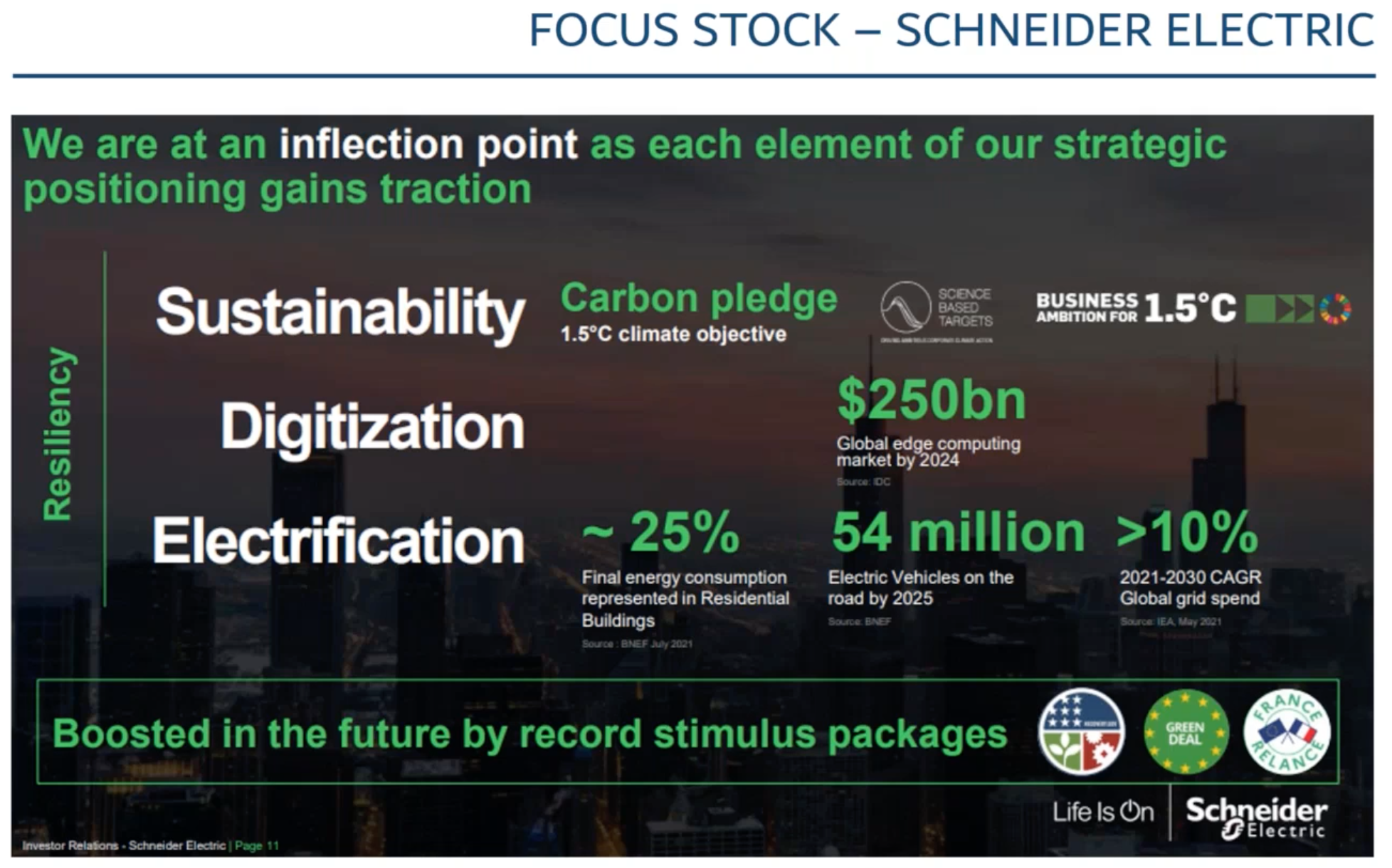

Source: Schneider Electric, August 2021

Schneider Electric

Schneider Electric is a French multinational ideally placed to benefit from the move towards electrification and automation.

Webinars, Zoom calls and remote working wouldn't be possible without the combination of the power infrastructure and the great data capacity we enjoy today.

Schneider Electric are at the forefront of both of those changes, along with industrial automation. They have some great products which help factories to automate and to produce much more efficiently.

There is also a power infrastructure element. As this energy transition moves forward and we need to reinvest in the power grid, it really puts Schneider right in the centre of that change.

Source: Schneider Electric, August 2021

Schneider's investor relations team expects a compound annual growth rate in global spending on energy grids of more than 10% between now and 2030. If you just put that in context of what we've seen over our lifetimes, that's a multiple of the rates of growth observed in power infrastructure investment so far.

Technological changes including the move towards 5G mobile communications and edge computing are also likely to work to Schneider's advantage. Power management is another market segment it can address.

The company is now seeing accelerated growth and improving return on capital, and all from a history of mundane, industrial conglomerate type growth rates with pretty low valuations.

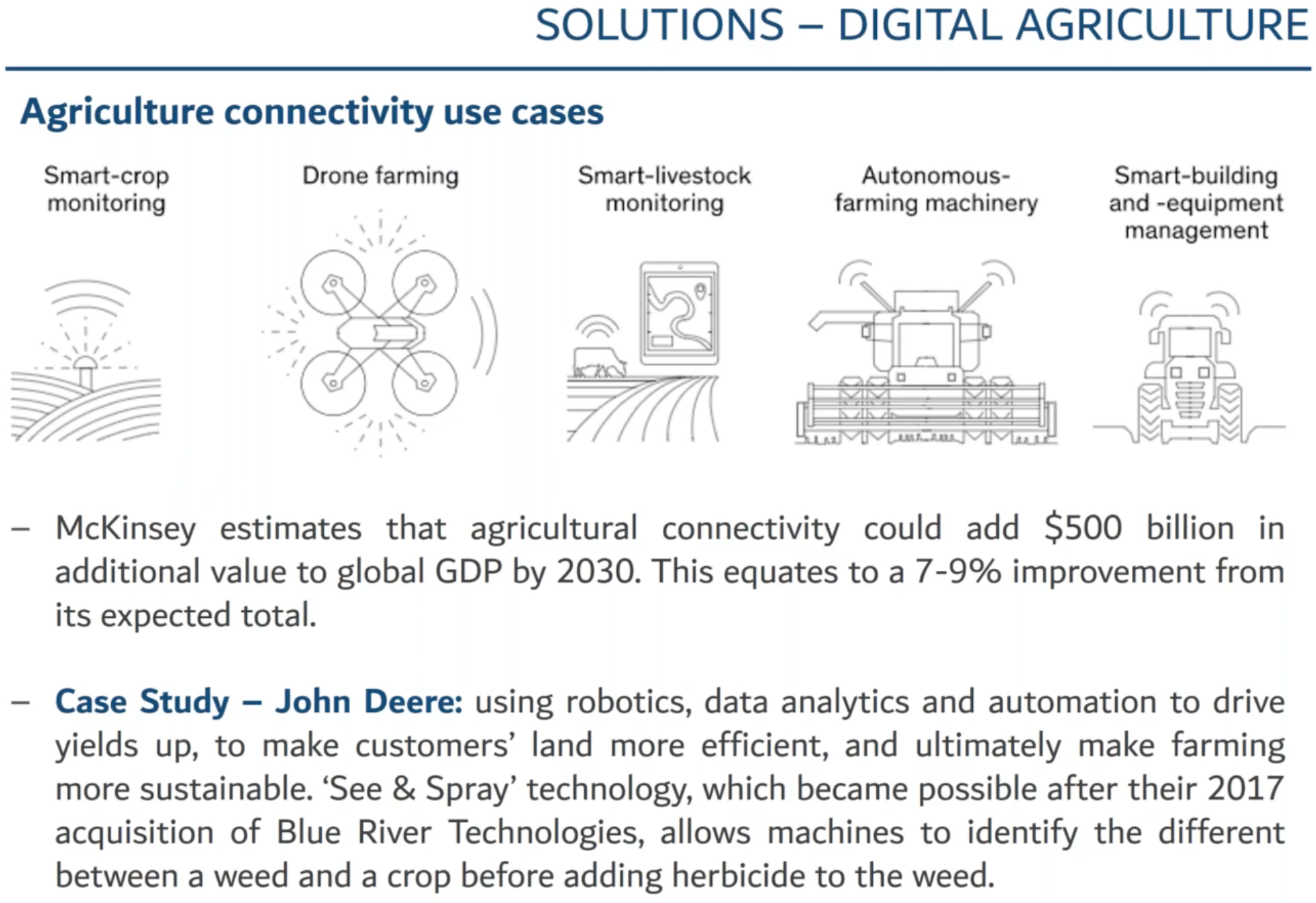

Source: McKinsey, "Agriculture's connected future: how technology can yield new growth", October 2020

John Deere

The US manufacturer John Deere demonstrates how new technology is disrupting conventional farming (refer image above).

John Deere is making substantial progress digitising its products and enabling farmers to target pesticides much more accurately. That will enable them to become more efficient, reduce consumption and lower the impact on soils.

Capital equipment costs will rise for farmers but spending on chemicals will lessen.

The demand and order book for John Deere right now is strong and we believe this is an attractive long-term growth story.

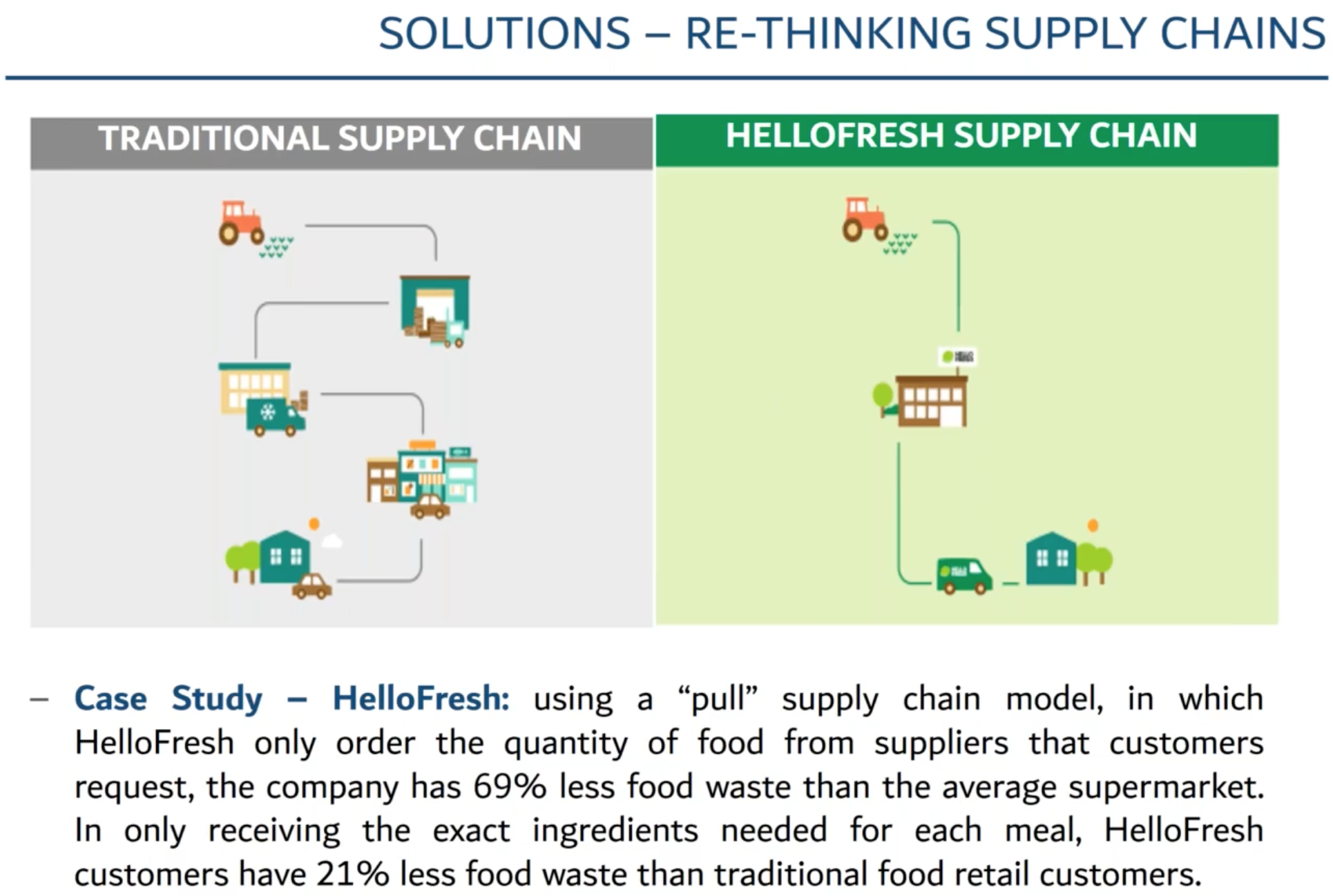

Source: HelloFresh

HelloFresh

The case study of HelloFresh, another favoured investment, shows the efficiencies that are possible in the food chain (see above).

The model of a supermarket chain having stores close to people's houses is an inefficient way to distribute food.

There's a lot of waste in that supply chain that goes from farmer to wholesaler onto another distributor, eventually to the store, then to your home. A good chunk of that food then ends up in the bin.

With HelloFresh, you order a week in advance, you know exactly the portions that you're going to receive, and you know the meals you're going to have.

HelloFresh orders what they require from suppliers, take it direct to their distribution centre and send it straight to your home.

It's stored, it's used within the week and, critically, there's very little waste. There may be a bit of additional packaging, but the carbon footprint of their supply chain is far lower than the traditional means of distributing groceries.

Source: Nikko AM

Nikko AM's approach to ESG

There's lots of change going on within ESG and people worry: Is my fund ESG friendly? Where does it rank? And what are the ratings? These are all very important questions. We take a lot of care. We have very strong ESG ratings.

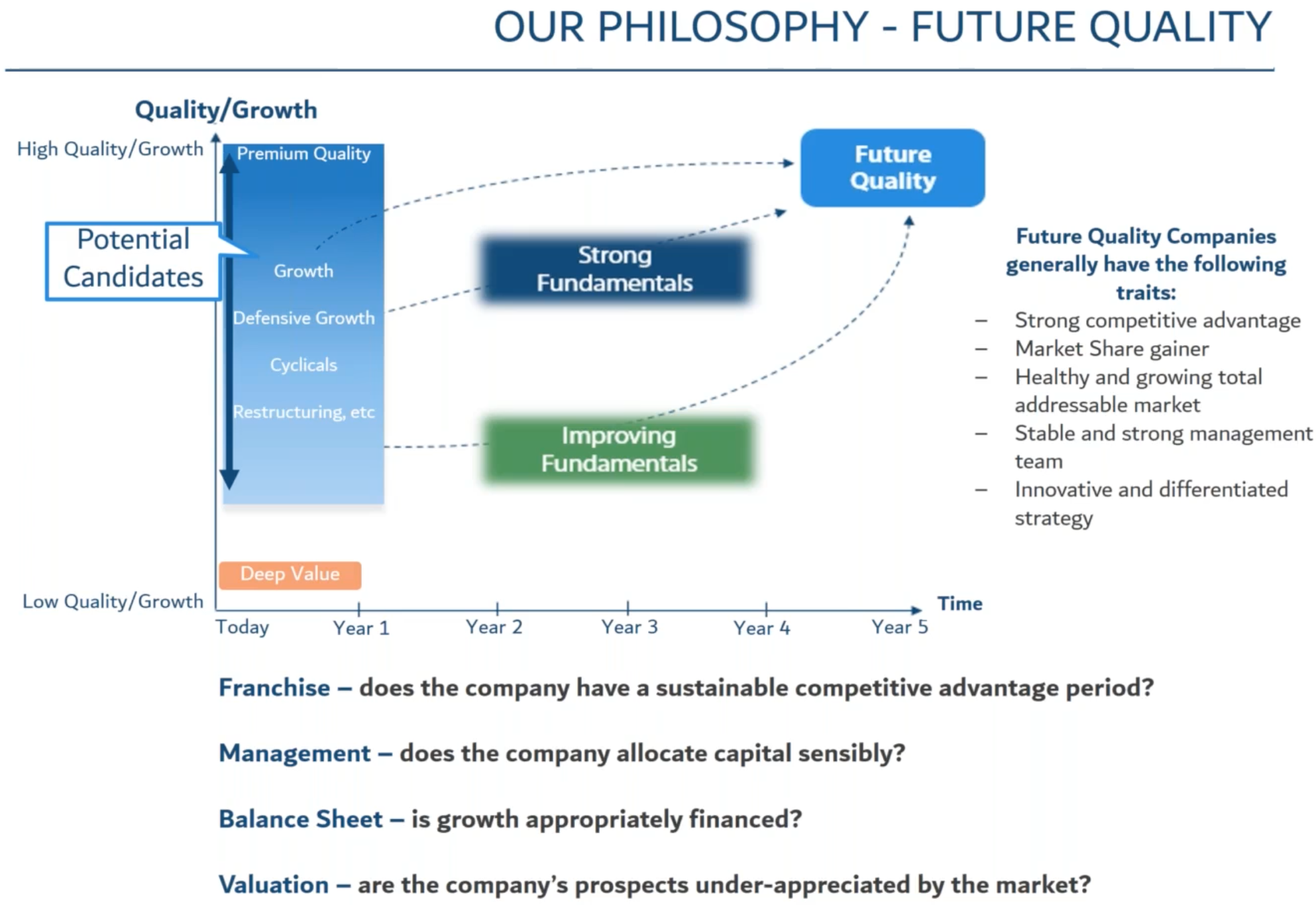

But critical to where we're going with our investments is staying focused on what we call our future quality philosophy.

Per the above graph, Nikko AM’s global equity team looks for factors such as:

- Improving returns on capital.

- Solid growth.

- Sensible valuation.

- How capital is allocated into new projects, e.g. Carlisle and its roof garden systems, and Schneider and its power infrastructure technology.

That gives you a flavour of some of the disruption that's underway and how we’re responding to the challenge, staying true to our philosophy of focusing on these future quality businesses.

4 topics

1 fund mentioned

.jpg)

.jpg)