Four risks in a market priced for perfection

Since the lows of early 2020, markets have experienced a pretty strong recovery. Yet, with equity markets at an all-time high, while most of us are locked up at home, it can still be easy to feel like there is an imbalance in the world.

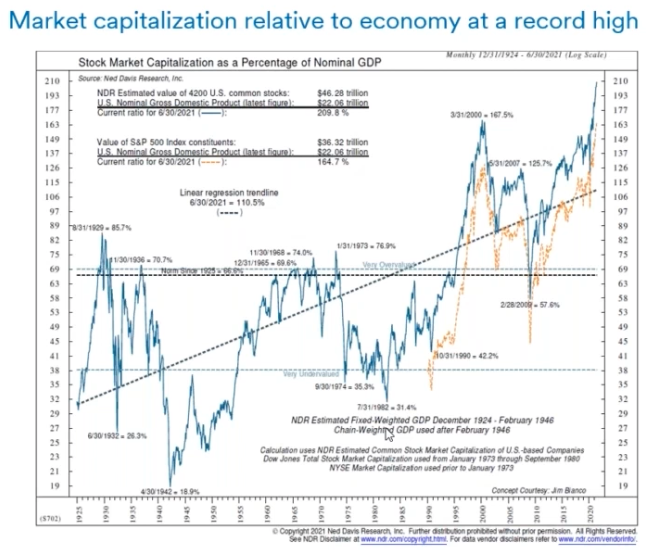

I came across this chart below recently, showing the US equity market since the 1920s. The combined value of the share market relative to the output of the economy has never been this high.

However, just because valuations are stretched doesn't mean that equity markets are going to fall over. Then again - as this trend continues things become increasingly vulnerable.

At the peak of the tech boom, relative to the economy, the market was trading at about 1.7 times GDP. In 2008 markets were sitting around 1.3 times and today markets are 2.1 times GDP. So for us, these figures give us some pause to think about where markets are and how much further they can go from here.

The reason: Interest Rates remain low

Considering how interest rates have moved over time is very valuable here to help gives us some clues as to what might actually happen going forward and how sustainable those past gains actually are.

We know that one of the key things driving markets has been simply low interest rates, the idea being that if there's no return available in the bank, anything is better than that.

While dividend yields have come down, a significant premium has remained to any low-risk interest-bearing security. And that's created positive support for equity markets. But it's not great if you had cash in the bank.

The other factor is that if we allow for inflation, real interest rates across the board have been, close to zero or negative. So we've had free money supporting the economy and particularly the share market over the last two years.

Valuations in context: Markets are priced for perfection

Equities

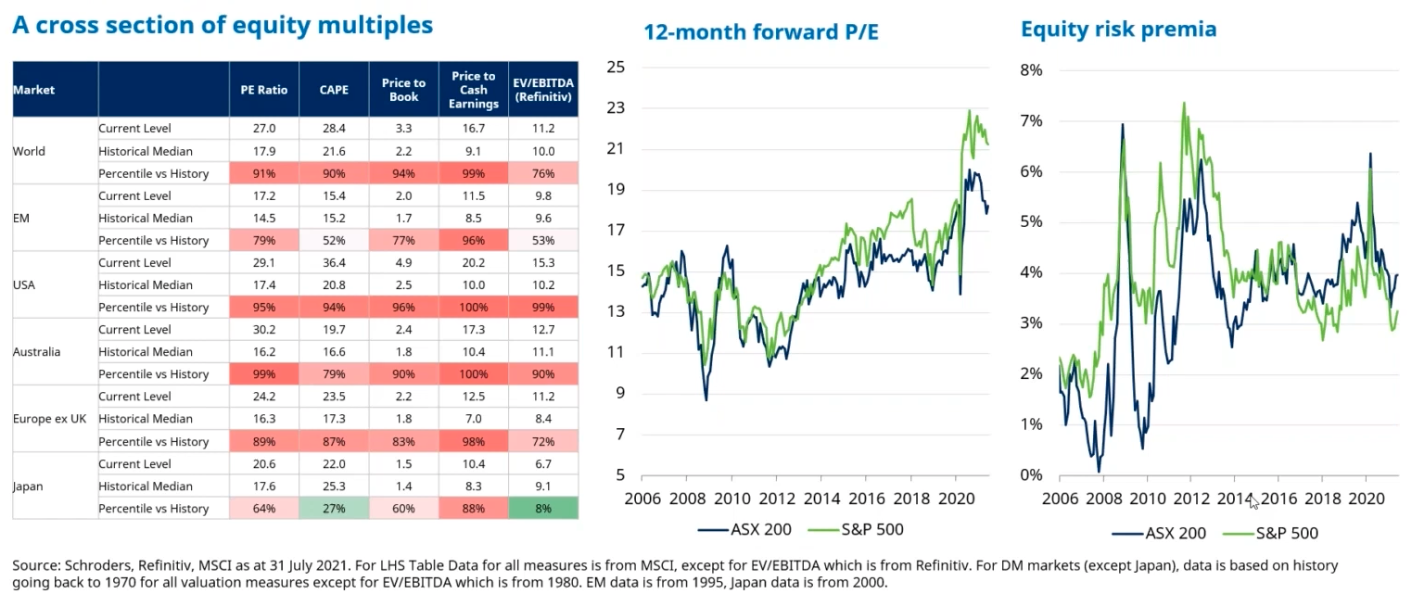

One of the problems with thinking about valuation is there isn't one measure of valuation which is absolutely right or wrong. It depends on your frame of reference. The panel below and on the left breaks down key share markets across a range of different valuation metrics.

Looking globally, we can see that on almost all measures valuations are stretched. Current equity prices sit in the top percentile for almost all metrics. Part of that reason is the recent success of technology companies.

We've seen companies like Afterpay whose market cap exceeds well beyond the earnings they're expected to make. Looking across all the regions it's hard to argue that share markets aren't pricing in a pretty positive outlook for the future. That's giving us pause right now.

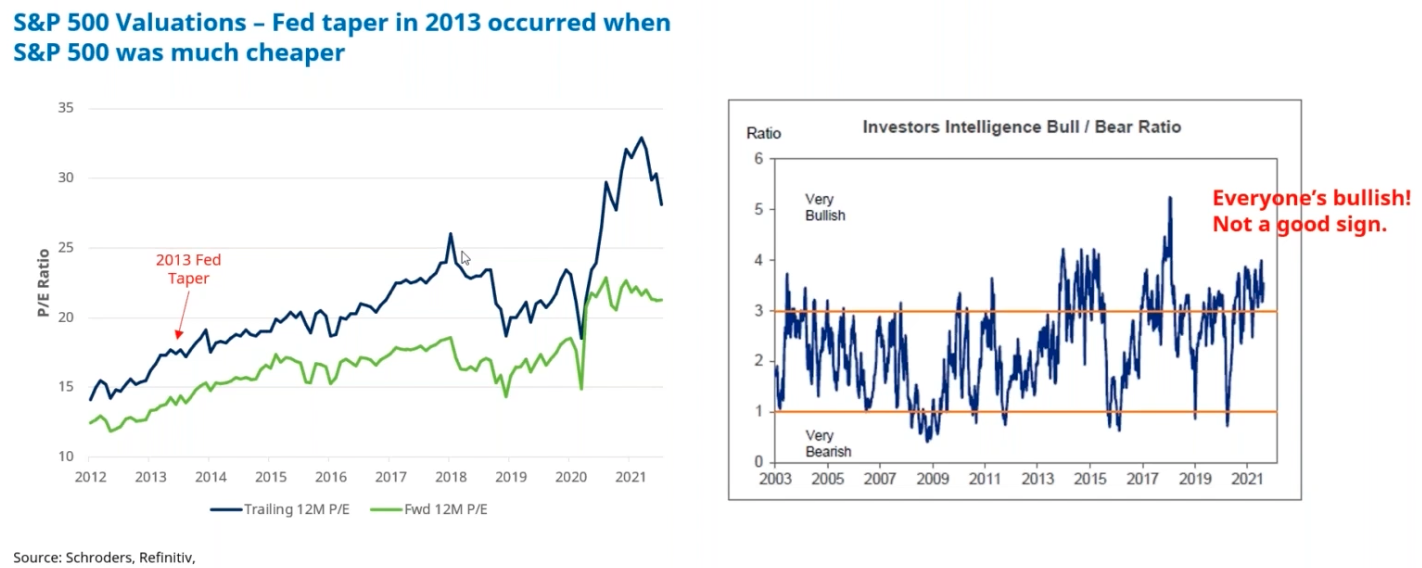

Another is upon consideration of the two charts on the right. They show the 12-month forward P/E ratio and the Equity risk premia for both the S&P 500 and the ASX 200. Both graphs largely show that a lot of optimism is priced in here and the market is pretty broadly supportive of the equity story right now.

Bonds

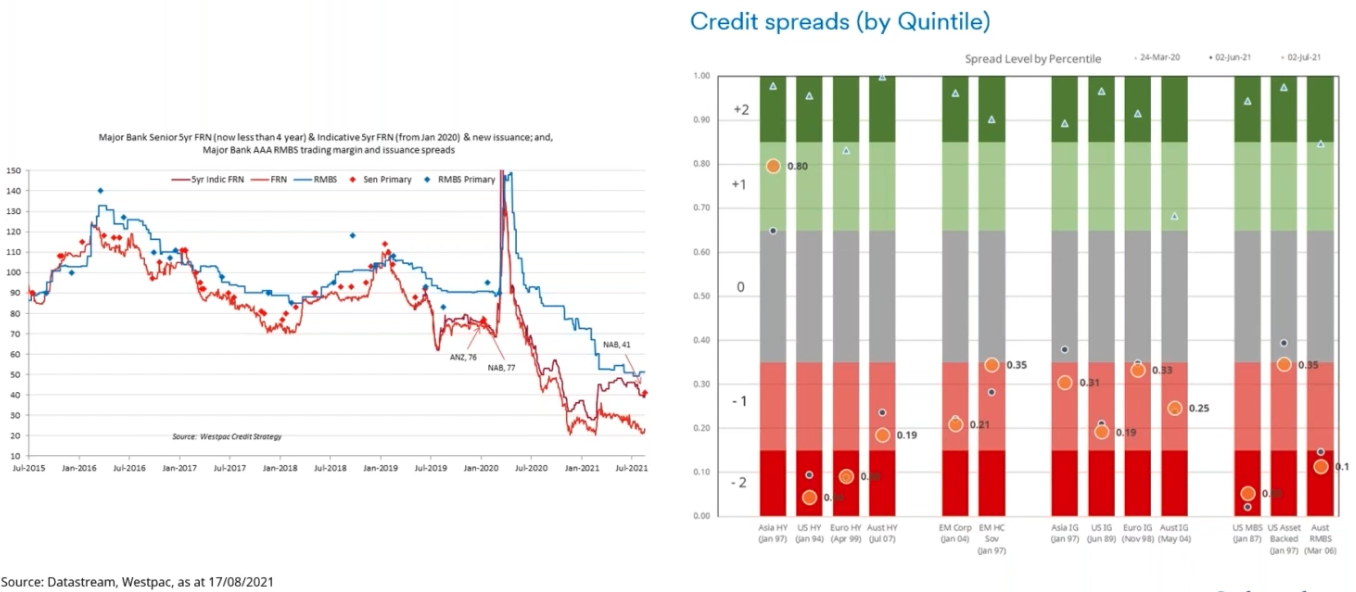

It's a similar story when we consider credit. On the left, the graph below shows the cost of borrowing for the major banks in Australia over the last few years. It's no surprise that they have come down quite dramatically. The banks were borrowing at sort of margins of around 1 - 1.25% five years ago and that's come down a long way to around 20 to 40 basis points.

If we look across the breadth of the credit opportunity set you can see across the board, bar Asian high-yield, credit spreads have become quite compressed. So in our view, there's not a lot of cheap assets left behind.

What could go wrong?

So if markets are priced for perfection, what could actually go wrong from here? Well, I think there's a couple of risks that investors need to be thinking about.

1) Inflation

The first is inflation. We're seeing plenty of asset price inflation at the moment. Whether it be through equity markets or just trying to follow what's happening in real estate, that liquidity has to go somewhere.

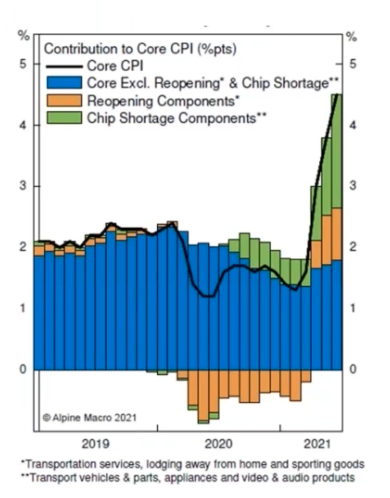

Additionally, as economies are looking to reopen supply chains are still disrupted globally. When you combine robust growth, recessionary policy settings, and problems in supply chains, these factors push up both headline and core inflation - and that's not to mention the rise in commodity prices as well.

However, as the chart shows, a lot of that can be put down to the shorter-term challenges of reopening and chip shortages. At the moment, the jury is still out as to whether we end up with an inflation problem. We're certainly seeing a rise in inflation in a cyclical sense, but to be the thing that really derails risk assets, it needs to be something that puts pressure on policymakers to materially adjust the settings.

Our read on this at the moment is that the situation needs to be watched carefully. Right now it's a cyclical problem, but whether that's going to result in a permanent rise in the rate of inflation is yet to be seen.

2) Strong growth prompts Fed response (Taper Tantrum Mark II)

On that theme, one of the things we are worried about is whether central banks will feel the need to adjust the current settings and taper the very favourable liquidity and policy backdrop that has supported markets for the last decade. A large element of the strength we are seeing in markets at the moment is due to investors being quite confident that central banks aren't going to pull the rug out from under them. While, we believe this is true, at some point markets need to be tested.

One might argue that since the taper tantrum, there is a lot more transparency nowadays with the awareness of what a sudden policy change can have on equities, but back then share markets were a lot cheaper.

In 2013 multiples were much lower coming out of the GFC and once the Fed started to make a couple moves on rates all hell broke loose. What's different now is that there's a lot more stimulus in the system and we have much more elevated valuations. While we think that policymakers understand the need to tread carefully, the embedded risk in the system right now makes it all the more important that policymakers get it right. We think that anything that forces the Fed's hand, given where markets are, could be problematic.

3) Booming real economy takes liquidity away from the market

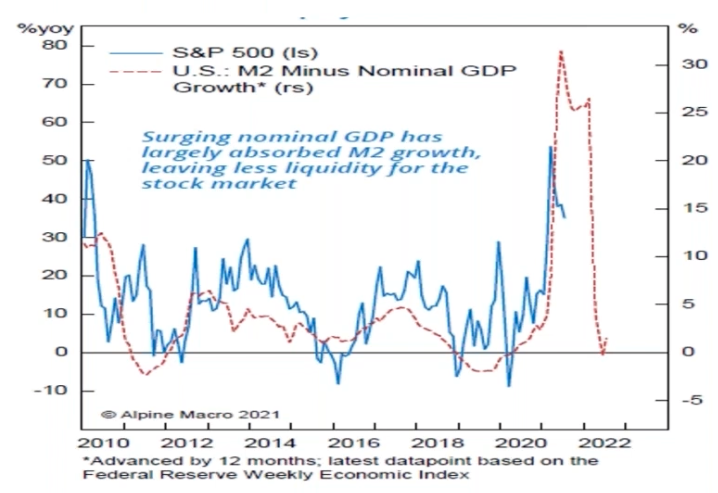

Another threat to markets is the strength of the economy creating the seeds of its own demise. As the economy has recovered, we've seen a lot of liquidity flow into financial assets but this trend is starting to turn and now a lot of liquidity is being spent in the real economy.

This can be seen in the graph below showing the money supply minus nominal GDP. Whenever this turns negative it's often bad news for markets. We would expect to see equities hit at first, and then credit markets to follow. In our view, the overlay of this issue with the challenging position of central banks puts markets at risk of volatility.

4) New waves of COVID arrest the global reopening

The final thing that could go wrong could be the global handling of COVID-19. At the moment it looks like things are heading in the right direction in terms of global vaccination rates and economies reopening but I think investors should be wary of over extrapolating these trends. What we don't want to see are further widespread lockdowns as this could be a real threat to optimism in markets.

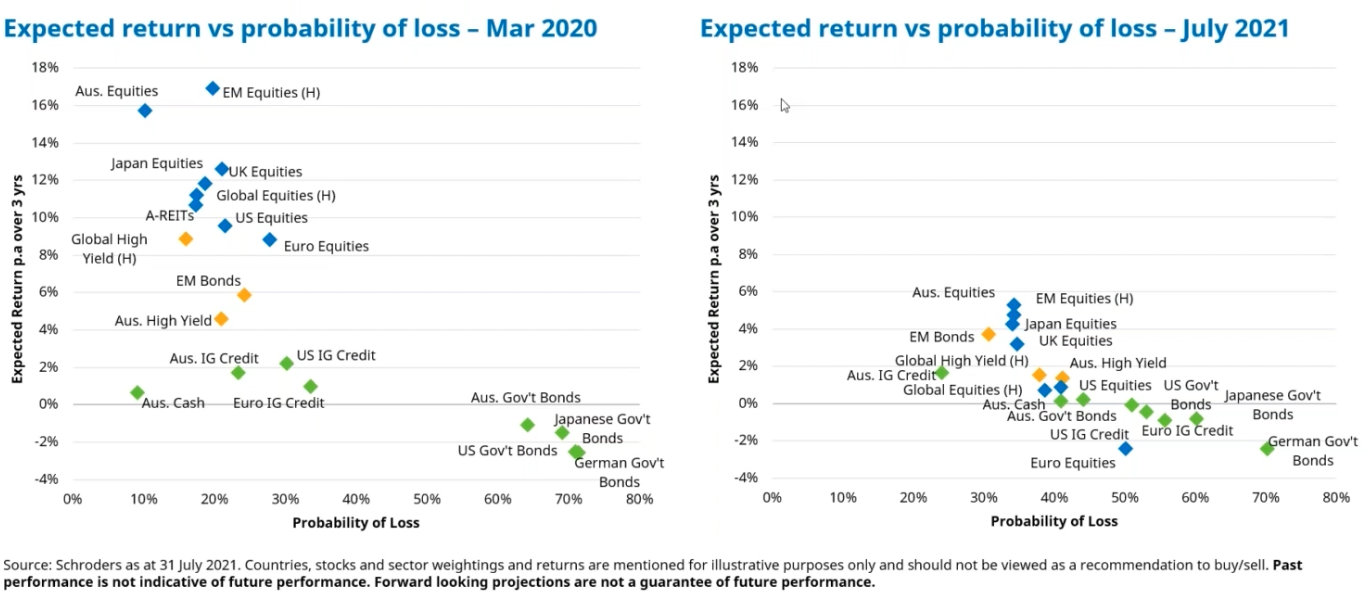

risk/return spreads across asset classes are compressing

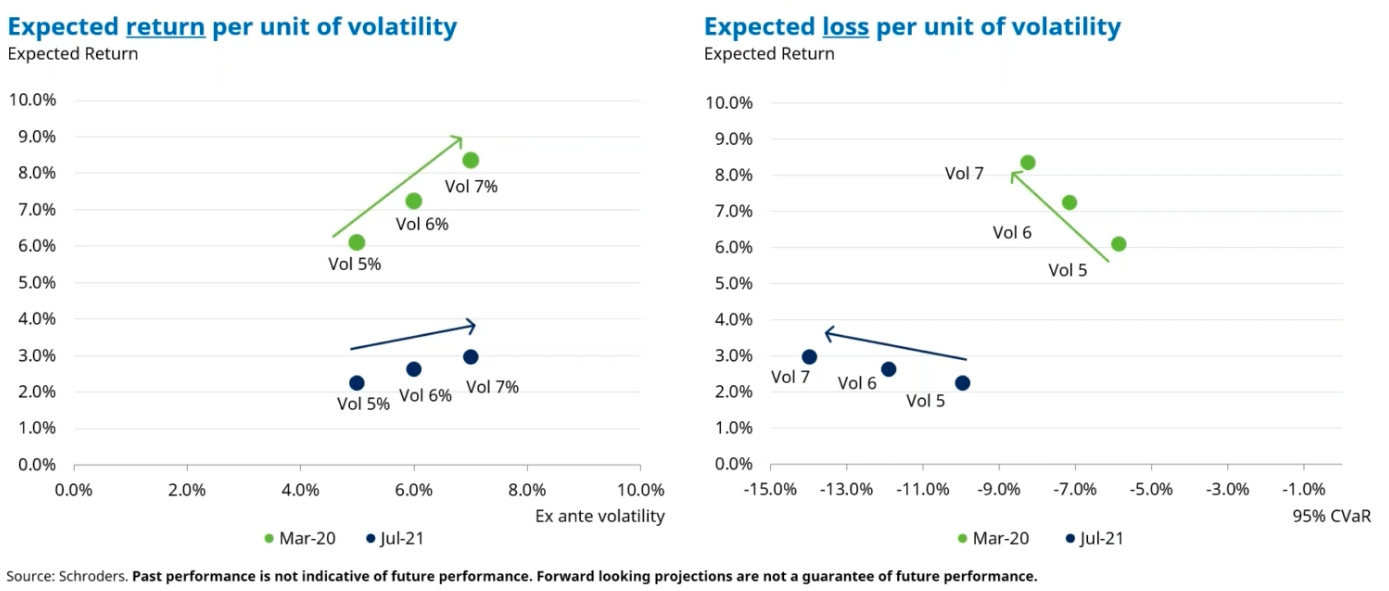

Some of the factors that originally were very accommodative for markets have now flipped. What we're seeing is that the return opportunities for asset classes across the board are becoming compressed. There's much less return on offer nowadays than there was last year for taking on the same amount of risk.

This can be seen further when we look at portfolio risk. We can see again on two different measures of risk, volatility and expected loss, that an increase in risk has a much lower expected return today.

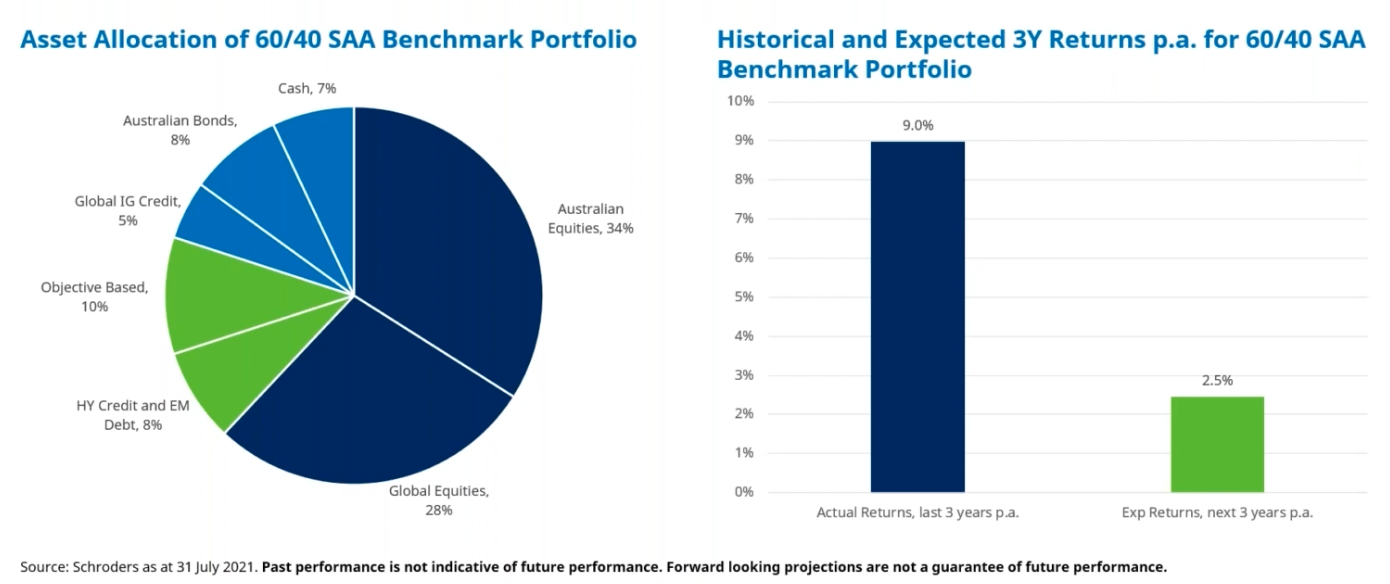

We believe that considering the elevated valuations, very low credit spreads and very low bond yields, the standard balanced portfolio will begin to struggle. We expect these returns to be around 2.5% p.a. over the next three years versus the 9% p.a. enjoyed over the last three years.

Where we see opportunities to invest

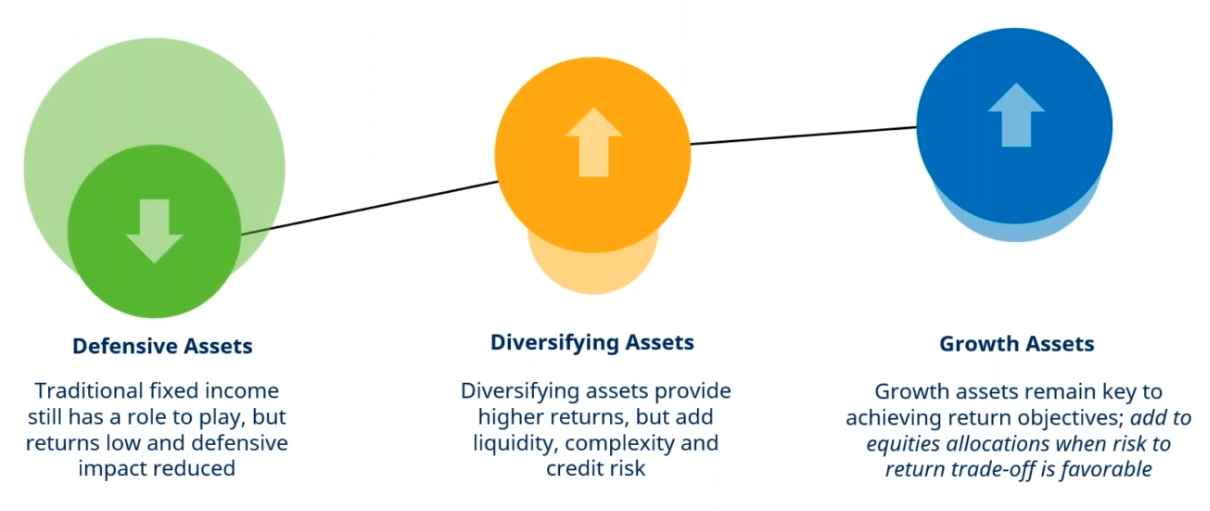

For our fund, we are reducing our exposure to defensive assets like government bonds and are considerably increasing our exposure to diversified assets like high-yield credit which we believe has been left behind.

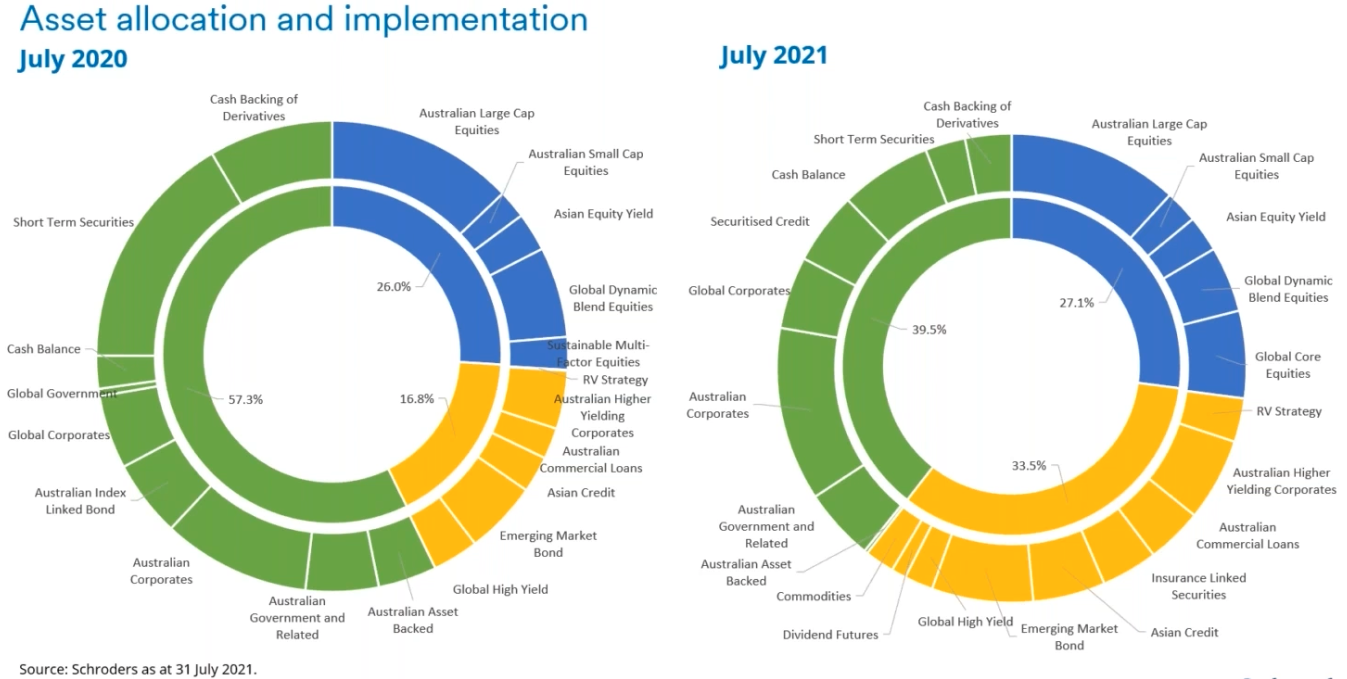

The most significant difference in our portfolio from this time last year is the increased role of actively managed diversified assets which has almost doubled (shown in orange). We believe there is now a need to move away from defensive assets like government bonds, cash and residential mortgage-backed securities that are offering little yield into defensives which are offering compelling yield and diversification. Inside that group, we like assets like Asian credit, commercial lending and commodities to help protect the portfolio from inflation.

In equities, while our allocation proportion remains largely similar we are shifting away from value into quality stocks that can grow their earnings.

Legend (Green: Defensive assets; Orange: Diversified assets; and Blue: Growth assets)

A lot of good news priced in

We don't want to paint a bearish picture here but we do believe this is an environment where there is a lot of good news priced in.

We believe there have been a few asset classes left behind and investors will be rewarded by investing broader and deeper over the coming months through tactical asset allocation.

These insights have been summarised from the key points of my latest webinar, which can be viewed in its entirety here.

Take advantage of opportunities wherever they exist

With the flexibility to invest across a broad range of asset classes, we aim to help investors grow their wealth with a reduced risk of losing money when markets fall. Click 'contact' to find out more, and make sure you keep up to date with our latest Livewire content by hitting 'follow' below.

5 topics

1 contributor mentioned