Gene Editing and Beyond

The manipulation and editing of DNA is a field of study which can be quite divisive in conversation.

On the one hand, we are exploring new frontiers of scientific technology, opening up pathways to cures and treatments which were considered inconceivable within our lifetime – along with new markets for healthcare which come with that possibility.

On the other side of the podium, gene editing is untested technology which may have serious unintended consequences, both acute and chronic. Furthermore, there have been issues raised ethically and the possibility that it leads to social inequality, something we will touch on later.

From both an investment and moral perspective, it is important for us to recognise both sides of the debate and attempt to forge a middle ground.

From this middle-ground we will be in a better position to answer the question: can gene-editing be beneficial to the overall vitality of the human race and is there a plausible industry to be developed around the technology?

How does it work?

Genome editing, or “gene editing”, is a relatively new technology which allows scientists to edit the DNA of different organisms, including plants, animals, and all the way down to bacteria.

Gene editing works on the principle of deleting or replacing a DNA sequence within a living organism. For the bulk of editing, the mechanism through which this occurs is a transfer of genetic material between organisms – remember that, it’ll be useful towards the end of this note.

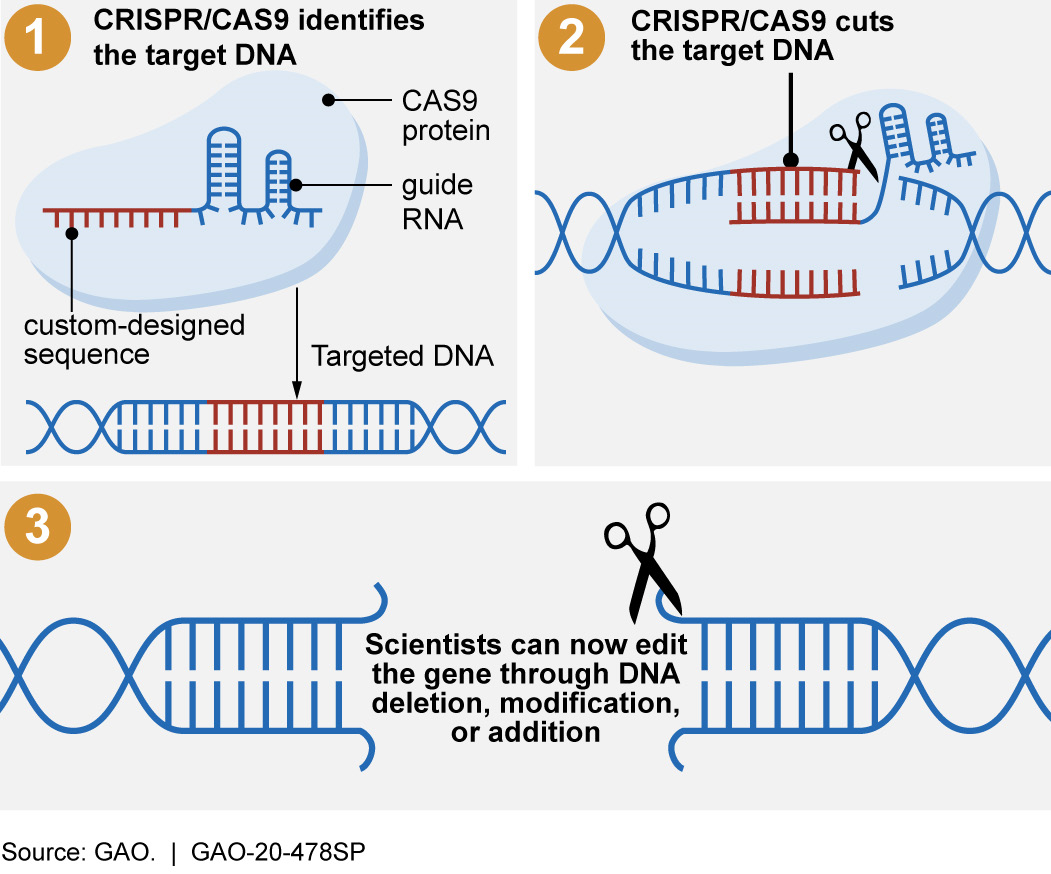

In a very simplistic diagrammatic representation, you can see that the process involves “cutting” one particular strand of target DNA to either add it somewhere else, add something else in between the cuts, or delete it entirely.

Source: U.S Government Accountability Office (GAO)

This particular process employs one of the newest editing tools known as CRISPR, a name many would be familiar with – it has developed over the last decade to be one of the cheapest and easiest ways to conduct gene editing.

Possible applications and market

Gene therapy is still only in clinical trial and experimental stages throughout much of the developed world, there are already use cases which are being tested today.

According to research house Markets and Markets, the global gene therapy market is estimated to grow to $13 billion USD by 2024 – a CAGR of 27.8% from 2019.

Taking our view on what could drive this kind of growth, it is highly likely that “somatic therapy” (therapy which targets non-reproductive cells which are identified to cause some form of disease) is the most advanced treatment and the one with the most immediate application to our ageing population.

Today, the most relevant applications are the treatment of diseases which currently have limited to no other treatment options. One well-known application was a United Kingdom study in 2015, where gene therapy was used to cure a one-year-old child’s leukemia.

Cancer is, of course, one of the largest target markets for this form of therapy. According to a report by Global Industry Analytics, the global cancer therapy market is set to surpass $204 billion USD (annually) by 2024, with various forms of cancer accounting for almost 10 million deaths in 2020 – over double the deaths from COVID-19 since the start of the pandemic.

Relatedly, studies are forming around the use of gene therapy to enhance the effectiveness of immunotherapy treatment, a market which on its own Grand View Research projects will reach $126.9 billion USD by 2026.

Gene therapy, more specifically “germline therapy” which changes the DNA in our reproductive cells, can also be used to potentially counteract hereditary diseases. Germline therapy has a generation-to-generation impact, so the addressable market is difficult to define.

To gene, or not to gene?

As mentioned in the intro, gene editing can be a contentious issue.

The positive interpretation of this technology is of course grounded in hope; hope for a healthier life, hope to rid ourselves of crippling disease, hope for our children, and so on. Though the technology is impressive, without a significant scientific background it is difficult to understand beyond the abstract summary, so our views as investors and as society will largely be emotionally driven.

The men in my family are predisposed to bowel cancer; the idea of having a therapy that could protect myself, or could protect my potential future son, is one which appeals to both hope and our existential fear of what might be lurking around the corner.

But that existential fear is also the biggest “con” against the technology.

Naturally, there are regulatory and technical barriers to overcome – governments must be satisfied with the efficacy and safety of the treatment, technology must become accessible, cost-effective, and accurate – but the largest fear will be driven by the question, “what if something goes wrong and my DNA is changed forever?”. Unintended changes to our genetic makeup is a rather large deterrent to public acceptance.

Another issue, one which is less talked about, is the potential social issues gene therapy could create – for sake of this note’s word count, we’ll leave the ethical argument to philosophers.

The first argument will be the prohibitive cost: imagine a world in which the wealthiest of society can extend their life by curing previously incurable diseases, whilst those less fortunate languish in chronic illness. The only imaginable result is an increasing social divide and rampant inequality.

The other, even more, dystopic risk is that human diversity is reduced by “editing away” various qualities or physical traits within populations which the prevailing scientific community at the time consider undesirable. I do not personally subscribe to the thought this could prevail; this is essentially predicting, that given the opportunity, we would use a brand new technology to pursue mass eugenics.

Investible opportunities

Although still a developing industry, there are some key players and vehicles which allow investors to get exposure to genomic editing companies.

The original inventors of CRISPR technology (Jennifer Dounda, Emmanuelle Charpentier and Feng Zhang), have all partnered with their respective universities/institutional sponsors to create companies and commercialise CRISPR technology.

Appropriately named, CRISPR Therapeutics (CRSP:NASDAQ) is one of the largest CRISPR biotech start-ups. Founded by Charpentier, the company is currently conducting clinical trials for applications in cancer treatment and hereditary blood disorders (primarily haemophilia).

The company has partnered with other pharmaceutical/healthcare players in a bid to gain size and strategic partnerships, most recently Capsida Biotherapeutics and Vertex Pharmaceuticals (VRTX:NASDAQ).

Source: Bloomberg

There are also broader exposures available to investors through ETFs.

For a passive approach, the Invesco Dynamic Biotechnology & Genome ETF (PBE:NYSE) holds $290 million USD in FUM and looks to track the Dynamic Biotech and Genome Index. This is a highly concentrated index of 30 U.S listed companies, focussing on those which can benefit from advances in biotech and genetic engineering.

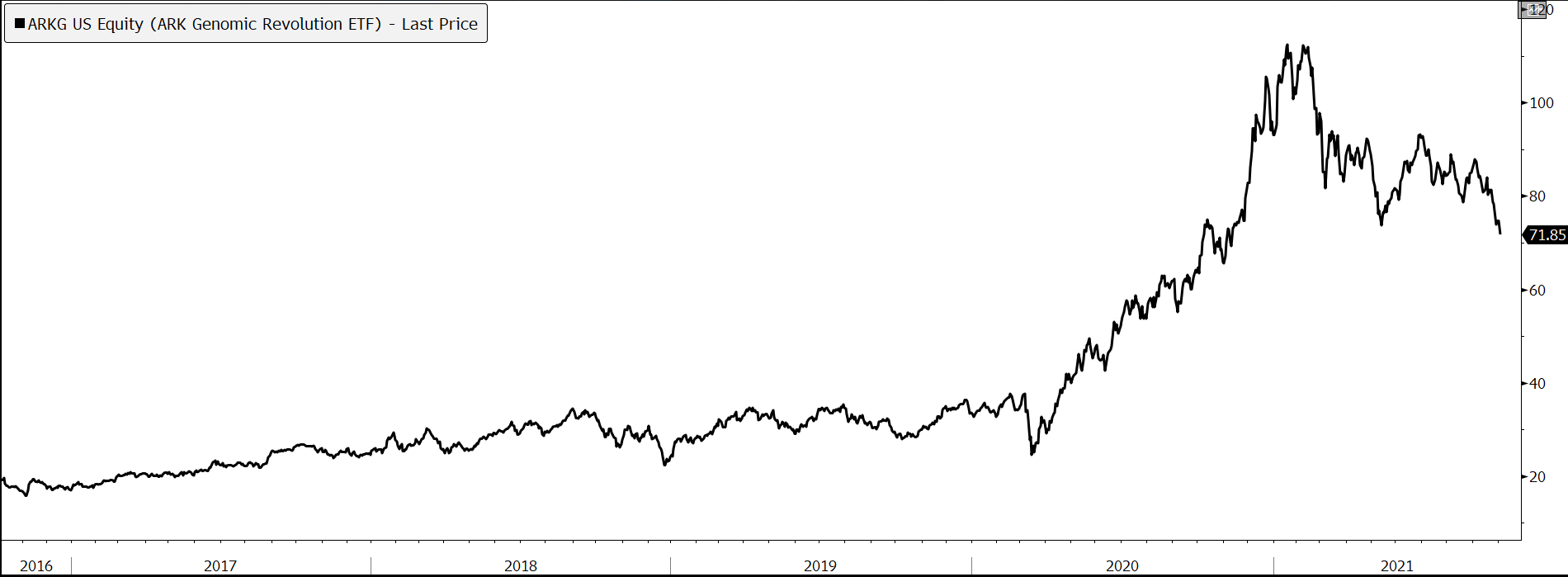

For an active approach, the most well-known exposure is without a doubt ARK Genomic Revolution ETF (ARKG:BATS), which covers a broader spectrum of healthcare sectors including stem cells, agricultural biology, bioinformatics and CRISPR technology. As of June 2021, gene therapy only made up 7.8% of the portfolio holdings.

Source: Bloomberg

Bonus round: synthetic biology

This may seem pre-emptive to jump past a developing industry to the industry which may surpass it - but indulge me for just a moment.

Synthetic biology, or “synbio”, is the progression of gene editing in the sense that it constructs completely new genetic material, whereas current gene editing transfers existing genetic material (as mentioned earlier).

This exponentially increases the scope of how organisms can be altered, beyond what we currently know is possible in existing organisms. Beyond just medicine, synbio can improve the energy density of plant matter as an alternative biofuel, develop microorganisms which can clean pollution from ocean waters, and remove allergens from certain agricultural produce.

The applications to medicine are vast and untested, but one of the most compelling ideas is the development of a “living drug”, presently envisioned as a cocktail of actual live organisms which enter the body and can dynamically target different diseases – in a sense, a second immune system in a pill.

This is still very much in the theoretical stage but offers tremendous opportunity in the coming decade(s).

A gene-ius idea

Though a contentious issue, we cannot disregard the potential addressable market gene editing may have in the future, and what technologies may come beyond.

The ageing population as a structural support for healthcare outperformance in the long term is well-known, and advancements such as this in the treatment of some our largest disease burdens look set to accelerate that growth aggressively.

Regulatory approvals and advancements in technology are inevitable as the science progresses and trails continue, so the primary risk to this investment thesis is the public perception of the treatment.

If we become comfortable with the idea of DNA-editing, then society as a whole may be radically different in the next few decades as we live amongst the potential developments which come from a transformed healthcare system and approach to treating disease – there are not often opportunities to become an investor in a world-changing technology, but this may be one of them.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic