Global capital securities – an income alternative and complement to local hybrids

With interest rates near all-time lows, ASX-listed bank hybrids have become an increasingly popular source of regular and stable income for clients alongside the traditional credit and fixed income markets.

We believe global hybrids/bank capital securities have a role to play in adding diversification to existing fixed income portfolio allocations.

At present, they offer more attractive yields than the local ASX hybrid market and provide exposure to a global banking universe. The global banking universe has improved fundamentals: through higher capital ratios and balance sheet de-risking since the global financial crisis.

Global bank capital securities are accessible primarily to institutional investors. With its larger market size and variety relative to ASX bank hybrids, they offer ample opportunities for active management through the investment cycle.

What are capital securities?

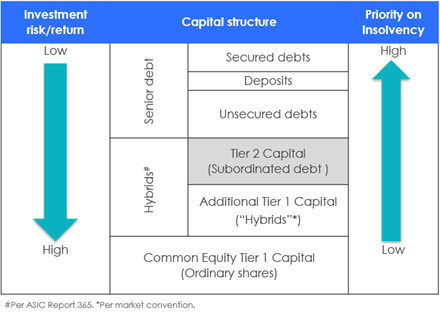

In Australia, capital securities are often called "bank hybrids" because they tend to combine both equity-like and debt-like characteristics. These securities sit above equities but below senior debt in the event of insolvency. They also offer a higher level of return to compensate for this risk. They tend to offer some of the highest yields of all liquid investment grade, or near-investment grade, bonds.

Unlike bank equities, of which some banks had their dividends reduced or stopped during the COVID-19 crisis, capital securities have a much higher threshold for impairment and were not affected.

Improving global banking fundamentals

Since the 2008 financial crisis, increasing banking sector regulation has:

- driven material increases in the core capital of banks,

- reduced on-balance sheet risk-taking, and

- forced banks to improve liquidity and funding stability.

As a result, banks are required to hold more capital against their assets, in particular against riskier forms of lending (capital charges for banks are based on the level of credit risk). In line with this, banks have revised their risk assessment and lending practices and, in many cases no longer lend to parts of the market with high levels of credit risk.

Subsequently, since 2009 non-performing loans have reduced materially in the sector, especially in Europe where the periphery has actively provisioned and sold bad loans.

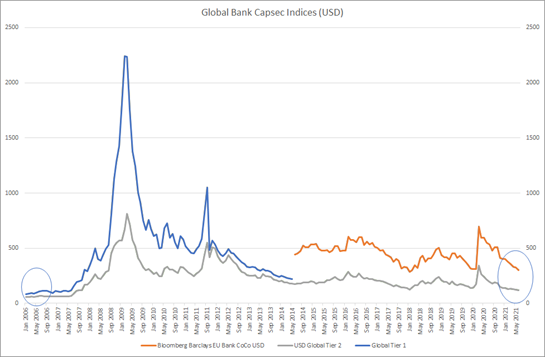

As part of a more conservative stance from regulators to require banks to fortify their balance sheets, we’ve seen a large amount of issuance of bank capital securities, which has expanded the investment opportunity set. The credit spread for these securities is still higher than pre-2009 when banks had lower capitalisation rates.

Source: Bentham, Bloomberg, as at 30th June 2021

Two of the more common types of capital securities are Additional Tier 1 (AT1) and Tier 2 Securities. These securities sit above equity but below senior unsecured debt (as shown in the table below).

Since the original Basel III (bank regulation) rules in 2010, regulators have generally taken a more conservative approach to the total loss-absorbing capital requirements, which has led to incremental capital security issuance. These securities included key new terms around loss absorption and coupon cancellation (effectively becoming more complex to review). However, given the fundamental improvements, the primary area of risk focus is on extension risk, being that, the bonds are not called and left outstanding. As a result of these terms being included, AT1 securities can also be referred to as ‘contingent convertible securities’ or CoCo’s.

The current spreads on offer in this space offshore are attractive relative to liquid investment grade and high yield credit at present, particularly given the structural improvement in the banks’ balance sheets. Importantly, COVID-19 showed that bank dividends can be cut or stopped while hybrid coupons remained fully and paid.

As an example, the "yield to call" on an average European Capital Securities portfolio is currently around 3.25%, almost 0.88% above that of the local hybrids market (including franking).

Bentham currently invests in global capital securities via our multi-sector funds and those holdings include some of the largest financial companies in Europe and the US including Lloyds, Societe Generale, JP Morgan and Barclays.

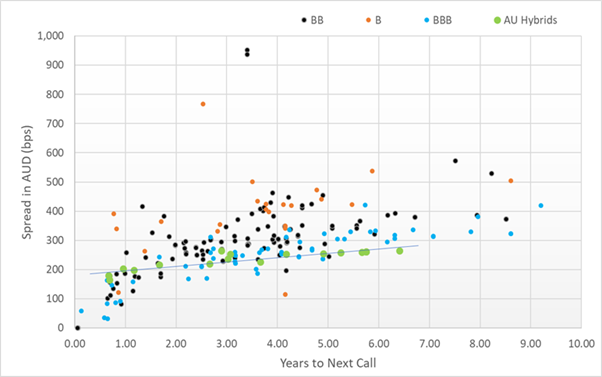

Referencing the table below, ASX hybrids are shown by the light green dots versus the European and UK bank CoCo universe.

Source: Bentham, Bloomberg, 22nd July 2021

Market size differential: ASX hybrids versus offshore

The global capital securities market is 35-times larger than the Australian listed hybrid market. Australian major banks comprise roughly 75% of all domestic ASX hybrid issuance, and this is spread across four issuers and 19 issues. This is clearly dwarfed by the opportunity set offshore in both number of issuers and issues.

The ASX listed hybrid market only tends attract domestic investors, because franking credits are a key driver of valuations and are not valued by offshore investors. This limited buyer base means that the market pricing and liquidity is sensitive to local demand. Further, by having overlapping exposures to Australian banks via both shares and hybrids (for income) it creates unnecessary portfolio concentration risk for an investment exposure that can be easily diversified by investing in globally.

Active management is key

Given the complexities involved in these types of securities, including structure, triggers, optionality and credit hedging we believe it requires extensive fundamental research and well-developed risk systems.

The best approach to accessing the sector is via an active institutional manager who can assess the terms and conditions of each issuer and build a diversified portfolio for clients while managing those risks.

In a world where income remains a key issue for retirees, bank capital securities are well placed to meet this demand - particularly if you look to broaden your allocations beyond the Australian market.

By expanding the capital security universe to include selected offshore markets (which are not accessible to retail investors), investors can benefit from not only a larger opportunity set but also additional diversification away from the Australian Economy.

Look beyond for new sources of income

Bentham invests in institutional quality asset classes that diversify risk while generating regular monthly or quarterly income for investors. Click 'follow' below to hear more of our insights.

2 topics