Fund in Focus

•

Sponsored

CBOE:YLDX

Coolabah Global Floating-Rate High Yield Complex ETF

CBOE:YLDX

Followed by 14 people

Livewire Markets

EBND

Vaneck Emerging Income Opportunities Active ETF

ASX:EBND

Followed by 4 people

LEND

Vaneck GLBL Listed Private Credit (Aud Hedged) ETF

ASX:LEND

Followed by 20 people

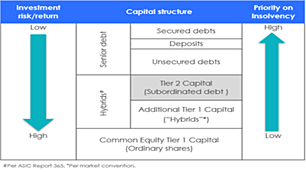

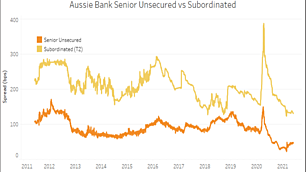

SUBD

Vaneck Australian Subordinated Debt ETF

ASX:SUBD

Followed by 5 people

Livewire Markets

Advertisement

MQSD

Macquarie Subordinated Debt Active ETF

ASX:MQSD

Followed by 8 people

Livewire Markets

MQSD

Macquarie Subordinated Debt Active ETF

ASX:MQSD

Followed by 8 people

Livewire Markets

MQDB

Macquarie Dynamic Bond Active ETF

ASX:MQDB

Followed by 6 people

MQIO

Macquarie Income Opportunities Active ETF

ASX:MQIO

Followed by 6 people

MQSD

Macquarie Subordinated Debt Active ETF

ASX:MQSD

Followed by 8 people

Livewire Markets

ANZ

ANZ Group Holdings Ltd

ASX:ANZ

Followed by 6947 people

BOQ

Bank of Queensland Ltd

ASX:BOQ

Followed by 271 people

NAB

National Australia Bank Ltd

ASX:NAB

Followed by 1259 people

Livewire Markets

HBRD

Betashares Australian Hybrids Active ETF

ASX:HBRD

Followed by 39 people

Coolabah Capital

CBA

Commonwealth Bank of Australia

ASX:CBA

Followed by 1640 people

NAB

National Australia Bank Ltd

ASX:NAB

Followed by 1259 people

Daintree Capital

WBC

Westpac Banking Corporation

ASX:WBC

Followed by 1434 people

Livewire Markets

CWN

CROWN RESORTS LIMITED

ASX:CWN

Followed by 68 people

NFN

NUFARM FINANCE (NZ) LIMITED

ASX:NFN

Followed by 10 people

RHC

Ramsay Health Care Ltd

ASX:RHC

Followed by 350 people

Narrow Road Capital

1-20 of 59

.jpg)

.jpg)