The forgotten asset class presenting exciting opportunities

Livewire Markets

Poor old income investors were some of the hardest hit by the pandemic. It's still uncertain when interest rates will begin to rise, despite market whispers. It's on that basis that traditional forms of fixed income have well and truly disappointed over the last twelve months. There is one exception to that, however.

Hybrid securities, the unique amalgamation of debt and equity, have presented investors with an opportunity to attain return with limited risk. In a world where income is hard to come by, hybrids may be the answer investors have been searching for. But where is all the opportunity hiding? Is it in the big four banks, or will corporate hybrids like Ramsay Healthcare and Nufarm take the crown for the most exciting opportunities?

To answer these questions, I reached out to three hybrid experts to identify where they're identifying opportunities currently.

Responses come from:

- Mihkel Kase, Schroders Australia

- Campbell Dawson, Elstree Investment Management

- Andrew Papageorgiou, Realm Investment House

The answer may not be so obvious

Mihkel Kase, Schroders Australia

We’re conscious that hybrids over time have become more concentrated in the financials sector. Corporate issuance into the hybrid space has declined and now it's predominantly financials. So from our perspective, when we're constructing broader portfolios, we want to be aware of a couple of things. One is the sector concentration in financials, which means there's a natural limitation, how much we want to hold. Second, being subordinated in periods of equity market volatility, particularly when equity markets sell-off, you typically get a larger drawdown in the capital value. Thirdly we need to be aware of liquidity.

So investors get a higher income component, but you are down the capital structure so when stress does hit financial markets, then typically you have a greater capital drawdown in hybrids. In the GFC, some of these instruments traded 80 or 90 cents on the dollar. In the pandemic, it wasn't to the same extent, but the volatility and downside risk of hybrids are higher than bonds. So concentration and potential downside mean that whilst we consider hybrids as an important source of income in the current environment we need to consider diversification and using a broad opportunity set for investing.

In terms of structures, bank hybrids can be split into T1 and T2 securities. So T1, are typically your listed franked securities and the T2 are typically your 10 non-call five which are typically cash pay and issue into the wholesale market.

As wholesale investors, we broadly favour the T2 securities as we can typically trade in higher volumes, and the coupon is full cash pay.

From a portfolio perspective in the current environment, we're trying to maximise the cash from coupons and as such we probably prefer T2 over the franked T1 format. However, for retail investors, I can see how they may prefer listed hybrids that also have franking credits and tax benefits which may be beneficial to their portfolio.

Finding medium risk and return

Campbell Dawson, Elstree Investment Management

With Term Deposits at close to zero, we think that

the only way investors can generate a satisfactory level of income is to invest

in a range of assets with medium risk and returns, such as hybrids and bond and

loan funds. Hybrids may have lower returns than high yield bonds or loans, but

they also are less risky and are liquid - liquidity and low risk are important.

During the Covid 19 crisis, the price of many LICs that invested in bonds or

loans fell by up to 45%. Hybrids fell by much less and if an investor wished to

change their asset allocations, it is less costly to sell hybrids rather than a

LIC or equity, which had fallen by around 40% at the worst. Of course, hybrids

should never be the whole solution to income, but part of the solution.

Since the GFC, hybrid margins have generally remained in the range of 3% to 4.5%, despite the substantial improvement in the underlying creditworthiness of banks and insurers since then. Bank equity levels have roughly doubled, providing greater protection to bank deposits and hybrid and debt holders.

Over the decade margins on corporate debt have narrowed as well. We think there is some possibility that the market will re-rate hybrids, particularly given the lack of alternative income assets and the expectation that cash rates will remain close to zero for the next few years.

If

there is a re-rating, margins will narrow and price rise producing capital

gains. A narrowing of margins to the post GFC low of 2.2% will produce capital

gains of c2.5% on top of the annual income levels of 2.5% - 3.0%. Longer-dated

hybrids would produce greater capital gains in such a scenario. We expect ANZ

to announce a new hybrid shortly. Usually, there is a slight yield premium for

new issues and we expect the ANZ hybrid to be longer-dated. The combination of

a yield premium and long maturity could result in healthy price gains over the

next year if margins continued to narrow.

Winning in frothy market conditions

Andrew Papageorgiou, Realm Investment House

The current environment has seen shorter maturity assets in various credit asset classes plummet to record tights, for context major bank 5-year unsecured floating debt is trading at 0.35% over 3M BBSW, historically this number has been closer to 1%.

This compression has been driven by the excess liquidity within the market that has in turn leaked into other related credit markets.

The hybrid market has also benefited from this dynamic, with investors seeking alternatives to 0% savings rates, this sees the hybrid markets trading at lower traded margins than what we have been accustomed to in the post GFC era.

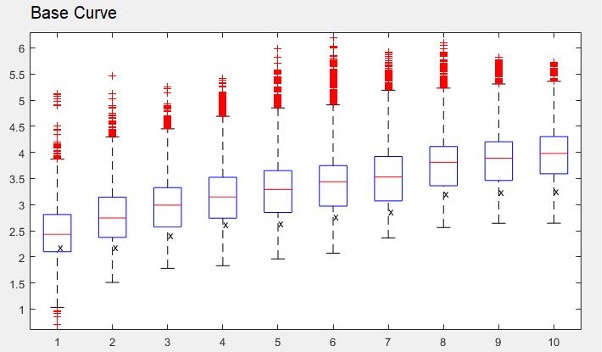

The box plot attached compares the Australian major bank hybrid curve to its 10-year average. The red horizontal line denotes the average over the last 10 years across the curve and the X denotes current.

Source: Realm Investment House

While this market seems expensive versus its long-term history, contextually speaking there are parts of this market that compare very favourably to other markets.

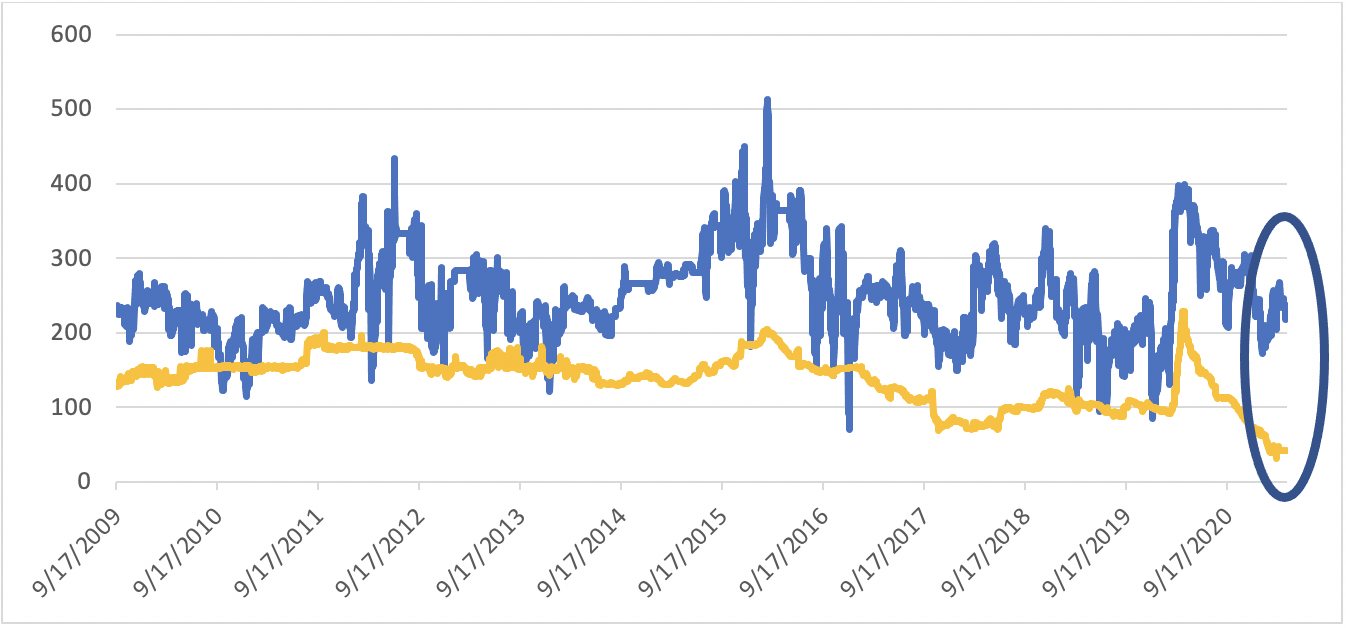

The chart below illustrates the compensation provided for big 4 hybrids (in basis points) with a call date of approximately 1 year versus major bank subordinated debt with a similar maturity. The current difference of almost 1.8% can be characterised as high by historical terms.

Source: Realm Investment House

While this isn’t a trade to make one wealthy, these assets do provide reasonable carry while also presenting less relative risk than longer-dated hybrid maturities. This is because longer maturities are more leveraged to changes in yield expectations and as such exhibit higher price volatility in instances where markets become dislocated. The short end of the hybrid curve provides a balance between yield and risk in a very difficult market that is showing signs of frothiness and complacency.

Wrapping up hybrids

Well, friends, that sums up this three-part hybrids collection. I hope you enjoyed learning all the intricacies of this wild beast of an asset class as much as I did. The reality is ... hybrids fit into the category of concepts that I have accepted I will never fully wrap my head around. But one thing I have learnt whilst writing this collection is hybrids are an unloved area of the market, with some serious potential to diversify your portfolio.

If you enjoyed this collection, please make sure to give it a like and follow my profile for more content like this. If you missed it, part 1 of this collection - The Hitchhiker's Guide to Hybrids acted as an explainer on this asset class, whilst part 2 explained why hybrids are a great tool to diversify your portfolio. Read it here.

2 topics

4 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.