Global micro-caps, Napoleon and common misconceptions

Spheria Asset Management

Global micro-caps is a relatively unfamiliar asset class for most investors and one which is dogged by misconceptions.

We want to challenge these myths and help investors understand more about what can be the most lucrative part of the market.

Sympathising with Napoleon

History judges Napoleon Bonaparte as a brilliant mind and great leader, despite at times being thin-skinned and arrogant. The modern perception of Napoleon in Western countries has been influenced by the British media of the day, which smeared Napoleon as a frustrated little man.

This has been picked up in popular culture, where cartoons and films depict Napoleon as very short in stature.

However, historians suggest this slur is a misconception. Napoleon was instead close to the average adult male height of the time.

Global micro-caps have much in common with the French emperor.

At first glance, global micro-caps appear too risky for most. This is a reflection of the widespread belief that all global micro-caps are tiny start-up stocks. This isn’t the case.

We define a Global micro-cap as a company with a market capitalisation below US$1 billion. While this is relatively small in a global context, most would be labelled small-cap companies in the Australian market

Amongst this large universe, investors are presented with a plethora of established businesses that have proved themselves through the economic cycle. Risk can be further minimised by identifying great global micro-caps with strong free cash flow and conservatively leveraged balance sheets.

Take Tracsis (LON: TRCS) for example. Over the next two years, this UK software company is forecast by consensus to grow EPS by 94% beyond its pre-COVID levels. Of course, since this is a micro-cap, consensus is made up of only one UK-based sell-side analyst.

Despite the company’s modest market capitalisation of US$350 million, it sits on a cash hoard of US$29 million. Historically, 116% of earnings (EBIT) has converted to free cash flow, meaning its earnings are not conjured by accounting magic but instead convert to cold hard cash. Strong free cash flow helps eliminate downside risk for investors since the company can self-fund its own future growth even when capital markets are shut, as they occasionally do.

Tracsis’ strong earnings growth, high free cash flow conversion, and net cash balance sheet show investors need not compromise when investing in micro-caps, quite the opposite, given the enormous opportunity set.

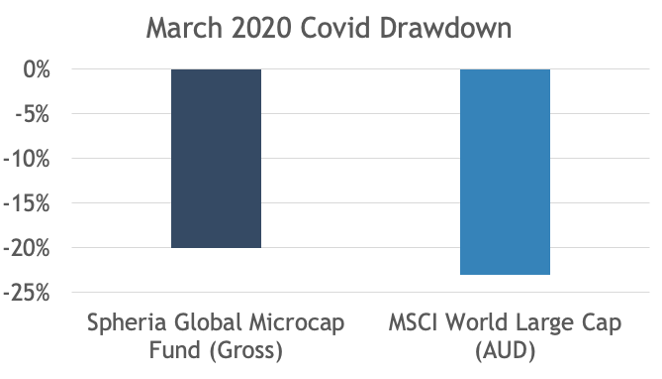

The strong risk characteristics that can be found in global micro-caps is illustrated below, where you can see the gross drawdown in our global micro-caps fund versus the MSCI large caps index during the height of the COVID-19 crisis.

Not one of our portfolio holdings needed to raise equity during the crisis or in the months following.

COVID-19 has also highlighted another key advantage for global micro-cap investors. As the crisis began to unfold, investors were able to stress-test micro-cap stocks much easier than larger, more complex multinational companies.

As an example, we immediately stress-tested all portfolio companies for liquidity. Any company that could not survive 12 months of lockdown with existing debt facilities was sold (we sold three in total). And during the worst of the lockdowns, we also found micro-caps were more agile and able to control costs and liquidity far easier than their larger counterparts.

Napoleon rarely compromised

The French leader was known for his exacting standards and global micro-cap investors should be, too. Given the enormous universe of companies to choose from, micro-cap investors rarely have to compromise on fundamentals and can gain exposure to a mix of growth and contrarian investments.

A portfolio of great global micro-caps can be constructed with a weighted average net cash balance sheet, superior to even the NASDAQ, which is full of cash-rich companies like Apple.

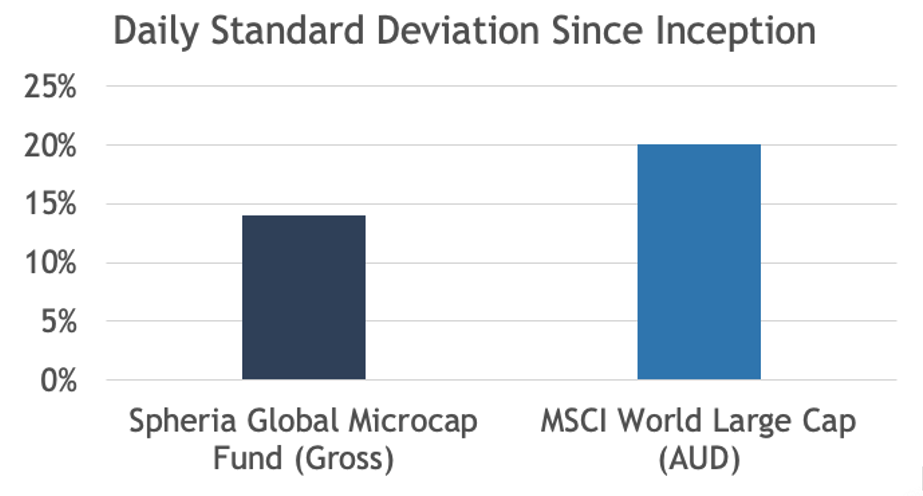

We have built a portfolio with lower daily volatility than the MSCI World Index. The Fund’s Beta relative to the MSCI World Index is only 0.49 ex-post, since inception.

Source: Bloomberg, Spheria. Inception 1 March 2019.

When global micro-caps can conquer

When divided about the direction of markets, global micro-caps can help conquer.

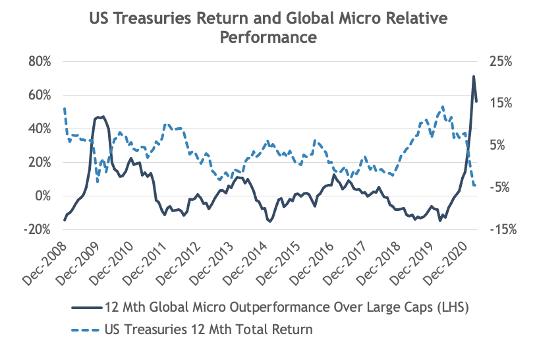

Compared to other assets, micro-caps better complement fixed income assets given their stronger performance as the economy accelerates. As the chart below illustrates, global micro-caps outperform large caps when fixed-income assets are underperforming.

This is one of the economic environments in which the asset class can offer investors an additional pillar of portfolio strength.

As one of the few global micro-cap fund managers in the world, we are taking up the challenge of promoting the asset class.

We genuinely believe too many investors are currently missing out on the part of the market that has delivered the best returns historically.

So, much like Napoleon who was always up for a conflict, we’ll keep fighting the misconceptions about global micro-caps. And if we fail, pay us a visit in St Helena next time you’re in the neighbourhood.

Greater alpha opportunity in this unexplored part of the market. Discover more about global microcaps today.

Visit the Spheria Asset Management website, follow the team on LinkedIn or click contact below to make a direct enquiry.