Has this widely held stock's dividend disaster come to an end?

Since it was privatised in November 1997, one of the country's most well-known firms has consistently been at the front line of its own sector's change. Its T22 strategy was supposed to reduce costs and make the customer experience better. But it has turned out to be anything but a simple plan to execute.

Telstra (ASX: TLS) is in the midst of splitting itself into three different entities serving three different sets of customers. Its infrastructure assets are already two separate companies (InfraCo Fixed and InfraCo Towers) while the third retail arm is still branded publicly as Telstra.

But as this strategy comes to an end and paves the way for T25 (part two of its revitalisation master plan), questions still linger:

- Can Telstra continue to offset losses from its expensive fixed-line market in the highly competitive mobile market?

- Will it be able to take advantage of its major competitors' problems such as the Optus hacking?

- How much can it monetise the value of its InfraCo assets?

- And perhaps most importantly - will the dividend hikes keep coming? Or was last August's increase a one-hit wonder?

To help answer those questions, I sat down with abrdn's interim Head of Australian Equities Natalie Tam.

Note: This interview took place on Thursday 16 February 2023. Telstra is a Top 10 holding in the abrdn Australian Equity Fund and the abrdn Australian Sustainable Equity Fund.

Telstra (ASX: TLS) H1 Key Results

- Revenue +7.6% to $11.3 billion

- EBITDA +11.4% to $3.86 billion

- Net profit +25.7% to $934 million

- Dividend +6.3% to 8.5 cents per share, second straight increase

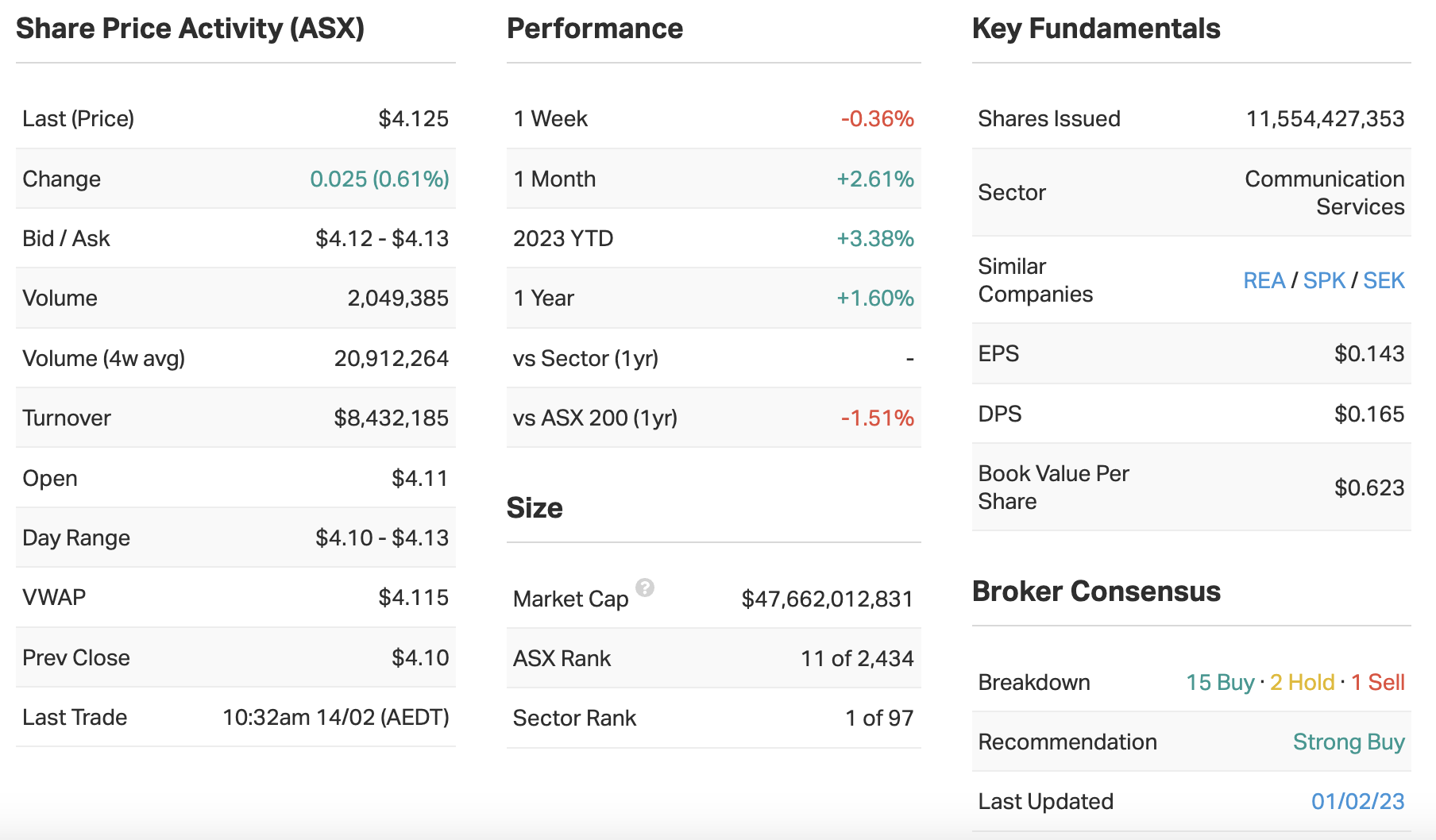

Key Company Data

MarketMeter

TLS was ranked ninth in the ASX 100 MarketMeter institutional investor sentiment research with regard to sustainability reporting. For more information on MarketMeter, please click here.

What were your key takeaways from Telstra's results?

This was a solid result that was slightly ahead (1-2%) of consensus at the EBITDA line. Full-year guidance was reiterated, and the dividend increased by 6% which shows confidence in the outlook.

What was the market's reaction to this result? Was it an overreaction, an underreaction or appropriate?

Telstra outperformed the market by around 1-2% on the day. It is a well-held stock, so this was an entirely appropriate response to a result that came in line slightly ahead of expectations.

Were there any major surprises in this result that you think investors should be aware of?

The Mobile division was particularly strong, boosted by increases in prices and a return to international roaming. Telstra estimates that the cyber incident at Optus impacted 1H23 net subscriber adds in the order of positive low-to-mid tens of thousands.

There is some criticism that Telstra was unable to take more advantage of the Optus data breach, but I think this reflects the impact of price rises that Telstra put through earlier in the half. While consumers were annoyed by the breach, it wasn’t necessarily a material trigger to go elsewhere.

The most disappointing part of the result was the Fixed Enterprise division. This division's earnings were well below expectations. It has been an area of weakness for several halves as Data & Connectivity has suffered from ongoing disruption from technology change and elevated competition.

Telstra has put in place measures to improve the performance of this division, including actively reducing rates to make plans more competitive and proactively reaching out to customers to minimise churn.

Would you buy, hold or sell Telstra on the back of these results?

Rating: BUY

In our view, it’s a core holding that we expect to modestly outperform relative to the market. Telstra is quite a defensive exposure given the non-discretionary nature of telco services, which provides a good level of earnings resilience.

This is more important and has greater value in the current market environment where earnings predictability across the market has fallen as the economic outlook is clouded by high inflation and a “higher for longer” rates rhetoric.

What's your outlook on Telstra and its sector over 2023? Are there any risks to Telstra and its sector that investors should be aware of given the current market environment?

One of the biggest challenges to navigate is how far Telstra can push prices up to offset inflationary pressures. In 2022, low unemployment and savings buffers allowed many companies to pass on cost inflation, but this is changing in 2023. The risk is that, at some point, customers won’t be able to tolerate the next price rise and you’ll see higher-than-expected churn to cheaper competitors, or spinning down to cheaper plans.

To the upside, a positive catalyst in the next 12-18 months is likely to be the value realisation from InfraCo. While management was reticent to provide any details on what form the value realisation could take, they did point to the precedent of Amplitel, where Telstra sold a 49% stake and returned around half of the proceeds to shareholders in the form of a buyback.

From 1 to 5 where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or cautious about the market in general?

Rating: 4

The market has bounced 15% from its low point in October last year, and now we think there is the potential for a pull-back in the short term.

We’re a bit cautious about the outlook for the next three to six months, largely because the recent hawkish shift by the Fed and the RBA hasn’t been entirely digested by equity markets. And because there are increasing risks to corporate earnings from inflationary pressures.

As the potential for rate cuts towards the end of 2023 grows, the outlook for markets becomes more positive, so on a longer-term 12-month view, we are bullish.

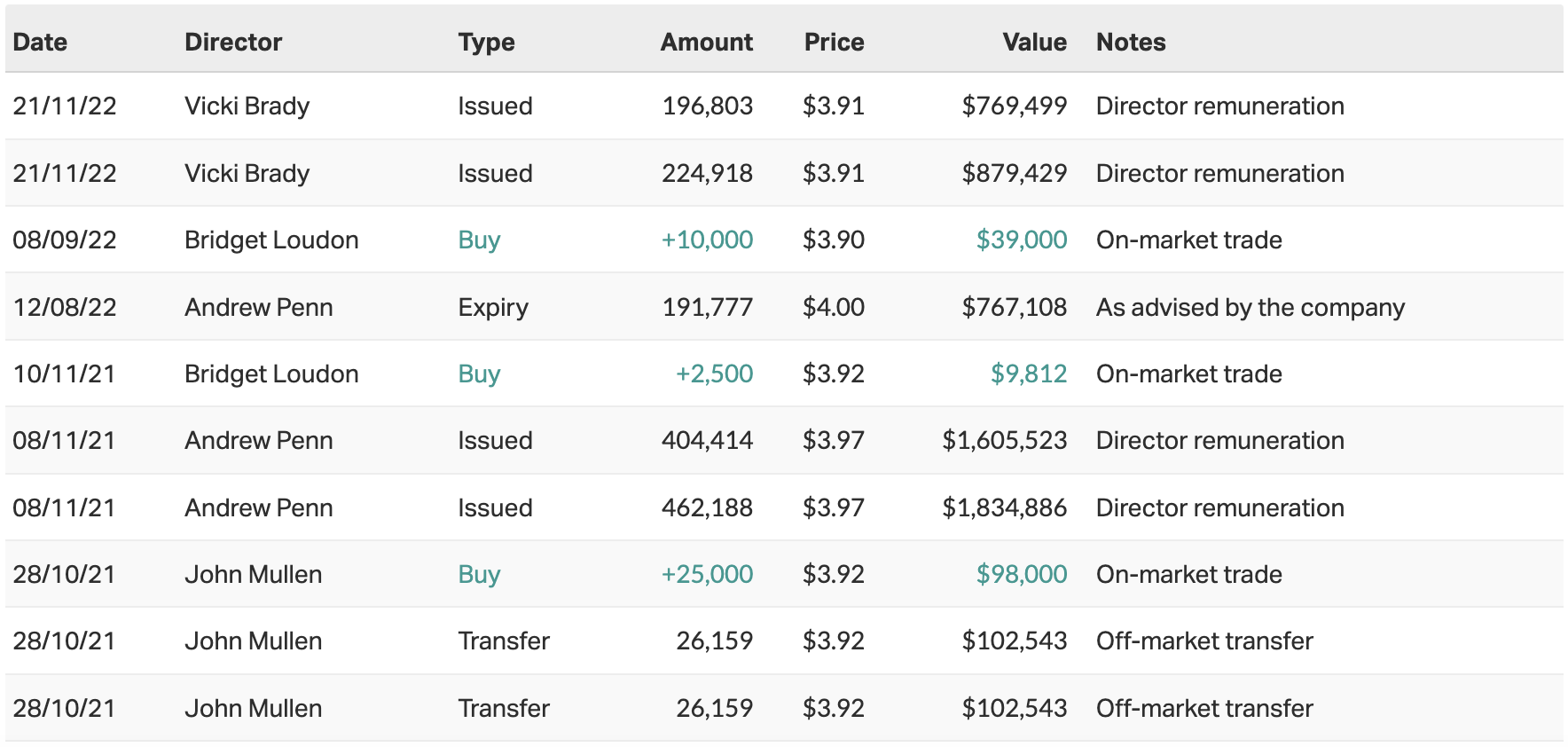

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

3 topics

1 stock mentioned

2 contributors mentioned